Despite Geo-Political tensions, Nifty closes above Mother line. It was quite remarkable for Nifty to close above the Mother line (50 Hours EMA) despite the Geo-Political tensions and brewing storm of escalations at border. This shows the character of not only Indian market but the resilience of India as a nation. In yesterday's post itself we had mentioned that strong technical resistance has been reached. Add the tension and intent of India to fight against terrorism so it was a perfect recipe for a major fall. Which may happen if things escalate further next week but recovering from 23847 and to close above 24K at 24039 shows that when things will be back to normal the indices will bounce back. Resistance for Nifty now remain at 24096, 24335 and 24504. Supports for Nifty remain at 23914 (Major Mother line support) of 50 Hours EMA, 23800, 23530 and finally 23363.

While Long term players, FII, HNI and DII look at such opportunities to invest for Retail trader it becomes very difficult to control their emotions in such an environment of Geo-political pressure and then we saw a huge fall in the market. The opportunity was seized by both DII and FII with both hands as both turned net buyers for Rs.6492+ Crores. So traders / investors should always avoid knee jerk reactions. Who knows what happens during the weekend the support and resistance levels to watch out for are already mentioned in the message.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Risk!!!

2018 Cycle Repeat? Bullish Bitcoin Until End of YearSee my DXY analysis for my full view on the performance on bitcoin (and other risk assets as well)

-Summary- bullish like 2018 until end of year.

-This chart pointing out time frames of past cycles, the over all market structure of bitcoins price, and the transformation of a bullish trend into the parabolic. (where I think we are now)

Crypto Risk Management: The Most Overlooked EdgeIn the thrilling yet unforgiving world of crypto, profit potential is massive—but so is the risk. Every trader or investor enters the space with dreams of 10x gains, but without a solid risk management strategy, many exit just as fast—with a trail of losses.

Risk management is the art of protecting your capital while giving yourself the best shot at long-term profitability. It’s not just a skill; it’s a survival strategy.

What Are the Risks in Crypto?

Crypto markets are unique—24/7, global, and driven by emotion, hype, and tech disruption. With that come several risk categories:

Market Risk – Volatile price swings can wipe out unprepared traders.

Liquidity Risk – Low-volume coins can be hard to exit during dumps.

Regulatory Risk – Government crackdowns or bans (e.g., Binance or XRP cases).

Security Risk – Hacks, rug pulls, phishing scams, and smart contract bugs.

Operational Risk – Mistakes like sending funds to the wrong address or using faulty bots.

These risks aren’t just theoretical—think of the LUNA/UST collapse or the FTX debacle. Billions were lost due to poor risk management at multiple levels.

🧠 Core Principles of Risk Management

To stay in the game long-term, you need to adopt some fundamental principles:

Preserve capital first, profit later.

Risk small, aim big.

Never risk more than you can afford to lose.

Think in probabilities, not certainties.

Be consistent, not lucky.

Even the best traders lose—but they survive because they manage their downside better than the rest.

🛠️ Tools & Techniques That Can Save Your Portfolio

1. ✅ Position Sizing

Don’t bet your whole stack on one trade. A common approach is to risk 1–2% of your portfolio per trade. That way, even a streak of bad trades won’t destroy your capital.

2. 🛑 Stop-Loss & Take-Profit

Always have predefined stop-loss levels to cut losses, and take-profit targets to lock in gains. Trading without a stop-loss is like driving without brakes.

3. 📊 Diversification

Spread your investments across different sectors (DeFi, AI, Layer 1s, etc.). Don’t rely on one narrative or one coin.

4. ⚖️ Leverage Control

Leverage can amplify gains—and losses. Avoid high leverage unless you’re an experienced trader with a tight plan.

5. 🔁 Portfolio Rebalancing

Adjust your allocations periodically. If one asset balloons in value, rebalance to lock in gains and manage exposure.

6. 💵 Using Stablecoins

Stablecoins like USDT, USDC, or DAI are great for hedging during volatility. Park profits or prepare dry powder for dips.

🧠 Psychological Risk: The Silent Killer

Many traders don’t lose due to bad analysis—they lose to emotions.

FOMO leads to buying tops.

Fear leads to panic selling bottoms.

Revenge trading after losses leads to bigger losses.

Greed blinds you from taking profits.

The key is discipline. Create a plan, follow it, and review your mistakes objectively.

