OPEN-SOURCE SCRIPT

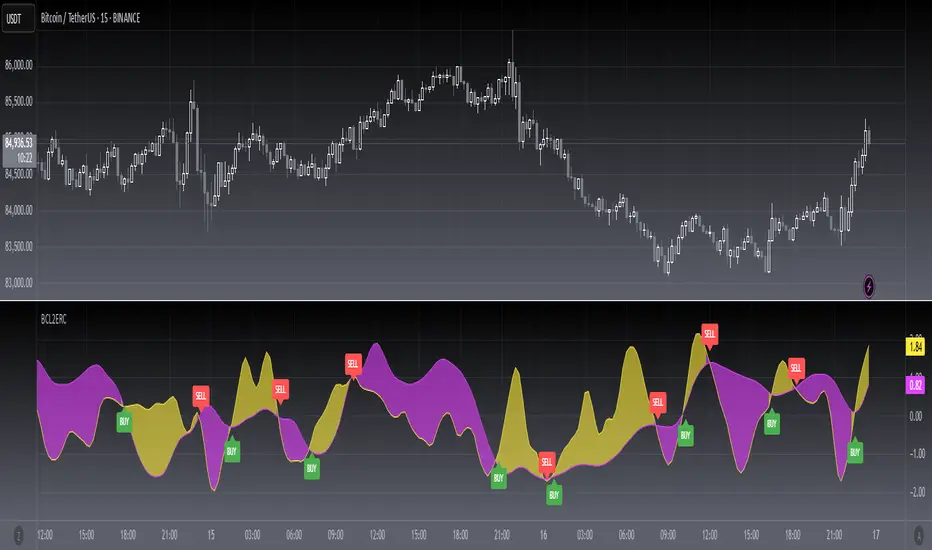

Updated [blackcat] L2 Ehlers Reflex Cross

Level: 2

Background

John F. Ehlers introuced Reflex Cross indicator in Feb, 2020.

Function

In “Reflex: A New Zero-Lag Indicator” in Feb, 2020, John Ehlers introduces a new averaging indicator that he has designed with reducing lag in mind. According to the Dr . Ehlers , this new indicator can be used to generate signals in a more timely manner than other lagging calculations. The script displays the Reflex Cross indicator discussed in the article. The reflex indicator synchronizes with the cycle component in the price data. Its companion, the trendflex oscillator, retains the trend component.

Key Signal

FastRF --> Ehlers Reflex Cross fast line

SlowRF --> Ehlers Reflex Cross slow line

Pros and Cons

100% John F. Ehlers definition translation, even variable names are the same. This help readers who would like to use pine to read his book.

Remarks

The 95th script for Blackcat1402 John F. Ehlers Week publication.

Readme

In real life, I am a prolific inventor. I have successfully applied for more than 60 international and regional patents in the past 12 years. But in the past two years or so, I have tried to transfer my creativity to the development of trading strategies. Tradingview is the ideal platform for me. I am selecting and contributing some of the hundreds of scripts to publish in Tradingview community. Welcome everyone to interact with me to discuss these interesting pine scripts.

The scripts posted are categorized into 5 levels according to my efforts or manhours put into these works.

Level 1 : interesting script snippets or distinctive improvement from classic indicators or strategy. Level 1 scripts can usually appear in more complex indicators as a function module or element.

Level 2 : composite indicator/strategy. By selecting or combining several independent or dependent functions or sub indicators in proper way, the composite script exhibits a resonance phenomenon which can filter out noise or fake trading signal to enhance trading confidence level.

Level 3 : comprehensive indicator/strategy. They are simple trading systems based on my strategies. They are commonly containing several or all of entry signal, close signal, stop loss, take profit, re-entry, risk management, and position sizing techniques. Even some interesting fundamental and mass psychological aspects are incorporated.

Level 4 : script snippets or functions that do not disclose source code. Interesting element that can reveal market laws and work as raw material for indicators and strategies. If you find Level 1~2 scripts are helpful, Level 4 is a private version that took me far more efforts to develop.

