XAUUSD: Buy or Sell ?Hello everyone, let’s take a look at OANDA:XAUUSD and plan the latest strategy for this afternoon!

Currently, this precious metal is trading around the 3039 USD level, recording a 1.94% gain on the day.

The main driver of the rally comes from the news that the United States will impose tariffs of up to 104% on imports from China starting Wednesday. This decision has sparked concerns about a potential global economic recession, thereby boosting demand for safe-haven assets like gold.

In addition, the market is expecting the Federal Reserve (Fed) to begin a rate-cutting cycle soon, with over a 60% chance of it happening as early as May, and a projected five more rate cuts in 2025. This expectation is weakening the USD, further supporting gold prices. Although some Fed officials continue to deliver hawkish signals, concerns that tariffs could increase inflation remain and are putting pressure on the Fed's upcoming policy decisions.

From a technical standpoint, an effort to shift the trend has formed above the resistance of the descending trend channel, and price is now reacting near the key resistance level at 3055. A breakout and price consolidation above 3055 will trigger the continuation of the current upward move. A retest of the previous broken consolidation resistance at 3020 may also occur.

The market structure is fully bullish. A breakout above key resistance or a pullback to support levels will likely lead to the next phase of growth, but if the 3055 level is broken earlier than expected, it could eventually push this metal up to 3110.

If you find this information useful, don’t forget to like and follow Gary to stay updated with the latest insights!

Supportandresitance

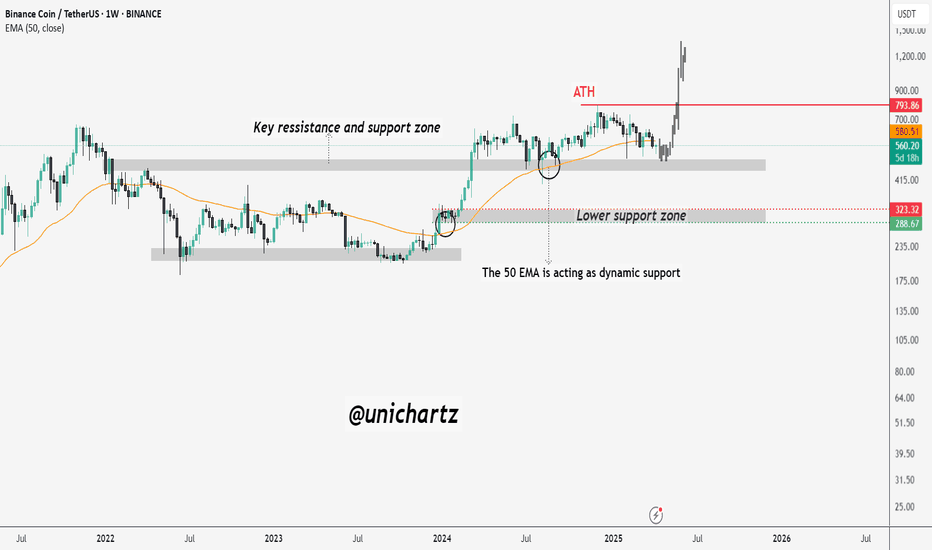

BNB Bulls Must Defend This LevelBNB is currently trading near a key support and resistance zone, a historically significant area that has acted as both supply and demand over the past few years. After reaching its all-time high (ATH) near $793, price has been gradually correcting, and is now approaching a critical point.

The 50-week EMA (Exponential Moving Average) is acting as dynamic support, and so far has played a strong role in providing bounce zones during corrections. This EMA is currently being tested once again, and price action around it will be crucial.

Just below this lies a major horizontal support zone around $415–$430, which previously served as a breakout base in 2023. If this area holds, BNB could see a rebound attempt.

GPS recalculating, HSI is finding its way back to the bull routePEPPERSTONE:HK50

D chart : it tries to returning into uptrend channel.

HSI:HSI

D Chart

We look forward to see it at 24192, 24385! Let's continue to monitor.