🚫 Common Mistakes to Avoid

Going all-in on one trade or coin

Holding through massive drawdowns hoping for a recovery

Ignoring stop-losses

Overleveraging small positions to “win it all back”

Risk management is about avoiding unnecessary pain, not killing your gains.

🧭 Final Thoughts

The best traders in crypto aren't those who win big once—they're the ones who survive long enough to win over and over. Risk management is your edge in a market that respects no one.

Whether you’re a scalper, swing trader, or long-term HODLer, never forget: capital is your lifeline. Guard it with your strategy, protect it with your plan, and grow it with patience.

✍️ By Green Crypto

Empowering traders with analysis, tools, and education. Stay sharp. Stay profitable.

$BTC is facing a systemic threat—and it's becoming real.This post is a follow-up to my highly controversial idea from last year:

Back then, many laughed and called me a fool. But it's happening:

Forbes: "Quantum Leap or False Alarm? Bitcoin’s Fate in the Quantum Age"

www.forbes.com

CoinDesk: "Bitcoin Developer Proposes Hard Fork to Protect BTC from Quantum Threats"

www.coindesk.com

Key points:

Bitcoin is not digital gold. It can be hacked.

We have about 5 years to move to quantum-resistant encryption.

This requires a hard fork, forcing all BTC holders to move their coins to a new wallet.

Those who don’t move their coins? They’re burned—permanently lost.

How?

Quantum computers can use a “long-range attack” to derive private keys from public keys. In early BTC transactions, public keys were visible—around 2 million BTC are at risk.

Consequences:

Two chains will coexist: BTC (legacy) and BTC (quantum-safe).

SegWit adoption took 2 years. Expect similar delays.

2 million BTC could be lost forever (≈10% of supply).

Satoshi’s coins? Gone.

We'll have BTC, BTCQ, and BCH side by side.

Why would whales support this?

Removes inactive or lost coins

Doubles their holdings across chains

Protects their assets from being hacked

Is this bullish? Should you buy BTC?

Not sure. This is a systemic risk. The panic from Bitcoin developers says it all.

I warned you. Read my original post. Follow me to stay ahead of what’s next.

📉 Potential consequences

Bitcoin chain split: Legacy chain vs. upgraded chain (like BTC/BCH but even messier).

Burned coins: Could cause a deflationary shock if millions of old coins become inaccessible.

Temporary loss of trust: Confusion = market panic. Price volatility could spike.

Regulatory scrutiny: Governments could use this as an excuse to push CBDCs or new crypto laws.

New “Bitcoin” brand wars: Just like the BCH/BSV split, there may be competing narratives.

Can the developers fix this problem?

Yes, developers can upgrade Bitcoin to be quantum-safe.

But the real danger lies in:

Coordination failure

Loss of user trust

A messy migration

Potential devaluation of old BTC

Legal and branding chaos

#Bitcoin #BTC #CryptoNews #QuantumComputing #CryptoRisk #HardFork #Blockchain #CryptoSecurity #SatoshiNakamoto #CryptoWarning #DYOR #Altcoins #BTCFork #BitcoinUpdate #QuantumThreat

SHARK PATTERNHarmonic Pattern Trading Strategy:

1. Combine patterns with 2-3 confirmations (e.g., MA, BB, RSI, Stoch) for increased accuracy.

2. Implement proper risk management.

3. Limit exposure to 3% of capital per trade.

4. Exercise caution: Not every Harmonic Pattern presents a good trading opportunity.

5. Conduct thorough diligence and analysis before trading.

Disciplined approach = Enhanced edge.

The last 4 previous Stockmarket Fear spikes were great buys...for Bitcoin, allowing investors to enhance their long-term holdings.

Purchasing risk assets when the #VIX exceeds 50 and over 20% of stocks fall below their 200-day moving average has consistently yielded positive returns, with a success rate of one hundred percent when evaluated one week, one month, and three months later.

This particular scenario has only happened 11 times in the history of the S&P 500, and the reading from Monday, April 7th, marked one of those rare instances.

#BTFD

XOM Analysis: Oil's Next Move & Policy ShiftsNYSE:XOM currently piques my interest, particularly with oil prices potentially stabilizing or rising further. Recent geopolitical developments and policy shifts under Trump’s administration—such as rolling back Biden-era energy regulations, reducing methane fees, and easing LNG export permits—could significantly influence the energy landscape.

