Newbie - Ichimoku - BTCBTC drop ~4-5% and everybody is fearing. But Why ? What I see with Ichimoku is a return on Tenkan Sen D1 and retest of a SSB extension support. Daily Doji on 18 January said it all : indecision of the market.

So now we must watch if Tenkan Sen keep price (Tenkan Sen is the weaker line of Ichimoku) or if price continue dropping maybe to Kijun Sen or at least to next SSB extension support (~8441$), where Chikou Span may bounce.

Search in ideas for "ICHIMOKU"

My Ichimoku Market Scanner + Harmonic PatternMy brand new Ichimoku Market Scanner Advanced spotted an interesting situation.

We are now in a Weekly lateral phase. At the top of this lateral channel we can see a congestion ended with the breakdown of the flag.

This down movement dived into Kumo Cloud and broke it.

All signals are now in short direction so i set up my trade on this retracement move and try to follow prices till the bottom of this channel.

I also spotted a possible Cypher pattern in formation, this could be a first take profit at the 0.786 XC zone.

Tell me what you think about it and press like button if you agree with my analysis.

Merry Christmass everyone!

USDCHF a la baja - Indicador: ICHIMOKUSegún el indicador ICHIMOKU el USDCHF en periodo de 1D deberia seguir cayendo por la fuerza de la tendencia que ha roto la nube de los SENKOU SPAN, tambien el TENKAN-SEN ha roto la nube hacia abajo.

Adicional a esto existe una resistencia en 0,984 que era un soporte en octubre, si no se logra romper ese soporte es segura que vamos a a baja.

[NEWBIE IDEA] BTC/USD range H4 with Ichimoku twist ?/!\ I'm a newbie in trading. So I share my ideas as is and only to get comments from community. I don't give any advices. /!\

Range H4 spotted with Ichimoku twist (didn't see it before) ?

Will see if price goes on range top (or bottom) again and maybe short or long depending of signals. I never trade on range median.

CADJPY strong fundamental breaking the Ichimoku cloud!Interest rate from the Bank of Canada has just been confirmed at 1.75%.

With the Federal Reserve (USD) aiming to keep interest rate in a range of 1.50 and 1.75% (with the decision on the 11th of December), BoE (GBP) expecting to confirm a 0.75% interest rate (decision on the 19th of December), ECB (EUR) at 0% with a good chance to go negative in 2020 (next decision on the 12th of December ). Considering also Japan and Switzerland in negative territory (-0.10% and -0.75%), the decision to keep the interest rate at 1.75% could be read as a positive news for the CAD.

The price got a very strong momentum, breaking the Ichimoku cloud and going above last important swing high.

I think we have more than one reason to enter this trade, so let's see how it goes!

EURCHF breakout of the Ichimoku Cloud and ascending channelEURCHF is breaking through the up-channel and the Ichimoku cloud. As mentioned yesterday in the YouTube video, I was waiting for this kind of situation to open a short position. I couldn't get a great risk to reward ratio because I want to place the stop loss above the cloud and the take profit based on the measured move. Still a good opportunity.

EURGBP trading the breakout of last swing high + Ichimoku CloudEURGBP is attempting to break a very strong downtrend, with the price trying to go above last important swing high and above the Ichimoku cloud. We have talked about this potential trade on my YouTube channel, I hope you had the chance to follow the idea and structure your own trade.

#bitcoin - 3D E-to-E (end-to-end) #ichimokuGood morning guys,

today we are having a very simple look at what´s been happening without drawing a single line or zone.

Fact 1: We have talked about the bearish descending triangle with the Quarterly Pivot as Support and been saying this has better odds to break down than up and it´s anything else than a bullish formation.

Fact 2: For those who know me well enough: the 3D-interval (my absolute fav) is essential looking at the Ichimoku cloud, Bitcoin has tested the P-Q once more whilst diving into the cloud and failed to bounce, this was the final hint.

Fact 3: The Yearly Pivot plus the support through the cloud has been clear target of this major move.

What happens next?

Assuming we ignore BAKKT, the Yearly Pivot is key, right now we could accumulate here and once more find support exactly at this price level (couple of hundreds of $ swings within). Asking myself how the odds are that we break down further doesn´t make sense right now, also a fact is, it would not be nice if we would as we might see levels as low as 5.4k-4k.

Without reversal signs, this is a an area that does not give away a direction and is, therefore, a classy no-trade-zone.

___________________________________________

Warm regards,

Neru

AMD Rising Wedge, But bullish Ichimoku (2 Day)AMD right now is creating a rising wedge. This should break to the downside, however the ichimoku is currently very bullish. I predict that AMD goes to $32 ish, and has a dump, possibly all the way down to $12-$13, or even $6.