W Chart PEPPERSTONE:HK50

in 1H 4H chart mentioned the Index is intact and in the Bullish runway!

Look at longer term and trade zen-ly!

Cultivating and nurturing your trading mindset:

Pay attention to your trading strategy becoming a great trader but not profits from one trade.

Happy Trading Everyone.

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Share your trading journey to encourage the trading buddies *

Where will gold price go today?Hello dear friends, a new week has arrived, wishing you a lot of energy!

At the beginning of the new trading week, gold continues to extend its previous downward trend. The precious metal once dropped below the $3,000 mark but quickly regained some recovery, although it has not yet fully stabilized. Currently, the trading level is moving around the $3,027 area, marking a decline of more than 0.32% at the time of writing.

Regarding the outlook, global economic and political factors indicate an unfavorable environment for gold prices during this period.

Accordingly, this week, 16 experts participated in the Kitco News Gold Survey, and the results show that Wall Street has reversed its extremely optimistic view from the previous week. Five experts (31%) predict that gold prices will recover this week. Eight (50%) believe that gold prices will continue to decline. The remaining three (19%) think that gold prices will move sideways around the current low levels.

Meanwhile, the Kitco online survey attracted 273 retail investors to participate. Retail investor sentiment only slightly decreased compared to the previous week. A total of 167 people (61%) expect gold prices to rise this week; 70 people (26%) predict a decline; while the remaining 36 people (13%) think prices will move sideways.

What about you, what do you think about the gold price trend this week?

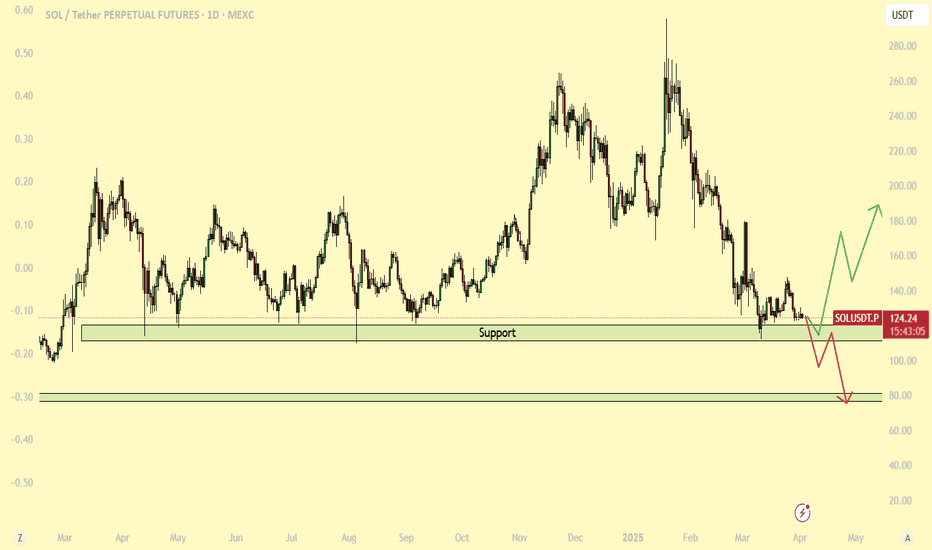

Solana’s Critical Support at $120 - Will It Hold or Break?Solana has been respecting its $120 support level for over a year, consistently bouncing back every time it tested this zone. However, the price is now once again hovering around this crucial level after a small bounce a couple of weeks ago. The key question remains: will Solana hold this support and rally again, or is a major breakdown coming?

Weakening Support: A Bearish Signal?

When a price level is tested repeatedly, it often weakens as buyers at that level get exhausted. The most recent bounce from $120 was notably weak, indicating that buying pressure might be fading. This could be an early warning sign that sellers are gaining control, increasing the probability of a breakdown.

The $75 Scenario: What If Support Fails?

