Silver is Again in the Bullish directionHello Traders

In This Chart XAGUSD HOURLY Forex Forecast By FOREX PLANET

today XAGUSD analysis 👆

🟢This Chart includes_ (XAGUSD market update)

🟢What is The Next Opportunity on XAGUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

Silveranalysis

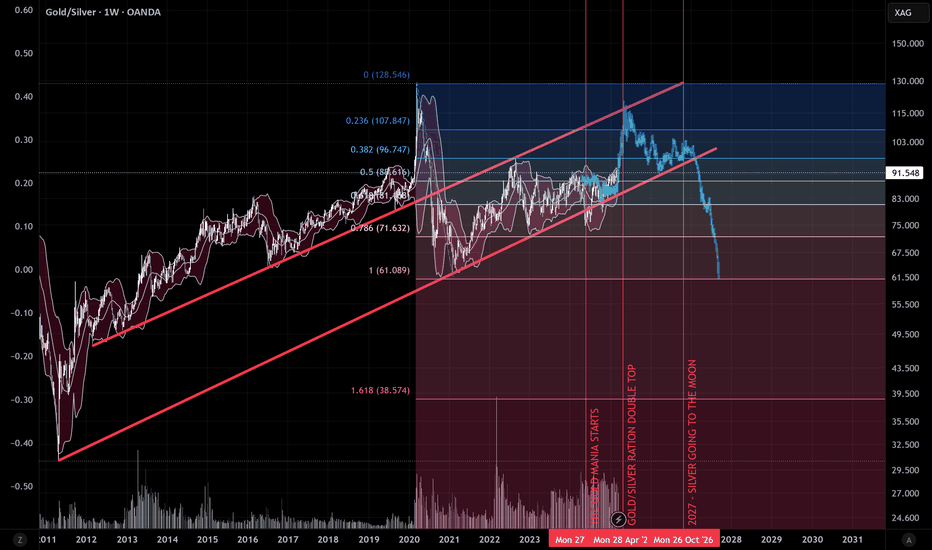

Silver pleasurable ATMMany people are happy with their silver positions... What will make them sell it??

A loss of 50% into 2027 with a fake capitulation bottom.. Pump and dump??

They would be able to stock up on all the silver needed for smart cities and military weapons.

I like silver and we need it. BUT they need it manipulated to a cheap price and the military industry gets what it wants.

BE SAFE, NOT FINANCIAL ADVICE!!!

Silver Analysis: Bearish Continuation Toward $31 Support ?🧠 Chart Context & Setup

Chart Type: Candlestick

Timeframe: Likely 4H or Daily

Indicators Used:

EMA 50 (Red) — 32.814

EMA 200 (Blue) — 32.559

🔍 Key Technical Levels

Resistance Zone: 33.600 – 33.950

Price faced repeated rejection in this zone, confirming it as a valid supply/resistance area.

Support Zone: 30.600 – 31.100

Marked as the next potential demand zone, aligning with previous accumulation and reaction levels.

Current Price: ~32.618

Just below the 50 EMA and slightly above the 200 EMA.

🔄 Market Structure

The market experienced a strong bearish impulse in early April, followed by a bullish correction that reclaimed the 200 EMA.

Multiple internal liquidity (INT.LQ) sweeps were taken before forming a potential lower high (LH) at the resistance zone.

The recent bearish move broke below the EMAs and previous structure, indicating a possible shift back to bearish momentum.

📉 Bearish Scenario Outlook (Most Probable as of Now)

The chart shows a projected lower high formation, likely leading into a continuation of the bearish move.

If price fails to break back above 32.800–32.900, we could expect a sell-off toward the support zone (30.600–31.100).

This move aligns with:

Breakdown below EMAs

Failed bullish continuation

Rejection from a strong resistance zone

🧭 EMA Analysis

EMA 50 > EMA 200, but the price is now sandwiched and showing signs of weakness.

If price sustains below both EMAs, momentum is likely to favor bears in the short to medium term.

⚠️ Risk Factors to Watch

Any strong bullish engulfing candle reclaiming the 33.000 zone could invalidate the bearish thesis.

Fundamentals like USD volatility, inflation data, or geopolitical tension could impact Silver drastically.

✅ Conclusion

The chart currently suggests a bearish continuation setup, with the potential for price to revisit the $31.00–$30.60 support zone after rejecting resistance. A retest of broken structure around 32.700–32.800 might provide an ideal entry for sellers.

XAGUSD - SILVERSupport and Resistance clearly defined in the chart.

