$136 Resistance Crumbles: Solana Bulls Take the Lead...Solana Breaks Key Resistance – Eyes Set on $150 and $180 Targets

Solana (SOL) has successfully broken through the strong resistance level at $136 after several failed attempts, signaling a potential continuation of its current uptrend. This breakout marks a significant technical milestone for SOL, which had previously struggled to maintain momentum above this price zone.

If Solana is able to hold above the $136–$137 level, it could open the door for further gains, with short- to mid-term price targets around $150 and $180. The breakout aligns with broader bullish sentiment in the crypto market and may attract new buyers looking to ride the trend.

For traders or investors interested in entering a position, the $136–$137 range could offer a potential entry point, provided the breakout holds and is supported by volume. As always, proper risk management is recommended, and watching for confirmation on the next few candles could be key.

Solanaanalysis

Solana SOL Reveals The Manipulator's Plan!Hello, Skyrexians!

It's time to update BINANCE:SOLUSDT analysis. We have already told about Solana dump when price was next to $300 where told about $110 and as usual did not count last wave, but anyway bounce from this area was anticipated. What is next?

Recent top was the wave 5 of higher degree, we have shown it many times, today no need to do it again. Now asset is in ABC correction. Wave A was 5 waves shaped. Last wave has been finished with the green dot on the Bullish/Bearish Reversal Bar Indicator and now we are in the wave B. It has the target at 0.5-0.61 Fibonacci which is somewhere next to $200. From there we expect the huge crash below $90 in the wave C. Solana potential dump is not cancelling potential altseason on OTHERS.D because it's in top-10 crypto cap assets. May be it's time to transfer money from overvalued SOL to undervalued crypto?

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

Canada Approves First Spot Solana ETFs, Launch Set For 16th AprThe Ontario Securities Commission (OSC) has approved the world’s first spot Solana (SOL) exchange-traded funds (ETFs), marking a major step forward for crypto investment products in North America. Beginning April 16, 2025, several asset managers—Purpose Investments, Evolve ETFs, CI Global Asset Management, and 3iQ—will offer direct exposure to SOL on Canadian exchanges.

Unlike derivatives-based products, these ETFs will hold physical SOL tokens, giving both institutional and retail investors a regulated way to invest in the Solana blockchain ecosystem. Each provider will track a separate index, allowing for a range of strategies. In addition, these funds will feature staking options, providing a potential yield advantage over other crypto ETFs.

With this approval, Solana becomes the third cryptocurrency to receive spot ETF approval in Canada, following Bitcoin and Ethereum. The news has sparked increased whale activity and fresh speculation that the United States could follow with its own Solana ETF approvals in the future.

Technical Analysis

Solana’s price has been trading below $150, consolidating within a wider range. The key technical level to watch is $147, which marks an internal structure lower high. A strong break and close above $147 could signal a bullish shift in market structure, potentially triggering upward momentum. On the other hand, if the price fails to close above this level, it may drop below $120, reinforcing bearish pressure.

The ETF launch could become a catalyst for either outcome, depending on how the market reacts to the new inflows. At present, Solana continues to trade just below the critical threshold, awaiting a decisive move as April 16 approaches.

Breaking: Purple Pepe ($PURPE) Is Gearing Up For BreakoutPurple pepe ($PURPE) One of the OG Pepe coins on Solana. Originally created July 2023, the token sat dormant on the blockchain. A year later, liquidity was added and trading went live.

The memecoin is now gearing up for a breakout once it breaks the $0.000046 psychological resistant zone, a 60% price surge is feasible with increasing momentum as hinted by the RSI at 54.72.

The crypto market is still volatile with CRYPTOCAP:BTC swinging in between the $80,000 - $85,000 support points. The memecoin hype is moderate now, most especially the Solana memecoinomy but the price of CRYPTOCAP:SOL has taken a deja vu lately, surprising the crypto market by reclaiming the $130 pivot point.

Should CRYPTOCAP:SOL undergo a bullish continuation pattern, this same momentum might dissipate to the Purple pepe ($PURPE) coin and not only $PURPE coin, but almost all the coins in the Solana ecosystem.