If Solana fails to hold $120, the next major support level sits around $75—a price zone where significant demand previously emerged. A breakdown could trigger a sharp move lower as stop-losses get triggered and bearish momentum accelerates.

Key Factors to Watch:

• Volume & Strength of the Current Test – Is buying volume picking up, or are sellers in control?

• Market Sentiment & Macro Trends – Broader crypto market trends, Bitcoin’s movement, and macroeconomic factors could influence Solana’s direction.

• False Breakouts & Traps – Sometimes, a brief break below support is a shakeout before a strong reversal. A reclaim of $120 after a breakdown could signal a bullish trap for shorts.

Final Thoughts

While $120 has been a strong floor for Solana, repeated tests make it more fragile. If buyers fail to step in with conviction, a drop toward $75 becomes a real possibility. However, if bulls defend this level strongly, we could see another bounce, potentially setting up a reversal.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

Gold returns to a sharp decline?Dear friends!

Gold has a downward trend today, with the current price fluctuating around 3,097 dollars. The main reason is due to the tax measures of U.S. President Donald Trump, which help clarify the market trend but raise concerns about economic recession, thereby boosting the demand for USD, leading to an increase in its value, which affects gold.

From a technical perspective, it is not advisable to buy at this moment, as the risk is high, and for selling, we should wait for the price to establish a clear trend.

At present, it is most worth waiting for consolidation on the basis of a downward trend, as the market will sharply hit important milestones that you can build your trading strategy upon.

If you find this information useful, don't forget to like and follow Gary to receive the latest updates!

Gold at the Edge! Rebound or Breakdown?Hi Traders! 🚀 XAU/USD is testing a key trendline support—will it bounce or break?

🔹 Scenarios:

📈 Buy if it breaks above $3,010, with a stop loss at $3,008 and targets at $3,020 and $3,057.

📉 Sell if it breaks below $3,008, with a stop loss at $3,012 and targets at $3,000 and $2,985.

📊 RSI near oversold—potential bounce ahead! Keep an eye on the price action.

📢 Stay alert to economic news! High-impact events could bring volatility.

🔥 Smash that like button and show some energy! Let’s trade like pros! 🚀

⚠️ Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trade at your own risk.

GBPUSD Week 13 Swing Zone/LevelsYour next trade could be the beginning of your success in Forex.

We’ve been performing exceptionally well so far, identifying key swing levels as always.

- Stop Loss (SL): Set between 10-15 pips from the 5-minute candle entry.

- Dynamic Take Profit (DTP): Adjusted based on price reaction to swing levels.

Let’s capitalize on the momentum!

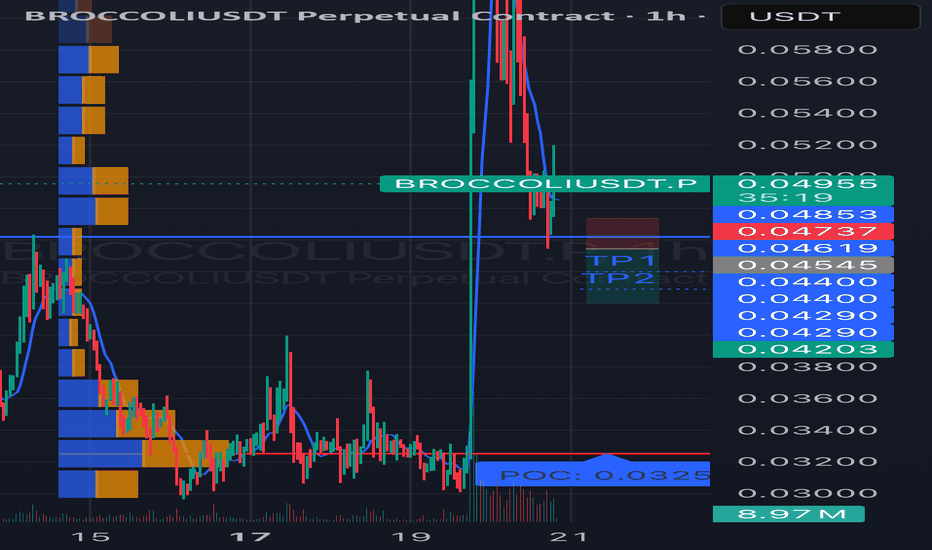

#BROCCOLIUSDT is showing bearish potential SHORT BYBIT:BROCCOLIUSDT.P from $0.04545