My intuition suggests Trump’s "Mar-a-Lago Accord" might involve major global economies reducing holdings of US dollar assets, swapping short-term treasuries for century bonds. Such currency shifts and reduced drilling activity could lead to a tighter oil supply, benefiting prices. Additionally, a weakening US dollar could positively impact technology stocks, as investors rotate towards sectors less affected by traditional commodities.

Technical Analysis (Daily & Hourly Chart)

Current Price: Approximately $103.00

Key Resistance Levels:

Immediate resistance: $103.93 (L.Vol ST 1b)

Important resistance zone: $104.74 (118 AVWAP)

Critical resistance (Last week's high): ~$106.46

Key Support Levels:

Near-term support: $101.13 (Weeks Low Long)

Major support: $97.92 (Best Price Short)

Trading Scenarios

Bullish Scenario (Continued oil strength & supportive policy shifts):

Entry Trigger: Sustained breakout and close above immediate resistance at $103.93.

Profit Targets:

Target 1: $104.74 (AVWAP resistance)

Target 2: $106.46 (recent swing high)

Stop Loss: Below recent pivot around $101.00, limiting risk effectively.

Bearish Scenario (Oil price weakness or production surge):

Entry Trigger: Failure to sustain the above resistance at $103.93 or a breakdown below near-term support at $101.13.

Profit Targets:

Target 1: $99.00 (psychological & short-term support)

Target 2: $97.92 (strong support, ideal short target)

Stop Loss: Above $104.75 to control risk in case of a reversal.

Thought Process & Final Thoughts

Given the current geopolitical and regulatory environment, XOM appears poised for potential upside if oil prices remain strong and policy shifts materialize. However, caution is warranted, as oil companies seem hesitant to increase production due to profitability concerns. Clearly defined technical levels will help navigate trade entries and exits effectively around these evolving macroeconomic conditions.

Earnings Date: May 2nd—Keep positions nimble as earnings can significantly impact short-term volatility.

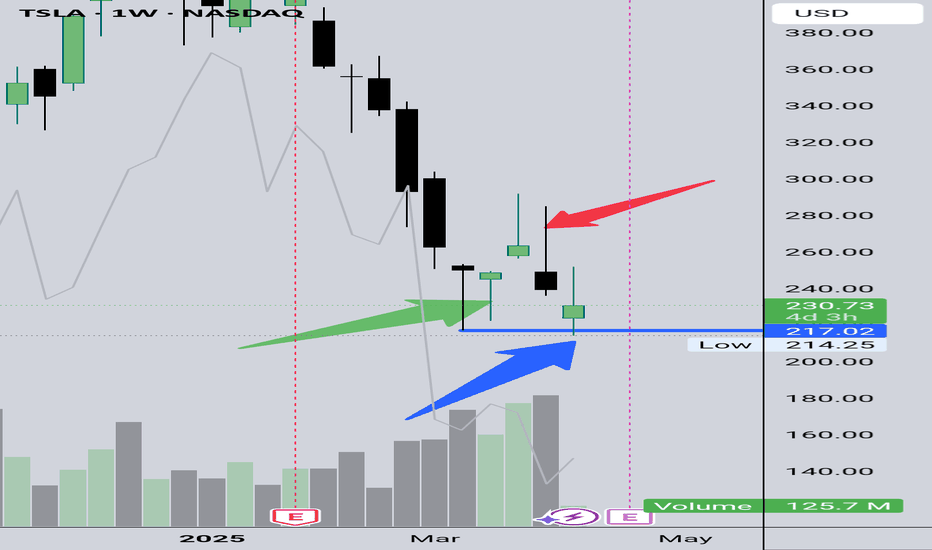

TESLA Always Pay YOURSELF! Tsla Stock were you PAID? GOLD Lesson

⭐️I want to go into depth regarding the this topic but it is a long one with PROS & CONS for doing and not doing it.

Every trader must choose what's best for them but you will SEE when I finally get to the write up that MANY OF THE PROS are NOT FINANCIAL but PSYCHOLOGICAL❗️

Another of 🟢SeekingPips🟢 KEY RULES!

⚠️ Always Pay YOURSELF.⚠️

I know some of you chose to HOLD ONTO EVERYTHING and place your STOP at the base of the WEEKLY CANDLE we entered on or the week priors base.

If you did that and it was in your plan GREAT but... if it was NOT that is a TRADING MISTAKE and You need to UPDATE YOUR JOURNAL NOW.

You need to note EVERYTHING. What you wanted to see before your exit, explain why not taking anything was justified to you, were there EARLY exit signals that you did not act on. EVERYTHING.

