PROTECTED SOURCE SCRIPT

Updated Volatility Filter

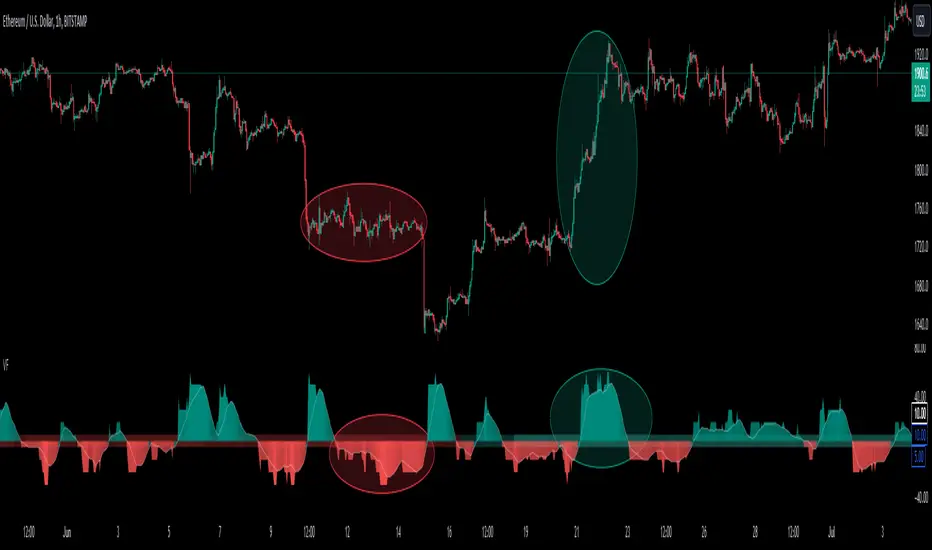

The "Volatility Filter" script is designed to measure market volatility across two different timeframes and determine whether the market is flat or trending.

It uses custom-tuned versions of four different indicators to measure volatility and distinguish between trending and ranging conditions.

The selected indicators are:

1 - Average Directional Index (ADX) Volatility

2 - Damiani Volameter

3 - Trader Pressure Index (TPI)

4 - Williams Alligator Indicator

The script calculates a filter score for both the current timeframe and a user-specified higher timeframe. It offers two types of filter scores, controlled by the 'FilterType' parameter. The filter score is then visualized on the chart as the main oscillator for the current timeframe and a filled bar for the higher timeframe.

The script utilizes a custom moving average function that provides 17 different ways to calculate a moving average, giving the user extensive flexibility in tailoring the script to their needs.

By using custom indicators and unique score calculation methods across two timeframes, this script provides a comprehensive measure of market volatility, aiding traders in identifying trending and ranging market conditions.

This script also provides two additional parameters for tuning its calculations and output, allowing to adjust the script to any trading style and the characteristics of the market being traded.

1 - Threshold: This parameter sets a threshold that the oscillator needs to surpass for the current market move to be considered as a trend. By adjusting the threshold, traders can control how much volatility is required to register a move as trending. A higher threshold will require more volatility for a trend to be recognized, meaning that the market needs to be moving more strongly for a trend to be identified.

2 - Length: This parameter is used to smooth the oscillator. It determines the number of periods used in the calculation of the moving average of the volatility filter score. A longer length will consider more data points and therefore provide a smoother line, which can be useful in accounting for the fading of trends. When trends start to lose their strength but are still present, a longer length can help in maintaining the recognition of the trend, aiding in making accurate trading decisions.

By adjusting these parameters, traders can fine-tune the script's sensitivity to market volatility and its recognition of trends, providing valuable flexibility in adapting to different market conditions and trading strategies.

It uses custom-tuned versions of four different indicators to measure volatility and distinguish between trending and ranging conditions.

The selected indicators are:

1 - Average Directional Index (ADX) Volatility

2 - Damiani Volameter

3 - Trader Pressure Index (TPI)

4 - Williams Alligator Indicator

The script calculates a filter score for both the current timeframe and a user-specified higher timeframe. It offers two types of filter scores, controlled by the 'FilterType' parameter. The filter score is then visualized on the chart as the main oscillator for the current timeframe and a filled bar for the higher timeframe.

The script utilizes a custom moving average function that provides 17 different ways to calculate a moving average, giving the user extensive flexibility in tailoring the script to their needs.

By using custom indicators and unique score calculation methods across two timeframes, this script provides a comprehensive measure of market volatility, aiding traders in identifying trending and ranging market conditions.

This script also provides two additional parameters for tuning its calculations and output, allowing to adjust the script to any trading style and the characteristics of the market being traded.

1 - Threshold: This parameter sets a threshold that the oscillator needs to surpass for the current market move to be considered as a trend. By adjusting the threshold, traders can control how much volatility is required to register a move as trending. A higher threshold will require more volatility for a trend to be recognized, meaning that the market needs to be moving more strongly for a trend to be identified.

2 - Length: This parameter is used to smooth the oscillator. It determines the number of periods used in the calculation of the moving average of the volatility filter score. A longer length will consider more data points and therefore provide a smoother line, which can be useful in accounting for the fading of trends. When trends start to lose their strength but are still present, a longer length can help in maintaining the recognition of the trend, aiding in making accurate trading decisions.

By adjusting these parameters, traders can fine-tune the script's sensitivity to market volatility and its recognition of trends, providing valuable flexibility in adapting to different market conditions and trading strategies.

Release Notes

Hi everyone!I decided to update this wonderful script, this time there is a lot of new stuff:

Comprehensive Volatility Analysis: The script now combines key indicators like

ADX, Damiani Filter, Trader Pressure Index, Bill Williams Alligator, MT4 Momentum, Momentum, Volatility %, and a Historical Volatility Index.

Approach is the same, but now there is more metrics that filter is considering.

Expanded Moving Average Types: The update introduces a wider range of moving average types, including EMA, AHMA, BMF, DSWF, EVWMA, FLSMA, GMMA, HCF, and others. This enhancement provides users with more options to smooth their volatility filter scores according to their preferences.

Closed Source Code for Exclusive Edge: As with the previous version, this script remains closed source. This decision is made to protect the unique edge it provides in the market, ensuring that my followers maintain an exclusive advantage in their trading strategies.

Protected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Protected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.