2 Scenarios on my mind is as follows:

Short Term:

Silver Drops to 32 (rounding), where there is a strong long time support for that area. and Target 1 "T1" is at 33.677 (33.600)

Where Long Term due to the lagging effect from gold, long term outlook is heading towards the 34.134 "T2" and 34.578 "T3" and settle there till it moves up again.

Silver - Expecting Retraces Before Prior Continuation LowerH1 - Strong bearish momentum

Lower lows on the moving averages of the MACD indicator.

Expecting retraces and further continuation lower until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Trading Silver’s Retrace: 50% Equilibrium Strategy for XAGUSD🪙 XAUUSD Technical Analysis

The daily chart for XAGUSD shows a significant sell-off after a strong bullish move, with a retracement of approximately 21.93% from the recent swing high. However, the price has since broken structure to the upside, indicating a potential shift in momentum back to the bulls. The current price action is trending upward, approaching the previous high, which could act as a resistance level. Your plan to look for a retrace into the 50% equilibrium of the recent swing on the 4-hour chart is technically sound, as this level often acts as a magnet for price and a potential area for institutional order flow. Waiting for a pullback and a bullish structural break in your area of interest increases the probability of a successful long entry.

🔍 Key Levels & Price Action

The 50% equilibrium of the recent swing (measured from the swing low to the swing high) is a classic area for price to retrace before resuming the trend. If price pulls back into this zone and forms a bullish structure (such as a higher low or a bullish engulfing candle), it could provide a high-probability long setup. Watch for confirmation on lower timeframes (like the 4H) for added confluence. The previous high around $35 may act as resistance, so partial profits or tighter stops near this level could be prudent.

🌐 Fundamentals & Sentiment

Silver is currently benefiting from a mix of macroeconomic factors. Ongoing inflation concerns, central bank buying, and geopolitical tensions (such as those in Eastern Europe and the Middle East) are supporting precious metals. Additionally, industrial demand for silver remains robust, especially with the global push toward green energy and solar panel production. However, a stronger US dollar or rising bond yields could temporarily cap gains. Sentiment among retail traders is cautiously bullish, with many looking for dips to buy, but there is also a risk of volatility if macro data surprises.

🧠 Alternative Views

Some analysts caution that the recent rally may be overextended, and a deeper correction could occur if risk-off sentiment returns or if the Fed signals more aggressive tightening. Others point to the strong uptrend and suggest that any pullback is likely to be bought, especially if it aligns with key technical levels like the 50% retracement. Keep an eye on COT (Commitment of Traders) data for signs of large speculator positioning, as well as ETF flows for additional clues on institutional sentiment.

📈 Trade Management & Risk

If entering long on a pullback to the 50% equilibrium, consider using a stop loss below the swing low to protect against a deeper correction. Scaling out profits as price approaches the previous high or key resistance zones can help lock in gains. Always use proper risk management and avoid overleveraging, especially in a volatile market like silver.

🎬 Video Title Options

"Silver’s Next Move: 50% Retrace Entry? XAGUSD Trade Idea & Analysis"

"Bullish Breakout or Bearish Trap? XAGUSD 4H Trade Setup Explained"

"Silver Price Action: Waiting for the Perfect Pullback! (XAGUSD Analysis)"

"XAGUSD: Is the Silver Rally Just Getting Started? Key Levels to Watch"

"Trading Silver’s Retrace: 50% Equilibrium Strategy for XAGUSD"

⚠️ Disclaimer

This analysis is for educational and informational purposes only and does not constitute financial advice. Trading involves risk, and you should always do your own research and consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results.

Silver Update – April Rollercoaster Ends in Bullish Setup?What a month it has been for Silver also!

In early April, the metal broke down from a rising wedge pattern, triggering a waterfall drop of around 6,000 pips. The plunge took us right into the 28 zone, but the reversal that followed was nothing short of spectacular.

In just two trading days, Silver rocketed back above the key 30 level, and the rally didn’t stop there. By mid-month, it reclaimed the 32 support – a level previously broken during the drop.

📉 Last week, however, price action turned quiet compared to the volatility in Gold, with Silver entering a tight consolidation.

But here’s the key point:

➡️ Despite the sharp early-month drop, the structure is now bullish again and remains so as long as 32 holds.

💡 Trading Plan:

I'm looking to buy dips near 32 in anticipation of a breakout above 33.15 – the upper boundary of the recent consolidation.

If that level gives way, Silver could accelerate its gains and make a new attempt toward 35.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

XAG/USD "The Silver" Metal Market Heist Plan (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "The Silver" Metal Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Pink MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level for Pullback Entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 1 Day timeframe (32.000) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 27.000 (or) Escape Before the Target

⚙💿XAG/USD "The Silver" Metal Market Heist Plan (Swing/Day Trade) is currently experiencing a Neutral trend (there is a chance to move bearishness),., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

Detailed Point Explanation 📋

Fundamentals 🌟: Silver’s dual role ensures resilience, but USD and rates cap gains ⚖️.