However, On a bearish tone, if $PURPE should fail to pull the bullish stunt, there is a possibility of a break below the $0.000035 support point which will negate the bullish thesis previously given as it will resort to massive selling spree.

Purple Pepe Price Live Data

The live Purple Pepe price today is $0.000041 USD with a 24-hour trading volume of $788,837 USD. Purple Pepe is down 4.21% in the last 24 hours. With a live market cap of $17,071,104 USD. It has a circulating supply of 417,213,801,892 $PURPE coins and a max. supply of 420,690,000,000 $PURPE coins.

Solana Rises Over 18% In Last 7 Days as ETF Talks Fuel OptimismSolana has gained strong upward momentum, trading around $130 in the last 24 hours. The token reached a new weekly high, outperforming many altcoins during the broader crypto market recovery. Growing speculation around the possible approval of a Solana Exchange-Traded Fund (ETF) has fueled this bullish movement.

Investor attention turned sharply after Bloomberg ETF analyst James Seyffart clarified that the U.S. Securities and Exchange Commission (SEC) has until October 10 to issue a final decision on the proposed Solana ETF. However, he also pointed out that early approval is still possible, though unlikely. Under the leadership of Paul Atkins and with input from Hester Peirce's Crypto Task Force, the SEC may fast-track decisions related to digital assets.

A Solana ETF could bring institutional capital into the ecosystem, similar to what happened with Bitcoin and Ethereum after their respective ETFs gained approval. Analysts believe that updated regulations, especially regarding asset custody and digital definitions, will be key in shaping the outcome. If progress continues, early approval remains a possibility, although most market watchers still expect a final decision closer to the October deadline.

Technical Analysis

On the chart, SOL has found support at a major demand zone around the $110–$115 range. The price is now trading above this area after reading below $100 at some point, marking an internal bearish break of structure. If the bullish momentum can sustain to trade and close above the recent lower high at around $147, that move would suggest a shift in trend.

If the price fails to maintain momentum and break above $147, bearish momentum will continue, with a potential retest of the support zone below $100.

$PWEASE Coin surged 29% Today Amidst Falling Wedge Pattern$PWEASE coin built on the solana blockchain, created on the Pump.fun platform graduated from a bonding curve and is making waves surging 29% for the past 24 hours with eyes set on a 100% surge amidst 2 consecutive falling wedge patterns identified on the chart.

With the RSI at 54.43 this gives more room for $PWEASE to capitalize on the wedge and pick momentum up. If this move should materialize, $PWEASE is set to break the recent All time high of $0.03884.

Pwease Price Live Data

The live Pwease price today is $0.028897 USD with a 24-hour trading volume of $31,547,475 USD. Pwease is up 29.32% in the last 24 hours, with a live market cap of $28,895,321 USD. It has a circulating supply of 999,926,221 PWEASE coins and a max. supply of 1,000,000,000 PWEASE coins.

$SOL Weekly Bounce from Dynamic Support – Watch for BreakoutCRYPTOCAP:SOL is holding above a key rising trendline that has acted as strong support since 2021. After a successful retest near $95–$100, SOL bounced sharply and is now trading above $120.

This move also confirms a reclaim of a previous resistance-turned-support zone. As long as it holds, SOL could aim for $145 and above.

DYOR, NFA

Solana Surges Nearly 8% As Janover Pivots to Solana Treasury The price of Solana ( CRYPTOCAP:SOL ) famously known as the ethereum killer has surged nearly 8% today as Commercial property platform Janover pivots to Solana treasury strategy, stock surges 1,100% as investors rush in prior the news.

Janover has invested over $9.6 million into Solana (83,000+ SOL) as part of a new digital asset treasury strategy, with plans to stake its holdings and run validators to generate onchain revenue.

The move follows a $42 million funding round and has triggered a 1,100% surge in Janover’s stock price as the company positions itself as a transparent, publicly traded vehicle for crypto exposure.

Solana has lost grip of the $120 pivot for the past 2 weeks, but reclaimed the zone today currently trading at $120.54 per $SOL.

The daily price chart shows Solana has been trading within an enclose rectangular zone with the Resistant and support points slightly above each other. For Solana, a break above the $170 zone could pave way for a move to the $200- $270 zone. Similarly, a break below the $100 zone could be catastrophic for Solana.

