Search in ideas for "MACD"

Key Levels With MACD Divergence For SPX500 19/03/19On the 15 minutes chart of SPX500, we can see very clearly the divergence between MACD and the price records, the divergence on MACD indicator is not a signal for me to sell, it just tells me that the uptrend we can see on the 15 minutes chart is powerless, there are 2 options I'm waiting for to sell.

1 - if the price will breakout the support below I'll look for price action setup to sell,

2 - Sell at 2870.00 on the first touch, it's a great supply that we can see on the daily chart.

In both cases, the demand below will be the first target and the final target is 2400.00 zones.

The Green Organic Dutchman - W-MACD-CCI watchTGODF on weekly showing nearing entry point for MACD cross and CCI crossing 0. Keep watching here @Pokethebear.

TGODF , TLRY , NYSE:ACB , NYSE:CGC , NASDAQ:CRON , AMEX:HEXO

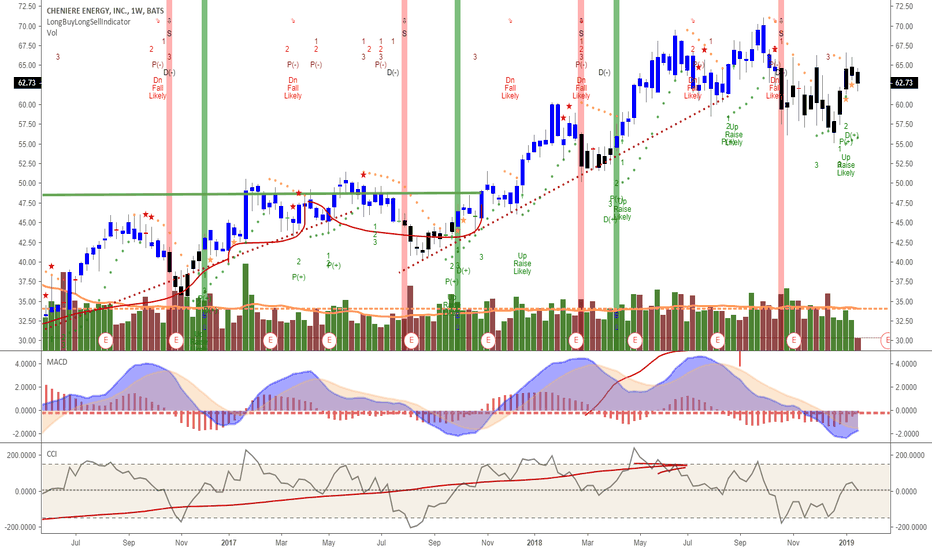

LNG winter fuel use time: MACD and CCI entry signalsOn weekly candlestick chart, MACD is shown crossing over and CCI at 0, but on downward slope at $62.73.

Await 2nd LNG port set-up and exports looking positive as cold weather driving use. LNG will also be a growing industrial energy fuel to replace coal and oil energy plants, as 30% lower CO2.

Nuclear and solar are only better ones and solar equipment costs not net zero CO2. Nuclear has proven solid long term CO2 near zero source (add CO2 output to make plant, deliver fuel).

Tilray nearing full retracement - daily MACD - CCI watch Tilray is currently $71.74/share and falling in this weeks sell off and good chance to drop near full retracement to $65-66 range. Great time to buy half and have standing order 8% below this for full retracement, or just wait.

$65.50 target with MACD cross-over on 12/26 and CCI about to cross positive.

BTCUSD - Descending Triangle (Breakout) & MACD Bearish DivergentHi All,

Here is my simple explanation for this TA.

1. Descending Triangle (Breakout). We are in the breakout area of the descending triangle. you can see spike in volume at the breakout after the declining in the volume from the beginning of the pattern is formed.

2. MACD Bearish Divergent. To spot this pattern, you require to check on the blue oscillator which is 12 EMA. It show higher high and the MACD histogram is showing higher low before the reversal.

This TA is for Educational purpose and not a financial advice. If you are happy with my charts and would like to follow more in the future, feel free to follow my profiles.

