OPEN-SOURCE SCRIPT

Zweig Market Breadth Thrust Indicator [LazyBear]

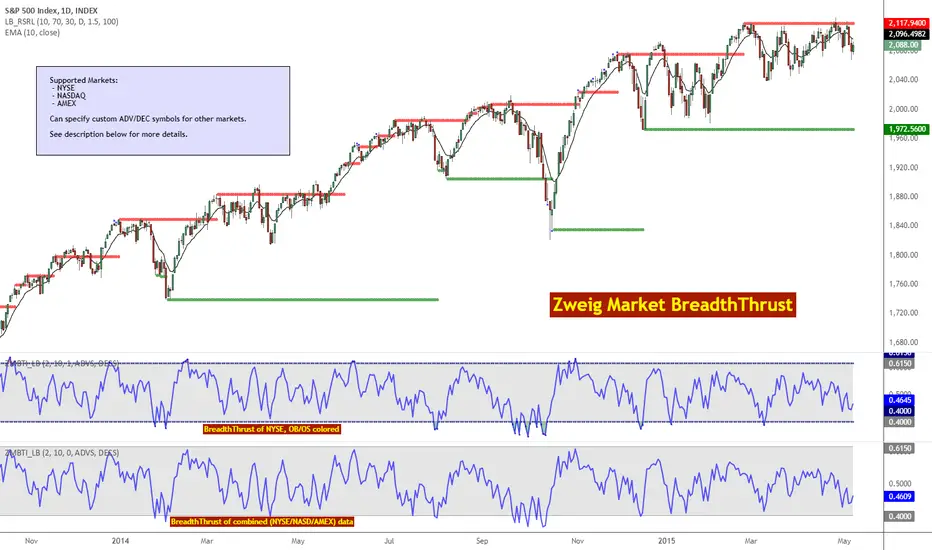

The Breadth Thrust (BT) indicator is a market momentum indicator developed by Dr. Martin Zweig. According to Dr. Zweig a Breadth Thrust occurs when, during a 10-day period, the Breadth Thrust indicator rises from below 40 percent to above 61.5 percent.

A "Thrust" indicates that the stock market has rapidly changed from an oversold condition to one of strength, but has not yet become overbought. This is very rare and has happened only a few times. Dr. Zweig also points out that most bull markets begin with a Breadth Thrust.

All parameters are configurable. You can draw BT for NYSE, NASDAQ, AMEX or based on combined data (i.e., AMEX+NYSE+NASD). There is also a "CUSTOM" mode supported, so you can enter your own ADV/DEC symbols.

More info:

Definition: investopedia.com/terms/b/breadth-thrust-indicator.asp

A Breadth Thrust Signal: mcoscillator.com/learning_center/weekly_chart/a_breadth_thrust_signal/

A Rare "Zweig" Buy Signal: moneyshow.com/articles.asp?aid=GURU-39533

Zweig Breadth Thrust: recessionalert.com/zweig-breadth-thrust-redux/

List of my public indicators: bit.ly/1LQaPK8

List of my app-store indicators: blog.tradingview.com/?p=970

A "Thrust" indicates that the stock market has rapidly changed from an oversold condition to one of strength, but has not yet become overbought. This is very rare and has happened only a few times. Dr. Zweig also points out that most bull markets begin with a Breadth Thrust.

All parameters are configurable. You can draw BT for NYSE, NASDAQ, AMEX or based on combined data (i.e., AMEX+NYSE+NASD). There is also a "CUSTOM" mode supported, so you can enter your own ADV/DEC symbols.

More info:

Definition: investopedia.com/terms/b/breadth-thrust-indicator.asp

A Breadth Thrust Signal: mcoscillator.com/learning_center/weekly_chart/a_breadth_thrust_signal/

A Rare "Zweig" Buy Signal: moneyshow.com/articles.asp?aid=GURU-39533

Zweig Breadth Thrust: recessionalert.com/zweig-breadth-thrust-redux/

List of my public indicators: bit.ly/1LQaPK8

List of my app-store indicators: blog.tradingview.com/?p=970

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

For quick access on a chart, add this script to your favorites — learn more here.

List of my free indicators: bit.ly/1LQaPK8

List of my indicators at Appstore: blog.tradingview.com/?p=970

List of my indicators at Appstore: blog.tradingview.com/?p=970

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

For quick access on a chart, add this script to your favorites — learn more here.

List of my free indicators: bit.ly/1LQaPK8

List of my indicators at Appstore: blog.tradingview.com/?p=970

List of my indicators at Appstore: blog.tradingview.com/?p=970

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.