However, the RSI shades a bit of a light at the end of the tunnel as it stands at 47, which is prime for a reversal.

$DAKU Set for A 50% Surge Amidst Bouncing From Support Point Der Daku ($DAKU) a token created and deployed on the Solana blockchain from the pump.fun platform has graduated from a bonding curve and transition to Raydium a DEX on the Solana ecosystem is set to break with an estimated 50% surge.

The asset is trying to find support in the $0.045 pivot. Should $DAKU consolidate from that point, a breakout is imminent without major CEX listings and a thriving community with about 19300 members on Telegram and about 1039 followers on X.

This Dog-themed memecoin on Solana ecosystem could be the next big thing with the RSI at 44.52 this only proffers more room for a breakout albeit the crypto market is highly volatile.

The $0.07 pivot is acting as a resistant point should buyers break above this point, $DAKU will be setting course for a new all time high price.

SOL Trade Plan: Daily Support, Liquidity Grab & Trade Idea.Solana (SOL) is currently navigating a challenging market environment, with broader sell-offs across the crypto space weighing heavily on its price action. On the daily and 4-hour timeframes, SOL has traded into a significant support zone, marked by previous swing lows. This area has historically acted as a magnet for buyers, but the recent dip below these levels suggests a liquidity grab is underway. This move has likely triggered sell stops sitting below the lows, creating the potential for a reversal as smart money steps in. ⚡

Zooming into the 15-minute timeframe, SOL is consolidating within a tight range, reflecting a period of indecision. This range-bound behavior often precedes a breakout, and a bullish break above the range could signal the start of a recovery. A shift in market structure—marked by higher highs and higher lows—would provide further confirmation of bullish intent.

Key Insights:

Daily Timeframe: SOL has dipped below key support levels, sweeping liquidity.

4-Hour Timeframe: Price is overextended, trading into a critical demand zone.

15-Minute Timeframe: Consolidation within a range, awaiting a breakout for directional clarity.

Trading Plan:

Patience is Key: Wait for SOL to break out of the 15-minute range to the upside. 🚀

Market Structure Confirmation: Look for a clear shift to bullish market structure (higher highs and higher lows). 📊

Entry Strategy: Enter long positions after confirmation, with a stop-loss placed below the range low. 🛡️

Profit Targets: Focus on resistance levels on the 4-hour and daily timeframes for potential take-profit zones. 🎯

Levels to Watch:

Support Zone: Previous daily swing lows, now acting as a liquidity zone.

Resistance Zone: The upper boundary of the 15-minute range and key levels on the 4-hour chart.

This setup highlights the importance of waiting for confirmation before entering a trade. While the liquidity grab below support is a promising signal, a breakout and bullish structure are essential to avoid false moves. As always, this is not financial advice—traders should conduct their own analysis and manage risk appropriately. ⚠️

$LUCE Gearing For A Comeback Amidst Bullish Symmetrical TriangleLUCE token ( LSE:LUCE ) a token created on the Solana ecosystem is set for a parabolic surge after breaking out of a symmetrical triangle pattern.

The asset has undergone multiple trough and crest pattern prior the market's volatility. So many assets faced extreme selling pressure for the past 2 days amidst Donald Trump's Tax Tariff laws, a move that saw about $2.85 trillion wiped out from the US stock market yesterday.

However, LSE:LUCE managed to break of a symmetrical triangle pattern despite the dip, setting its compass above the 1-month high. Should LSE:LUCE breakout of the 1-month high resistant point, a move to a $50 million market cap will be inevitable.

With listings from Bybit, Gateio, MEXC, Bitget, BingX, HTX and quiet a number of exchanges, LSE:LUCE could be the catalyst to spark the next cycle of memes in the Solana blockchain.

LUCE Price Live Data

The live LUCE price today is $0.013456 USD with a 24-hour trading volume of $7,003,198 USD. LUCE is up 0.75% in the last 24 hours, with a live market cap of $13,455,554 USD. It has a circulating supply of 999,999,996 LUCE coins and a max. supply of 1,000,000,000 LUCE coins.

SOL/USDT May SOL lose the weekly support? Key Level to buy!Hey traders! 👋 Let’s dive into the weekly chart for SOLUSDT.

