Johnson & Johnson Beats Q1 Estimates, Premarket Not Doing WellJohnson & Johnson (NYSE: NYSE:JNJ ) on Tuesday reported better-than-expected Q1 results and lifted its sales forecast for the full year.

Johnson & Johnson (NYSE: NYSE:JNJ ), together with its subsidiaries, engages in the research and development, manufacture, and sale of various products in the healthcare field worldwide, operating in two segments, Innovative Medicine and MedTech. Posted adjusted earnings per share (EPS) of $2.77 on revenue of $21.89 billion.

However, analysts had expected $2.56 and $21.56 billion, respectively, according to estimates compiled by Visible Alpha.

Price Action

Shares of Johnson & Johnson (NYSE: NYSE:JNJ ) were up about 1% immediately following the report, but the uptick was shortlived as the stock is down -0.54% in premarket trading. They entered the day up about 7% since the start of the year.

The company lifted its projected sales range to $91.0 billion to $91.8 billion, up from $89.2 billion to $90.0 billion previously. It also held its adjusted EPS forecast steady at $10.50 to $10.70, "including tariff costs, dilution from the Intra-Cellular Therapies acquisition, and updated foreign exchange."

Since reporting a disappointing 2025 sales outlook in January, the company closed its nearly $15 billion acquisition of Intra-Cellular Therapies and announced plans to lift its U.S. investment to more than $55 billion over the next four years.23

Technical Outlook

Shares of NYSE:JNJ closed Monday's session up 1.73% and despite the Q1 Earnings beat, the premarket session tells a different story as the asset is down 0.54% in Tuesday's session.

The asset is trading within an enclosed rectangular formation with a perfectly formed support and resistant zones as indicated in the chart. A break above the the key moving averages could cement a bullish breakout that may resort to a break above the $169 resistant point.

With the RSI at 45.35, NYSE:JNJ is well positioned for a bullish campaign once traders digest the earnings news.

Nyse

Chevron (CVX) – Strong Growth & Cash Flow ExpansionCompany Overview:

Chevron NYSE:CVX continues to demonstrate strong operational efficiency, strategic expansion, and record-breaking U.S. production.

Key Catalysts:

Production Growth & Profitability 🚀

Global production up 7% in 2024.

U.S. output surged 19% to record levels.

Permian Basin nearing 1M bpd, reinforcing cash flow strength.

Strategic Expansion & Sustainability 🌍

Gulf of Mexico projects targeting a boost from 200K to 300K bpd.

Future Growth Project in Kazakhstan enhances long-term production & ESG alignment.

Navigating Venezuelan challenges while leveraging stable U.S. policies for continued growth.

Investment Outlook:

Bullish Case: We remain bullish on CVX above $139.00-$140.00, backed by resilient production growth & execution.

Upside Potential: Our price target is $215.00-$220.00, supported by strong cash flow & expansion initiatives.

🔥 Chevron – Powering the Future with Growth & Stability. #CVX #EnergyStocks #OilAndGas

BlackRock Beats EPS Estimates Despite Revenue Miss in Q1 2025 BlackRock Inc. (NYSE: NYSE:BLK ) reported adjusted earnings per share (EPS) of $11.30 for Q1 2025. This beat the Zacks Consensus Estimate of $10.25, marking a 10.24% surprise. In the same quarter last year, EPS was $9.81.

Revenue came in at $5.28 billion, missing the estimate of $5.33 billion by 1%. However, it rose from $4.73 billion a year earlier. The company has surpassed EPS estimates in all four of the last quarters and has topped consensus estimates twice in that span. In the previous quarter, BlackRock posted EPS of $11.93, beating the $11.27 estimate. That represented a surprise of 5.86%.

BlackRock operates in the Financial - Investment Management industry. The market now awaits management’s outlook for future earnings. This will shape short-term price direction. So far in 2025, BlackRock shares have dropped 16.2%. In comparison, the S&P 500 has declined 10.4%.

Technical Analysis

BlackRock rebounded from a strong support zone near $780. This level aligns with the long-term horizontal support level that has held for over 3 years now. The RSI sits at 41, indicating it is nearly oversold. However, a bullish reversal momentum is forming around the support zone.