Macro 📊: Inflation aids 🔥, but growth and policy risks create volatility ⚡.

Geopolitics 🌐: Safe-haven demand helps 🛡️, though trade wars hurt industrial use 🚨.

Supply/Demand ⚖️: Deficit is a strong bullish driver 📉, despite short-term fluctuations ⚡.

Technicals 📉: Near-term weakness 🐻 within a broader uptrend 🐮.

Sentiment 😊: Balanced ⚖️, with cautious optimism prevailing 🌟.

Seasonal 🍂: Neutral ⚖️, with minor weather-related disruptions ❄️.

Intermarket 🔗: Gold supports 🥇, USD resists 💵 – a tug-of-war ⚔️.

Investors/Traders 👥: Long-term bulls 🐮 vs. short-term bears 🐻 reflect split views ⚖️.

Trends 🔮: Short-term dip 📉, medium/long-term rally potential ⬆️.

Outlook 📝: Mildly bullish ⭐, favoring longs over 6-12 months 🐮.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAGUSD Trade Plan: 1D Support, Liquidity Grab, & Bullish Setup!Silver (XAGUSD) is currently exhibiting signs of being overextended, as evidenced by its recent price action on the daily and 4-hour timeframes. The metal has traded into a critical support zone, marked by previous lows on the daily chart. This zone represents a significant area of interest, as it has historically acted as a key level for buyers to step in. However, the current price action has dipped below these lows, eating into sell-side liquidity in the form of stop-loss orders placed beneath this level. This liquidity grab is a classic move often seen in markets before a potential reversal.

On the 15-minute timeframe, the price is consolidating within a range, suggesting a possible accumulation. A break above this range, accompanied by a bullish market structure shift, could signal the beginning of a reversal and provide a compelling buy opportunity. This aligns with the idea of a "spring" in Wyckoff theory, where price manipulates liquidity before reversing direction.

Traders should remain patient and wait for confirmation of a bullish breakout on the lower timeframe before entering long positions. Key factors to monitor include strong bullish momentum, a clear break of the range, and the formation of higher highs and higher lows. Until these conditions are met, caution is advised, as the current downtrend could persist. 📉➡️📈

Key Levels to Watch:

Support Zone: Previous daily lows (now acting as a liquidity zone).

Resistance Zone: The upper boundary of the current 15-minute range.

Trading Plan:

Wait for a break of the 15-minute range to the upside. 🚀

Look for a bullish market structure shift (higher highs and higher lows). 📊

Enter long positions with a tight stop-loss below the range low. 🛡️

Target key resistance levels on the 4-hour and daily timeframes for potential take-profit zones. 🎯

This analysis highlights the importance of patience and discipline in trading. While the current setup is promising, confirmation is key to avoid premature entries. As always, this is not financial advice, and traders should conduct their own due diligence before making any decisions. ⚠️

Silver Tested Key Resistance LevelFenzoFx—Silver tested the $30.81 resistance level today. If this holds, the downtrend may resume, targeting $28.75 and possibly $27.73 if selling pressure persists.

A bullish reversal could occur if XAG/USD exceeds and stabilizes above $30.81.

>>> Trade XAG/USD at FenzoFx Decentralized Forex Broker.

Silver’s Deep Retrace: Long Setup with Bullish Potential I’ve entered a long trade on Silver (XAG/USD) after observing a deep retrace to the 0.7 Fibonacci level on the daily timeframe. The entry at $28.96 is positioned strategically based on historical support and the current technical setup.

The stop loss is set at $26.54 to mitigate risk, while the take profit target is $36.00, aligning with a potential bullish continuation. In the bearish scenario, a break below $27.50 will prompt a reassessment and tighter risk management. Conversely, on the bullish side, breaking above $32.50 will strengthen the case for holding towards the TP.

Silver’s price action showcases its potential for a significant bounce back, supported by current geopolitical and macroeconomic conditions.

Fundamentals:

1. Federal Reserve’s Hawkish Stance:

The Fed’s updated projections for rate cuts in 2025 have pressured silver prices, as a stronger dollar and rising Treasury yields (above 4.5%) diminish the appeal of non-yielding assets. However, easing inflation in the long term could rejuvenate demand for precious metals.

2. Geopolitical Tensions:

Although silver traditionally benefits from uncertainty, recent macroeconomic headwinds, such as concerns about tariffs under the new Trump administration and sluggish global economic recovery, have overshadowed its safe-haven status.