Level 5 : indicator/strategy that do not disclose source code. private version of Level 3 script with my accumulated script processing skills or a large number of custom functions. I had a private function library built in past two years. Level 5 scripts use many of them to achieve private trading strategy.

Background

John F. Ehlers introuced Reflex Cross indicator in Feb, 2020.

Function

In “Reflex: A New Zero-Lag Indicator” in Feb, 2020, John Ehlers introduces a new averaging indicator that he has designed with reducing lag in mind. According to the Dr . Ehlers , this new indicator can be used to generate signals in a more timely manner than other lagging calculations. The script displays the Reflex Cross indicator discussed in the article. The reflex indicator synchronizes with the cycle component in the price data. Its companion, the trendflex oscillator, retains the trend component.

Key Signal

FastRF --> Ehlers Reflex Cross fast line

SlowRF --> Ehlers Reflex Cross slow line

Pros and Cons

100% John F. Ehlers definition translation, even variable names are the same. This help readers who would like to use pine to read his book.

Remarks

The 95th script for Blackcat1402 John F. Ehlers Week publication.

Readme

In real life, I am a prolific inventor. I have successfully applied for more than 60 international and regional patents in the past 12 years. But in the past two years or so, I have tried to transfer my creativity to the development of trading strategies. Tradingview is the ideal platform for me. I am selecting and contributing some of the hundreds of scripts to publish in Tradingview community. Welcome everyone to interact with me to discuss these interesting pine scripts.

The scripts posted are categorized into 5 levels according to my efforts or manhours put into these works.

Level 1 : interesting script snippets or distinctive improvement from classic indicators or strategy. Level 1 scripts can usually appear in more complex indicators as a function module or element.

Level 2 : composite indicator/strategy. By selecting or combining several independent or dependent functions or sub indicators in proper way, the composite script exhibits a resonance phenomenon which can filter out noise or fake trading signal to enhance trading confidence level.

Level 3 : comprehensive indicator/strategy. They are simple trading systems based on my strategies. They are commonly containing several or all of entry signal, close signal, stop loss, take profit, re-entry, risk management, and position sizing techniques. Even some interesting fundamental and mass psychological aspects are incorporated.

Level 4 : script snippets or functions that do not disclose source code. Interesting element that can reveal market laws and work as raw material for indicators and strategies. If you find Level 1~2 scripts are helpful, Level 4 is a private version that took me far more efforts to develop.

Level 5 : indicator/strategy that do not disclose source code. private version of Level 3 script with my accumulated script processing skills or a large number of custom functions. I had a private function library built in past two years. Level 5 scripts use many of them to achieve private trading strategy.

Release Notes

OVERVIEWThis indicator implements Ehlers Reflex Cross, utilizing dual-length reflex calculations to generate trading signals. It features customizable fast and slow lengths for adaptive market conditions.

FEATURES

• Dual-length Ehlers Reflex calculation

• Visual crossover plotting

• Real-time BUY/SELL alerts

• Color-coded fill area between lines

• Customizable input parameters

HOW TO USE

Access the indicator settings

Adjust input parameters: • Price: Select source price (default: hl2) • FastLength: Set faster reflex period (default: 20) • SlowLength: Set slower reflex period (default: 50)

Monitor the indicator for: • Crossovers between fast and slow lines • Alert signals for potential entry points • Color-coded background for trend direction

LIMITATIONS

• Requires sufficient historical data for accurate calculations

• Performance may vary across different market conditions

• Backtesting recommended before live usage

NOTES

The indicator plots two colored lines representing fast and slow reflex values

Background fills indicate trend direction (yellow for bullish, fuchsia for bearish)

Alert notifications are triggered on confirmed crossovers

Labels appear at crossover points to highlight entry opportunities

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

For quick access on a chart, add this script to your favorites — learn more here.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

For quick access on a chart, add this script to your favorites — learn more here.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.