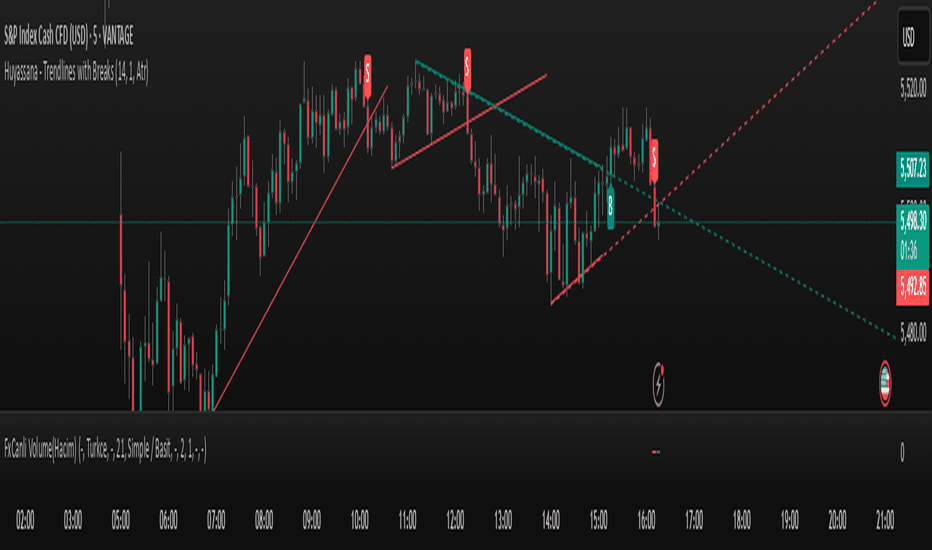

Trendingline ZMDConfirming the Breakout

To avoid false breakouts, consider these confirmation signals:

A candle close beyond the trendline.

Increased volume during the breakout.

Retesting the trendline as support/resistance.

Trading the Breakout

Entry: Enter a trade after confirmation signals.

Stop Loss: Place a stop loss slightly beyond the trendline to limit risk.

Take Profit: Set profit targets based on support/resistance levels or Fibonacci extensions.

Trendline Retest Strategy

After breaking a trendline, the price often retests the broken trendline before continuing in the new direction. If the price respects the trendline as a new support/resistance, it adds further confirmation.

By following these steps, traders can effectively use trendline breakouts to identify high-probability trading opportunities.

Chart patterns

Breakout & Breakdown Detector with CPRwhwn a break out is indicated enter into a buy position and whwn breakdown is indicated exit trade

Dynamic Breakout Breakdown Trackerbreak out and break down calculator

you can calculate break out and break down from this indicator and this will calculate the levels dynamically

Enhanced Range Filter Strategy with ATR TP/SLBuilt by Omotola

## **Enhanced Range Filter Strategy: A Comprehensive Overview**

### **1. Introduction**

The **Enhanced Range Filter Strategy** is a powerful technical trading system designed to identify high-probability trading opportunities while filtering out market noise. It utilizes **range-based trend filtering**, **momentum confirmation**, and **volatility-based risk management** to generate precise entry and exit signals. This strategy is particularly useful for traders who aim to capitalize on trend-following setups while avoiding choppy, ranging market conditions.

---

### **2. Key Components of the Strategy**

#### **A. Range Filter (Trend Determination)**

- The **Range Filter** smooths price fluctuations and helps identify clear trends.

- It calculates an **adjusted price range** based on a **sampling period** and a **multiplier**, ensuring a dynamic trend-following approach.

- **Uptrends:** When the current price is above the range filter and the trend is strengthening.

- **Downtrends:** When the price falls below the range filter and momentum confirms the move.

#### **B. RSI (Relative Strength Index) as Momentum Confirmation**

- RSI is used to **filter out weak trades** and prevent entries during overbought/oversold conditions.

- **Buy Signals:** RSI is above a certain threshold (e.g., 50) in an uptrend.

- **Sell Signals:** RSI is below a certain threshold (e.g., 50) in a downtrend.