🛡 Stop Loss: $0.04737

🕒 Timeframe: 1H

⚡️ Overview:

➡️ BYBIT:BROCCOLIUSDT.P is showing bearish momentum on the 1-hour timeframe after a significant drop from $0.06000 to the current consolidation zone of $0.4203–$0.4885.

➡️ The price recently tested the $0.04545 level (a possible retest of a broken support, now acting as resistance), which could serve as an entry point for a short.

➡️ The volume profile on the left shows strong buyer interest at $0.0325 (POC), which acts as a key support level. However, the lack of significant buying volume at current levels suggests potential for further downside.

➡️ The price structure remains bearish: lower highs and lows are forming after the drop.

➡️ The RSI (14) indicator on the 1H timeframe is presumably around 45 (based on price action), indicating neutral momentum with room for a downward move.

🎯 Take Profit Targets:

💎 TP 1: $0.04400

💎 TP 2: $0.04290

💎 TP 3: $0.04203

⚡️Plan:

➡️ Entry: Sell below $0.04545 after the 1-hour candle closes below this level to confirm the rejection from resistance.

➡️ Stop Loss: Set at $0.04737, which provides a 7% risk from the entry point and protects against a potential breakout.

➡️ Risk/Reward Ratio: From 1:2 (for TP1) to 1:5 (for TP3), making this trade attractive from a risk management perspective.

➡️ After the drop, the price has stabilized, indicating possible consolidation or accumulation.

➡️ Resistance zone: $0.04885 (upper boundary of the current range).

Technical Indicators:

➡️ The chart shows candles in red and green, reflecting bearish and bullish movements.

➡️ After the sharp decline, the price has formed lower highs and lows, but in recent hours, there’s an attempt at recovery.

📢 A price rejection below $0.04545 with increasing selling volume increases the likelihood of reaching the targets.

📢 The $0.04400 and $0.04290 levels may act as areas for partial profit-taking, so monitor price action in these zones.

📢 Risks: If the price breaks above $0.04885, it could signal a false breakdown and a potential reversal to the upside. In this case, consider reassessing the position.

📊 The decline in BYBIT:BROCCOLIUSDT.P aligns with cautious sentiment in the crypto market.

📊 As of March 20, 2025, BYBIT:BTCUSDT.P is trading around $90,000, showing signs of consolidation, which may pressure altcoins like BYBIT:BROCCOLIUSDT.P

BYBIT:BROCCOLIUSDT.P is showing bearish potential on the 1H timeframe.

⚡️A confirmed rejection below $0.04545 is your signal to act!

Charting the Path Forward: Key Levels to WatchPrevious Analysis: Successful Bullish Breakout

In our previous analysis, we identified a Falling Wedge pattern accompanied by bullish divergence, forecasting a breakout above 147.807. The price hit our target, confirming the bullish momentum and reaching key Fibonacci levels.

What’s Next:

Upon analyzing the chart, we observe that price has found support at 147.535 after a pullback during the American session. We anticipate the price to reach our first target, and after consolidation and a possible pullback, we expect to hit our second target near the upper line of the channel.

However, if the price declines from the first target and breaches support at 147.535, the next key support level is at 146.306.

Remember to follow your risk management strategies to protect your capital.

Alts- Will they drop further? (+name your alt)In my early February analysis on altcoins , I noted that while a bounce was likely after the sharp drop triggered by Trump’s initial tax remarks, the $1.3T level would act as strong resistance.

I expected another decline once this resistance was confirmed— which is exactly what happened, as the market reached that level and began to drop again.