🟢SeekingPips🟢 ALWAYS SAYS THE BEST TRADING BOOK YOU WILL EVER READ WILL BE YOUR COMPLETE & HONEST TRADING JOURNAL ⚠️

📉When you read it in black amd white you will have YOUR OWN RECORD of your BEST trades and TRADING TRIUMPHS and your WORST TRADES and TRADING ERRORS.📈

✅️ KEEPING an UPTO DATE JOURNAL is STEP ONE.

STUDYING IT IS JUST AS IMPORTANT👍

⭐️🌟⭐️🌟⭐️A sneak peek of the LESSON after will be HOW & WHEN TO ENTER WHEN THE OPEN BAR IS GOING THE OPPOSITE WAY OF YOUR IDEA.👌

🚥Looking at the TESLA CHART ABOVE you will see that we were interested in being a BUYER when the weekly bar was BEARISH (GREEN ARROW) and we started to consider TAKE PROFITS and EXITS when the (RED ARROW) Weekly bar was still BULLISH.🚥

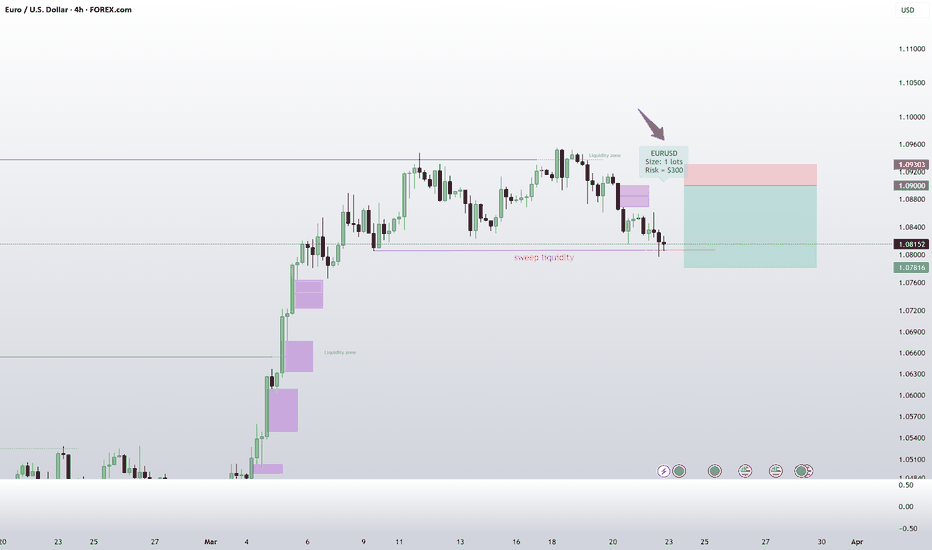

EURUSD Short with Risk Manager ToolI received some messages about the Risk Manager Indicator.

This indicator was created by me and it calculates the Lot Size you need to enter in order to follow your risk management rules.

You just need to fill the % of your balance you want to risk on each trade, the entry price and the number of pips of your stop loss. Then the indicator automatically calculates the position size.

It works on XAU, FOREX, OIL and US100/MNQ1! markets.

It's a private indicator and it's available on my website.

DXY, bullish or bearish?Welcome back!

Today i'm posting a small idea on the DXY. Usually i cover crypto but the macro is important. A weak dollar correlates with more risk being taken and a strong dollar with less risk being taken. Hence my analysis of the DXY.

In the above chart a couple of things can be seen which makes the outlook hard to predict.

On one side there is a bullflag on the monthly timeframe with a target of 130!

On the other side, looking under we can see a bearish MACD cross and a bearish stoch RSI. On average it takes half a year to a year for a cross like this to recover.

This causes me to be bearish on the dollar and bullish on risk-on assets.

Thanks for reading

Is Erdogan’s Gambit Destabilizing Turkey’s Future?Erdogan’s administration continues to engage in high-stakes geopolitical maneuvers by maintaining direct and indirect ties with groups designated as terrorist organizations. His government’s strategic alliances, notably with Hayat Tahrir al-Sham (HTS), serve immediate military and political goals in Syria, despite significant international controversy and longstanding terrorist designations by the U.S. and other global actors.

