OPEN-SOURCE SCRIPT

z_score_bgd

Updated

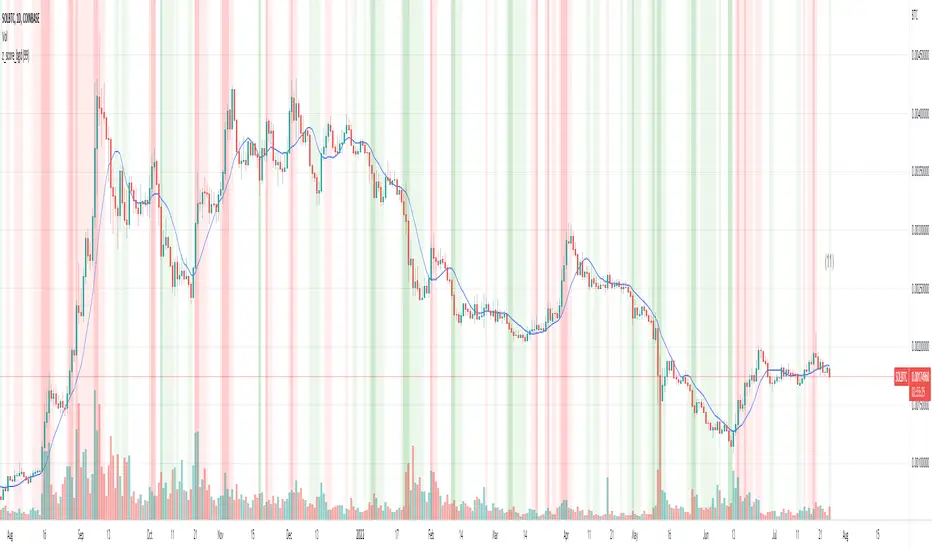

Z-score indicator for volatile currency pairs, showing STRONG BUY, BUY, SELL, STRONG SELL zones by shading the chart background.

---------------------------------

Background

---------------------------------

Based on mean reversion, a theory that after a swing in price the price will tend back to the mean. This offers some ability to predict future trends.

The formula for calculating a z-score is is z = (x-μ)/σ, where x is the pair price, μ is the mean for a population, and σ is the population standard deviation.

---------------------------------

Set up

---------------------------------

The user can define their own value for the "window" or population, which is the number of preceding days to evaluate. This value will affect the frequency and magnitude of trades, with higher "window" values reducing the frequency of reversions but increasing their magnitude.

Where the value for "window" is left at 99, the default values below will be applied in the background. Otherwise the user's selection will be in effect.

atombtc 18

avaxbtc 21

ethbtc 18

ftmbtc 11

maticbtc 11

solbtc 11

soleth 16

The default values above are intended for the daily time-frame.

---------------------------------

Interpreting the indicator

---------------------------------

Dark green -> large deviation below mean price (strong buy)

Green -> moderate deviation below mean price (buy)

Red -> moderate deviation below mean price (sell)

Dark red -> large deviation below mean price (strong sell)

Z-score is an imperfect indicator, as with all indiciators and trading decisions must be confirmed by multiple indicators and consider other factors.

Release Notes

Defaults to overlay the price chart.Open-source script

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in publication is governed by House rules. You can favorite it to use it on a chart.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.