After multiple tests of the rising trendline that began in October 2023, last week saw a breakdown, with price finding support just above $900B (an important level as we can see from the posted chart).

But was that the full extent of the drop?

In my view, we are far from being in the clear, and further declines seem likely. Technically, the rising trendline has been broken, and the recent rebound appears to be corrective rather than the start of a sustained recovery.

As long as the price remains below the $1.15T–$1.2T zone, I see a high probability of the market

breaking under 900B zone support and reaching $700B in the coming months.

The game plan is clear: DCA,accumulate, and let the market work!HKEX:2800

Breakthrough downtrend channel on last Sept2024 and W-Chart formed MACD Goldencross for bullish mode.

If enter now at 24.50

Target Profit 1 Level at : 30.70 (~25.3%)

Target Profit 2 @33.50; another ~9% (cumulative + ~36%)

Target Profit 3 : ATH

Continue to DCA and accumulate; you may wait for slight retracement to add position. 24.26

Time frame : 9-24months

It created higher hi recently for W chart.

🔎 DYODD and don't listen to anyone. Invest in yourself, do some study and learn along the way while you trying to verify or finding the answer if to start invest in CHN/HKG markets.

Follow your trade plan then zen with 📙 and 🍵 while waiting for profits to be reazlied.

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Share your trading journey to encourage the trading buddies.

GBPJPY Trade Analysis**GBP/JPY 15-minute chart**

**Trade Analysis & Idea:**

📉 **Previous Downtrend**: The pair experienced a strong drop before finding support around **191.400**.

📈 **Current Recovery**: Price is now rebounding and trading above short-term moving averages (blue & red EMA).

🔄 **Resistance Zone**: The **192.000 - 192.200** area may act as resistance for further upside.

### **Potential Trade Setups:**

1️⃣ **Bullish Continuation**:

- If price **breaks & closes above 192.000**, we could see further upside towards **192.400 - 192.600**.

- A strong candle close above resistance would confirm bullish momentum.

2️⃣ **Rejection & Pullback**:

- If price struggles to hold above 192.000, a pullback toward **191.700 - 191.500** is possible.

- Look for **bearish candlestick patterns** (e.g., rejection wicks, engulfing candles) to confirm a short opportunity.

### **Risk Management:**

✅ Secure partial profits at key levels.

✅ Use **tight stop-loss** below **191.700** for longs or above **192.200** for shorts.

EURGBP - Approaching Key Resistance: Is 0.8370 the next target?OANDA:EURGBP is nearing a key resistance level that has previously acted as a strong barrier, triggering bearish momentum in the past. This zone also aligns with prior supply areas where sellers have stepped in, making it a potential point of interest for those looking for short opportunities. Given its historical significance, how price reacts here could set the tone for the next move.

If bearish signals emerge, such as rejection wicks, bearish candlestick patterns, or signs of weakening bullish pressure, I anticipate a move toward the 0.83700 level. However, a clear breakout above this resistance could challenge the bearish outlook and open the door for further upside. It's a pivotal area where price action will likely provide clearer clues on the next direction.

Just my take on support and resistance zones, not financial advice. Always confirm your setups and trade with a proper risk management.

AUDUSD – LONGAUDUSD – LONG

ENTRY PRICE - 0.62850

SL - 0.61800

TP - 0.64900

Always follow the 6 Golden Rules of Money Management:

1. Protect your gains and never enter into a position without setting a stop loss.

2. Always trade with a Risk-Reward Ratio of 1 to 1.5 or better.

3. Never over-leverage your account.

4. Accept your losses, move on to the next trade and trust the software.

5. Make realistic goals that can be achieved within reason.

6. Always trade with money you can afford to lose.

Please leave your comment and support me with like if you agree with my idea. If you have a different view, please also share with me your idea in the comments.

Have a nice day!

