Gold is in the Bullish DirectionHello Traders

In This Chart GOLD HOURLY Forex Forecast By FOREX PLANET

today Gold analysis 👆

🟢This Chart includes_ (GOLD market update)

🟢What is The Next Opportunity on GOLD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

Xauusdanalysis

When will gold's continued highs peak?In terms of the short-term operation strategy for gold, it is recommended to do more on pullbacks and short on rebounds. The short-term focus on the upper side is the 3128-3130 line of resistance, and the short-term focus on the lower side is the 3100-3097 line of support.

Operation strategy reference:

Short order strategy:

Strategy 1: Short (buy short) two-tenths of the position in batches near the rebound of gold around 3127-3130, stop loss 3140, target around 3115-3105, and look at the 3100 line if it breaks;

Long order strategy:

Strategy 2: Go long (buy up) two-tenths of the position in batches near the pullback of gold around 3100-3102, stop loss 3090, target around 3120-3128, and look at the 3140 line if it breaks;

Gold- Target and new ATH reached. Now what?In my analysis yesterday, I mentioned that Gold would likely reach a new all-time high (ATH), but for that to happen, it was crucial for bulls to hold strong at the 3025-3030 support zone.

Indeed, Gold made a new ATH, reaching my target zone of 3080 overnight. I closed my buy trade with a profit of 550 pips.

Now, the key question is: What’s next?

In my opinion, there’s a strong possibility that Gold will continue its upward movement and test the 3100 level. However, at the current price of 3075, entering a buy trade is not justified from a risk perspective.

For now, I’m staying out of the market. If a retracement occurs, I’ll be watching the 3050 zone closely—most importantly, I’ll assess how the market reacts at that level before making any decisions.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

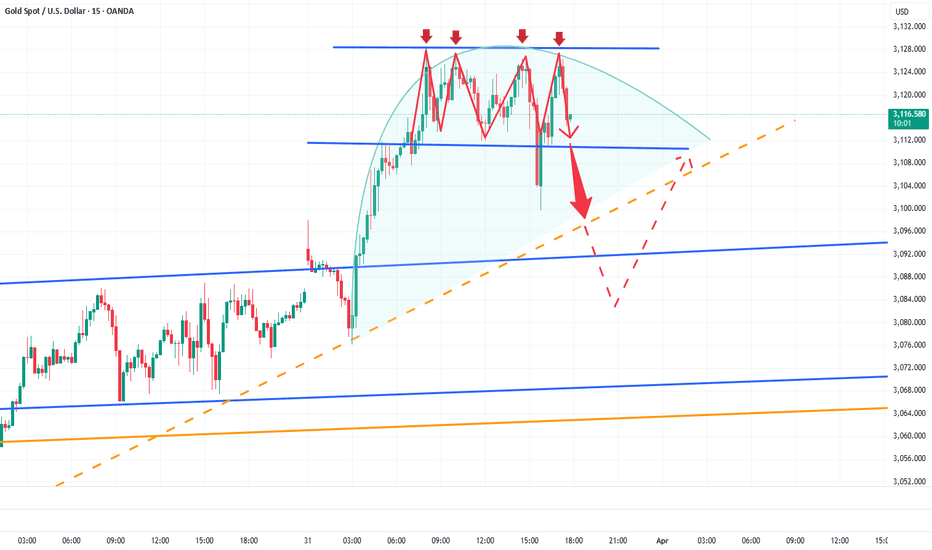

3/31 Gold Trading StrategiesThe five-wave upward movement in gold has been completed. Next, we expect a period of consolidation around 3130, forming a short-term top before a potential pullback. However, during this consolidation phase, there is a possibility of a price surge, though the probability is low.

Trading Suggestions:

For conservative traders: Avoid rushing into positions. It’s better to wait for a pullback and the confirmation of a secondary top before entering trades.

For aggressive traders: You may enter at the current price, but be cautious with your position sizing and leave room for potential additions.

Based on the magnitude of the previous upward movement, the expected retracement zone is around 3110-3096, where a minor support level may form.

