PROTECTED SOURCE SCRIPT

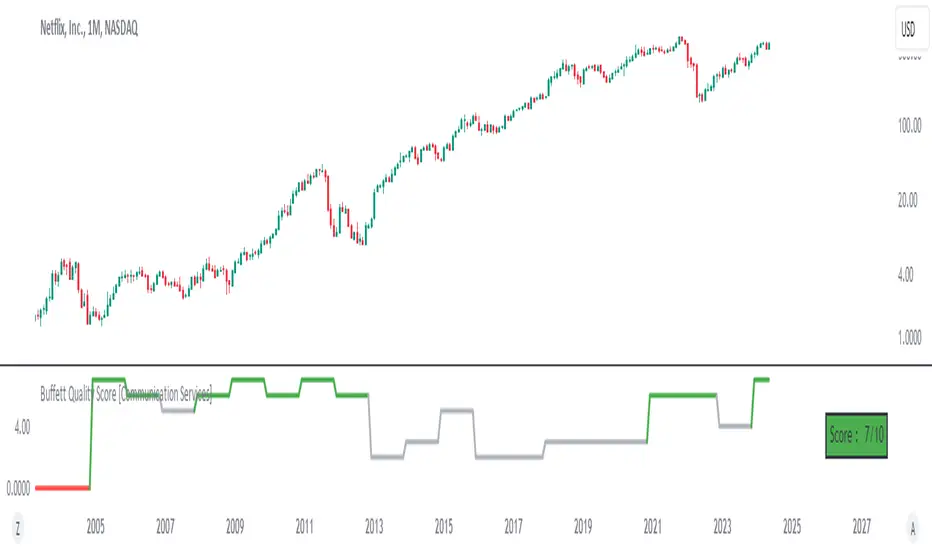

Buffett Quality Score [Communication Services]

Buffett Quality Score "Communication Services": Analyzing Communication Companies with Precision

The communication services sector encompasses a diverse range of companies involved in telecommunications, media, and entertainment. To assess the financial strength and performance of companies within this sector, the Buffett Quality Score [Communication Services] employs a tailored set of financial metrics. This scoring system, inspired by the Piotroski F-Score methodology, assigns points based on specific financial criteria to provide a comprehensive quality assessment.

Scoring Methodology

The Buffett Quality Score [Communication Services] is designed to evaluate the overall financial health and quality of companies operating within the communication services sector. Each selected financial metric is chosen for its relevance and importance in evaluating a company's performance and potential for sustainable growth. The score is computed by assigning points based on the achievement of specific thresholds for each indicator, with the total points determining the final score. This methodology ensures a nuanced analysis that captures the unique dynamics of the communication services industry.

Selected Financial Metrics and Criteria

1. Return on Invested Capital (ROIC) > 10.0%

Relevance: ROIC measures a company's efficiency in allocating capital to profitable investments. For communication companies, a ROIC above 10.0% indicates effective capital utilization, crucial for sustaining growth and innovation.

2. Return on Equity (ROE) > 15.0%

Relevance: ROE evaluates the return generated on shareholders' equity. A ROE exceeding 15.0% signifies robust profitability and effective management of shareholder funds, essential for investor confidence in communication companies.

3. Revenue One-Year Growth > 10.0%

Relevance: High revenue growth indicates strong market demand and successful business strategies. For communication services, where innovation and content delivery are paramount, growth exceeding 10.0% reflects market leadership and competitive positioning.

4. Gross Margin > 40.0%

Relevance: Gross margin measures profitability after accounting for production costs. In the communication services sector, a gross margin above 40.0% demonstrates efficient operations and high-value content offerings, critical for maintaining competitive advantage.

5. Net Margin > 10.0%

Relevance: Net margin assesses overall profitability after all expenses. A net margin exceeding 10.0% indicates effective cost management and operational efficiency, fundamental for sustained profitability in communication companies.

6. EPS One-Year Growth > 10.0%

Relevance: EPS growth reflects the company's ability to increase earnings per share. For communication firms, where content monetization and subscription models are prevalent, EPS growth above 10.0% signals successful business expansion and value creation.

7. Piotroski F-Score > 6.0

Relevance: The Piotroski F-Score evaluates fundamental strength across various financial metrics. A score above 6.0 suggests strong financial health and operational efficiency, crucial for navigating competitive pressures in the communication services industry.

8. Price/Earnings Ratio (Forward) < 25.0

Relevance: The forward P/E ratio compares current share price to expected future earnings. A ratio below 25.0 indicates reasonable valuation relative to growth prospects, important for investors seeking value opportunities in communication stocks.

9. Current Ratio > 1.5

Relevance: The current ratio assesses short-term liquidity by comparing current assets to current liabilities. In communication companies, a ratio above 1.5 ensures financial flexibility and the ability to meet short-term obligations, vital for operational stability.

