OPEN-SOURCE SCRIPT

Kernel Weighted DMI | QuantEdgeB

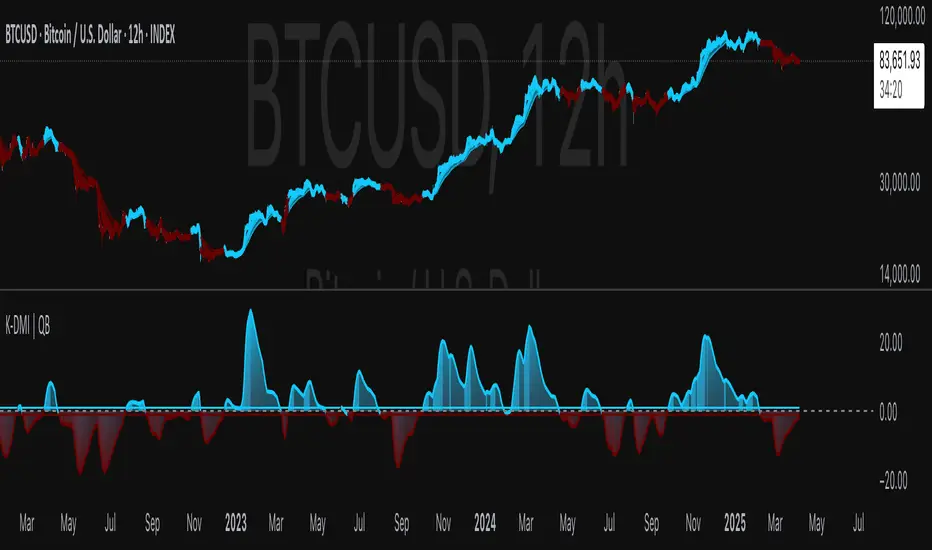

📊 Introducing Kernel Weighted DMI (K-DMI) by QuantEdgeB

🛠️ Overview

K-DMI is a next-gen momentum indicator that combines the traditional Directional Movement Index (DMI) with advanced kernel smoothing techniques to produce a highly adaptive, noise-resistant trend signal.

Unlike standard DMI that can be overly reactive or choppy in consolidation phases, K-DMI applies kernel-weighted filtering (Linear, Exponential, or Gaussian) to stabilize directional movement readings and extract a more reliable momentum signal.

✨ Key Features

🔹 Kernel Smoothing Engine

Smooths DMI using your choice of kernel (Linear, Exponential, Gaussian) for flexible noise reduction and clarity.

🔹 Dynamic Trend Signal

Generates real-time long/short trend bias based on signal crossing upper or lower thresholds (defaults: ±1).

🔹 Visual Encoding

Includes directional gradient fills, candle coloring, and momentum-based overlays for instant signal comprehension.

🔹 Multi-Mode Plotting

Optional moving average overlays visualize structure and compression/expansion within price action.

📐 How It Works

1️⃣ Directional Movement Index (DMI)

Calculates the traditional +DI and -DI differential to derive directional bias.

2️⃣ Kernel-Based Smoothing

Applies a custom-weighted average across historical DMI values using one of three smoothing methods:

• Linear → Simple tapering weights

• Exponential → Decay curve for recent emphasis

• Gaussian → Bell-shaped weight for centered precision

3️⃣ Signal Generation

• ✅ Long → Signal > Long Threshold (default: +1)

• ❌ Short → Signal < Short Threshold (default: -1)

Additional overlays signal potential compression zones or trend resumption using gradient and line fills.

⚙️ Custom Settings

• DMI Length: Default = 7

• Kernel Type: Options → Linear, Exponential, Gaussian (Def:Linear)

• Kernel Length: Default = 25

• Long Threshold: Default = 1

• Short Threshold: Default = -1

• Color Mode: Strategy, Solar, Warm, Cool, Classic, Magic

• Show Labels: Optional entry signal labels (Long/Short)

• Enable Extra Plots: Toggle MA overlays and dynamic bands

👥 Who Is It For?

✅ Trend Traders → Identify sustained directional bias with smoother signal lines

✅ Quant Analysts → Leverage advanced smoothing models to enhance data clarity

✅ Discretionary Swing Traders → Visualize clean breakouts or fades within choppy zones

✅ MA Compression Traders → Use overlay MAs to detect expansion opportunities

📌 Conclusion

Kernel Weighted DMI is the evolution of classic momentum tracking—merging traditional DMI logic with adaptable kernel filters. It provides a refined lens for trend detection, while optional visual overlays support price structure analysis.