Trading Strategy:

📉 Sell in the 3121-3131 range

📈 Buy in the 3105-3090 range

Trade carefully

GOLD: What to do if you Hold a Short position?Gold is rebounding. Pay attention to the resistance above 3020. At present, we can see obvious selling pressure on the 2H chart. MACD has formed a divergence. 2H is a larger period. Its form is short, which means that tomorrow or the day after tomorrow, the market will fall sharply.

In addition, the divergence of MACD is sometimes repaired by shock market. This situation is not uncommon, so when trading, we need to focus on the support.

Judging from the current candlestick chart arrangement, there is support near 3100, followed by the 3096-3088 range. If a larger divergence pattern is to be formed, the price may reach the 3036-3048 range. At that time, there is no need to hesitate too much, just sell it.

Multiple top signs appear, short gold!Although gold rebounded quickly after hitting 3100, it does not rule out the process of testing and confirming the top. I think that in the short term, we can still short gold in batches with the help of 3025-3035 zone suppression. Then wait patiently for gold to retrace!

If gold can fall below the 3100-3095 zone during the decline, gold may accelerate downward to the area around 3085 under the stimulation of selling. Let us wait and see!

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

Strong acceleration to the top? Gold trading analysis strategyGold early layout plan: Long and short strategies in the real market all the way to stop profit, lucrative profits, witnessed by the whole network!

News: On the fundamentals, last week's re-strengthening, in addition to the escalation of tensions in the global economy and trade, there is also support from the Middle East tensions and the optimistic impact of the Ukraine negotiations that are not as expected; and this week will usher in Trump's tariff week, and countries are currently relatively tough and oppose the unilateral imposition of tariffs by the United States. And a comprehensive response is about to be made. This will increase economic concerns and the safe-haven demand for gold. Therefore, although there are some profit-taking and resistance suppression in the gold price at present, under the mutual game of global trade tariffs and the intensification of geopolitical tensions, a temporary retracement is still creating entry opportunities for bulls, and in the short term, it is still expected to refresh the historical high to around US$3,150. In the day, we will pay attention to data such as the Chicago PMI in March and the Dallas Fed Business Activity Index in March in the United States. It is expected that the impact will be limited. According to the trend of last week, there is also momentum for strengthening again. Therefore, the day will still be bullish and rebound-oriented. This week, the focus will be on the implementation of global trade tariffs on Wednesday and the non-farm payrolls report on Friday, which may strengthen gold's safe-haven appeal. Other important data include Tuesday's ISM manufacturing PMI and JOLTS job openings, Wednesday's ADP employment, and Thursday's ISM non-manufacturing PMI and initial jobless claims.

Gold technical analysis: Gold technical analysis: Gold is really simple, you can make money with your eyes closed, and now it has reached the point where everyone can make money. On the contrary, I began to become cautious and timid. Gold jumped high in the early trading, quickly sold off and washed the market, and successfully got many people off the bus with a trick of fishing for the moon in the bottom of the sea, and then pulled up all the way, which was really strong. I emphasized before that gold would not peak if it did not soar by hundreds of dollars, and now this rhythm is getting closer and closer. Today, it rose by 50 US dollars a day. I dare to guarantee that there will be another day of 100 US dollars this week, which means that the top is just around the corner. Go long with the trend, but don't be a long-term investor. Today, we will focus on the breakout of 3127-30. If it fails to break higher, then this point may become a short-term high point. It is best to go long when it falls back to around 3100-3105. Finally, I would like to advise the majority of retail investors that when the market fluctuates violently, if you cannot control yourself and go with the trend, overall, today's short-term operation strategy for gold is to go long on pullbacks and go short on rebounds. The short-term focus on the upper resistance of 3128-3130 and the short-term focus on the lower support of 3100-3097. Friends must keep up with the rhythm. Maintain the main pullback and go long. In the middle position, watch more and do less, be cautious in chasing orders, and wait patiently for key points to enter the market. I will remind you of the specific operation strategy during the session, and pay attention to it in time. If your current gold operation is not ideal, I hope that your investment can avoid detours. Welcome to communicate with us!