Bullish Signals:

Price moves above cloud (trend)

Cloud turns from red to green

Price Moves above the Base Line (momentum)

Conversion Line moves above Base Line (momentum)

NZD/CAD technical(Ichimoku,MACD,CurrencyStrength) & funadamentalTechnical:

1.Ichimoku: Ichimoku giving a sell signal.

2.MACD: MACD is also giving a sell signal.

3.Currency Strength:

NZD is much weaker than CAD

Fundamental:

Due to the trade war between China & US, Chinese currency is weakening, so is NZD..

Crude Oil price gaining strength, so is CAD.

Trading Plan:

I'll Open short position when market opens (20 May)

There is a news release of CAD on 22 May, I'll stay away from the market at that time(OR I'll put a large stop loss).

And I hope I can Continue with this pair this whole week, Since there is no other news releases awaiting for this pair.

I'll keep updating....

RENBTC LONG BINANCE via VPVR ICHIMOKU FIB OBV and ADXDespite the powerfully momentous sell off since the REN ICO, we have seen a very aggressive reaccumulation from the markets constituents under 0.00200000. The short term trend is looking rather Bullish. On Balance Volume is drastically under the trend angle, indicative of an obvious accumulation opportunity for institutional traders. The Possitive DMI is above the 20 line and is about to bounce off the ADX, which is also above the 20. We can see that the Tenkan-sen and Kijun-sen are about to cross in Bullish behavior. We can also see that the Kumo Cloud is about to Twist. Likely the strongest indicator to be taken here in terms of market repectecting an indication. Price is consolidating above the Point of Control and my speculative Take Profit targets are based off of High Volume and Low Volume Node mountains and valleys as we should all know how price likes to move from LVN to HVN and vice versa. TPs are also in confluence with a Fibonacci extension taken from the latest reaccumulation swing directly after the Climactic Sell off. If I were to take this trade, I would use the pertinent values of the Ichimoku Kinko Hyo relative to that point in the future. Please let me know if you have any input here.

For a bit of fundamental analysis, the parent company of REN is MSFT. The current strong bullish trend for Microsoft has been mirrored by RENTBTC and RENTBNB on BINANCE. And general adoption of aunanoymous coins is ground exponentially accross all exchanges.

Thank you for taking the time to read this.

Litecoin Bitcoin LTC/BTC Analysis - IchimokuHello, let's look at how Litecoin is doing.

The 4 hours chart show us a bullish trend, however I'd wait to see my Ichimoku histogram to flip back up in weekly to confirm the optimistic scenario.

I also publish my analysis on my Website: blockchainfiesta.com

Thanks for reading.

AUDUSD H4 Cypher with RSI/Ichimoku confirmationsHey traders what's up?

If you are a pattern trader you may have noticed this Cypher. The SL and TP are displayed on the chart. This is a high probability trade.

I added a RSI divergence for confirmation, and although a TK / KJ divergence in the Ichimoku for a second confirmation.

For the targets there are on the charts, but you can althought take an SSB or the KJ, depends of your trading profile.

Good luck traders ;)

How to trade BTC using Ichimoku (1D chart)Right... Without going into too much detail, BTC is more ''bullish'' than it has been all year so far, according to the cloud.

At the moment, on the 1 day chart, we have:

(1) Lagging span above the price - which is, in my opinion, one of the best early and aggressive entry signals for traders, this is a very weak bullish signal but usually the first component to flip from bearish to bullish.

(2) A (weak) bullish TK cross below the cloud. Once again, a confirmation that we are heading into bullish territory.

Current situation:

*BTC is currently within the cloud, which indicates that price action is neutral, there is neither a bullish or bearish trend established. Keep this in mind.

*We have a flat Kumo edge (indicated with the yellow line) , which a lot of Ichimoku traders see as a ''magnet'', it is the .5 fib from the last peak and last bottom. Price tends to move towards that line.

*The Bearish Kumo (cloud) is getting thinner, and might even flip bullish for the first time this year, this would be another confirmation that we are headed towards bullish territory. However, the cloud was thinner mid-June so don't rely on this yet, just keep an eye on it.

TLDR; What to do:

1. Keep an eye on BTC and watch it move through the last major resistance (the Kumo edge - indicated with the yellow line)

2. If it fails to break this resistance keep in mind that we might test the resistance again and break through it and BTC is bullish as hell.

3. If price declines and hits the lower edge of the cloud (major support) it will either bounce, or break through the cloud - breaking through the lower cloud edge would be incredibly bearish and means that we will most likely see new lows.