This risky strategy has had a pronounced impact on the Turkish economy. Investors have increasingly shifted their capital from the Turkish Lira to the U.S. dollar, leading to a notable rise in the USD/TRY rate. Fears of further economic isolation and the looming threat of sanctions—which could cut off Turkey from critical European banking and trade services—have only intensified market instability.

The growing strains within NATO and shifting regional alliances are compounding these economic challenges. Erdogan’s pragmatic yet contentious foreign policy raises serious questions about Turkey’s future role within the alliance, as Western partners deliberate potential sanctions and other measures. Meanwhile, evolving dynamics with regional powers such as Russia and Iran add further uncertainty to Turkey’s strategic position and economic prospects.

$XAUUSD | Gold - Nearing ExhaustionGold has seen a strong rally over the past week – technically impressive, but from a Risk-On perspective, it’s more of a warning sign. As I mentioned in my Nvidia market report, I don’t think the Risk-Off phase will last forever. But for now, I believe we’re not quite done with it yet.

From where I stand, Gold could push a bit higher. My next target is the 161.8% Fibonacci extension at $3,038, which I expect to act as a reaction level. After that, I’m targeting a drop back down into the $2,955 to $2,930 area – this is where I expect sub-wave ((iv)) to complete.

What happens next will depend on how price reacts within that zone. Ideally, we’ll see one final move up to complete sub-wave (v) or roman ((iii)), but where exactly that ends is still unclear – I’ll reassess as we approach the zone.

For now, Gold remains strong – but I believe it's nearing exhaustion.

Is Apple's Empire Built on Sand?Apple Inc., a tech titan valued at over $2 trillion, has built its empire on innovation and ruthless efficiency. Yet, beneath this dominance lies a startling vulnerability: an overreliance on Taiwan Semiconductor Manufacturing Company (TSMC) for its cutting-edge chips. This dependence on a single supplier in a geopolitically sensitive region exposes Apple to profound risks. While Apple’s strategy has fueled its meteoric rise, it has also concentrated its fate in one precarious basket—Taiwan. As the world watches, the question looms: what happens if that basket breaks?

Taiwan’s uncertain future under China’s shadow amplifies these risks. If China moves to annex Taiwan, TSMC’s operations could halt overnight, crippling Apple’s ability to produce its devices. Apple’s failure to diversify its supplier base left its trillion-dollar empire on a fragile foundation. Meanwhile, TSMC’s attempts to hedge by opening U.S. factories introduce new complications. If Taiwan falls, the U.S. could seize these assets, potentially handing them to competitors like Intel. This raises unsettling questions: Who truly controls the future of these factories? And what becomes of TSMC’s investments if they fuel a rival’s ascent?

Apple’s predicament is a microcosm of a global tech industry tethered to concentrated semiconductor production. Efforts to shift manufacturing to India or Vietnam pale against China’s scale, while U.S. regulatory scrutiny—like the Department of Justice’s probe into Apple’s market dominance—adds further pressure. The U.S. CHIPS Act seeks to revive domestic manufacturing, but Apple’s grip on TSMC muddies the path forward. The stakes are clear: resilience must now trump efficiency, or the entire ecosystem risks collapse.

As Apple stands at this crossroads, the question echoes: Can it forge a more adaptable future, or will its empire crumble under the weight of its design? The answer may not only redefine Apple but also reshape the global balance of tech and power. What would it mean for us all if the chips—both literal and figurative—stopped falling into place?

Will Russia’s New Dawn Reshape Global Finance?As the Russo-Ukrainian War edges toward a hypothetical resolution, Russia stands poised for an economic renaissance that could redefine its place in the global arena. Retaining control over resource-laden regions like Crimea and Donbas, Russia secures access to coal, natural gas, and vital maritime routes—assets that promise a surge in national wealth. The potential lifting of U.S. sanctions further amplifies this prospect, reconnecting Russian enterprises to international markets and unleashing energy exports. Yet, this resurgence is shadowed by complexity: Russian oligarchs, architects of influence, are primed to extend their reach into these territories, striking resource deals with the U.S. at mutually beneficial rates. This presents a tantalizing yet treacherous frontier for investors—where opportunity dances with ethical and geopolitical uncertainties.

The implications ripple outward, poised to recalibrate global economic currents. Lower commodity prices could ease inflationary pressures in the West, offering relief to consumers while challenging energy titans like Saudi Arabia and Canada to adapt. Foreign investors might find allure in Russia’s undervalued assets and a strengthening ruble, but caution is paramount. The oligarchs’ deft maneuvering—exploiting political leverage to secure advantageous contracts—casts an enigmatic shadow over this revival. Their pragmatic pivot toward U.S. partnerships hints at a new economic pragmatism, yet it prompts a deeper question: Can such arrangements endure, and at what cost to global stability? The stakes are high, and the outcomes remain tantalizingly uncertain.

