DAX Weekly CLS Range Model 1 - TP GAPHi friends, new weekly range created. As always we are looking for the manipulation in to the key level around the range. Don't forget confirmation switch from manipulation phase to the distribution phase to make the setup valid. Stay patient and enter only after change in order flow. If price reach

Market indices

US500: Risk of a Deeper CorrectionUS500: Channel breakdown should signal a risk of a deeper correction

US500 has been trading inside a rising channel, but recent price action shows clear weakness near the upper boundary. The rejection from the channel top suggests buyers are losing control and a corrective move may already be unde

NIFTY50.....Explodes massiv!Hello Traders,

the NIFTY50 explodes this morning with a massive of 639 points, just measured by the candle. In fact, it skyrocked nearly 900 points by measuring by yesterdays to tdays close! What a move!

I would argue, that this move was to fast, too much, and much to extend for only two trading day

Discord Stock Hits Exchanges in March IPO: What You Should KnowDiscord NASDAQ:DISCORD has filed confidential IPO paperwork with the SEC and is aiming for a March debut (ref: the IPO calendar ), reigniting speculation around one of Silicon Valley’s most closely watched private companies.

The late-stage startup has lined up heavyweight underwriters Goldman Sa

SPX500 | Earnings Beats Fuel Strong Open for U.S. StocksSPX500 | Earnings Beats Fuel Risk Appetite, Futures Point Higher

U.S. equity futures are set for a strong open, extending the positive momentum from the previous session as earnings beats from major tech companies reignited demand across the AI and growth space.

Earnings moved back into focus afte

SPX500: Bearish Drop to 6850?As the previous analysis worked exactly as predicted, FX:SPX500 is eyeing a bearish reversal on the 4-hour chart , with price testing a key resistance zone after lower highs, converging with a potential entry area that could trigger downside momentum if sellers defend amid recent volatility.

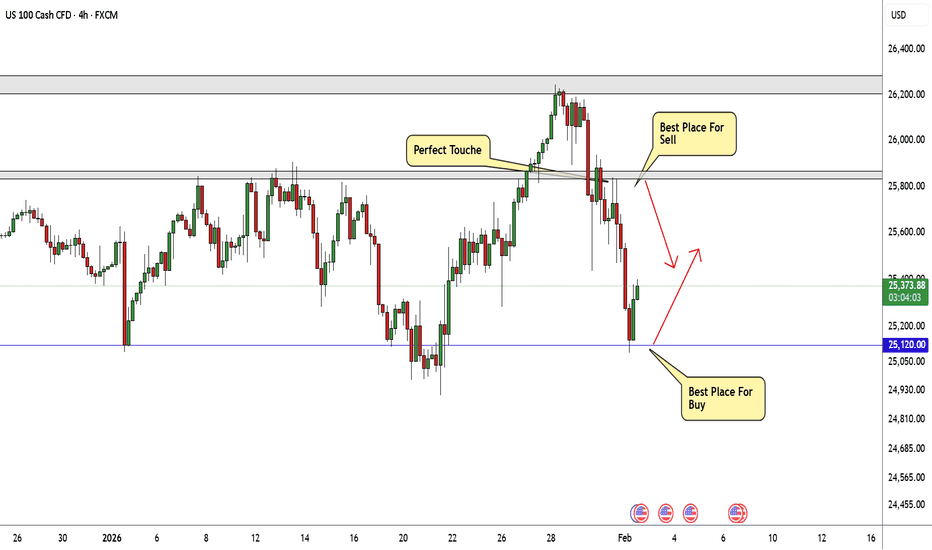

Nasdaq Best Places To Buy And Sell Cleared , 800 Pips Waiting !Here is m y opinion on NASDAQ On 4H T.F , We have a Huge movement To Downside as i mentioned in my last Analysis About Nasdaq & Then to Upside Now , and we have a good range for buy and sell started between 25120.00 to 25800.00 so we can buy and sell n\Nasdaq This Week from 2 areas , 25120.00 will b

Tech Analysis of KSE-100 Index on 30-Min TF (03-02-2026) by TCATech Analysis of PSX / KSE-100 Index on 30-Min TF (03-02-2026)

In our latest analysis, the KSE-100 index has successfully planted an "S-A-T" and has posted both a higher low and a higher high, signaling a robust uptrend. This development suggests that the pullback phase is likely ending, and a new b

Updated wave structure for the Cash sp 500 Major turn is at hand Under the current wave structure and Fib relationships within the waves We have forming a Major Top The breakdown in IGV is the canary in the coal mine and The 10 and 20 year bonds markets show a breakdown forming The rotation is nearing the end of what I call the g

US DOLLAR H4 | Bearish Reversal The price is reacting off our sell entry level at 97.41, which is a pullback resistance.

Our stop loss is set at 98.07, which is a pullback resistance.

