OPEN-SOURCE SCRIPT

Updated iD EMARSI on Chart

SCRIPT OVERVIEW

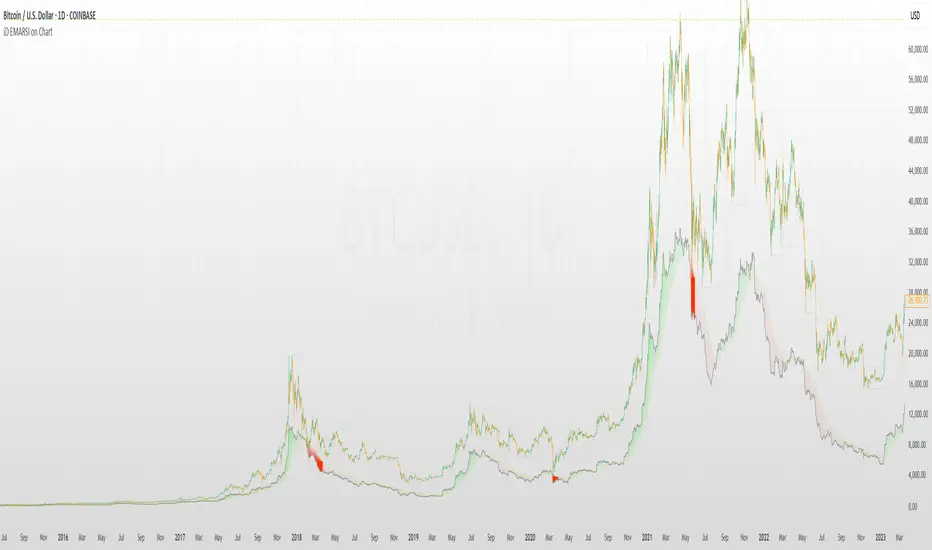

The EMARSI indicator is an advanced technical analysis tool that maps RSI values directly onto price charts. With adaptive scaling capabilities, it provides a unique visualization of momentum that flows naturally with price action, making it particularly valuable for FOREX and low-priced securities trading.

KEY FEATURES

1 PRICE MAPPED RSI VISUALIZATION

Unlike traditional RSI that displays in a separate window, EMARSI plots the RSI directly on the price chart, creating a flowing line that identifies momentum shifts within the context of price action:

Pine Script®

2 ADAPTIVE SCALING SYSTEM

The script features an intelligent scaling system that automatically adjusts to different market conditions and price levels:

Pine Script®

3 MODIFIED RSI CALCULATION

EMARSI uses a specially formulated RSI calculation that works with an adaptive base value to maintain consistency across different price ranges:

Pine Script®

4 MOVING AVERAGE CROSSOVER SYSTEM

The indicator creates a smooth moving average of the RSI line, enabling a crossover system that generates trading signals:

Pine Script®

5 VISUAL REFERENCE FRAMEWORK

The script includes visual guides that help interpret the RSI movement within the context of recent price action:

Pine Script®

6 DYNAMIC COLOR SYSTEM

The indicator uses color fills to clearly visualize the relationship between the RSI and its moving average:

Pine Script®

7 REAL TIME PARAMETER MONITORING

A transparent information panel provides real-time feedback on the adaptive parameters being applied:

Pine Script®

BENEFITS FOR TRADERS

INTUITIVE MOMENTUM VISUALIZATION

By mapping RSI directly onto the price chart, traders can immediately see the relationship between momentum and price without switching between different indicator windows.

ADAPTIVE TO ANY MARKET CONDITION

The three scaling methods (ATR-Based, Price-Based, and Volume-Based) ensure the indicator performs consistently across different market conditions, volatility regimes, and price levels.

PREVENTS EXTREME VALUES

The adaptive scaling system prevents the RSI from generating extreme values that exceed chart boundaries when trading low-priced securities or during high volatility periods.

CLEAR TRADING SIGNALS

The RSI and moving average crossover system provides clear entry signals that are visually reinforced through color changes, making it easy to identify potential trading opportunities.

SUITABLE FOR MULTIPLE TIMEFRAMES

The indicator works effectively across multiple timeframes, from intraday to daily charts, making it versatile for different trading styles and strategies.