Gold operation strategy: Go long on the 3100-3105 line of gold.

Trading discipline: 1. Don’t blindly follow the trend: Don’t be swayed by market sentiment and other people’s opinions. Follow your own operation plan. Market information is complicated and blindly following the trend can easily lead to the dilemma of chasing ups and downs.

2. In gold trading, we will continue to pay attention to news and technical changes, inform us in time if there are any changes, strictly implement trading strategies and trading disciplines, move forward steadily in the volatile market, and achieve stable asset appreciation.

(Note: The above strategy is based on the current trend, and will be adjusted according to real-time fluctuations during trading. It is for reference only)

Gold fell into a high-level consolidation.Although the gold price briefly fell back to 3100 points, the strength was limited. The big positive line quickly broke through, showing that the short-term momentum was insufficient, the long-term was still strong, and the probability of a new high was greatly increased. On the hourly chart, the gold price maintained high fluctuations, and the strength and sustainability of the retracement were not strong. The technical form of the small-level cycle was gradually adjusted in place, and it was expected to continue to rise in the late trading. The upper resistance was concentrated in the 3127-3133 range, and the lower support was in the 3107-3103 range.

Strategy: It is recommended to buy at 3105-3100, stop loss at 3093, target at 3120-3130, and break at 3140.

Gold continues to look above 3100Today, we will focus on the breakout of 3127-30. If it fails to break higher, then this point may become a short-term high point. It is best to go long if it falls back to 3100-02. It is still possible to go short if it falls back to 3102 and then rebounds to 3125-27. If you cannot control yourself and go with the trend, then going short may be the best choice. It is better not to do it than to make a mistake! Watching more and doing less is also a suitable strategy. Overall, it is recommended to go long on pullbacks and short on rebounds in terms of short-term gold operations. The short-term focus on the upper side is the 3128-3130 resistance line, and the short-term focus on the lower side is the 3100-3097 support line.

Operational Strategy;Gold will pull back to around 3100-3102, buy 20% of the position in batches, stop loss at 3090, target around 3115-3125, and look at 3150 if it breaks;

Gold opened higher and broke the historical high again Gold is still in a golden cross with upward bullish divergence. The bullish strength of gold is still there, but gold is rushing higher, so we must beware of short-term adjustments in gold. If gold breaks through the previous historical high of 3100, then 3100 will be a turning point support for gold in the short term. If it falls back to 3100, continue to buy on dips. As long as it does not fall below 3100, gold will continue to be the home of the bulls and will be in a strong unilateral position in the short term. On the whole, gold is in a continuous upward trend, the bulls are climbing steadily, the lows are constantly moving up, and the highs are constantly refreshing. At present, the gold price still has room to rise. The focus below is on the 3070 support line, followed by the 3100 line. On the whole, the short-term operation strategy for gold is to focus on long positions on pullbacks and short positions on rebounds. The short-term focus on the upper side is the 3100-3120 resistance line, and the short-term focus on the lower side is the 3066-3070 support line.

Gold operation strategy reference:

Short order strategy:

Strategy 1: Short 20% of the gold position in batches when it rebounds to around 3100-3115, stop loss at 3120, target around 3085-3075, and look at the 3070 line if it breaks;

Long order strategy:

Strategy 2: Long 20% of the gold position in batches when it pulls back to around 3070-3073, stop loss at 3060, target around 3085-3095, and look at the 3120 line if it breaks;

Gold breaks through historical highs again, trend and analysis.From the perspective of future trends, combined with various signals from fundamentals and technical aspects, spot gold is still in an upward cycle dominated by bulls in the short term. From a technical perspective, the weekly, daily and H4 cycle performances are all extremely strong, with no signs of decline or desire to fall. Therefore, cyclical bullishness needs to wait for the daily line to peak or to break out of a continuous decline before looking at the effective space for decline.

