New Bitcoin miner ‘capitulation’ hints at sub-$100K BTC price bottom

Bitcoin is giving classic local bottom signs as miners face a new “capitulation” phase, data reveals.

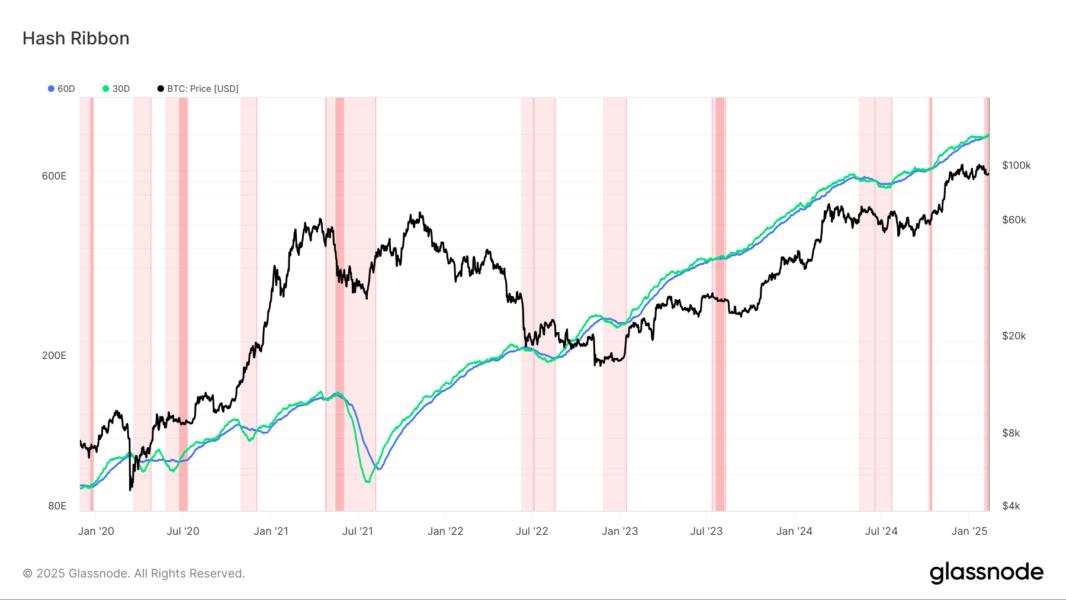

In an X post on Feb. 10, analytics account Bitcoindata21 flagged a “triggering” turnaround for Bitcoin’s BTCUSD hash ribbon indicator.

Bitcoin miners in spotlight amid bull run slump

The hash ribbon is a well-known leading indicator of incoming BTC price reversals at local lows.

When the 30-day moving average of hashrate dips below its 60-day equivalent, miners are perceived to be experiencing “capitulation” — or as Bitcoindata21 observes, “when Bitcoin becomes too expensive to mine relative to the cost of mining.”

Such events are rare and tend to precede periods of protracted BTC price upside.

“The Hash Ribbon indicates that the worst of the miner capitulation is over when the 30d MA of the hashrate crosses above the 60d MA (switch from light red to dark red areas),” the X post explains alongside a chart from onchain analytics firm Glassnode.

The last miner capitulation phase occurred in mid-October 2024, just before BTCUSD advanced beyond old all-time highs of $73,800 to reach $108,000 two months later.

Darkfost, a contributor to onchain analytics platform CryptoQuant, described the hash ribbon as a “reliable signal” for market entries.

“Notably, It has only missed once due to the unprecedented impact of the COVID-19 market shock,” he wrote in a Quicktake blog post on Feb. 11.

“A lot can happen” before next BTC buy signal

Charles Edwards, founder of quantitative Bitcoin and digital asset fund Capriole Investments, noted that miners added BTC exposure in early February.

“Bitcoin miners are once again growing their stack,” he told X followers alongside Capriole data covering miner netflows.

On hash ribbon data, Edwards described the latest capitulation as having “just started,” arguing that the true market turning point signal had not yet arrived.

“We all know what it means when a Hash Ribbon buy signal eventually follows…” he acknowledged.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.