If the price continues to rise, resistance and target lie at the $1,084.22 recent high. A break above $950 may trigger a run toward the $1,000–$1,084 range. If the price is rejected, it could revisit the $780 support or possibly the ascending trendline sitting below the horizontal support.

Morgan Stanley (NYSE: MS) Reports Strong Q125 ResultsMorgan Stanley (NYSE: NYSE:MS ) Beats Q1 estimates with record Equity Trading Revenue. The bank posted earnings per share (EPS) of $2.60, beating analyst expectations of $2.18. Revenue reached a record $17.74 billion, topping forecasts of $16.44 billion.

The bank's equity trading revenue soared 45% year-over-year. It reached a new high of $4.13 billion as growth came across business lines and regions. Asia showed particularly strong performance. Prime brokerage and derivatives led gains, fueled by high client activity in volatile markets.

Morgan Stanley shares dropped 1% after the earnings release. However, the stock remains up over 20% in the past year. Volatility in global markets helped trading desks outperform.

Technical Analysis

Morgan Stanley bounced sharply from the $95 support zone. Buyers stepped in near the previous breakout level. Volume increased and confirmed renewed interest. This was seen as Trump paused tariffs for the next 90 days as well. Current price action suggests a recovery trend. The RSI stands at 39, hinting at oversold conditions. A potential path points to $142.03, which acts as the immediate resistance level.

If the price breaks $113 cleanly, momentum could carry it to $130 and beyond. If it fails, it is most likely to retest $95 support level. A strong break above recent highs would confirm bullish continuation. For now, Watch out the $113 and $142 levels closely.

XPeng Inc. (XPEV) – Driving the Smart EV Revolution Company Snapshot:

XPeng NYSE:XPEV is solidifying its status as a smart electric vehicle pioneer, blending cutting-edge AI, proprietary battery tech, and global expansion to challenge the status quo in EV innovation.

Key Catalysts:

Product Innovation 🚀

New 2025 G6 & G9 feature 5C fast-charging AI batteries

Turing-powered autonomous driving is among the most advanced in China

XNGP smart driving system reaches 86% active user penetration across cities

AI-Defined Vehicles 🤖

Launch of XPENG P7+, an AI-enhanced EV with futuristic user interfaces

Showcases XPeng’s edge in machine learning + mobility

Global Expansion 🌍

Entering UK, Indonesia, and Switzerland, boosting brand recognition & revenue diversification

Creates strategic foothold in key international EV markets

First-Mover Advantage 🔧

One of the few companies to integrate full-stack smart driving + proprietary battery tech

Strong R&D focus (40% of workforce) keeps XPeng at the forefront of next-gen mobility

Investment Outlook:

✅ Bullish Above: $17.50–$18.00

🚀 Upside Target: $25.00–$26.00

📈 Growth Drivers: Global footprint, AI-defined mobility, and rising EV adoption

⚡ XPeng – The AI brain behind tomorrow’s drive. #XPEV #EVInnovation #AIOnWheels

Warning: what can save us from a collapse: must read.⚠️This analysis isn’t purely chart-based, but in this macro environment, understanding the bigger picture is essential for predicting market movements. Hopefully, TradingView will allow this idea so that everyone can read it.

What Can Save Us?

Before looking for a solution, we must first acknowledge the problem—and then determine if and when a resolution is coming.

1. Trump’s Tariffs & Policies: A Market Shock

Trump’s economic strategy marks a radical departure from the policies of the past 30 years. However, previous administrations weakened U.S. global influence, shifting power in favor of China.

Since Trump's motto is "Make America Great Again", serious changes are inevitable. Until investors fully grasp these policies, uncertainty will persist.

Let’s break down the key areas of impact and Trump’s expected responses:

2.Monetary Policy & The Federal Reserve

The Federal Reserve (FED) and Jerome Powell are not aligned with the White House.

Powell is sticking to his monetary policy approach, but Trump needs 0% interest rates to implement his vision.

Markets hate uncertainty, and this is fueling volatility.