The upper resistance of gold is currently connected by the recent high point line and the extension line. The upper pressure can be seen in the 3128-3132 area, and the lower support can be seen in 3100 or even 3086. After getting support, enter the market to buy more. If it breaks through, the upper side will further look to around 3152-3177

Short gold, pullback to 3110-3095 zoneToday gold rebounded sharply after falling back to around 3076. The current highest rebound is around 3128. The current highest rebound is around 3128. Although part of the reason is due to the support of the market's risk aversion, I think it is more of a catharsis of the market's bullish sentiment.

So at this time, we should not chase long gold; because with the sharp rebound of gold, the risk of going long is gradually accumulating; secondly, we can refer to the trend of silver. After reaching the high point, it has begun to fall. I think gold may refer to the trend of silver and choose to fall in the short term.

Therefore, in terms of short-term trading, you may wish to consider shorting gold in the 3125-3135 zone, and the 3105-3095 zone is the first focus of our attention to long gold levels after a short-term correction.

You must keep your trading mind active, only in this way can you avoid too many stupid trading signals.The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

Gold at New Record—Will the Rally Continue?Spot gold opened higher and rose further in the early trading on Monday (March 31st). It once broke through the level of $3,090 per ounce and reached a new all-time high of $3,128 per ounce. This market movement was mainly driven by geopolitical risks and market concerns about the global trade war, which attracted investors to flock to safe-haven assets.

This week, multiple factors in the market have interwoven to affect the price of gold. On Wednesday, the tariff policy was finally determined, and the ADP data also caused fluctuations in the market. On Friday, the non-farm payrolls data will once again test the nerves of the market, presenting both risks and opportunities. Against this backdrop, gold has demonstrated the charm of a safe-haven asset. The economic slowdown in the United States, the intensification of the US debt crisis, and the tense geopolitical situation in the Middle East have all provided impetus for the rise in the price of gold.

From a technical perspective, gold surged after opening in the morning and then quickly declined, but it stabilized and rebounded later. The weekly, daily, and 4-hour charts all show a bullish trend, with strong upward momentum. On the hourly chart, gold maintains a good upward trend, with previous highs and lows continuously rising, and the bulls are in the dominant position. Currently, the upper resistance is in the range of $3,135 - $3,138, while the lower support is in the range of $3,070 - $3,080. In terms of operation, it is recommended to go long on pullbacks as the main strategy and go short on rebounds as a supplementary strategy.

XAUUSD

buy@3090-3100

tp:3120-3130-3150

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

Expect gold to retreat to the 3100-3090 zoneOn a crazy Monday, gold fell back to around 3076 and then rebounded, and continued to rise to around 3128. It has now fallen back slightly and is fluctuating in a narrow range around 3120!

Although gold does maintain a strong position at present, what makes me more alert is that once gold retreats $3-5, it will be enough to make more buyers crazy and actively rush into gold long transactions. This is an extremely dangerous signal in my opinion! Because if with the withdrawal of large funds and panic selling, more bulls will be defeated.

So I explicitly refuse to chase long gold above 3120, because as gold rises rapidly, the risk of going long is gradually accumulating, so the liquidity of gold is gradually weakening, so gold may need to retreat more to increase liquidity before continuing to rise! And if the tariff policy introduced on April 2 is carried out in a more moderate way, then market sentiment will be greatly eased, and gold may also collapse.

So I think in short-term trading, we can still short gold in batches in the 3125-3135 zone, and expect gold to at least fall back to the 3100-3090 zone.

XAUUSD:Place short positions during the rebound I conducted resistance tests at the levels of 3,100 and 3,115. However, in the early trading session, the price of gold surged rapidly, soaring all the way to around 3,027. In the later period, choosing to stand by and observe to avoid risks could also be regarded as a sound strategy. Now, the market has approached a stable state. The resistance test at 3,027 has proven to be effective. One can place a short position near 3,025 during the rebound.