TRANSPARENT PARAMETER ADJUSTMENT

The information panel provides real-time feedback on how the adaptive system is adjusting to current market conditions, helping traders understand why the indicator is behaving as it is.

CUSTOMIZABLE VISUALIZATION

Multiple visualization options including Bollinger Bands, different moving average types, and customizable colors allow traders to adapt the indicator to their personal preferences.

CONCLUSION

The EMARSI indicator represents a significant advancement in RSI visualization by directly mapping momentum onto price charts with adaptive scaling. This approach makes momentum shifts more intuitive to identify and helps prevent the scaling issues that commonly affect RSI-based indicators when applied to low-priced securities or volatile markets.

The EMARSI indicator is an advanced technical analysis tool that maps RSI values directly onto price charts. With adaptive scaling capabilities, it provides a unique visualization of momentum that flows naturally with price action, making it particularly valuable for FOREX and low-priced securities trading.

KEY FEATURES

1 PRICE MAPPED RSI VISUALIZATION

Unlike traditional RSI that displays in a separate window, EMARSI plots the RSI directly on the price chart, creating a flowing line that identifies momentum shifts within the context of price action:

// Map RSI to price chart with better scaling

mappedRsi = useAdaptiveScaling ?

median + ((rsi - 50) / 50 * (pQH - pQL) / 2 * math.min(1.0, 1/scalingFactor)) :

down == pQL ? pQH : up == pQL ? pQL : median - (median / (1 + up / down))

mappedRsi = useAdaptiveScaling ?

median + ((rsi - 50) / 50 * (pQH - pQL) / 2 * math.min(1.0, 1/scalingFactor)) :

down == pQL ? pQH : up == pQL ? pQL : median - (median / (1 + up / down))

2 ADAPTIVE SCALING SYSTEM

The script features an intelligent scaling system that automatically adjusts to different market conditions and price levels:

// Calculate adaptive scaling factor based on selected method

scalingFactor = if scalingMethod == "ATR-Based"

math.min(maxScalingFactor, math.max(1.0, minTickSize / (atrValue/avgPrice)))

else if scalingMethod == "Price-Based"

math.min(maxScalingFactor, math.max(1.0, math.sqrt(100 / math.max(avgPrice, 0.01))))

else // Volume-Based

math.min(maxScalingFactor, math.max(1.0, math.sqrt(1000000 / math.max(volume, 100))))

scalingFactor = if scalingMethod == "ATR-Based"

math.min(maxScalingFactor, math.max(1.0, minTickSize / (atrValue/avgPrice)))

else if scalingMethod == "Price-Based"

math.min(maxScalingFactor, math.max(1.0, math.sqrt(100 / math.max(avgPrice, 0.01))))

else // Volume-Based

math.min(maxScalingFactor, math.max(1.0, math.sqrt(1000000 / math.max(volume, 100))))

3 MODIFIED RSI CALCULATION

EMARSI uses a specially formulated RSI calculation that works with an adaptive base value to maintain consistency across different price ranges:

// Adaptive RSI Base based on price levels to improve flow

adaptiveRsiBase = useAdaptiveScaling ? rsiBase * scalingFactor : rsiBase

// Calculate RSI components with adaptivity

up = ta.rma(math.max(ta.change(rsiSourceInput), adaptiveRsiBase), emaSlowLength)

down = ta.rma(-math.min(ta.change(rsiSourceInput), adaptiveRsiBase), rsiLengthInput)

// Improved RSI calculation with value constraint

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

adaptiveRsiBase = useAdaptiveScaling ? rsiBase * scalingFactor : rsiBase

// Calculate RSI components with adaptivity

up = ta.rma(math.max(ta.change(rsiSourceInput), adaptiveRsiBase), emaSlowLength)

down = ta.rma(-math.min(ta.change(rsiSourceInput), adaptiveRsiBase), rsiLengthInput)

// Improved RSI calculation with value constraint

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

4 MOVING AVERAGE CROSSOVER SYSTEM

The indicator creates a smooth moving average of the RSI line, enabling a crossover system that generates trading signals:

// Calculate MA of mapped RSI

rsiMA = ma(mappedRsi, emaSlowLength, maTypeInput)

// Strategy entries

if ta.crossover(mappedRsi, rsiMA)

strategy.entry("RSI Long", strategy.long)

if ta.crossunder(mappedRsi, rsiMA)

strategy.entry("RSI Short", strategy.short)

rsiMA = ma(mappedRsi, emaSlowLength, maTypeInput)

