US-DOLLAR

Chinese secret weapon, BoC interest rate decision & US GDPYesterday was “dictated” by the dollar but without new highs and explosive growth. By and large, consolidation at the top is continuing. For a breakthrough to new local maxima, a serious reason is needed. In theory, today's data on US GDP might be a reason for this. These are revised growth figures for the first quarter. However, analysts are skeptical enough - the majority is expecting a revision of the preliminary value downward. We also tend to the fact that the data will come out either extremely close to 3% or even lower. So, in our opinion, the dollar would rather “rush” downward than upward. In this regard, our position on finding points for sales, the dollar has not changed. Rather, the current entry points are very close to the ideal ones.

The trade war escalation initiated by the United States naturally raised a question on a retaliatory strike from China. So far, Sino actions were more than restrained, but there is a huge range of methods in Chinese to influence. We are going to talk about a secret weapon today. Everyone has heard about the volume of US government debt owned by China and the markets attention is oriented in that direction, but a blow could be struck out of the blue. China is the world leader in the supply of rare-earth elements (controls about 80% of the world market), which is crucial for many modern industrial products. So hypothetically, as a means of counteracting US aggression, the Chinese authorities may limit their deliveries to the United States, which, in turn, will have a very negative impact on a number of American companies.

The decision of the Bank of Canada on the parameters of monetary policy was announced yesterday. The rate was left unchanged. Comments of the Central Bank as a whole were cautious. The Central bank is concerned about the uncertainty due to the trade war.

All investors' attention will be focused on data on US GDP. As for our trading positions, they have not changed: we will look for points for buying of the euro and the pound against the US dollar, sales of oil and the Russian ruble, as well as buying of gold and the Japanese yen.

Worst record of pound, Fed, dollar growth & drop in price of oilEscalation of a trade war has led not only to concerns expansion about global economic growth, but also to a fall in the rates of developing countries’ currencies. Since quotation mainly goes against the dollar, it has become an unwitting beneficiary because of this. The correlation between the dynamics of the dollar and the currencies of developing countries reached a maximum value. So the dollar reigned on its throne again. Given the current US attack on China’s technology sector (just yesterday, Huawei also received 5 more Chinese technology companies from the US Government), analysts at Nordea Investment Funds are expecting the dollar to strengthen further in the foreign exchange market, especially against the currencies of developing countries. However, our position goes contrary to the above. We believe that the dollar climbed too high, and will continue to look for points for its intraday and medium-term sales.

The pound, however, is continuing to experience serious difficulties. Against the euro , the dollar is experiencing the longest series of falls in history. May confidently goes to her fourth defeat in an attempt to approve a contract test in Parliament. According to current information, the date of voting is scheduled for June 3. But the pressure on May is increasing also many people are no longer sure that she will generally hold out at the helm before the voting, let alone after its results.

Despite a more than obvious fundamental negative, it seems like current prices are already interesting enough to begin the first round of medium-term buying. This is a long game, so you need to be prepared to endure several hundred accumulated losses and periodically average position. But in the end, of course, in our opinion, the transaction should gild or, at least, significantly increase the financial result.

The motivation for buying is still the same – “rigid” Brexit, that markets are being discounted for, is an extremely unlikely option, which means that the markets got caught up in selling pounds and went below its fair value, especially in the case of the most gate-breaking outcomes of Brexit: the parties either agree, or a repeated referendum will generally remove this issue from the agenda.

The minutes of the last FOMC Fed meeting were published yesterday. Representatives of the Central Bank announced that their "patient" approach will remain relevant for some time. That is, the pause is delayed.

As for other news and macroeconomic statistics, inflation in the UK is slightly lower than expected, but markets are not interesting at, for now, so no conclusions can be made about this. Retail sales in Canada came out better than expected and only strengthened our desire to look for points for buying the Canadian dollar.

About the oil , perfectly fulfilled our sales recommendations yesterday. The formal reason for the start of sales of steel data from the US Department of Energy on oil reserves in the US, which increased by 4.74 million barrels over the week (the markets were preparing for reduction by 1.7 million barrels). Recall, we recommend medium- term and intraday sales of oil .

Thursday promises to be quite a busy day in terms of macroeconomic statistics. First of all, we pay attention to the indicators of business activity in Europe and the USA, as well as the state of the real estate market in the USA.

Our trading positions today are as follows: we are looking for points for buying of the euro against the US dollar , sales of oil and the Russian ruble , as well as buying of gold and the Japanese yen .

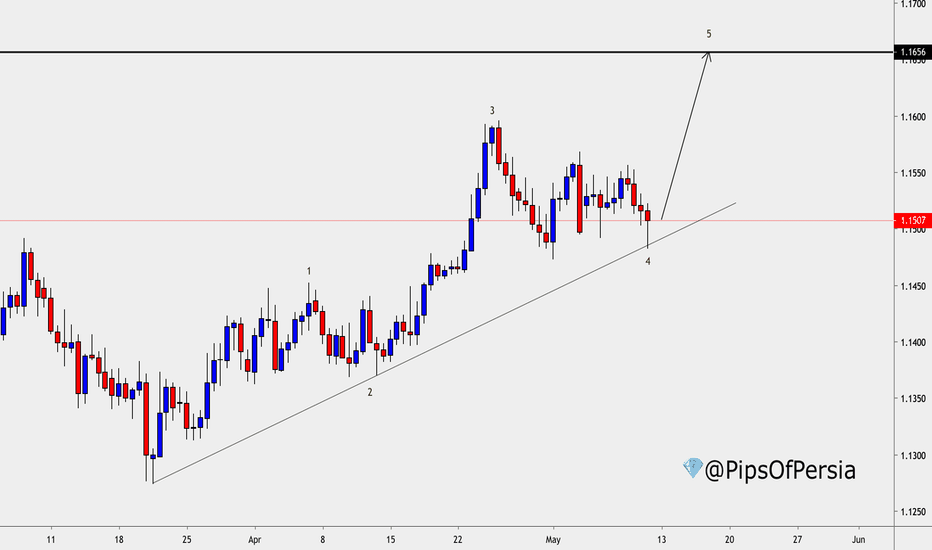

BULLISH USD?!Simple 12H analysis on the USD Weighted Index (not DXY)

Seems as though we are creating a 1-5 elliott wave, and reacting strongly to the drawn trendline.