XAUUSD Trading Strategy:

sell@3125

TP:3115-3105

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

Gold rose more than 1% in a single dayGold technical analysis

The resistance level of the daily chart is 3150, and the support level below is 3060

The resistance level of the four-hour chart is 3150, and the support level below is 3078

The resistance level of the one-hour chart is 3130, and the support level below is 3098

Risk aversion and policy expectations jointly push up the price of gold. After stabilizing at $3100, the next target is $3130-3170; if the NY market data is negative or a technical correction occurs, it is necessary to pay attention to the effectiveness of the support near 3100.

Comprehensive consideration is mainly to buy at low levels, focusing on the breakthrough signal of $3130, the 4-hour rising channel is intact, and the rising channel that breaks through 3130 will move towards the 3150-3170 range

Gold surges and then falls, indicating an imminent fallGold early stage layout plan: Long and short strategy all the way to stop profit in the actual market, huge profits, witnessed by the whole network!

Technical analysis of gold: At present, Trump's tariff policy will be officially announced on Wednesday. Today, Asian stock markets fell across the board in the Asian session, because Asian stock markets opened the earliest. According to historical laws, the stock market's reaction is the fastest. European stocks may also fall across the board. The short-term decline in the stock market often brings a short-term rebound in the price of gold. Focus on the trend of the US stock market. Once the US stock market falls sharply and rapidly, it is often accompanied by a rapid decline in the price of gold. In the morning, the price of gold has rebounded by more than 50 points from the low of 3076 to 3127. After rebounding by more than 50 points, we can intervene in short selling at 3120-25, and close the position when it falls back to around 3105-15. Today, the European and American sessions focus on the breakout of 3127-30. If the European session fails to break higher, then this point may become a short-term high point. It is best to take long positions when it falls back to around 3105-3100. Finally, I would like to advise all retail investors that when the market fluctuates violently, if you cannot control yourself and go with the trend, then shorting may be the best choice. It is better not to do it than to make mistakes! Watching more and doing less is also a suitable strategy. I will remind you of the specific operation strategy during the trading session, and you should pay attention to it in time. If your current gold operation is not ideal, I hope that your investment can avoid detours. Welcome to communicate and exchange!

Gold operation strategy: short gold at 3120-25, target 3105-3115, and go long at 3110-3100.

Trading discipline: 1. Don't blindly follow the trend: Don't be swayed by market sentiment and other people's opinions, and operate according to your own operation plan. Market information is complicated and blindly following the trend is easy to fall into the dilemma of chasing ups and downs.

2. In gold trading, we will continue to pay attention to news and technical changes, inform you in time if there are any changes, strictly implement trading strategies and trading disciplines, move forward steadily in the volatile market, and achieve stable asset appreciation.

(Note: The above strategy is based on the current trend, and will be adjusted according to real-time fluctuations during trading. It is for reference only)

GOLD:Short positions are dominant in New York sessionToday, gold jumped higher and opened higher. After filling the gap, it continued to rise, breaking through the 3100 mark and approaching 3130. The excessive and rapid rise caused the MACD indicator to diverge, giving us the opportunity to short this time, from which we gained 1000+ points of profit. Together with the profit of nearly 2000 points in the Asian session, we have gained more than 3000 points of profit today.

At present, the price is still falling, with weak support roughly around 3107 and strong support around 3098. Before the start of the US session, the price is expected to fluctuate in the 3100-3130 area. There will be large fluctuations after the opening, and the possibility of falling from a high position is greater, so the US session can pay more attention to the opportunity to short at a high position.

GOLD Price Analysis: Key Insights for Next Week Trading DecisionGold surged to a record high of $3,086 last week as investors dumped Equities and Crypto for safe-haven assets. With rising inflation concerns and uncertainty surrounding Trump’s tariffs, fears of a US recession or stagflation are driving the market.

📈 Will Gold continue its rally, or is a pullback coming? In this video, I break down my thought process and how I’m strategically positioning for the next big move.

#GoldPrice #XAUUSD #MarketAnalysis #GoldTrading #Forex #Inflation #SafeHaven #TradingStrategy

Disclaimer:

Forex and other market trading involve high risk and may not be for everyone. This content is educational only—not financial advice. Always assess your situation and consult a professional before investing. Past performance doesn’t guarantee future results.