🔴 Trump's Response:

Expect a bombshell move—Trump will fire Jerome Powell and replace him with a Fed chairman who supports rate cuts to 0%. This will cause short-term chaos but ultimately fuel a massive market rally as:

✔️ The housing market recovers

✔️ Liquidity surges

✔️ Stocks skyrocket

3.U.S. Dependence on China & Russia for Raw Materials

The U.S. imports essential resources from China and Russia, making it vulnerable.

The BRICS alliance is strengthening, further threatening U.S. dominance.

🔴 Trump's Response:

Trump has openly expressed interest in acquiring Greenland, citing its rich natural resources. He will take it by military force if necessary, positioning the U.S. as a raw material powerhouse on par with Russia.

4.Lost Allies: Canada, Mexico & South America

Canada is aligning with Europe

Mexico & South America are leaning towards BRICS

🔴 Trump's Response:

To counter this:

Canada will be pressured into rejoining a U.S.-led trade bloc—or face potential annexation.

South American economies will be crippled by tariffs, forcing them to reintegrate under U.S. influence.

5.Geopolitical Conflicts: Middle East & Ukraine

Iran is aligned with Russia & China

Ukraine relies on Europe (France, UK, EU), rather than the U.S.

The U.S. is not benefiting from these wars

🔴 Trump's Response:

If Zelensky continues to align with Europe, Trump may order a full-scale U.S. bombing of Ukraine, flatten Kyiv, eliminate Zelensky live on TikTok, and then split Ukraine with Russia.

This move would:

✔️ Strengthen U.S.-Russia relations

✔️ Secure a deal on Greenland

✔️ Humble Europe

6.Conclusion: A Global Power Shift

Expect a period of chaos and fear. However, what investors must understand is that Trump is 100% serious about these moves—and he will execute them regardless of global opinion.

If Trump’s strategy works:

✅ The U.S. will regain dominance

✅ Markets will rally hard

✅ Confidence in the U.S. economy will be restored

If Trump fails:

🚨 A prolonged economic downturn (15-20 years of stagflation)

🚨 U.S. & Europe suffer major losses

🚨 Best move? Relocate to Asia or the Middle East before the crash.

So, even if Trump’s policies seem insane, the best-case scenario is that he succeeds.

💡 DYOR (Do Your Own Research)

#Bitcoin #Crypto #Trump #MAGA #Geopolitics #StockMarket #SPX500 #Trading #Investing #Economy #FederalReserve #RateCuts

Breaking: CarMax, Inc. (NYSE: KMX) Shares Down Nearly 15% TodayShares of CarMax, Inc. (NYSE: KMX) tanked nearly 15% today amidst missing Fourth Quarter Profit expectation.

CarMax (KMX) shares dropped in premarket trading Thursday after the used-car retailer's fiscal fourth-quarter profit and used-vehicle sales came in below analysts' expectations.1

The Virginia-based company reported earnings per share (EPS) of $0.58 on net sales and operating revenue of $6.00 billion, both up from $0.32 and $5.63 billion a year ago.2 Analysts polled by Visible Alpha projected $0.68 and $5.99 billion, respectively.

CarMax sold a total of 301,811 used vehicles, including 182,655 retail and 119,156 wholesale units, each below consensus. Analysts were looking for 312,800 units of combined sales, consisting of 185,900 retail and 126,900 wholesale vehicles.

A year ago, CarMax said it expected to reach 2 million annual vehicle sales between fiscal 2026 and 2030. It said that before it reached that unit figure, it expected annual revenue to reach $33 billion and market share of up to 10-year-old used vehicles to hit 5%.

Analysts have said both new and used cars are likely to become thousands of dollars more expensive as a result of the Trump administration's tariffs.

CarMax shares, which entered Thursday down 4% over the past 12 months, were down 8% immediately after the report. Last quarter, the stock surged as CEO Bill Nash said the better-than-expected results were helped by "a more stable environment for vehicle valuations.

Breaking: Delta Air Lines, Inc. (NYSE: $DAL) Surged 8% TodayShares of Delta Airlines, Inc (NYSE: NYSE:DAL ) surges 8% today after the company reported adjusted earnings per share (EPS) of $0.46 on operating revenue of $14.04 billion. Analysts polled by Visible Alpha had forecast $0.39 and $13.89 billion, respectively.

