OPEN-SOURCE SCRIPT

Average Price Bar (APB) with Dynamic EMA

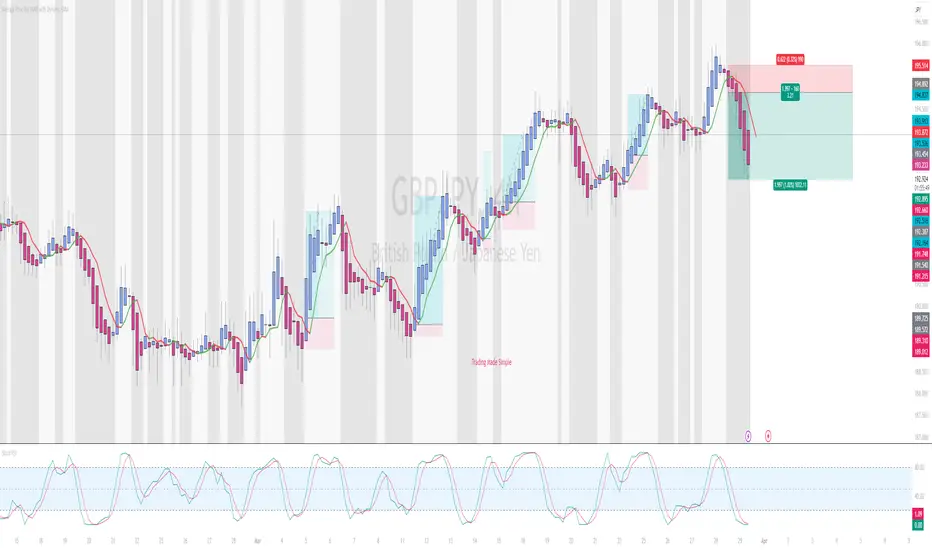

Trading Made Simple: APB + Dynamic EMA with Stochastic (8,3,3) Strategy

Introduction

The "Trading Made Simple" strategy, originally developed by BigE on ForexFactory in 2011, is a powerful yet straightforward approach to trading that combines price action, moving averages, and momentum indicators to identify high-probability setups. This enhanced version integrates:

Average Price Bar (APB) – A smoothed candlestick representation that filters market noise.

Dynamic EMA (5-period, HLC3-based) – Acts as a trend filter, changing color based on its position relative to price.

Stochastic (8,3,3) – A fast momentum oscillator to confirm overbought/oversold conditions.

Core Trading Rules (BigE's Original Concept)

Trend Direction: The EMA defines the trend (bullish if price is above, bearish if below).

Stochastic Confirmation:

Long Trades: Look for Stochastic crossing up from oversold (<20) while price is above the EMA.

Short Trades: Look for Stochastic crossing down from overbought (>80) while price is below the EMA.

APB as Entry Confirmation:

A bullish APB close above the EMA strengthens long signals.

A bearish APB close below the EMA strengthens short signals.

Why This Combination Works

APB + EMA provides a clean trend bias, reducing false signals.

Stochastic (8,3,3) adds momentum confirmation, ensuring entries are timed well.

The background color shift (green/red) makes trend reversals visually intuitive.

This system is ideal for swing traders and day traders looking for a rule-based, discretionary approach that removes emotional decision-making while keeping trading simple and effective.

Introduction

The "Trading Made Simple" strategy, originally developed by BigE on ForexFactory in 2011, is a powerful yet straightforward approach to trading that combines price action, moving averages, and momentum indicators to identify high-probability setups. This enhanced version integrates:

Average Price Bar (APB) – A smoothed candlestick representation that filters market noise.

Dynamic EMA (5-period, HLC3-based) – Acts as a trend filter, changing color based on its position relative to price.

Stochastic (8,3,3) – A fast momentum oscillator to confirm overbought/oversold conditions.

Core Trading Rules (BigE's Original Concept)

Trend Direction: The EMA defines the trend (bullish if price is above, bearish if below).

Stochastic Confirmation:

Long Trades: Look for Stochastic crossing up from oversold (<20) while price is above the EMA.

Short Trades: Look for Stochastic crossing down from overbought (>80) while price is below the EMA.

APB as Entry Confirmation:

A bullish APB close above the EMA strengthens long signals.

A bearish APB close below the EMA strengthens short signals.

Why This Combination Works

APB + EMA provides a clean trend bias, reducing false signals.

Stochastic (8,3,3) adds momentum confirmation, ensuring entries are timed well.

The background color shift (green/red) makes trend reversals visually intuitive.

This system is ideal for swing traders and day traders looking for a rule-based, discretionary approach that removes emotional decision-making while keeping trading simple and effective.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

For quick access on a chart, add this script to your favorites — learn more here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

For quick access on a chart, add this script to your favorites — learn more here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.