// Strategy entries

if ta.crossover(mappedRsi, rsiMA)

strategy.entry("RSI Long", strategy.long)

if ta.crossunder(mappedRsi, rsiMA)

strategy.entry("RSI Short", strategy.short)

5 VISUAL REFERENCE FRAMEWORK

The script includes visual guides that help interpret the RSI movement within the context of recent price action:

// Calculate pivot high and low

pQH = ta.highest(high, hlLen)

pQL = ta.lowest(low, hlLen)

median = (pQH + pQL) / 2

// Plotting

plot(pQH, "Pivot High", color=color.rgb(82, 228, 102, 90))

plot(pQL, "Pivot Low", color=color.rgb(231, 65, 65, 90))

med = plot(median, style=plot.style_steplinebr, linewidth=1, color=color.rgb(238, 101, 59, 90))

pQH = ta.highest(high, hlLen)

pQL = ta.lowest(low, hlLen)

median = (pQH + pQL) / 2

// Plotting

plot(pQH, "Pivot High", color=color.rgb(82, 228, 102, 90))

plot(pQL, "Pivot Low", color=color.rgb(231, 65, 65, 90))

med = plot(median, style=plot.style_steplinebr, linewidth=1, color=color.rgb(238, 101, 59, 90))

6 DYNAMIC COLOR SYSTEM

The indicator uses color fills to clearly visualize the relationship between the RSI and its moving average:

// Color fills based on RSI vs MA

colUp = mappedRsi > rsiMA ? input.color(color.rgb(128, 255, 0), '', group= 'RSI > EMA', inline= 'up') :

input.color(color.rgb(240, 9, 9, 95), '', group= 'RSI < EMA', inline= 'dn')

colDn = mappedRsi > rsiMA ? input.color(color.rgb(0, 230, 35, 95), '', group= 'RSI > EMA', inline= 'up') :

input.color(color.rgb(255, 47, 0), '', group= 'RSI < EMA', inline= 'dn')

fill(rsiPlot, emarsi, mappedRsi > rsiMA ? pQH : rsiMA, mappedRsi > rsiMA ? rsiMA : pQL, colUp, colDn)

colUp = mappedRsi > rsiMA ? input.color(color.rgb(128, 255, 0), '', group= 'RSI > EMA', inline= 'up') :

input.color(color.rgb(240, 9, 9, 95), '', group= 'RSI < EMA', inline= 'dn')

colDn = mappedRsi > rsiMA ? input.color(color.rgb(0, 230, 35, 95), '', group= 'RSI > EMA', inline= 'up') :

input.color(color.rgb(255, 47, 0), '', group= 'RSI < EMA', inline= 'dn')

fill(rsiPlot, emarsi, mappedRsi > rsiMA ? pQH : rsiMA, mappedRsi > rsiMA ? rsiMA : pQL, colUp, colDn)

7 REAL TIME PARAMETER MONITORING

A transparent information panel provides real-time feedback on the adaptive parameters being applied:

// Information display

var table infoPanel = table.new(position.top_right, 2, 3, bgcolor=color.rgb(0, 0, 0, 80))

if barstate.islast

table.cell(infoPanel, 0, 0, "Current Scaling Factor", text_color=color.white)

table.cell(infoPanel, 1, 0, str.tostring(scalingFactor, "#.###"), text_color=color.white)

table.cell(infoPanel, 0, 1, "Adaptive RSI Base", text_color=color.white)

table.cell(infoPanel, 1, 1, str.tostring(adaptiveRsiBase, "#.####"), text_color=color.white)

var table infoPanel = table.new(position.top_right, 2, 3, bgcolor=color.rgb(0, 0, 0, 80))

if barstate.islast

table.cell(infoPanel, 0, 0, "Current Scaling Factor", text_color=color.white)

table.cell(infoPanel, 1, 0, str.tostring(scalingFactor, "#.###"), text_color=color.white)

table.cell(infoPanel, 0, 1, "Adaptive RSI Base", text_color=color.white)

table.cell(infoPanel, 1, 1, str.tostring(adaptiveRsiBase, "#.####"), text_color=color.white)

BENEFITS FOR TRADERS

INTUITIVE MOMENTUM VISUALIZATION

By mapping RSI directly onto the price chart, traders can immediately see the relationship between momentum and price without switching between different indicator windows.