Falling Wedge Breakout in Play? Key Levels to Watch!After analyzing the chart across multiple timeframes, we have identified a Falling Wedge pattern, signaling a potential bullish breakout. Additionally, bullish divergence is visible on most timeframes, reinforcing the likelihood of upward momentum.

Currently, the price is trading above a strong support level at 146.213, indicating a solid base. Our nearest resistance stands at 147.807—a breakout above this level could pave the way for further gains. The next key targets align with the 38.2% and 50% Fibonacci retracement levels, offering potential profit opportunities.

As always, stick to your risk management strategy to protect your capital. Stay disciplined and trade wisely!

The Steps to Identify Key Levels on Chart Scalping Opportunity)**The Steps to Identify Key Levels on Chart:**

1. **Support & Resistance:**

- Identify areas where the price has bounced multiple times.

- Based on your chart, key **support** seems around **2900**, while **resistance** could be near **2925-2930**.

2. **Trendlines:**

- Check if highs/lows are forming a triangle pattern.

- If lower highs and higher lows appear, it could be a **symmetrical triangle** (potential breakout).

3. **Moving Averages & Volume:**

- The **moving averages (EMA)** are close together, suggesting consolidation.

- Look for a volume spike near breakout points (above 2925 or below 2900).

### **Possible Chart Pattern Scenarios:**

- If price **breaks above 2925-2930 with volume**, it could be a **bullish breakout**.

- If price **drops below 2900**, it may confirm a **bearish breakdown** (continuation down).

- If price keeps bouncing between 2900-2925, it's likely **range-bound** (scalping opportunity).

Euro can rebound up from support line to 1.1000 pointsHello traders, I want share with you my opinion about Euro. Looking at this chart, we can see that a few days ago, the price entered a range, where it immediately broke through the 1.0425 support level, which aligned with the buyer zone, and then moved to the upper part of the range. After trading near this area for some time, the price dropped back to the buyer zone, reaching the support line before starting to rise again. Soon, the Euro broke the 1.0425 level once more and later exited the range, continuing its upward movement. Not long after, the price climbed to the 1.0805 support level, which coincided with a support area. It traded around this level for a while before breaking through it as well. Following that, the Euro reached the resistance line, reversed, and corrected back to the support area, where it found support again. Recently, it rebounded and started moving upward. Given this, I expect a further rebound from the support line and a breakout above the resistance line. Based on this scenario, my TP is set at 1.1000 points Please share this idea with your friends and click Boost 🚀

US30 (Dow Jones) 4H & 1H Analysis US30 is currently trading in a well-defined downward channel, making lower highs and lower lows. The next critical support sits near the 31,880 “Major Low,” where any decisive break could lead to further downside. On the upside, watch for a potential bullish bounce targeting the fair value gap and Fib confluence around 32,400–32,500. A breakout above the channel top may signal a trend shift, while a rejection there would likely keep the bearish momentum intact. Always monitor price action and manage risk around these key levels.

NVDA $90 PRISONAs last time we were stuck within the $90 range I can see a previous order block that was created and retested making it invalid. I am considering regardless this area of $91/94 as a good demand area. Not only the sentiment of the fanatics is that it is a discounted price at $90. But speculations are already running online that once they reach this area, they need to load up to head to $130.

This is a good sentiment to capitalize both on the movement down and the bounce.

The good traders do not become "fans" of a company. We just capitalize on fanatic sentiments to get their money as any good record label would with their artist.

Ladies and gentlemen, NVDA is our artist for this week concert.

Let us capitalize on the fans and hope they request an encore.

TSLA’s Failed Breakout: Reversal or Deeper Drop Ahead?Tesla (TSLA) Market Outlook & Long-Term Investment Report

Tesla (TSLA) has positioned itself as more than just an electric vehicle (EV) manufacturer. With its advancements in robotics, artificial intelligence (AI), autonomous driving, and energy solutions, Tesla is becoming a major player in multiple high-growth industries. While recent price action has shown volatility, long-term investors see buying opportunities at key support levels.

