OPEN-SOURCE SCRIPT

Rendon1 Swing Market Turns

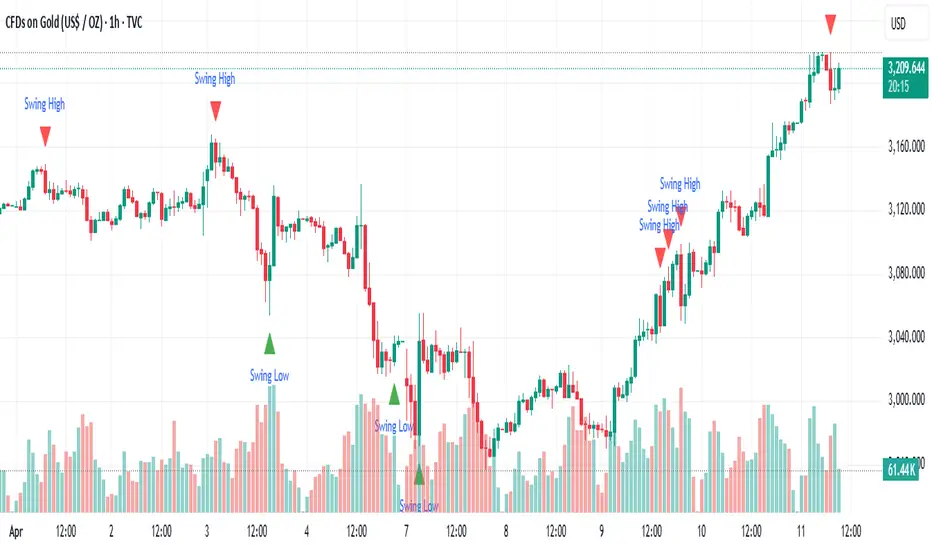

**Swing Market Turns Indicator**

This indicator identifies potential swing highs and swing lows by integrating Relative Strength Index (RSI), volume confirmation, and higher timeframe (HTF) levels to accurately detect market reversals and turning points. Specifically optimized for swing traders, this tool aims to pinpoint moments when price momentum is shifting, providing clear signals for trade entries and exits.

### How It Works:

- **RSI Divergence:** Detects momentum shifts through RSI overbought and oversold conditions.

- **Higher Timeframe Levels:** Confirms reversals using support and resistance levels from higher timeframes.

- **Volume Confirmation:** Ensures stronger validity of signals by checking if current volume exceeds the moving average of recent volume.

### Key Features:

- Visual labels on chart clearly indicating potential swing highs and lows.

- Customizable RSI period, RSI overbought/oversold thresholds, volume moving average length, and higher timeframe selections.

- Built-in alert conditions for immediate notifications when swing opportunities are detected.

### Recommended Use:

- Ideal for traders focusing on swing trading strategies, particularly those looking for high-probability turning points.

- Effective across multiple assets including forex, stocks, commodities, and crypto.

- Suitable for various intraday and higher timeframes, with customization options available.

### Settings:

- **RSI Period:** Adjust the sensitivity of RSI calculation.

- **Higher Timeframe:** Select the timeframe used for support/resistance reference.

- **RSI Overbought/Oversold:** Customize thresholds defining extreme RSI values.

- **Volume MA Length:** Specify the length for volume moving average calculation.

Feel free to customize the parameters to best fit your trading style and asset of choice.

**Disclaimer:**

This indicator does not guarantee profitable trades and should be used in conjunction with proper risk management and additional analysis methods.

This indicator identifies potential swing highs and swing lows by integrating Relative Strength Index (RSI), volume confirmation, and higher timeframe (HTF) levels to accurately detect market reversals and turning points. Specifically optimized for swing traders, this tool aims to pinpoint moments when price momentum is shifting, providing clear signals for trade entries and exits.

### How It Works:

- **RSI Divergence:** Detects momentum shifts through RSI overbought and oversold conditions.

- **Higher Timeframe Levels:** Confirms reversals using support and resistance levels from higher timeframes.

- **Volume Confirmation:** Ensures stronger validity of signals by checking if current volume exceeds the moving average of recent volume.

### Key Features:

- Visual labels on chart clearly indicating potential swing highs and lows.

- Customizable RSI period, RSI overbought/oversold thresholds, volume moving average length, and higher timeframe selections.

- Built-in alert conditions for immediate notifications when swing opportunities are detected.

### Recommended Use:

- Ideal for traders focusing on swing trading strategies, particularly those looking for high-probability turning points.

- Effective across multiple assets including forex, stocks, commodities, and crypto.

- Suitable for various intraday and higher timeframes, with customization options available.

### Settings:

- **RSI Period:** Adjust the sensitivity of RSI calculation.

- **Higher Timeframe:** Select the timeframe used for support/resistance reference.

- **RSI Overbought/Oversold:** Customize thresholds defining extreme RSI values.

- **Volume MA Length:** Specify the length for volume moving average calculation.

Feel free to customize the parameters to best fit your trading style and asset of choice.

**Disclaimer:**

This indicator does not guarantee profitable trades and should be used in conjunction with proper risk management and additional analysis methods.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Do not have 30K followers, do not have to share 15 trade a day, because you pay subscription, do not live from subscription, but sharing my knowledge trades and signals. For free. If you want to join, you are welcomed. t.me/+CE3Vdc5m72w4MjRk

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Do not have 30K followers, do not have to share 15 trade a day, because you pay subscription, do not live from subscription, but sharing my knowledge trades and signals. For free. If you want to join, you are welcomed. t.me/+CE3Vdc5m72w4MjRk

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.