OPEN-SOURCE SCRIPT

Updated Bond Yield Recession Indicator

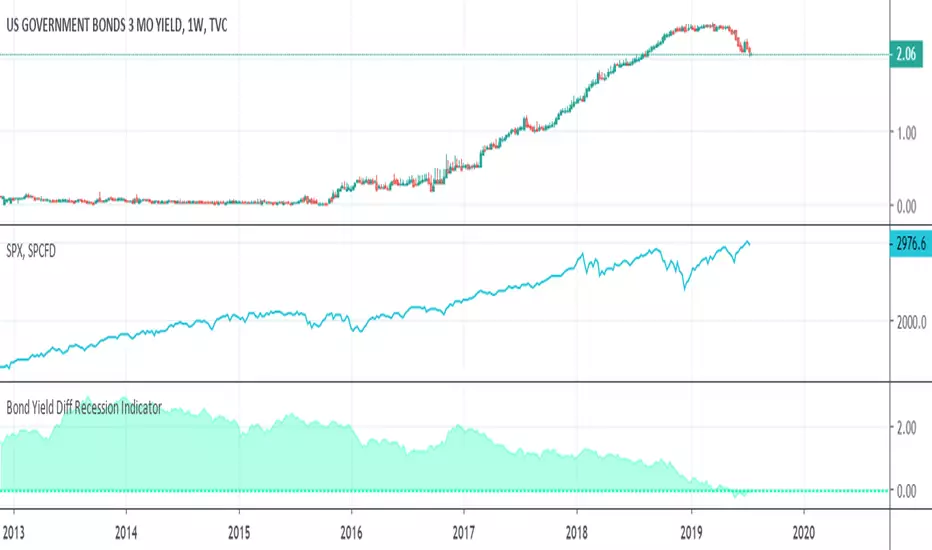

This model uses the difference between 10-year and 3-month Treasury rates to calculate the probability of a recession in the United States twelve months ahead.

By a simple gimpse, it has been correct for the last two recessions of 2000 and 2008.

newyorkfed.org/research/capital_markets/ycfaq.html

fred.stlouisfed.org/series/T10Y3M

By a simple gimpse, it has been correct for the last two recessions of 2000 and 2008.

newyorkfed.org/research/capital_markets/ycfaq.html

fred.stlouisfed.org/series/T10Y3M

Release Notes

v2Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

For quick access on a chart, add this script to your favorites — learn more here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

For quick access on a chart, add this script to your favorites — learn more here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.