#### **C. ADX (Average Directional Index) for Trend Strength Confirmation**

- ADX ensures that trades are only taken when the trend has **sufficient strength**.

- Avoids trading in low-volatility, ranging markets.

- **Threshold (e.g., 25):** Only trade when ADX is above this value, indicating a strong trend.

#### **D. ATR (Average True Range) for Risk Management**

- **Stop Loss (SL):** Placed **one ATR below** (for long trades) or **one ATR above** (for short trades).

- **Take Profit (TP):** Set at a **3:1 reward-to-risk ratio**, using ATR to determine realistic price targets.

- Ensures volatility-adjusted risk management.

---

### **3. Entry and Exit Conditions**

#### **📈 Buy (Long) Entry Conditions:**

1. **Price is above the Range Filter** → Indicates an uptrend.

2. **Upward trend strength is positive** (confirmed via trend counter).

3. **RSI is above the buy threshold** (e.g., 50, to confirm momentum).

4. **ADX confirms trend strength** (e.g., above 25).

5. **Volatility is supportive** (using ATR analysis).

#### **📉 Sell (Short) Entry Conditions:**

1. **Price is below the Range Filter** → Indicates a downtrend.

2. **Downward trend strength is positive** (confirmed via trend counter).

3. **RSI is below the sell threshold** (e.g., 50, to confirm momentum).

4. **ADX confirms trend strength** (e.g., above 25).

5. **Volatility is supportive** (using ATR analysis).

#### **🚪 Exit Conditions:**

- **Stop Loss (SL):**

- **Long Trades:** 1 ATR below entry price.

- **Short Trades:** 1 ATR above entry price.

- **Take Profit (TP):**

- Set at **3x the risk distance** to achieve a favorable risk-reward ratio.

- **Ranging Market Exit:**

- If ADX falls below the threshold, indicating a weakening trend.

---

### **4. Visualization & Alerts**

- **Colored range filter line** changes based on trend direction.

- **Buy and Sell signals** appear as labels on the chart.

- **Stop Loss and Take Profit levels** are plotted as dashed lines.

- **Gray background highlights ranging markets** where trading is avoided.

- **Alerts trigger on Buy, Sell, and Ranging Market conditions** for automation.

---

### **5. Advantages of the Enhanced Range Filter Strategy**

✅ **Trend-Following with Noise Reduction** → Helps avoid false signals by filtering out weak trends.

✅ **Momentum Confirmation with RSI & ADX** → Ensures that only strong, valid trades are executed.

✅ **Volatility-Based Risk Management** → ATR ensures adaptive stop loss and take profit placements.

✅ **Works on Multiple Timeframes** → Effective for day trading, swing trading, and scalping.

✅ **Visually Intuitive** → Clearly displays trade signals, SL/TP levels, and trend conditions.

---

### **6. Who Should Use This Strategy?**

✔ **Trend Traders** who want to enter trades with momentum confirmation.

✔ **Swing Traders** looking for medium-term opportunities with a solid risk-reward ratio.

✔ **Scalpers** who need precise entries and exits to minimize false signals.

✔ **Algorithmic Traders** using alerts for automated execution.

---

### **7. Conclusion**

The **Enhanced Range Filter Strategy** is a powerful trading tool that combines **trend-following techniques, momentum indicators, and risk management** into a structured, rule-based system. By leveraging **Range Filters, RSI, ADX, and ATR**, traders can improve trade accuracy, manage risk effectively, and filter out unfavorable market conditions.

This strategy is **ideal for traders looking for a systematic, disciplined approach** to capturing trends while **avoiding market noise and false breakouts**. 🚀

CISD with Alerts [neo|]█ OVERVIEW

CISD (or Change in State of Delivery) is an ICT concept and reversal pattern which may allow traders to identify reversals or changes in market structure early, compared to using traditional market structure. This script aims to correctly identify, and update these levels and provide alerts, so that traders can take advantage of this concept with ease.

█ CONCEPTS

Simply put, CISD may be identified when price closes above the open of the candle which started the most recent downtrend or liquidity sweep. Generally, it is most powerful when applied to key points in the market as a confirmation from where you may want price to reverse.