ADAPTIVE TO ANY MARKET CONDITION

The three scaling methods (ATR-Based, Price-Based, and Volume-Based) ensure the indicator performs consistently across different market conditions, volatility regimes, and price levels.

PREVENTS EXTREME VALUES

The adaptive scaling system prevents the RSI from generating extreme values that exceed chart boundaries when trading low-priced securities or during high volatility periods.

CLEAR TRADING SIGNALS

The RSI and moving average crossover system provides clear entry signals that are visually reinforced through color changes, making it easy to identify potential trading opportunities.

SUITABLE FOR MULTIPLE TIMEFRAMES

The indicator works effectively across multiple timeframes, from intraday to daily charts, making it versatile for different trading styles and strategies.

TRANSPARENT PARAMETER ADJUSTMENT

The information panel provides real-time feedback on how the adaptive system is adjusting to current market conditions, helping traders understand why the indicator is behaving as it is.

CUSTOMIZABLE VISUALIZATION

Multiple visualization options including Bollinger Bands, different moving average types, and customizable colors allow traders to adapt the indicator to their personal preferences.

CONCLUSION

The EMARSI indicator represents a significant advancement in RSI visualization by directly mapping momentum onto price charts with adaptive scaling. This approach makes momentum shifts more intuitive to identify and helps prevent the scaling issues that commonly affect RSI-based indicators when applied to low-priced securities or volatile markets.

Release Notes

[h1]Overview of EMARSI Strategy[/h1][h2]Signal Generation[/h2]

The script now generates signals based directly on RSI/MA crossovers:

- Bullish Signal: When mapped RSI crosses above its MA

- Bearish Signal: When mapped RSI crosses below its MA

- Option to require minimum trend duration before triggering

// Detect crossovers

bullishCross = ta.crossover(mappedRsi, rsiMA)

bearishCross = ta.crossunder(mappedRsi, rsiMA)

// Simplified signal generation

bool validBullishSignal = bullishCross and (not useFilteredSignals or bearishTrendBars >= minTrendDuration)

bool validBearishSignal = bearishCross and (not useFilteredSignals or bullishTrendBars >= minTrendDuration)

bullishCross = ta.crossover(mappedRsi, rsiMA)

bearishCross = ta.crossunder(mappedRsi, rsiMA)

// Simplified signal generation

bool validBullishSignal = bullishCross and (not useFilteredSignals or bearishTrendBars >= minTrendDuration)

bool validBearishSignal = bearishCross and (not useFilteredSignals or bullishTrendBars >= minTrendDuration)

[h2]Key Components[/h2]

- Custom RSI calculation with adaptive scaling options

- Mapped RSI that aligns the indicator with price chart

- Simple moving average of the mapped RSI for crossover detection

- Trend duration tracking to filter signals

// Calculate RSI components with adaptivity

up = ta.rma(math.max(ta.change(rsiSourceInput), adaptiveRsiBase), emaSlowLength)

down = ta.rma(-math.min(ta.change(rsiSourceInput), adaptiveRsiBase), rsiLengthInput)

// RSI calculation with value constraint

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

// Map RSI to price chart

mappedRsi = useAdaptiveScaling ?

median + ((rsi - 50) / 50 * (pQH - pQL) / 2 * math.min(1.0, 1/scalingFactor)) :

down == pQL ? pQH : up == pQL ? pQL : median - (median / (1 + up / down))

up = ta.rma(math.max(ta.change(rsiSourceInput), adaptiveRsiBase), emaSlowLength)

down = ta.rma(-math.min(ta.change(rsiSourceInput), adaptiveRsiBase), rsiLengthInput)

// RSI calculation with value constraint

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

// Map RSI to price chart

mappedRsi = useAdaptiveScaling ?

median + ((rsi - 50) / 50 * (pQH - pQL) / 2 * math.min(1.0, 1/scalingFactor)) :

down == pQL ? pQH : up == pQL ? pQL : median - (median / (1 + up / down))

[h2]Visualization Elements[/h2]