This unfolding scenario challenges us to ponder the broader horizon. How will investors weigh the promise of profit against the moral quandaries of engaging with a resurgent Russia? What might the global financial order become if Russia’s economic ascent gains momentum? The answers elude easy resolution, but the potential is undeniable—Russia’s trajectory could anchor or upend markets, depending on the world’s response. Herein lies the inspiration and the test: to navigate this landscape demands not just foresight, but a bold reckoning with the interplay of economics, ethics, and power.

What Lies Beneath Rigetti’s Quantum Ambitions?Rigetti Computing, Inc. stands at the forefront of quantum innovation, chasing a future where computational power reshapes industries. Yet, allegations of securities fraud have cast a formidable shadow over its aspirations. The Rosen Law Firm’s investigation, sparked by claims that Rigetti may have misled investors with overstated progress or understated risks, intensified after a 45% stock drop on January 8, 2025—triggered by Nvidia CEO Jensen Huang’s assertion that practical quantum computers remain 20 years distant. This collision of legal scrutiny and market shock prompts a tantalizing question: can a company’s bold vision endure when its foundation is questioned?

The securities fraud allegations strike at the heart of Rigetti’s credibility. As the company advances its cloud-based quantum platform and scalable processors, the probe—echoed by The Schall Law Firm—examines whether its disclosures painted an overly rosy picture, potentially luring investors into a speculative abyss. Huang’s sobering timeline only amplifies the stakes, exposing the fragility of trust in a field where breakthroughs are elusive. What does it mean for a pioneer to navigate such treacherous waters, where technical promise meets the demand for transparency? This riddle challenges us to dissect the interplay of innovation and integrity.

For Rigetti’s investors, the unfolding drama is both a cautionary tale and a call to action. With millions of shares and warrants poised for market entry amid a $0.515 stock price, the allegations fuel uncertainty and ignite curiosity about resilience in crisis. Could this investigation, if resolved favorably, strengthen Rigetti’s resolve and refine its path? Or will it unravel a quantum dream deferred? As the company balances cutting-edge pursuit with legal reckoning, the enigma deepens, urging readers to ponder the price of progress and the courage required to sustain it against all odds.

Could One Event Propel Gold to $6,000?Gold has long been a refuge in times of crisis, but could it be on the brink of an unprecedented surge? Analysts now predict the precious metal could reach $6,000 per ounce, driven by a potent mix of geopolitical instability, macroeconomic shifts, and strategic accumulation by central banks. The prospect of a Chinese invasion of Taiwan, a major global flashpoint, could be the catalyst that reshapes the financial landscape, sending investors scrambling for safe-haven assets.

The looming threat of conflict in Taiwan presents an unparalleled risk to global supply chains, particularly in semiconductor production. A disruption in this critical sector could spark widespread economic turmoil, fueling inflationary pressures and eroding confidence in fiat currencies. As nations brace for potential upheaval, central banks and investors are increasingly turning to gold, reinforcing its role as a geopolitical hedge. Meanwhile, de-dollarization efforts by BRICS nations further elevate gold’s strategic importance, intensifying its upward trajectory.

Beyond geopolitical risks, macroeconomic forces add momentum to gold’s ascent. The U.S. Federal Reserve’s anticipated rate cuts, persistent inflation, and record national debt levels all contribute to a weakening dollar. This, in turn, makes gold more attractive to global buyers, accelerating demand. At the same time, the psychological factor—fear-driven safe-haven buying and speculative enthusiasm—creates a self-reinforcing cycle, pushing prices ever higher.

Despite counterforces such as potential Fed policy shifts or a temporary easing of geopolitical tensions, the weight of uncertainty appears overwhelming. The convergence of economic instability, shifting power dynamics, and investor sentiment suggest that gold’s march toward $6,000 is less a speculative fantasy and more an inevitable financial reality. As the world teeters on the edge of historic change, gold may well be the ultimate safeguard in an era of global upheaval.

NothingThis is the result of trusting certain politicians !!

Following the crowd isn't always the right move! It might seem bold, but if you take a look at the market, you'll see that even professional analysts have made mistakes multiple times. Still, when the big names on Wall Street say something, everyone listens because it's much easier to rely on an expert's words than to think and make decisions on your own.