📊 Current Price Action:

SOL is trading at $112.20, down 10.96% on the weekly chart. The price has been consolidating in a "Buying Zone" between the weekly support levels of $110.17 and $131.68. This zone has historically acted as a strong base, with the price bouncing from this area multiple times since late 2023.

🟢 Buying Zone and Support:

The current price is sitting in a critical "Buying Zone" between $110.17 and $131.68. This area has acted as a springboard for previous rallies, and if SOL holds above $110.17, it could be a good opportunity for accumulation. A break below $110.17, however, might lead to further downside toward the next support at $80.18 or even $54.00.

🎯 Target:

If SOL manages to break through the $195.71 resistance, the next major target is its previous ATH at $260. I’ve projected a potential move to $295.71, which would be a 95.71% increase from the current price of $112.20. This target aligns with the historical price structure and Fibonacci extensions.

⚠️ Risk Management:

Keep an eye on the $110.17 support. A weekly close below this level could signal bearish momentum, potentially driving the price toward lower supports. On the upside, watch for a strong breakout above $195.71 with high volume to confirm the bullish scenario.

What do you think about SOL’s setup? Are you bullish or bearish on Solana? Let’s discuss in the comments!

#SOLUSD #Solana #Crypto #TechnicalAnalysis #Breakout

Breaking: $FARTBOY Gearing for 250% Surge Amidst A Falling WedgeThe price of Fartboy coin ($FARTBOY) a token created on the Solana ecosystem is set to go parabolic surging more than 250% amidst breaking out of a falling wedge pattern. The asset is currently looking poised to breakout of the support point range it is currently trading at.

Since listing, $FARTBOY has peaked to as high as $189 million in market cap before retracing to the $33.4 million market cap. With build up momentum, $FARTBOY is set to pull out this same stunt in the long term.

Further solidifying this bullish thesis is the Relative Strength Index (RSI) at 36.68, this metric gives credence to our bullish speculation giving Fartboy more room to capitalize on the oversold nature and weak momentum to pick liquidity up.

About Fartboy

Project is CTO'd by big community over 100k people. X is on 2k followers in 2 days. In talks with some big exchanges hope to get listed everywhere.

This coin was called out via a call out group. People were loving it and then one of the guys who were invested before we even knew about it dumped on us. If you check the chart im sure youll see we made a heck of a comeback!

Fartboy Price Live Data

The live Fartboy price today is $0.033473 USD with a 24-hour trading volume of $669,858 USD. Fartboy is up 0.92% in the last 24 hours, with a live market cap of $33,454,631 USD. It has a circulating supply of 999,440,457 FARTBOY coins and a max. supply of 999,440,457 FARTBOY coins.

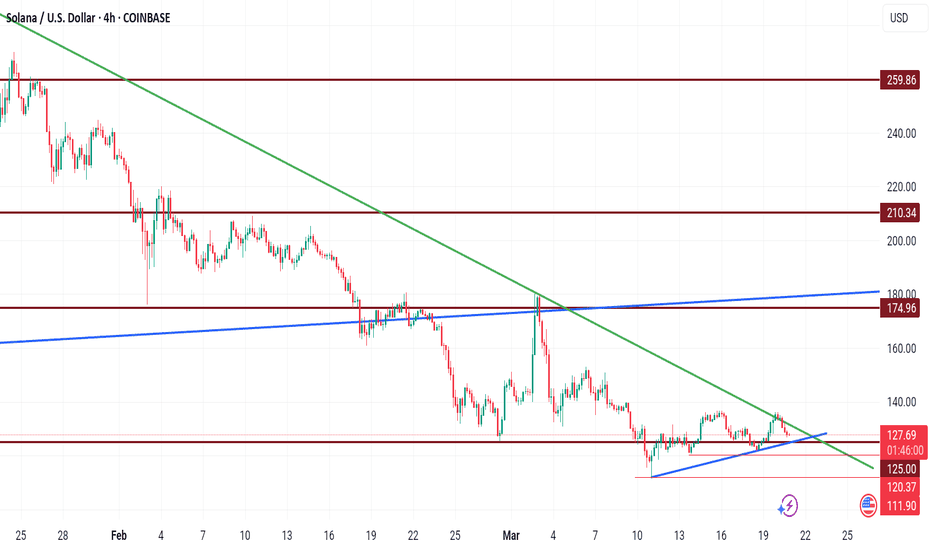

$125 buy target for Solana$125 buy target for Solana

My previous analysis came to play. The green TL acted as resistance zone despite the false breakout.