- RSI line and MA line with toggleable visibility

- Signal arrows at crossover points

- Color fills to indicate bullish/bearish conditions

- Bollinger Bands option for additional reference

// Signal visualization

plotshape(showSignalMarkers and validBullishSignal, "Bullish Signal",

style=shape.triangleup, location=location.belowbar,

color=color.new(bullSignalColor, 0), size=size.large)

plotshape(showSignalMarkers and validBearishSignal, "Bearish Signal",

style=shape.triangledown, location=location.abovebar,

color=color.new(bearSignalColor, 0), size=size.large)

plotshape(showSignalMarkers and validBullishSignal, "Bullish Signal",

style=shape.triangleup, location=location.belowbar,

color=color.new(bullSignalColor, 0), size=size.large)

plotshape(showSignalMarkers and validBearishSignal, "Bearish Signal",

style=shape.triangledown, location=location.abovebar,

color=color.new(bearSignalColor, 0), size=size.large)

[h2]Strategy Implementation[/h2]

- Entry signals on RSI/MA crossovers

- Optional trend duration filter to reduce false signals

- Trailing stop and take profit options for exits

- Position sizing control

// Strategy execution

if bullishCross

strategy.entry("Bull Signal", strategy.long, qty=positionSize, comment="Buy")

if bearishCross

strategy.entry("Bear Signal", strategy.short, qty=positionSize, comment="Sell")

// Apply trailing stop and take profit

if enableTrailingStop

strategy.exit("Bull Trail", "Bull Signal",

trail_points=close * trailingStopPercent / 100 * syminfo.pointvalue,

trail_offset=0)

if bullishCross

strategy.entry("Bull Signal", strategy.long, qty=positionSize, comment="Buy")

if bearishCross

strategy.entry("Bear Signal", strategy.short, qty=positionSize, comment="Sell")

// Apply trailing stop and take profit

if enableTrailingStop

strategy.exit("Bull Trail", "Bull Signal",

trail_points=close * trailingStopPercent / 100 * syminfo.pointvalue,

trail_offset=0)

[h2]Information Display[/h2]

- Current scaling factor and RSI base values

- Current trend direction and duration

- Total bullish and bearish signals generated

// Information display

var table infoPanel = table.new(position.top_right, 2, 6, bgcolor=color.rgb(0, 0, 0, 80))

if barstate.islast

table.cell(infoPanel, 0, 2, "Current Trend", text_color=color.white)

table.cell(infoPanel, 1, 2, mappedRsi > rsiMA ? "Bullish" : "Bearish",

text_color=mappedRsi > rsiMA ? bullSignalColor : bearSignalColor)

table.cell(infoPanel, 0, 3, "Trend Duration", text_color=color.white)

table.cell(infoPanel, 1, 3, str.tostring(mappedRsi > rsiMA ?

bullishTrendBars : bearishTrendBars), text_color=color.white)

var table infoPanel = table.new(position.top_right, 2, 6, bgcolor=color.rgb(0, 0, 0, 80))

if barstate.islast

table.cell(infoPanel, 0, 2, "Current Trend", text_color=color.white)

table.cell(infoPanel, 1, 2, mappedRsi > rsiMA ? "Bullish" : "Bearish",

text_color=mappedRsi > rsiMA ? bullSignalColor : bearSignalColor)

table.cell(infoPanel, 0, 3, "Trend Duration", text_color=color.white)

table.cell(infoPanel, 1, 3, str.tostring(mappedRsi > rsiMA ?

bullishTrendBars : bearishTrendBars), text_color=color.white)

[h2]Recent Fixes[/h2]

- Fixed plotshape syntax to be compatible with Pine Script v6

- Removed complex staging system in favor of direct signals

- Simplified codebase for better performance and clarity

- Added toggle options for better control over visualization

// Fixed plotshape calls

// OLD (causing errors):

// plotshape(showSignalMarkers and validBullishSignal ? true : na, ...)

// NEW (fixed for Pine v6):

plotshape(showSignalMarkers and validBullishSignal, ...)

// OLD (causing errors):

// plotshape(showSignalMarkers and validBullishSignal ? true : na, ...)

// NEW (fixed for Pine v6):

plotshape(showSignalMarkers and validBullishSignal, ...)

The strategy is now focused solely on generating signals from RSI/MA crossovers, making it easier to understand and more reliable in signal generation.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.