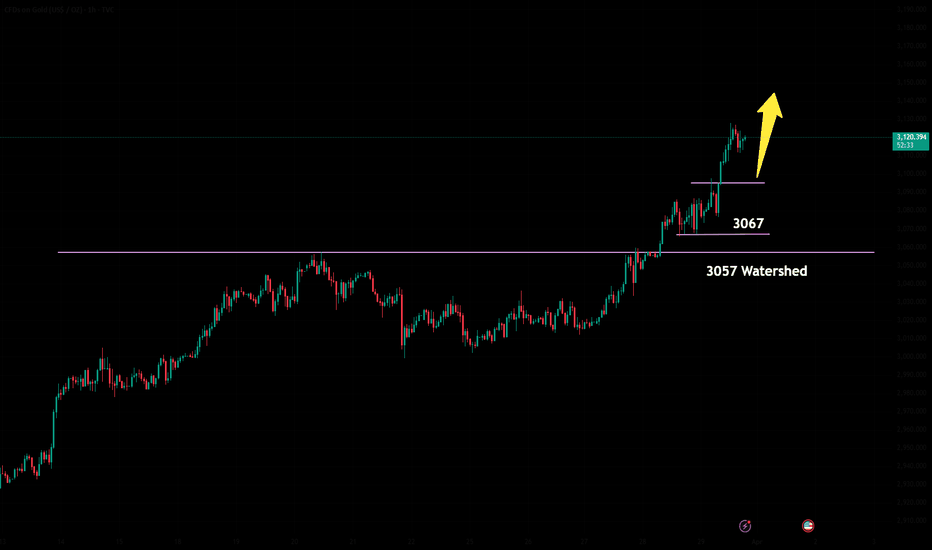

Next week’s opening trend forecast and layout!Early layout plan for gold: long and short strategies in the real market, all the way to profit, rich profits, witnessed by the whole network!

Technical analysis of gold: Gold rose again at the end of Friday, and finally closed the daily line with a bald positive line. After a brief adjustment, it rose again. Then, there will be high points to see next week. Continue to maintain the main decline and long, and do not guess the top for the bullish trend. This week is also a long and short strategy to stop profit all the way, and the intraday harvest is rich! The daily support is near 3057, but the strong will not have too much retracement, otherwise it will turn into shock, and the low point of the fall is near 3073. On Monday, the strong will rely on this position to be bullish. The upper pressure is near 3087. Don’t chase more before breaking the position. Breaking the position will gradually see above 3100! Next week, we will continue to focus on retracement and long, but don’t chase more. After all, the technical side needs to step back and adjust. Stepping back and long is the way to go with the trend. Maintain the main retracement and long, and watch more and move less in the middle position. Be cautious and chase orders, and wait patiently for key points to enter the market. I will remind you of the specific operation strategy during the trading session, please pay attention to it in time. If your current gold operation is not ideal, I hope that your investment can avoid detours. Welcome to communicate with us!

Gold operation strategy: Go long when gold falls back to 3070-60.

Trading discipline: 1. Don't blindly follow the trend: Don't be swayed by market sentiment and other people's opinions. Follow your own operation plan. Market information is complicated and blindly following the trend can easily lead to the dilemma of chasing ups and downs.

2. In gold trading, we will continue to pay attention to news and technical changes. Once there are changes, we will inform you in time, strictly implement trading strategies and trading disciplines, move forward steadily in the volatile market, and achieve stable asset appreciation.

(Note: The above strategy is based on the current trend, and will be adjusted according to real-time fluctuations during trading. It is for reference only)

Waiting for a healthy pullback or FOMO push to 3150+?🔸 News Update: Geopolitical Turmoil Boosts Gold’s Appeal 🔸

The Russian Ministry of Defense reported missile strikes on Ukrainian SBU and special operations units, further escalating tensions in Eastern Europe. This, combined with China’s continued gold hoarding and a weaker USD, has kept gold’s bullish momentum intact.