I expect the market to form the final wave, completing the elliott pattern, and for the impulse to be exact same size as the first wave, which will then bring us to the marked zone, which is a very key weekly reversal area.

USD still has some room to gain strength, even with all the trade wars happening. So i expect this to be a smooth journey for a bullish USD across the board.

@PipsOfPersia

t.me

GBPUSD TRADING PLAN

pound dollar is approaching 1.3 structure support level.

RSI is very oversold with clear divergence

+ we have a completed head and shoulders pattern.

neckline is a narrow resistance level around 1.304

our plan is:

wait and buy bullish breakout of a neckline

T1 - 1.308

T2- 1.314

Stop below left shoulder

USD bullishness didn’t spill over to the USD/JPY – GDP to help?On Friday, Forex traders will be focused on the new dataset covering the US economy for Q1/2019. In Q4 of last year, the US economy advanced at an annualized 2.2% on quarter, well below a 2.6% growth in the second estimate and compared to 3.4% in Q3/2018.

So, the question will be whether this trend of pessimistic readings continues, and how the USD will react. While we would usually expect the USD to drop in response to negative readings below expectations of 2.1%, after the USD index future instead broke out to new yearly highs, currently about to attack 98.00 points. Bullish momentum is probably only temporarily interrupted, but strong enough for a technical reversal.

That said, a reading above expectations could accelerate the move in the USD index future and result in a weekly close above 98.00 points.

Interestingly enough, the USDJPY wasn't really able to profit from the USD bullishness. We only saw a short spike above 112 to near-highs, but no follow through.

While a reading above expectations (> 2.1%) could certainly result in another attempt to sustainably break above 112.40 where further gains up to 114.50/115.00 become an option, a disappointing data set resulting in a stabilisation/corrective move in the USD could push the USD/JPY back towards 110.80/111.00 in the days to come.

EUR/USD forecastI am sure you all made good profits as per my previous EUR/USD forecast. Last week almost all US reports were positive. GDP showed a 3.2% growth. Job growth, retail sales, manufacturing activity, and inflation ticked higher and supported our shorts in EUR.

Coming week is crucial for the American dollar — all eyes on FOMC meeting. Last time Fed was so cautious about their view on the US economy. I have a feeling this week their tone will be more positive. Well, they don’t have to follow my guessings. But let’s see. In a word, all in Fed’s hands now. The most conservative traders should wait for a statement before taking a trade. Besides, the chat is silent too.

I mentioned many times that 1.11200 – 1.11000 would be buying opportunity, but no signal yet. So, watch the price action, accumulation (if any) and volumes. The volume will be a crucial factor coming week. I will consider longs with 1.13200 targets after spike with significant volume and pullback. Bounce up with low volume will invalidate this scenario. And in this case, I will watch for rejection with substantial volume to go short with 1.1060 target. So, no hurry in making money! Patience pays in trading. I believe you all aware of it. Last Friday I made only small scalping in EUR. But now will be waiting for a swing entry.

Buy 1.4% - AUDUSD at March and December '18 SupportsAUDUSD (Australian Dollar - US Dollar) is back at March 2019 and December 2018 lows around 0.70. Now is a prudent time to consider buying, the latest quote is 0.701. The target is at 0.71, around the 2 month moving average for a 1.4% difference.

Outlooks - 3 month

Bullish - JPY, AUD, CAD and CHF

Bearish - USD, GBP

Descending triangle in up trend: sell the breakout

Pound dollar is on focus:

1.30 support is the key level for this pair,

bearish breakout of it will trigger strong selling reaction.

Sell only when daily candle closes below structure

or wait and sell the retest of a broken level.

Targets based on structure:

1.28 and 1.27

TURKISH LIRA Forecast: Great short trade!

Market sentiment:

Bullish trend

Market is approaching significant resistance

Weakening bullish momentum

RSI overbought + divergence

Head and shoulders pattern formation

Wait and sell breakout of the neckline.

Targets are based on structure!

Please, check my signature!

Trading plan for dollar cad

Please check my signature and related ideas.

Market sentiment:

Strong bullish pressure around 1.33 support

Bullish breakout of descending triangle

Long term bullish trend

Trading plan:

To avoid a bull trap let the market close above 1.34

Then buy limit the broken support

Targets:

Initial target 1.344

Second target 1.349

A RECESSION is coming.Potentially we are at a very good 4H resistance as shown by our red box.

Over the past day price has stalled and is just ranging and failing to break this resistance which could mean price is getting ready to make bearish movement as the bulls are not strong enough to break this level.

So we are expecting bearish movement the rest of the week and hopefully hitting our TP or support zone and bagging us a nice few pips in the process.

With some high impact news for USD coming up this week and the state of the US economy we can only see bearish movement for the USD, and with that muppet Trump in charge things will only get worse... a recession is coming.