If you want to rely solely on yourself, well, your success is yours, but if you fail, you can't blame anyone but yourself. People naturally like to follow others, often without even realizing it. That's why many traders use mechanical trading systems to take decision-making out of their own hands and avoid hesitation.

If you like support me...

Could Silver's Price Soar to New Heights?In the realm of precious metals, silver has long captivated investors with its volatility and dual role as both an industrial staple and a safe-haven asset. Recent analyses suggest that the price of silver might skyrocket to unprecedented levels, potentially reaching $100 per ounce. This speculation isn't just idle talk; it's fueled by a complex interplay of market forces, geopolitical tensions, and industrial demand that could reshape the silver market landscape.

The historical performance of silver provides a backdrop for these predictions. After a notable surge in 2020 and a peak in May 2024, silver's price has been influenced by investor sentiment and fundamental market shifts. Keith Neumeyer of First Majestic Silver has been an outspoken advocate for silver's potential, citing historical cycles and current supply-demand dynamics as indicators of future price increases. His foresight, discussed across various platforms, underscores the metal's potential to break through traditional price ceilings.

Geopolitical risks add another layer of complexity to silver's valuation. The potential for an embargo due to escalating tensions between China and Taiwan could disrupt global supply chains, particularly in industries heavily reliant on silver like technology and manufacturing. Such disruptions might not only increase the price due to supply constraints but also elevate silver's status as a safe-haven investment during times of economic uncertainty. Moreover, the ongoing demand from sectors like renewable energy, electronics, and health applications continues to press against the available supply, setting the stage for a significant price rally if these trends intensify.

However, while the scenario of silver reaching $100 per ounce is enticing, it hinges on numerous variables aligning perfectly. Investors must consider not only the positive drivers but also factors like market manipulation, economic policies, and historical resistance levels that have previously capped silver's price growth. Thus, while the future of silver holds immense promise, it also demands a strategic approach from those looking to capitalize on its potential. This situation challenges investors to think critically about market dynamics, urging a blend of optimism with strategic caution.

TRADING LEVERAGE | How to Manage RISK vs REWARDFor today's post, we're diving into the concept " Risk-Reward Ratio "

We'll take a look at practical examples and including other relevant scenarios of managing your risk. What is considered a good risk to reward ratio and where can you see it ? This applies to all markets, and during these volatile times it is an excellent idea to take a good look at your strategy and refine your risk management.

You've all noticed the really helpful tool " long setup " or " short setup " on the left-hand column. This clearly identifies the area of profit (in green), the area for a stop-loss (in red) and your entry (the borderline). It also shows the percentage of your increases or decreases at the top and bottom. It looks like this :

💭Something to remember; It is entirely up to you where you decided to take profit and where you decide to put your stop loss. The IDEAL anticipated targets are given, but the price may not necessarily reach these points. You have that entire zone to choose from and you can even have two or three take profits points in a position.

Now, what is the Risk Reward Ratio expressed in the center as a number.number ?

The risk to reward ration is exactly as the word says : The amount you risk for the amount you could potentially gain. NOTE that your risk is indefinite, but your gains are not guaranteed. The risk/reward ratio measures the difference between the entry point to a stop-loss and a sell or take-profit point. Comparing these two provides the ratio of profit to loss, or reward to risk.

For example, if you're a gambler and you've played roulette, you know that the only way to win 10 chips is to risk 5 chips. Your risk here is expressed as 5:10 or 5.10 .You can spread these 5 chips out any way you like, but the goal of the risk is for a reward that is bigger than your initial investment. However, you could also lose your 5 and this will mean that you need to risk double as much in your next play to make up for your loss. Trading is no different, (except there is method to the madness other than sheer luck...)

Most market strategists and speculators agree that the ideal risk/reward ratio for their investments should not be less than 1:3, or three units of expected return for every one unit of additional risk. Take a look at this example: Here, you're risking the same amount that you could potentially gain. The Risk Reward ratio is 1, assuming you follow the exact prices for entry, TP and SL.

Can you see why this is not an ideal setup? If your risk/reward ratio is 1, it means you might as well not participate in the trade since your reward is the same as your risk. This is not an ideal trade setup. An ideal trade setup is a scenario where you can AT LEAST win 3x as much as what you are risking. For example:

Note that here, my ratio is now the ideal 2.59 (rounded off to 2.6 and then simplified it becomes 1:3). If you're wondering how I got to 1:3, I just divided 2.6 by 2, giving me 1 and 3.