10. Debt to Equity Ratio < 1.0

Relevance: A lower debt to equity ratio indicates prudent financial management and reduced reliance on debt financing. For communication firms, maintaining a ratio below 1.0 signifies a healthy balance sheet and lower financial risk.

Interpreting the Buffett Quality Score [Communication Services]

Conclusion

The Buffett Quality Score [Communication Services] provides a robust framework for evaluating communication companies, emphasizing critical financial indicators tailored to industry dynamics. By leveraging these insights, investors and analysts can make informed decisions, identifying companies poised for sustainable growth and performance in the ever-evolving communication services landscape.

Disclaimer: The Buffett Quality Score serves as a tool for financial analysis and should not replace professional advice or comprehensive due diligence. Investors should conduct thorough research and consult with financial experts based on individual investment objectives.

The communication services sector encompasses a diverse range of companies involved in telecommunications, media, and entertainment. To assess the financial strength and performance of companies within this sector, the Buffett Quality Score [Communication Services] employs a tailored set of financial metrics. This scoring system, inspired by the Piotroski F-Score methodology, assigns points based on specific financial criteria to provide a comprehensive quality assessment.

Scoring Methodology

The Buffett Quality Score [Communication Services] is designed to evaluate the overall financial health and quality of companies operating within the communication services sector. Each selected financial metric is chosen for its relevance and importance in evaluating a company's performance and potential for sustainable growth. The score is computed by assigning points based on the achievement of specific thresholds for each indicator, with the total points determining the final score. This methodology ensures a nuanced analysis that captures the unique dynamics of the communication services industry.

Selected Financial Metrics and Criteria

1. Return on Invested Capital (ROIC) > 10.0%

Relevance: ROIC measures a company's efficiency in allocating capital to profitable investments. For communication companies, a ROIC above 10.0% indicates effective capital utilization, crucial for sustaining growth and innovation.

2. Return on Equity (ROE) > 15.0%

Relevance: ROE evaluates the return generated on shareholders' equity. A ROE exceeding 15.0% signifies robust profitability and effective management of shareholder funds, essential for investor confidence in communication companies.

3. Revenue One-Year Growth > 10.0%

Relevance: High revenue growth indicates strong market demand and successful business strategies. For communication services, where innovation and content delivery are paramount, growth exceeding 10.0% reflects market leadership and competitive positioning.

4. Gross Margin > 40.0%

Relevance: Gross margin measures profitability after accounting for production costs. In the communication services sector, a gross margin above 40.0% demonstrates efficient operations and high-value content offerings, critical for maintaining competitive advantage.

5. Net Margin > 10.0%

Relevance: Net margin assesses overall profitability after all expenses. A net margin exceeding 10.0% indicates effective cost management and operational efficiency, fundamental for sustained profitability in communication companies.

6. EPS One-Year Growth > 10.0%

Relevance: EPS growth reflects the company's ability to increase earnings per share. For communication firms, where content monetization and subscription models are prevalent, EPS growth above 10.0% signals successful business expansion and value creation.

7. Piotroski F-Score > 6.0

Relevance: The Piotroski F-Score evaluates fundamental strength across various financial metrics. A score above 6.0 suggests strong financial health and operational efficiency, crucial for navigating competitive pressures in the communication services industry.

8. Price/Earnings Ratio (Forward) < 25.0

Relevance: The forward P/E ratio compares current share price to expected future earnings. A ratio below 25.0 indicates reasonable valuation relative to growth prospects, important for investors seeking value opportunities in communication stocks.

9. Current Ratio > 1.5

Relevance: The current ratio assesses short-term liquidity by comparing current assets to current liabilities. In communication companies, a ratio above 1.5 ensures financial flexibility and the ability to meet short-term obligations, vital for operational stability.

10. Debt to Equity Ratio < 1.0

Relevance: A lower debt to equity ratio indicates prudent financial management and reduced reliance on debt financing. For communication firms, maintaining a ratio below 1.0 signifies a healthy balance sheet and lower financial risk.

Interpreting the Buffett Quality Score [Communication Services]

- 0-4 Points: Indicates potential weaknesses across multiple financial areas, suggesting higher risk.

- 5 Points: Represents average performance, warranting further analysis to understand underlying factors.

- 6-10 Points: Reflects strong financial health and quality, positioning the company favorably within the competitive communication services industry.

Conclusion

The Buffett Quality Score [Communication Services] provides a robust framework for evaluating communication companies, emphasizing critical financial indicators tailored to industry dynamics. By leveraging these insights, investors and analysts can make informed decisions, identifying companies poised for sustainable growth and performance in the ever-evolving communication services landscape.

Disclaimer: The Buffett Quality Score serves as a tool for financial analysis and should not replace professional advice or comprehensive due diligence. Investors should conduct thorough research and consult with financial experts based on individual investment objectives.

Protected script

This script is published closed-source and you may privately use it freely.

Want to use this script on a chart?

The trend is your friend, until it's not...

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.