Our take profit is set at 96.19, which is a pullback support level.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe

See all popular ideas

Index collections

Frequently Asked Questions

An index is a financial instrument that measures the performance of underlying assets or tracks other financial data. Some indices are designed to provide a broad view of the market, while others focus on tracking a particular sector of the economy. Indices give traders an instant snapshot of market sentiment with a rising index suggesting optimism about the economy and a declining index signaling uncertainty.

For example, the S&P 500 Index (SPX) tracks the performance of 500 large publicly traded companies in the United States, while the US consumer price index (CPI) measures US inflation and deflation.

Usually, indices are expressed in points, but some, like the S&P 500, can be expressed in the national currency.

With TradingView, you can follow all indices in one place.

For example, the S&P 500 Index (SPX) tracks the performance of 500 large publicly traded companies in the United States, while the US consumer price index (CPI) measures US inflation and deflation.

Usually, indices are expressed in points, but some, like the S&P 500, can be expressed in the national currency.

With TradingView, you can follow all indices in one place.

Indices are used to track assets or financial data, so they're not designed for trading, but some financial instruments linked to indices can be traded on exchanges. They include mutual funds, exchange-traded funds (ETFs), index futures, contracts for difference (CFDs), and options on indices.

We recommend conducting a thorough analysis before settling with any of these instruments: explore indices ideas and forecasts and then select a reliable brokerage on TradingView. Once you open an account, you'll be all set to start investing in indices.

We recommend conducting a thorough analysis before settling with any of these instruments: explore indices ideas and forecasts and then select a reliable brokerage on TradingView. Once you open an account, you'll be all set to start investing in indices.

The main global indices that investors and traders track include the S&P 500, FTSE 100, Dow Jones, and more.

For your convenience, we have a list of all major indices in one place — analyze their stats to conduct a well-rounded analysis.

For your convenience, we have a list of all major indices in one place — analyze their stats to conduct a well-rounded analysis.

Stock market indices are mainly used to gauge the health of a particular sector of the world economy. For example, as one of the main global indices, the S&P 500 (SPX) provides investors and traders with insight into the health of the US economy. Another reputable index, the DAX Index, helps assess the performance of German blue-chip companies. It is one of the primary indicators of Germany's economic health in particular and, more broadly, the EU's economic health.

Today, CAC 40 is 8,179.50 EUR. It has increased by 0.64% over the past month. DAX is 24,780.79 EUR (1.15% up since last month) while FTSE 100 is 10,314.58 GBP (3.86% up since last month).

For the broader outlook, we have a list with indices of the European countries.

For the broader outlook, we have a list with indices of the European countries.

As of today, the S&P 500 stands at 6,917.82 USD, showing a 0.58% increase over the past month. Dow Jones is currently at 49,241.00 USD, reflecting a 2.36% increase during the same period. Meanwhile, Nasdaq 100 has reached 25,338.62 USD, marking a 0.73% decrease compared to the previous month.

For the broader outlook, we have a list with all indices in one place.

For the broader outlook, we have a list with all indices in one place.

The Standard and Poor's 500 (SPX) is one of the most reputable indices, tracking the performance of 500 largest publicly traded US-based companies. It represents approximately 80% of the total US equity market capitalization, making it the prime indicator of the US economy's health.

Today, the SPX is 6,917.82 USD, it has increased by 0.58% over the past month.

On TradingView, you can track SPX components and watch the SPX chart to stay on top on index dynamics.

Today, the SPX is 6,917.82 USD, it has increased by 0.58% over the past month.

On TradingView, you can track SPX components and watch the SPX chart to stay on top on index dynamics.

The Dow Jones, or just the Dow, is short for the Dow Jones Industrial Average Index (DJI). It is one of the most reputable indices, tracking the performance of 30 blue-chip US stocks. All of them are stable and trusted companies boasting a long history of weathering the market under different circumstances, from gains during bull runs to surviving global economic crises.

Today, the DJI is 49,241.00 USD, it has increased by 2.36% over the past month.

On TradingView, you can track DJI components and watch the DJI chart to stay on top of index dynamics.

Today, the DJI is 49,241.00 USD, it has increased by 2.36% over the past month.

On TradingView, you can track DJI components and watch the DJI chart to stay on top of index dynamics.

An index fund is a financial instrument that tracks the performance of a financial index. Since indices cannot be bought as they are, index funds can have different structures that provide investors with exposure to the identical price fluctuations of a given set of stocks.

For example, an index fund can hold the exact stocks in a proportion similar to the index's initial weight, given to each stock. Therefore, as the index changes, a well-structured index fund would change by the same value.

To gain insight into market indices, explore our community ideas on indices.

For example, an index fund can hold the exact stocks in a proportion similar to the index's initial weight, given to each stock. Therefore, as the index changes, a well-structured index fund would change by the same value.

To gain insight into market indices, explore our community ideas on indices.