For example, when price is in a downtrend, we take the open of the last consecutive downwards candle and observe the CISD once price closes above it, beginning an uptrend.

Examples:

COMEX:GC1!

CME_MINI:NQ1!

█ How to use

To use the indicator, simply apply it to your chart and modify any of your desired inputs.

• Bullish CISD color allows you to change the color of +CISD levels.

• Bearish CISD color allows you to change the color of -CISD levels.

• Line width allows you to modify the width of +-CISD lines.

• Line extension bars allows you to change how far ahead CISD levels are drawn (by default it is 5).

• Keep old CISD levels will allow you to preserve all past CISD levels if you would like to observe the logic.

• Enable stat table will let you add a table on your chart which will tell you the current CISD trend, as well as your ticker and timeframe.

• Table position allows you to customize where the table will appear on your chart.

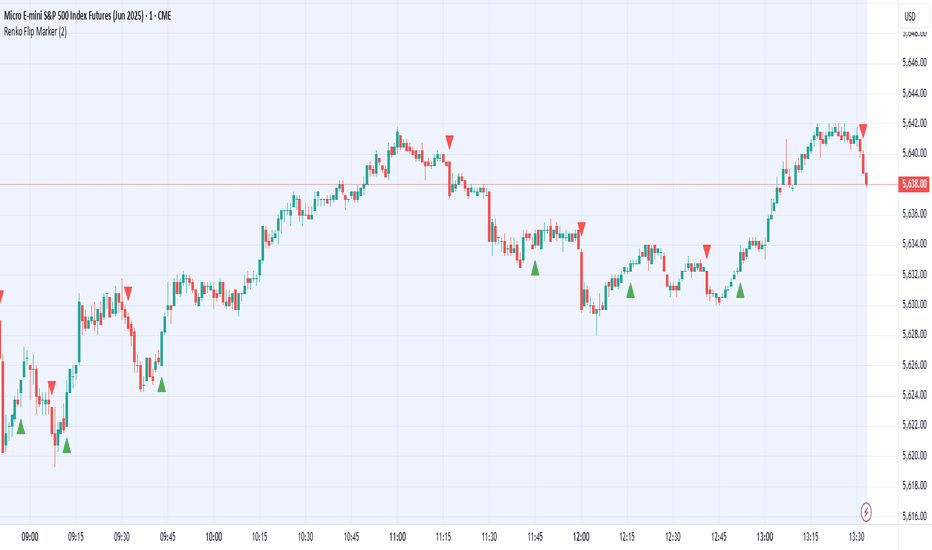

Renko Flip MarkerThis script shows on chart where Renko bricks flip for candlestick chart. I intended it for candlestick chart, but it seems to work Renko chart too from my testing so far. You may change the Renko size for your own scenario you're trading. Hopefully helps, Thank you.

GQT GPT - Volume-based Support & Resistance Zones V2搞钱兔,搞钱是为了更好的生活。

Title: GQT GPT - Volume-based Support & Resistance Zones V2

Overview:

This strategy is implemented in PineScript v5 and is designed to identify key support and resistance zones based on volume-driven fractal analysis on a 1-hour timeframe. It computes fractal high points (for resistance) and fractal low points (for support) using volume moving averages and specific price action criteria. These zones are visually represented on the chart with customizable lines and zone fills.

Trading Logic:

• Entry: The strategy initiates a long position when the price crosses into the support zone (i.e., when the price drops into a predetermined support area).

• Exit: The long position is closed when the price enters the resistance zone (i.e., when the price rises into a predetermined resistance area).

• Time Frame: Trading signals are generated solely from the 1-hour chart. The strategy is only active within a specified start and end date.

• Note: Only long trades are executed; short selling is not part of the strategy.

Visualization and Parameters:

• Support/Resistance Zones: The zones are drawn based on calculated fractal values, with options to extend the lines to the right for easier tracking.

• Customization: Users can configure the appearance, such as line style (solid, dotted, dashed), line width, colors, and label positions.