The company which provides scheduled air transportation for passengers and cargo in the United States and internationally reported passenger revenue per available seat mile (PRASM) of 16.78 cents and cost per available seat mile (CASM) of 19.69 cents; analysts had expected Delta to lose about 2.8 cents per ASM transporting passengers. Delta and domestic rivals United Airlines (UAL), American Airlines (AAL), and Southwest Airlines (LUV) all were profitable but lost money flying passengers in 2024.

Delta said it expects second-quarter revenue to rise or decline by 2% and adjusted EPS from $1.70 to $2.30, below the $2.41 consensus. The airline said it is not affirming or updating full-year projections at this time "given current uncertainty."

Analyst Forecast

According to 14 analysts, the average rating for DAL stock is "Strong Buy." The 12-month stock price forecast is $64.56, which is an increase of 68.30% from the latest price.

Technical Outlook

As of the time of writing, NYSE:DAL shares are up 6.69% trading within a bullish pattern. The asset has more to run as hinted by the RSI at 31. NYSE:DAL 's chart pattern shows a bullish engulfing candlestick and a break above the $45 pivot point could cement the path for a bullish move to the 1-month high.

Nasdaq Enters Correction Territory Do we go Deeper

Monthly analysis done on the NQ with the ambition to connect with current price activity and gauge a deeper technical understanding on if this is just the start of a bigger correction for the year ahead . Tools used in this video Standard Fib , TR Pocket , CVWAP/ PVWAP Incorporating PVWAP and CVWAP into trading strategies allows for a more nuanced understanding of market dynamics used to assess trading performance and market trends.

Date and price range and trend line .

Some research below regarding the previous correction that I reference the technicals to in the video .

In November 2021, the Nasdaq reached record highs

However, concerns over rising inflation, potential interest rate hikes by the Federal Reserve, and supply chain disruptions led to increased market volatility. These factors contributed to a correction in the Nasdaq, with the index experiencing notable declines as investors reassessed valuations, particularly in high-growth technology stocks.

VS Today

March 2025 Correction:

As of March 2025, the Nasdaq Composite has faced another significant correction. On March 10, 2025, the index plummeted by 4%, shedding 728 points, marking its third-worst point loss ever, with only earlier losses during the COVID-19 pandemic surpassing this.

This downturn has been attributed to several factors:

Economic Policies: President Trump's announcement of increased tariffs on Canada, Mexico, and China has unsettled markets, raising fears of a potential recession

Inflation Concerns: Investors are closely monitoring upcoming consumer-price index (CPI) reports to gauge inflation trends, as higher-than-expected inflation could hinder the Federal Reserve's ability to lower interest rates, exacerbating stock market declines

Sector-Specific Declines: Major technology companies, including Tesla, have experienced significant stock price declines, contributing to the overall downturn in the Nasdaq

Comparison of the Two Corrections:

Catalysts: The November 2021 correction was primarily driven by concerns over rising inflation and potential interest rate hikes. In contrast, the March 2025 correction has been influenced by geopolitical factors, including new tariff announcements, and ongoing inflation concerns.

Magnitude: While both corrections were significant, the March 2025 correction has been more severe in terms of single-day point losses. The 4% drop on March 10, 2025, resulted in a loss of 728 points, marking it as one of the most substantial declines in the index's history.

Investor Sentiment: Both periods saw increased market volatility and a shift towards risk aversion. However, the recent correction has been accompanied by heightened fears of a potential recession, partly due to inconsistent government messaging regarding economic prospects.

In summary, while both corrections were driven by concerns over inflation and economic policies, the March 2025 correction has been more pronounced, with additional factors such as new tariffs and recession fears playing a significant role.

Apple Inc. (NYSE:$ AAPL)Drops $300B+ in Tariff- Fueled Sell-OffApple Inc. (NYSE:$ AAPL) faced a massive sell-off on Thursday, April 4th 2025, with its stock closing at $188.38, down $14.81 (7.29%). This marked Apple’s worst trading day since March 2020. The steep drop came after former President Donald Trump announced a new set of tariffs targeting 185 countries, including major U.S. trading partners.