🔹 Key Takeaways:

1️⃣ Smoothed and stabilized DMI for reliable trend signal generation

2️⃣ Optional Gaussian/exponential weighting for adaptive responsiveness

3️⃣ Custom gradient fills, dynamic MAs, and candle coloring to support visual clarity

📌 Disclaimer: Past performance is not indicative of future results. No trading strategy can guarantee success in financial markets.

📌 Strategic Advice: Always backtest, optimize, and align parameters with your trading objectives and risk tolerance before live trading.

🛠️ Overview

K-DMI is a next-gen momentum indicator that combines the traditional Directional Movement Index (DMI) with advanced kernel smoothing techniques to produce a highly adaptive, noise-resistant trend signal.

Unlike standard DMI that can be overly reactive or choppy in consolidation phases, K-DMI applies kernel-weighted filtering (Linear, Exponential, or Gaussian) to stabilize directional movement readings and extract a more reliable momentum signal.

✨ Key Features

🔹 Kernel Smoothing Engine

Smooths DMI using your choice of kernel (Linear, Exponential, Gaussian) for flexible noise reduction and clarity.

🔹 Dynamic Trend Signal

Generates real-time long/short trend bias based on signal crossing upper or lower thresholds (defaults: ±1).

🔹 Visual Encoding

Includes directional gradient fills, candle coloring, and momentum-based overlays for instant signal comprehension.

🔹 Multi-Mode Plotting

Optional moving average overlays visualize structure and compression/expansion within price action.

📐 How It Works

1️⃣ Directional Movement Index (DMI)

Calculates the traditional +DI and -DI differential to derive directional bias.

2️⃣ Kernel-Based Smoothing

Applies a custom-weighted average across historical DMI values using one of three smoothing methods:

• Linear → Simple tapering weights

• Exponential → Decay curve for recent emphasis

• Gaussian → Bell-shaped weight for centered precision

3️⃣ Signal Generation

• ✅ Long → Signal > Long Threshold (default: +1)

• ❌ Short → Signal < Short Threshold (default: -1)

Additional overlays signal potential compression zones or trend resumption using gradient and line fills.

⚙️ Custom Settings

• DMI Length: Default = 7

• Kernel Type: Options → Linear, Exponential, Gaussian (Def:Linear)

• Kernel Length: Default = 25

• Long Threshold: Default = 1

• Short Threshold: Default = -1

• Color Mode: Strategy, Solar, Warm, Cool, Classic, Magic

• Show Labels: Optional entry signal labels (Long/Short)

• Enable Extra Plots: Toggle MA overlays and dynamic bands

👥 Who Is It For?

✅ Trend Traders → Identify sustained directional bias with smoother signal lines

✅ Quant Analysts → Leverage advanced smoothing models to enhance data clarity

✅ Discretionary Swing Traders → Visualize clean breakouts or fades within choppy zones

✅ MA Compression Traders → Use overlay MAs to detect expansion opportunities

📌 Conclusion

Kernel Weighted DMI is the evolution of classic momentum tracking—merging traditional DMI logic with adaptable kernel filters. It provides a refined lens for trend detection, while optional visual overlays support price structure analysis.

🔹 Key Takeaways:

1️⃣ Smoothed and stabilized DMI for reliable trend signal generation

2️⃣ Optional Gaussian/exponential weighting for adaptive responsiveness

3️⃣ Custom gradient fills, dynamic MAs, and candle coloring to support visual clarity

📌 Disclaimer: Past performance is not indicative of future results. No trading strategy can guarantee success in financial markets.

📌 Strategic Advice: Always backtest, optimize, and align parameters with your trading objectives and risk tolerance before live trading.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

For quick access on a chart, add this script to your favorites — learn more here.

🔹 Get access to our premium tools:

whop.com/quantedgeb/ 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

whop.com/quantedgeb/ 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

For quick access on a chart, add this script to your favorites — learn more here.

🔹 Get access to our premium tools:

whop.com/quantedgeb/ 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

whop.com/quantedgeb/ 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.