I see this baby coming down to kiss the blue TL as a support level before another push up.

I have a buy entry for $125.

Trade with caution as crypto market is a volatile one.

Please share your thoughts, like and follow for more charts.

Breaking: Raydium ($RAY) Surge 15% TodayRaydium an automated market maker (AMM) and liquidity provider built on the Solana blockchain for the Serum decentralized exchange (DEX) saw its native token NASDAQ:RAY surge 15% today amidst general market volatility.

The asset while trading at the $6- $8 axis just a month ago lost almost 80% of total value plummeting from a high of $8 to almost $1.5 causing panic selling behaviour. But momentum is brewing up.

A move above the 61.8% Fibonacci retracement point could catalyse a bullish move for NASDAQ:RAY with a move to the 1-month high resistant. Similarly, with the RSI at 60, NASDAQ:RAY might experience a temporary cool-off a move that might lead to a consolidatory move to the 1-month low that is not too far from the current market price.

Raydium Price Live Data

The live Raydium price today is $1.86 USD with a 24-hour trading volume of $260,230,671 USD. Raydium is up 15.98% in the last 24 hours, with a live market cap of $541,218,025 USD. It has a circulating supply of 290,847,971 RAY coins and a max. supply of 555,000,000 RAY coins.

JUST IN: First Solana ETFs to Launch in The US TomorrowThe highly functional open source project that banks on blockchain technology’s permissionless nature to provide decentralized finance (DeFi) solutions is set to debut its First Spot ETFs in the US tomorrow.

Price of Solana ( CRYPTOCAP:SOL ) surged 5% today amidst Solana ETFs set to to be launch tomorrow. A news that made Solana reclaim the $130 zone. With build-up momentum and RSI barely overbought at 53 CRYPTOCAP:SOL is set to break the 38.2% Fibonacci retracement point a level that aligns with $150- 160.

A break above this pivot point could send solana on a bullish course with eyes set on the $200- 270 price points.

Similarly, in the case of a reprieve, CRYPTOCAP:SOL might find support in the 78.6% Fibonacci retracement point before picking momentum up.

Solana Price Live Data

The live Solana price today is $130.00 USD with a 24-hour trading volume of $2,966,846,344 USD. Solana is up 5.12% in the last 24 hours, with a live market cap of $66,305,695,632 USD. It has a circulating supply of 510,033,072 SOL coins and the max. supply is not available.

Solana ($SOLUSD) - Monthly Demand InboundQuick TA for Solana $SOL. Many cryptos are at inflection points and will likely break higher or roll over from current prices (I think a move down is more likely, per long-term charts, and am hoping this happens for the sake of buying opportunities). Solana, like many other cryptos, has failed to develop meaningful 1D bullish momentum (RSI holding below 50). Should COINBASE:SOLUSD get another leg down, I'll be watching its behavior as it enters lower demand zones. 101.75-78.87 = monthly demand; 74.85-51.37 = weekly demand, but there are also buy areas higher. If Solana trades lower and approaches the aforementioned levels, use LTFs for signs of exhaustion/downtrend reversal. Personally, I wouldn't use "set-and-forget" buy limit orders; higher-beta cryptos may keep selling off until majors bottom/reverse and/or prices might not trade low enough to hit your limit price. I prefer more of a "hands-on" approach to trading, but to each their own.

On the road, so truncated analysis. Will update when I can. Thank you for your interest and let me know what you think!

Jon

@JHartCharts

SOL/USD "Solana vs U.S Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the SOL/USD "Solana vs U.S Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (160.00) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 1D timeframe (200.00) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

1st Target - 125.00 (or) Escape Before the Target

Final Target - 90.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

SOL/USD "Solana vs U.S Dollar" Crypto Market is currently experiencing a bearish trend,., driven by several key factors.