As a result, Apple’s market capitalization fell by more than $310 billion in a single day. These newly imposed tariffs, effective April 9th, include a 10% blanket duty on all imports, with higher rates applied to specific countries. China, Apple’s primary manufacturing hub, will face a combined 54% tariff—34% newly imposed, added to an existing 20% rate.

Other affected regions include the European Union (20%), Vietnam (46%), Taiwan (32%), and India (26%). Analysts consider Apple especially vulnerable to these policies due to its heavy reliance on overseas production, especially in China, where nearly 85% of iPhones are manufactured.

According to Dan Ives of Wedbush, future exemptions to these tariffs may depend on Apple’s efforts to localize its operations within the U.S., a move hinted at by the company earlier this year. However, no details have been confirmed regarding whether Apple’s U.S. expansion plans will qualify for tariff relief. The timing of the policy combined with Apple’s exposure to international supply chains, led to a bear shift in market.

Technical Analysis: Apple Breaks Below Key $197 Support

Apple’s price action shows an impulsive breakdown below the key $197 strong support level. The price is currently trading around $188, trading towards next support at $167 as the immediate support.

A drop below $167 could push the stock lower to a long-term support around $125, which was lastly retested in Dec 2022. On the upside, any recovery would first need to reclaim the broken support at $197, which now acts as resistance. The all-time high around $260 remains far away from reach unless the overall stock market sentiment improves.

Looking ahead, the chart outlines two likely scenarios. In the bullish case, Apple may find support around $167, bounce back and attempt to break above $197, possibly re-establishing it as a support zone.

In the bearish case, failure to hold $167 could push the stock lower to test $125, and if that level breaks, the price may continue downward. The current market outlook suggests a wait-and-see approach, to what happens at key level, as both macroeconomic news and technical levels continue to drive Apple stock lower.

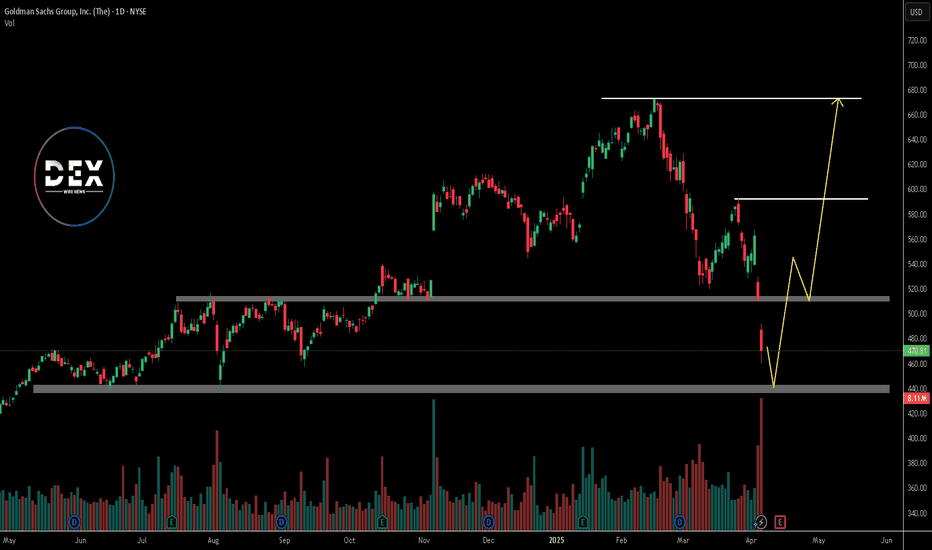

Goldman Sachs Raises Recession Odds to 35% Amid Tariff Fears Goldman Sachs (NYSE: GS) has lowered its S&P 500 year-end target again. The firm now sees the index ending at 5,700 points, down from its earlier forecast of 6,200. This revision comes just days before President Trump’s new round of tariffs is set to begin. The updated target implies only a 2% gain from Friday’s close of approximately 5,597.

Chief U.S. Equity Strategist David Kostin pointed to rising tariffs and slowing economic growth as key concerns. The revised forecast reflects a cautious outlook in light of economic risks. This is the second time Goldman has slashed its target this month.