Nothing is bullish about Ethereum - Ichimoku 1day chartNothing is bullish about Ethereum, keep that in mind.

Bitcoin is probably the best crypto to follow closely as everything else will just follow BTC - Including Ethereum, although Vitalik likes to disagree.

So, what do we have:

(1) A bearish TK cross. Price is going sideways so I don't think it's that valuable at the moment, but it is still bearish.

(2) A bearish cloud.

(3) Lagging span is beneath the price again, another bearish signal. Price going sideways so just like the TK cross, not that valuable at this moment, but bearish nonetheless.

(4) Price is still below the cloud.

TLDR; what do we do:

If you are looking for a long, Ichimoku tells you that it is best to wait until all components flip bullish (see the ones I described above) - and all of them are still bearish.

Look for the support bounce, indicated with the yellow line. It could bounce up a bit, but the complete movement definitely depends on what Bitcoin does - check out my Bitcoin chart on how to trade Bitcoin the following days (CRUCIAL!);

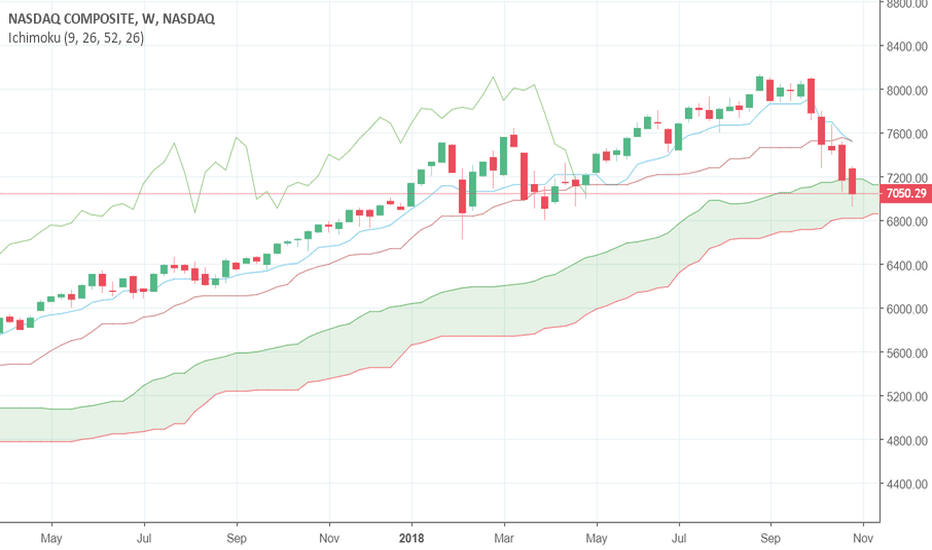

My decision ?Single or Double ichimoku Settings? I have recently been debating whether to use single or double ichimoku settings. I have inspiration coming from both Chaos Trader 63 (classical Ichimoku Chartist single settings)( 9, 26, 52, 26) and Josh O. (uses double Ichi setting 20, 60,120, 30 (derived from increasing the numbers to account for crypto being 24/7 365 compared to different times on Legacy Markets)). I enjoy listening to both of them and think they are both great at what they do.

Personally I find that Josh's method is more versatile in that there is the Edge to Edge Trade. This trade is somewhat of a range trade rather than a trend one (which ichi was developed for trend trading).

I also like the simplistic nature of Chaos trader's single settings. The deciding factor for me to choose the single settings was due to it being only trend based and quicker to react to the market than the double settings, thus allowing me to get more trades and more data on my trading to see what works best for me. The quicker pace of single settings also aligns with my faster paced personality and can only be described as feeling right for me.

Personally I think if you are having a hard time decideing which to go with you should test out a week on each and decide which you like best. Just don't use both. I tried that for a little while and it was way too much info.

EUR/CAD Ichimoku Edge to Edge TradeI have started using Ichimoku along with Heiken Ashi Candles to get a sense of the trend. I will be using the fractals and just below the kijun as stop losses.

In this strategy, the cloud and price relative to the cloud give the big picture of the trend and the Tenkan and Kijun lines are a picture of trend in the moment. I am not totally sure whether to involve the Chinkou span in my trading strategy yet so I am doing some research on it to find the success rate of using it vs not. The Chinkou Span gives insight on price compared with somewhat recent price (30 periods in my case).

The edge to edge trade is essentially playing a possibly ranging market where no clear trend is defined. For me to enter the trade I need to see a bullish TK cross and a green candle close inside the cloud. In this instance the CHinkou Span is also above price which is an added bonus bullish sign. The target is the box at the top of the cloud and the SL is at the fractal level circled. I will manually exit this trade if there is a gold candle close or if price closes below the kijun.