Technical Analysis & Key Levels

1. High-Timeframe Context (HTF)

- HTF Resistance: $415.71 – Tesla attempted to break above this level but faced rejection, leading to a sharp pullback.

- Major Support & Resistance Zone – A critical level where Tesla has previously consolidated and reacted strongly.

- Liquidity Zones (LQZs):

- Daily LQZ (~$238.18) – A key demand area where buyers could step in.

- Weekly LQZ (~$182.44 - $108.01) – A deeper liquidity zone, potentially offering even better long-term buying opportunities if the downtrend continues.

2. Market Structure & Trend Analysis

- **Failed Breakout:** Price action showed a breakout above resistance, but the failure to hold led to a sharp reversal, indicating a potential liquidity grab.

- **Retest of Support:** The price is currently testing a significant support level, which will determine the next move.

- **Momentum Shift:** The aggressive rejection at HTF resistance suggests sellers are in control in the short term, but this creates long-term entry opportunities.

Long-Term Investment Thesis

Tesla's expansion into AI, robotics, and autonomous technology presents significant long-term growth potential beyond its traditional automotive business. Here are the key areas driving Tesla's future:

1. Robotics & Artificial Intelligence

- **Tesla Optimus Robot:** Tesla’s humanoid robot project is expected to revolutionize industrial automation. It could become a major revenue source as industries move toward AI-driven labor solutions.

- **Neural Networks & AI Advancements:** Tesla’s AI systems, used for Full Self-Driving (FSD), are also being adapted for robotics, increasing its competitive edge.

2. Energy & Infrastructure Expansion

- **Solar & Energy Storage:** Tesla’s **Megapack** and **Powerwall** businesses are growing as renewable energy adoption accelerates.

- **Grid-Scale Energy Solutions:** Tesla’s energy division could play a crucial role in stabilizing power grids worldwide, providing another strong revenue stream.

3. Autonomous Vehicles & FSD

- Tesla’s **Full Self-Driving (FSD)** software could create a high-margin subscription-based revenue model.

- The potential for a **Tesla Robotaxi network** could disrupt the ride-sharing industry and unlock new business models.

4. Synergies with SpaceX & AI Computing

- Tesla benefits indirectly from advancements in **SpaceX** technologies, such as materials science and AI computing.

- The **Dojo supercomputer** is being developed to enhance AI training, which could accelerate Tesla’s robotics and self-driving ambitions.

Investment Strategy & Accumulation Plan

For long-term investors, Tesla's volatility provides attractive buying opportunities. A strategic approach would involve:

1. Key Accumulation Levels

- **Daily LQZ (~$238)** – A strong support zone where Tesla could see renewed buying interest.

- **Weekly LQZ (~$182-$108)** – A deeper level that may offer excellent long-term value if the price declines further.

2. Dollar-Cost Averaging (DCA) Strategy

- Instead of trying to time the absolute bottom, investors can **ladder buy-ins** at different liquidity zones to optimize their cost basis.

- This reduces risk and takes advantage of market dips without excessive exposure.

3. Risk Management & Long-Term Horizon

- Tesla is known for its volatility; maintaining **a long-term vision (5+ years)** is crucial for maximizing gains.

- Investors should be prepared for short-term fluctuations while focusing on Tesla’s multi-industry expansion.

Conclusion

Tesla’s failed breakout and recent pullback present a strategic buying opportunity for long-term investors. With its advancements in robotics, AI, energy, and autonomous technology, Tesla is well-positioned to be a key player in multiple trillion-dollar industries over the next decade. The current price action suggests that accumulation at liquidity zones could provide strong long-term returns.

As the robotics industry grows, Tesla’s potential as a leading producer for industrial automation is increasingly clear. Investors with a bullish long-term outlook may find current and upcoming dips as prime entry points.

Final Thought

**Is Tesla’s current dip a gift for long-term believers?** With its expanding technological footprint, this may be an opportunity to accumulate before the next major growth cycle. 🚀