At the same time, Goldman Sachs has raised its 12-month recession probability to 35%, up from a previous 20%. Chief Economist Jan Hatzius explained that higher tariffs and softening economic data contributed to the decision. Goldman now estimates the average U.S. tariff rate will rise to 15% in 2025, compared to an earlier projection of 10%.

Alongside these changes, the bank has cut its Q4 2025 U.S. GDP growth forecast to 1.0% from 1.5%. The adjustment follows weakening household and business confidence. Recent White House comments also suggest officials may accept short-term economic strain to pursue long-term trade objectives.

These developments reflect growing concern across Wall Street. Goldman’s 5,700 target ranks among the lowest of major forecasts. With markets already on edge, the new projection underscores broader fears over trade tensions and economic resilience.

Technical Analysis: Bearish Momentum Below $500

The S&P 500 has turned bearish after falling below a key support at $510. This level had held firm previously but now acts as resistance. The break and close below the key level signals strong bearish pressure and there is a possibility of more bearish momentum.

Price is currently trending lower towards the next potential support at $440. If it breaks below it, further drop could follow. The bearish pressure may continue unless the bulls defend the key support level.

However, if the bulls can finally defend the $440 level, it could potentially recover and target $510. In that case, the first resistance to overcome is $510. If it is also broken above, the next target would be the $592 resistance zone. A break above $592 could revive bullish momentum.

As of April 4th 2025, Goldman Sachs stock closed at $21.74, down 1.50% on the day. Investors await further updates ahead of the earnings report due April 14th 2025.

SNOW Finds Support at 200-Day SMASnowflake has been trading within a wide range between 108 and 240 over the past three years. During this period, revenue growth has remained steady, but operating and R&D expenses have consistently increased. This is a company that prioritizes growth and invests heavily in research, expanding its product offerings and business relationships.

However, the recent downturn, driven by tariffs and the broader selloff in AI and cloud-related stocks has exposed Snowflake's vulnerabilities.

The company reports reflect this caution. Recently, SNOW has received both downgrades and buy signals, highlighting analyst and market indecision. In such an environment, the stock’s performance will likely lean heavily on broader index movement. With a beta above 1.5, SNOW is expected to react more sharply to market swings. The consensus 12 month target still shows 38% upward potential.

Currently, Snowflake is finding support at the 200-day simple moving average. If the market manages to weather the impact of the April 2 tariffs and potential countermeasures, SNOW could stage a solid rebound. On the downside, the 130–135 zone stands out as a key support area just below the moving average.

Loar Holdings Inc. (NYSE: LOAR) Set To Report Earnings TodayLoar Holdings Inc (NYSE: LOAR), a company that designs, manufactures, and markets aerospace and defense components for aircraft, and aerospace and defense systems in the United States and internationally is set to report earnings result on Monday, March 31, 2025, before market open.

Belonging to the aerospace and defence sector, Loar Holdings Inc (NYSE: LOAR) closed Friday's session down 2.61% trading within the psychological support zone formed prior a falling wedge pattern.

With the RSI at 45 a breakout above the resistant point could cement the grounds for a bullish campaign. Similarly, a breakdown below the psychological support zone could lead to a selling spree for NYSE:LOAR shares.

Analyst Forecast

According to 4 analysts, the average rating for LOAR stock is "Strong Buy." The 12-month stock price forecast is $83.5, which is an increase of 26.57% from the latest price.

Comstock Resources (CRK) – Expanding U.S. Natural Gas DominanceCompany Overview:

Comstock Resources NYSE:CRK is accelerating natural gas production, reinforcing its position in the Western Haynesville play, a key U.S. gas region.

Key Catalysts:

Production Expansion & Strategic Acquisitions ⛽

Increasing drilling rigs from 5 to 7 for higher output.

Acquired 64,000 net acres in Haynesville, boosting reserves & market share.

Investment in Drilling & Midstream Infrastructure 🏗️

$1.0-$1.1 billion planned for 46 horizontal wells in 2025.

$130-$150 million allocated to midstream development, optimizing gas transport & profitability.

Market Strength & Growth Outlook 📈

Positioned to capitalize on rising U.S. natural gas demand & global LNG expansion.

Investment Outlook:

Bullish Case: We are bullish on CRK above $15.50-$16.00, supported by production growth & infrastructure investment.