⚡⭐Fundamental Analysis

Blockchain Trends: Solana's blockchain growth is expected to slow down, driven by increasing competition from other blockchain platforms.

Smart Contract Activity: Smart contract activity on Solana's blockchain is expected to decrease, driven by growing competition from other blockchain platforms.

Mining Difficulty: Solana's mining difficulty is expected to decrease, driven by decreasing network hash rate.

Transaction Volume: Solana's transaction volume is expected to decrease, driven by decreasing demand for cryptocurrency transactions.

⚡⭐COT Data

Non-Commercial Traders (Institutional):

Net Short Positions: 55%

Open Interest: 100,000 contracts

Commercial Traders (Companies):

Net Long Positions: 30%

Open Interest: 50,000 contracts

Non-Reportable Traders (Small Traders):

Net Short Positions: 15%

Open Interest: 20,000 contracts

COT Ratio: 0.6 (indicating a bearish trend)

⚡⭐Sentimental Outlook

Institutional Sentiment: 40% bullish, 60% bearish.

Retail Sentiment: 35% bullish, 65% bearish.

Market Mood: The overall market mood is bearish, with a sentiment score of -50.

⚡⭐On-Chain Analysis

Network Hash Rate: Solana's network hash rate has decreased by 10% over the past month, indicating a decline in mining activity.

Transaction Volume: Solana's transaction volume has decreased by 20% over the past month, indicating a decline in network activity.

Active Addresses: Solana's active addresses have decreased by 15% over the past month, indicating a decline in network adoption.

⚡⭐Market Data Analysis

Order Book Analysis: The SOL/USD order book is showing a significant imbalance, with more sell orders than buy orders, indicating a bearish market sentiment.

Liquidity Analysis: Solana's liquidity has decreased by 10% over the past month, indicating a decline in market participation.

Volatility Analysis: Solana's volatility has increased by 20% over the past month, indicating a more unpredictable market.

⚡⭐Positioning

Long Positions: 30% of total positions

Short Positions: 70% of total positions

Neutral Positions: 0% of total positions

Leverage: 2:1 (average)

⚡⭐Next Move Prediction

Bearish Move: Potential downside to 140.00-125.00.

Target: 125.00 (primary target), 90.00 (secondary target)

Next Swing Target: 80.00 (potential swing low)

Stop Loss: 190.00 (above the 30-day high)

Risk-Reward Ratio: 1:2 (potential profit of 30.00 vs potential loss of 15.00)

⚡⭐Overall Outlook

The overall outlook for SOL/USD is bearish, driven by a combination of fundamental, technical, and sentimental factors. The expected slowdown in Solana's blockchain growth, decreasing smart contract activity, and bearish market sentiment are all supporting the bearish trend. However, investors should remain cautious of potential upside risks, including changes in global economic trends and unexpected regulatory developments.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Solana SOL Will Bounce, But Then Scam!Hello, Skyrexians!

Couple of weeks ago we told you that BINANCE:SOLUSDT will reach $110 in the wave 5 inside the major wave A. You can find this analysis here . Exactly from this zone we have seen the bounce. This bounce is a major correction and those who listen this analysis could already be in the great profit. But anticipated bounce is not the bull run continuation and finally Solana will drop hard because its era is finished.

Let's take a look at the weekly time frame. Here we can see that 5 Elliott waves with the Awesome Oscillator's divergence. After that the major correction has been started. Wave A has been finished at $110 with the green dot at the Bullish/Bearish Reversal Bar Indicator and now we will see wave B, which will reach the Fibonacci 0.5 approximately at $200. From there we will see the scam drop in wave C. It will likely break the major Fibonacci 0.61 support. In this case game is over and Solana can fall for a years or even scam.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

Solana: Precision Landing?!Solana extended its sell-off and reached our blue long Target Zone between $117.73 and $40.43. The price then reacted right at the $109.89 support level, indicating that the low of the green wave 2 has been settled. Thus, the next step should involve a strong rally driven by the green wave 3, ultimately pushing SOL well beyond the $295.31 resistance and past its current all-time high. However, our Target Zone remains active, as there is a 40% chance that the price could revisit this range to complete the blue alternative wave (ii) below the $109.89 mark.