🟥 Sell Setup (Liquidity Trap Short)

Entry Zone: $3,121 – $3,125 (Liquidity Grab + HTF Supply)

Trigger: M5/M15 Bearish CHoCH + Weak Bullish Reaction

SL: Above $3,130 (Invalidation Level)

TP1: $3,100 (First Target)

TP2: $3,085 (Deep Profit Zone)

TP3: $3,074 (Full Breakdown)

📌 Why?

Liquidity Hunt Potential → Market may fake out longs before reversal

Bearish Order Flow Zone → Major supply area where sellers are active

HTF Expansion Exhaustion → Price needs to cool off before further gains

🟥 Sell Setup 2 (Momentum Reversal – Only If Confirmed)

Entry Zone: 3,150 – 3,155 (Extreme Supply Zone)

Trigger: Bearish CHoCH + FVG reaction

SL: Above 3,160

TP1: 3,120

TP2: 3,100

TP3: 3,073

📌 Reasoning:

Extreme premium level where HTF supply could react

Only valid if price extends to this level without pullback

Ideal for a larger reversal if bullish momentum fades

🟢 Buy Setup 3 (Intraday Continuation Play – If $3,100 Rejects)

Entry: $3,092 – $3,094 (LQ sweep + minor demand zone)

Trigger: M1/M5 CHoCH + bullish rejection wick

SL: Below $3,090

TP1: $3,100

TP2: $3,108

TP3: $3,117

📌 Why This Zone?

If NY sweeps $3,100 liquidity and retraces, $3,092 – $3,094 could be a quick buy-the-dip area.

Only valid if the previous demand structure remains intact.

Ideal for short-term scalps rather than a deep retrace buy.

⚠ If price drops aggressively below $3,090, don’t force the buy—$3,083 – $3,087 is the next stronger zone.

🟢 Next Fresh Buy Setup (If Price Dips Again)

Entry Zone: $3,067 – $3,070 (Untapped demand + imbalance fill)

Trigger: M1/M5 CHoCH + bullish confirmation

SL: Below $3,064 (Liquidity protection)

TP1: $3,090 (Reaction level)

TP2: $3,108 (Liquidity grab target)

TP3: $3,120+ (Continuation move)

📌 Why This Zone?

Previous NY session left unmitigated demand here.

If price pulls back, smart money will likely buy from this area.

Gold still bullish – this is the next potential buy-the-dip zone.

⚠️ If $3,067 fails, deeper support at $3,055 – watch for a strong reaction there!!

✅ Key Takeaways

✔ Gold remains bullish above $3,074 – buy dips, but avoid FOMO.

✔ A liquidity grab below $3,080 could be the next major long opportunity.

✔ Sells are scalps only – favor longs unless $3,067 breaks.

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your own plan and wait for confirmation before taking action.

Good luck on the market today.

NEXT HIGH is 3100 It's coming !! XAUUSD GOLD next move We have seen the gold rally from 2978 to 3058 , toped the level of 3058 which is the last all time high in last week , last fri day in US session we have seen some profit booking and also it retested the last swing low of asia of this week .

I'm predicting now that XAUUSD GOLD will make a new ALL TIME HIGH again in upcoming day's .

XAUUSD has broken through the key level of 3110As gold enters a tariff-sensitive week, market risk aversion has intensified. Heightened probabilities of escalating US sanctions against Russia and Iran have reignited uncertainty, driving demand for gold as the world's largest safe-haven asset. Its record-breaking rally reflects the prevailing market sentiment.

Gold is in a sustained uptrend, with bulls steadily advancing and higher lows forming alongside successive new highs. Current market conditions suggest there remains upside potential for gold prices.

For short-term gold trading today, the recommended strategy is to buy on dips as the primary approach and sell on rallies as a secondary tactic. Focus on the key short-term resistance levels at 3115-3120, and monitor the key short-term support levels at 3070-3075.

XAUUSD trading strategy

buy @ 3085-3090

sl 3070

tp 3100

Preserve capital, manage risk, generate returns, achieve sustainable long-term profitability, and continuously learn and develop through trading. Access the link below the article to obtain precise signals.