3. Industrial Outlook:

Challenges in the industrial demand for silver, particularly from China’s solar panel production slowdown, add pressure. However, as inflation stabilizes and geopolitical risks unfold, silver could regain its industrial and safe-haven allure.

Technicals:

• Entry: $28.96

• Stop Loss: $26.54

• Take Profit: $36.00

• Key Levels:

• Bearish Scenario: Manage position below $27.50.

• Bullish Case: Strength above $32.50 confirms upward momentum.

This setup leverages a confluence of technical retracement, macroeconomic factors, and the potential for a trend reversal. Stay sharp and pay yourself as the market unfolds.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

XAG/USD "The Silver" Metal Market Heist Plan(Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "The Silver" Metal Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move at (33.500) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the Support level Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 1H timeframe (34.200) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 32.800 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

XAG/USD "The Silver" Metal Market Heist Plan (Scalping/Day Trade) is currently experiencing a Neutral trend., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Buy Silver ETF @91Buy SILVER in all dips

Can be Multibagger!!

Target1 - 101

Target2 - 118

Target3 - 150

Disclaimer :-

I am not SEBI registered. The information provided here is for education purposes only.

I will not be responsible for any of your profit/loss with this channel suggestions.

Consult your financial advisor before taking any decisions

Silver Approaching ATH – Major Breakout Incoming?Silver is showing a strong bullish structure on the weekly timeframe. The price has been consistently forming Higher Highs (HH) and Higher Lows (HL), respecting a long-term ascending trendline that’s acting as dynamic support. This trendline has held multiple pullbacks, confirming strong underlying demand.

Currently, Silver is approaching its All-Time High (ATH) resistance near $34.83 while testing the upper resistance trendline of an ascending channel. A clean breakout above this level could trigger a major rally, potentially setting a new ATH. If the price faces rejection, a healthy pullback toward the support zone around $30 could offer another long-entry opportunity.

The structure remains bullish as long as Silver holds above the trendline support. A successful breakout above $34.83 could lead to a strong bullish continuation.

Still DYOR, NFA

Found this analysis helpful? Don’t forget to like, drop a comment, and follow us for more insights. Thanks for the love!

Silver Insights: Aggressive Strategies and Bullish SentimentHello, friends! I’m excited to share some observations on Silver.

Yesterday, I came across a couple of intriguing portfolios focused on this metal.

The first one is an aggressive call spread at $40-$40.25, while the second portfolio is a "butterfly" spread, positioned slightly lower.

Both portfolios are designed to capitalize on price movement, but the first one could yield a threefold profit with just a little push in its direction. The second one, however, will require some time and ideally needs to reach around $38 by the end of April.

From a technical standpoint, the chart shows a "spring compression", which often leads to the emergence of such portfolios. While I don’t place too much weight on predictive elements, the sentiment remains bullish.

Stay tuned, plan your trades and let’s see how this unfolds!

Always do your own research but do no hesistate visit us to leverage the comprehensive analysis from our team to enhance your trading advantage! 💪💼

SILVER at Key Support Level – Will Buyers Step In?OANDA:XAGUSD is experiencing a corrective move after rejecting from the upper boundary of the ascending channel. The price has now reached the lower boundary of the channel, aligning with a key demand zone. This confluence of trendline support and horizontal demand increases the probability of a bullish reaction from this level.

If buyers maintain control at this level, we could see a rebound toward the $34.12 level, which aligns with the midline of the ascending channel. This level could serve as a short-term target within the current bullish market structure. However, failure to hold above this support zone could invalidate the bullish outlook and signal further downside.

Traders should monitor bullish confirmation signals, such as rejection wicks, increasing volume, or bullish engulfing patterns, before entering long positions.

If you agree with this analysis or have additional insights, feel free to share your thoughts here!

GOLD TO SILVER RATIO ABOUT TO TOP OUT !!OANDA:XAUXAG The current Gold rush and the weak demand in Retail for Silver, Platinum or even Palladium clearly shows that Gold TVC:GOLD is heading for a double top in the coming two to three months against Silver TVC:SILVER , after which Silver will start having the upper hand and totally outperform Gold (add in Platinum and Palladium as well). This would also perfectly coincide with my editorial Silver prediction to break the $45-50 barrier in 2027 from a year ago:

Silver is in the bullish trend after testing supportHello Traders

In This Chart XAGUSD HOURLY Forex Forecast By FOREX PLANET

today XAGUSD analysis 👆

🟢This Chart includes_ (XAGUSD market update)

🟢What is The Next Opportunity on XAGUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts