Testing

The basics of back-testing (HOW TO)Hey Traders,

Today I wanted to follow on from the fantastic amount of comments that we are receiving from the previous video, "stop strategy jumping." It seems that so many of you took a whole heap of value from that video and for that I am very thankful and to everyone who reached out and told their story or let me know that it really touched them.

As highly requested, I wanted to run through a basic way to start getting the grips with strategy back-testing. How can we go about back-testing our strategies to ensure that they are profitable for us in the long run? Take a look, have a listen and tune in. Set up an excel sheet the way I do and get back testing. There's only one way to do this, and it is to do the hard work.

Let me know what you guys find. I can go more in depth in the future, but for now. It seems like most people wanted to get to grips with the absolute basics, which is what I'm going to show you today.

If you have any questions at all, please the comment section is the place to be. As always, have a fantastic trading week and a fantastic weekend traders. I'll see you very soon.

$SHIB Finding Support, New ATH Coming? Do you agree?In this video I breakdown SHIB using the Daily, 4h, and 15m timeframes.

Retail traders were hoping for a new ATH following the recent news stories going viral like the Kraken listing, game development, and increasing holders. But not so fast...

I show you the current support SHIB is testing and where a breakout or a shakeout could take us next.

Do you agree with my prediction?

Are you bullish on Shiba Inu Coin?

How to Backtest a Trading StrategyBacktesting is a manual or systematic method of determining whether a trading strategy or trading setup has been profitable in the past.

A trader should backtest a strategy to help determine if a trading strategy is likely a waste of time and money, or if it shows promise and profitability in a variety of markets.

While you can get software that does systematic backtesting… we prefer manual backtesting as it can be carried out by any type of trader,

It is a key component in developing an effective trading strategy. There are infinite possibilities for strategies, and any slight alteration will change the results. This is why backtesting is important, as it shows whether certain parameters will work better than others.

What Do I Backtest?

The first thing to note is that you don’t need a full trading strategy in order to start backtesting.

For example I personally am always looking at new trading setups and candlestick formation and then backtesting them to see how effective they are.

You can test small parts of a trading strategy before putting them all together.

And of course you can and SHOULD backtest your whole trading strategy in a number of different trading situations.

How to Backtest

1) You need data to use in testing… if you are testing short term strategies on small timeframes then use at least a few weeks of trading data.

If you are using higher timeframes then you should be using years of trading data.

2. Define the strategy parameters. Entry conditions, exit conditions etc. Include as many “If X happens then I will do Y” scenarios as possible so that your strategy is repeatable.

Its essential to include risk management in these parameters too. So decide on if you are risking a percentage of your account equally on each trade, what is that percentage. If you are managing your risk in another method, clearly define it as something you are able to measure.

ALL OF THESE PARAMETERS ARE WHAT YOU ARE MEASURING AND TESTING. THESE ARE THE ELEMENTS THAT YOU CAN CHANGE TO SEE WHICH ARE MORE OR LESS PROFITABLE.

3. Use the TradingView rewind tool to go back in time and remove the predictive nature of knowing where the chart will be headed.

You could go back in time and look for trades from a year, a month or a week in the past, depending on how far back you wish to look.

4. Analyse price charts for entry and exit signals. This can be done until all trades on the chart up to the current time have been located and marked or written down

(be aware that it can take some time and be prepared that you are unlikely to be able to do all of this backtesting in one session… it could take you a few sessions of backtesting and recording the trade outcomes to fully test a strategy.)

5. Once you have competed this process, then you can start to total all of the trade results up to see how profitable or unprofitable your trading strategy / setup has been over time.

What Goes Wrong in Backtesting

Typically the pitfalls and the ways that people fail at backtesting are based around not being through enough.

That could mean that people haven’t included enough data in the backtest.

It could mean that they left too many unknowns in the strategy so when using it in a live trading situation the strategy isn’t usable or realistic.

Also it could be that people don’t back test for long enough to see if the strategy is profitable or not. If you only have a small sample size of trade then even a short losing or winning streak of trades would dramatically affect the results. You need enough trades to show winning streaks, losing streaks and all between so that you can be confident that your strategy will be able to withstand those situations in live trading.

Imagine for example in your backtesting your strategy didn’t lose more than 2 trades in a row but when you start using it in live trading you get 5 losses in a row. This is a situation that hasn’t been tested so could show a different result.

The goal is to backtest for long enough and through enough so that nothing in live trading hasn’t been tested previously. While it may not be possible to fully achieve this… it should be the goal and you should feel confident enough that you have done everything possible to ensure this is the case.

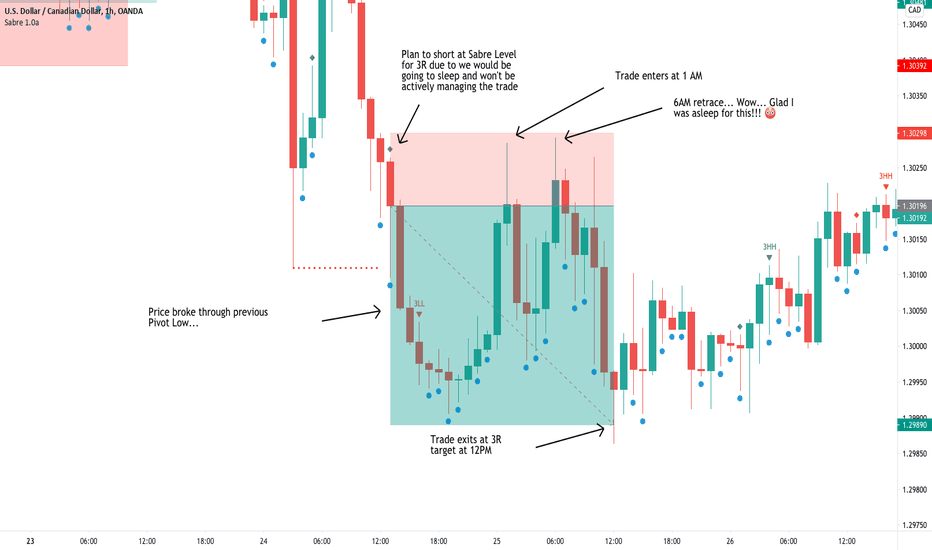

HOW-TO: Backtest Your Forex Strategy & Increase Your Win-RateIn my earlier article, " Proving Your Trading System with Backtesting ", I demonstrated how, in the Futures market, you could backtest your trading system, see what works and what doesn't, change your variables, and rinse & repeat until you have a winning trading formula.

You GET this winning formula by torture-testing (ahem, *back*testing) your system under every market condition.

My last video backtested Futures as an example and I received dozens of requests to demonstrate and develop a similar system using Forex, so here it is! This video will show you HOW you can backtest your own Forex Trading system over time, determine its results, and refine it until it is bulletproof (or marketproof!).

All you need is a Trading System, a Spreadsheet, and a great trading platform (ahem, like TradingView) :-)

Trading can be the most rewarding of careers, but only after putting in the hours of hard work. And like everything else in life, if you don't put in the work, you won't get the results. And if you put in the work AHEAD of time, you won't have to put a DIME of your hard-earned capital into the market until you are CONFIDENT that your system will multiply that money in your account rather than feed the market monster.

I hope you enjoy the video... but more importantly I hope it will help you become a better trader. If this was beneficial to you please feel free to leave a like, a follow, or a comment... I'd love to hear from you and stay in touch as we all move forward in our trading journeys!

Trade hard, and trade well!

-Anthony

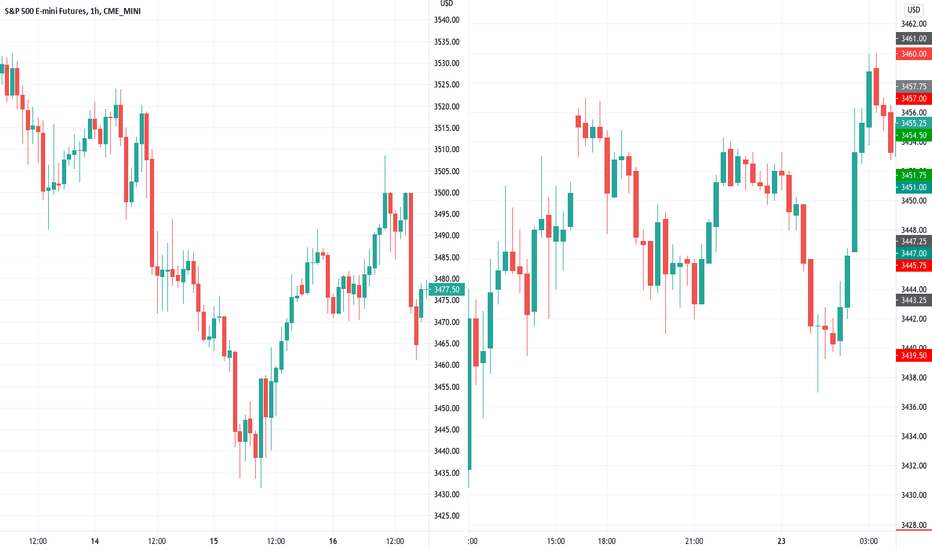

Backtesting Part 2: Testing Your Trading System in 3 Easy StepsIn my earlier article, " Proving Your Trading System with Backtesting ", I outlined the HOWs and WHYs of backtesting. Does your trading system work under all conditions? Under what conditions might it *not* work? Can you remove those instances from your plan? Under what conditions might you *improve* your win rate? In another article, " The Unexamined Trader ", Just as an unexamined life is not worth living, the unexamined trader should not be trading a system that has not been tested under every market condition (and I mean TORTURE tested under HUNDREDS of trades).

This video will show you HOW you can backtest your own system over time, determine its results, and refine it until it is bulletproof (or marketproof!).

All you need is a Trading System, a Spreadsheet, and a great trading platform (ahem, like TradingView) :-)

It will take some time and effort, but like everything else in life, if you don't put in the work, you won't get the results. And if you put in the work, you won't have to put a DIME of your precious capital into the market until you are CONFIDENT that your system will multiply that money in your account rather than feed the market monster.

I hope you enjoy the video... but more importantly I hope it will help you become a better trader. If this was beneficial to you please feel free to leave a like, a follow, or a comment... I'd love to hear from you and stay in touch as we all move forward in our trading journeys!

Trade hard, and trade well!

-Anthony