Upside Potential: Our price target is $30.00-$31.00, driven by expansion, operational efficiency, and market strength.

🔥 CRK – Fueling the Future of U.S. Natural Gas. #CRK #NaturalGas #EnergyStocks

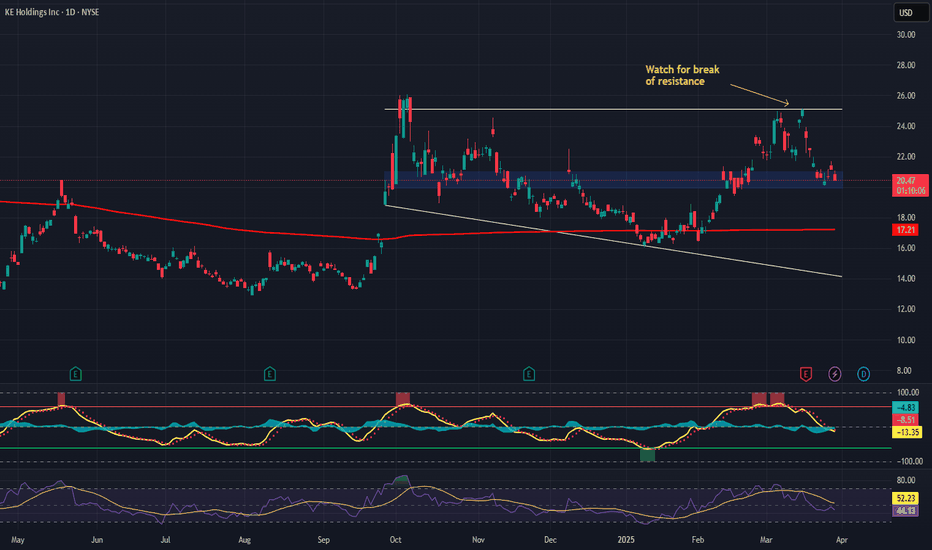

KE Holdings (BEKE) – Transforming China’s Real Estate MarketCompany Overview:

KE Holdings NYSE:BEKE is revolutionizing real estate with its hybrid digital-physical platform, leveraging strategic backing from Tencent (8% voting power).

Key Catalysts:

Strong Financial & Earnings Growth 💰

Analysts project 20.9% annual earnings growth and 26.7% EPS increase.

Reinforces BEKE’s leading position in China’s real estate sector.

Expanding Services & Market Reach 🌍

Acquisition of Shengdu Home Decoration (2022) strengthens BEKE’s homeownership services.

Broadens revenue streams beyond real estate transactions.

Strategic Backing & Partnerships 🤝

Tencent’s support enhances financial stability & collaboration opportunities.

Investment Outlook:

Bullish Case: We remain bullish on BEKE above $20.00-$21.00, supported by rising profitability & business expansion.

Upside Potential: Our price target is $36.00-$37.00, driven by earnings growth, platform expansion, and strategic alliances.

🔥 BEKE – Shaping the Future of Homeownership in China. #BEKE #RealEstateTech #GrowthStock

Harmony Gold Mining (HMY) – Strong Growth & Rising ProfitabilityCompany Overview:

Harmony Gold Mining NYSE:HMY continues to outperform expectations, delivering higher grades, cost efficiency, and production expansion.

Key Catalysts:

High-Quality Gold Extraction ⛏️

Underground recovered grades surged to 6.4 g/t, exceeding full-year guidance.

Reinforces HMY’s ability to extract high-quality ore.

Cost Efficiency & Rising Gold Prices 📈

All-in sustaining costs at ZAR 972,000/kg, well-managed despite inflationary pressures.

Gold’s safe-haven demand surging due to geopolitical tensions, boosting HMY’s margins.

Expansion & Future Growth 🚀

New high-grade mining site announced, set to enhance future production & revenue growth.

Investment Outlook:

Bullish Case: We remain bullish on HMY above $10.50-$11.00, supported by cost control & rising gold prices.

Upside Potential: Our price target is $17.00-$18.00, driven by high-margin production & increasing investor interest in gold.

🔥 HMY – Unlocking Gold’s Full Potential. #HMY #GoldMining #SafeHavenAsset