Another way to express this visually:

In the first chart example I have a really large increase for the long position and you can't easily simplify 7.21 so; here's a visual to break down what that looks like:

If you are setting up your own trade, you can decide at what point you feel comfortable to set your stop loss. For example, you may feel that if the price drops by more than 10%, that's where you'll exit and try another trade. Or, you could decide that you'll take the odds and set your stop loss so that it only triggers if the price drops by 15%. The latter will naturally mean you are trading at higher risk because your risk of losing is much more. Seasoned analysts agree that you shouldn't have a value smaller than 5% for your stop loss, because this type of price action occurs often during a day. For crypto, I would say 10% because we all know that crypto markets are much more volatile than stock markets and even more so than commodity markets like Gold and Silver, which are the most stable.

Remember that your Risk/Reward ratio forms an important part of your trading strategy, which is only one of the steps in your risk management program. Dollar cost averaging is another helpfull way to further manage your risk. There are many more things to consider when thinking about risk management, but we'll dive into those in another post.

Is Gold the Ultimate Safe Haven in 2025?In the labyrinthine world of finance, gold has once again captured the spotlight, breaking records as speculative buying and geopolitical tensions weave a complex narrative around its valuation. The precious metal's price surge is not merely a reaction to market trends but a profound statement on the global economic landscape. Investors are increasingly viewing gold as a beacon of stability amidst an ocean of uncertainty, driven by the Middle East's ongoing unrest and the strategic maneuvers of central banks. This phenomenon challenges us to reconsider the traditional roles of investment assets in safeguarding wealth against international volatility.

The inauguration of Donald Trump as President has injected further intrigue into the gold market. His administration's initial steps, notably the delay in imposing aggressive tariffs, have led to a nuanced dance between inflation expectations and U.S. dollar strength. Analysts from major financial institutions like Goldman Sachs and Morgan Stanley are now dissecting how Trump's policies might steer inflation, influence Federal Reserve actions, and ultimately, dictate gold's trajectory. This intersection of policy and market dynamics invites investors to think critically about how political decisions can reshape economic landscapes.

China's burgeoning appetite for gold, exemplified by the frenzied trading of gold-related ETFs, underscores a broader shift towards commodities as traditional investment avenues like real estate falter. The Chinese central bank's consistent gold acquisitions reflect a strategic move towards diversifying reserves away from the U.S. dollar, particularly in light of global economic sanctions. This strategic pivot in one of the world's largest economies poses a compelling question: are we witnessing a fundamental realignment in global financial power structures, with gold at its core?

As we navigate through 2025, gold's role transcends simple investment; it becomes a narrative of economic resilience and geopolitical foresight. The interplay between inflation, monetary policy, and international relations not only affects gold's price but also challenges investors to adapt their strategies in an ever-evolving market. Can gold maintain its luster as the ultimate Safe Haven, or will new economic paradigms shift its golden allure? This enigma invites us to delve deeper into the metal's historical significance and its future in a world where certainty is a luxury few can afford.

Can the Yuan Dance to a New Tune?In the intricate ballet of global finance, the Chinese yuan performs a delicate maneuver. As Donald Trump's presidency introduces new variables with potential tariff hikes, the yuan faces depreciation pressures against a strengthening U.S. dollar. This dynamic challenges Beijing's economic strategists, who must balance the benefits of a weaker currency for exports against the risks of domestic economic instability and inflation.

The People's Bank of China (PBOC) is navigating this complex scenario with a focus on maintaining currency stability rather than aggressively stimulating growth through monetary policy easing. This cautious approach reflects a broader strategy to manage expectations and market reactions in an era where geopolitical shifts could dictate economic outcomes. The PBOC's recent moves, like suspending bond purchases and issuing warnings against speculative trades, illustrate a proactive stance in controlling the yuan's descent, aiming for an orderly adjustment rather than a chaotic fall.

This situation provokes thought on the resilience and adaptability of China's economic framework. How will Beijing reconcile its growth ambitions with the currency's stability, especially under the looming shadow of U.S. trade policies? The interplay between these two economic giants will shape their bilateral relations and influence global trade patterns, investment flows, and perhaps even the future of monetary policy worldwide. As we watch this economic dance unfold, one must ponder the implications for international markets and the strategic responses from other global players.