RDD MACD x and ichimoku basicsWe have the beginning of a macd x on the 4 hr. Tenkan Sen, about to cross Kijun Sen on the Ichimoku. Chikou Span crossing above previous the price line, and price breaking out of cloud will be another bullish confirmation. RDD is giving us more and more signs. As always be careful, set stop losses and/or alerts, never panic.

Happy trading!

Ichimoku Lines explained here.

d.stockcharts.com

BTC: MACD Signals Aligning for a Potential Buying OpportunityLooking at several factors in parallel, BTC’s MACD is showing promising signs. The fast-moving average has started to curl up, suggesting a possible bullish cross above the slower line—typically a strong buy signal. The histogram has also been in the red for several weeks but is now curling upward, and we could be looking at our first green week.

However, the lack of a significant volume increase means there’s no clear confirmation of a trend reversal just yet, and we aren’t seeing the momentum required for new higher highs or all-time highs. But if these signals continue to align, this could turn into a fantastic buying opportunity.

The question is: will you take buying or selling actions based on these signals?

The macd on the btcusd daily.Correction in progress, macd reporting a new cycle but we knew this well. Now the thing to do is to wait and understand how long this correction will last, because there are still many buyers. The indicator here is drawing a high and agrees with the price, a signal that the bullish trend is very strong, this is in addition to the other bullish signals we have on btc, including the sequence of highs and lows on intermediate period and time, because by drawing the maximum at 73k usd, the price canceled the previous short-term correction made between December and January. I remind you that it is not enough to have a sequence of ascending highs and lows, but it is also necessary for the price to remain upwards for longer than downwards.

COSTCO: Bearish Butterfly with PPO and MACD Bearish DivergenceCostco has formed a Bearish Butterfly that lines up with the 0.786 retrace and is testing the zone for the second time with PPO Bearish Confirmation Arrows on both tests, PPO Bearish Divergence, and MACD Hidden Bearish Divergence. This looks like it could be setting up to revisit the lower half of the range.

SQQQ: Bullish Butterfly with PPO Circle and MACD DivergenceThe SQQQ has given us PPO Confirmation at a potential 1.414 Bullish Butterfly PCZ and has topped it off with MACD Hidden Bullish Divergence. If we are to see the QQQ pull back 50-65% then the SQQQ should go up about 100-200% from here, though I may end up just targeting $32 depending on how fast it goes.

A different way to identify momentum with MACD (BABA)Before coming up with this idea I asked myself the following question: is there a way to visualize whether sellers or buyers are in control during a certain move/period of stock price action?

In order to achieve this, I decided to connect the moves with the associated changes on the MACD histogram bars and try to plot the "area's" on the Histogram bars as a form of "accumulative momentum".

With BABA, it can be seen seen that a "change of character" has occurred since march of 2022 where for the first time the area above the 0 line between the histogram bars became larger than the area below it. Is this further evidence that the stock has been in accumulation mode ever since? Time will tell!

Trade with MACD & Bollinger Bandstesting indicators - MACD, Bollinger bands together on BTC/USD pair, to check if it works while changing the inputs. 1st test clear, gained 33% in long position. Will test multiple times on different instruments for conclusion. Let me know if any other idea of adding more indicator for accuracy for shorter timeframe of 3 min & 5 min.

Ericsson: Bullish Bat with MACD Bullish DivergenceWe have a Bullish Bat Visible on the Weekly and Monthly with Weekly MACD Bullish Divergence near the bottom of a Decades Long Range. If we bounce from here to the range top a Partial-Decline will be Confirmed that could likely result in a Breakout to $28.

Ericsson also has a great P/E Ratio to back it up and as a result i have gotten the Jan 19 (413d) 8 C call options that are currently trading at well below a dollar.

MACD: Bitcoin is squeezingMACD is a good tool for detecting squeezing. When squeezing happens, two MACD lines stick together and move horizontally. The charts below show this

over the years.

MACD now represents bitcoin squeezing. We should wait for a rapid jump in bitcoin (up or down) in the near future