• Volume Filtering: A volume moving average threshold is used to confirm the fractal signals, enhancing the reliability of the support and resistance levels.

• Alerts: The strategy includes alert conditions for when the price enters the support or resistance zones, allowing for timely notifications.

⸻

搞钱兔,搞钱是为了更好的生活。

标题: GQT GPT - 基于成交量的支撑与阻力区间 V2

概述:

本策略使用 PineScript v5 实现,旨在基于成交量驱动的分形分析,在1小时级别的图表上识别关键支撑与阻力区间。策略通过成交量移动平均线和特定的价格行为标准计算分形高点(阻力)和分形低点(支撑),并以自定义的线条和区间填充形式直观地显示在图表上。

交易逻辑:

• 进场条件: 当价格进入支撑区间(即价格跌入预设支撑区域)时,策略在没有持仓的情况下发出做多信号。

• 离场条件: 当价格进入阻力区间(即价格上升至预设阻力区域)时,持有多头头寸则会被平仓。

• 时间范围: 策略的信号仅基于1小时级别的图表,并且仅在指定的开始日期与结束日期之间生效。

• 备注: 本策略仅执行多头交易,不进行空头操作。

可视化与参数设置:

• 支撑/阻力区间: 根据计算得出的分形值绘制支撑与阻力线,可选择将线条延伸至右侧,便于后续观察。

• 自定义选项: 用户可以调整线条样式(实线、点线、虚线)、线宽、颜色及标签位置,以满足个性化需求。

• 成交量过滤: 策略使用成交量移动平均阈值来确认分形信号,提高支撑和阻力区间的有效性。

• 警报功能: 当价格进入支撑或阻力区间时,策略会触发警报条件,方便用户及时关注市场变化。

⸻

Body Percentage of Range (Colored)Short Description:

This indicator measures the dominance of the candle's body relative to its total range (High - Low), providing a visual gauge of intra-candle strength versus indecision. Columns are colored based on whether the body constitutes more or less than a defined percentage (default 50%) of the candle's total height.

Detailed Description:

What it Does:

The "Body Percentage of Range" indicator calculates, for each candle, what percentage of the total price range (High minus Low) is occupied by the candle's body (absolute difference between Open and Close).

A value of 100% means the candle has no wicks (a Marubozu), indicating strong conviction during that period.

A value of 0% means the candle has no body (a Doji), indicating perfect indecision.

Values in between show the relative balance between the directional move (body) and the price exploration/rejection (wicks).

How to Interpret:

The indicator plots this percentage as columns:

Column Height: Represents the percentage of the body relative to the total range. Higher columns indicate a larger body dominance.

Column Color:

Green Columns: Appear when the body percentage is above the user-defined threshold (default 50%). This suggests that the directional move within the candle was stronger than the indecision (wicks). Often seen during trending moves or strong momentum candles.

Red Columns: Appear when the body percentage is at or below the user-defined threshold (default 50%). This suggests that wicks dominate the candle (body is 50% or less of the range), indicating significant indecision, struggle between buyers and sellers, or potential reversals. These are common in choppy, consolidating, or reversal market conditions.

Orange Line (Optional MA): A Simple Moving Average (SMA) of the body percentages is plotted to help smooth the readings and identify broader periods where candle structure indicates more trending (high MA) vs. ranging/indecisive (low MA) characteristics.

Potential Use Cases:

Identifying Choppy vs. Trending Markets: Sustained periods of low, predominantly red columns (and often a low/declining MA) can signal a choppy, range-bound market where trend-following strategies might underperform. Conversely, periods with frequent high, green columns suggest a more trending environment.

Confirming Breakouts/Momentum: High green columns appearing alongside increased volume during a breakout can add conviction to the move's strength.

Spotting Potential Exhaustion/Reversals: A very tall green column after a strong trend, followed immediately by a low red column (like a Doji or Spinning Top pattern appearing on the price chart), might signal potential exhaustion or a pending reversal, indicating indecision has suddenly entered the market.

Filtering Entries: Traders might avoid taking entries (especially trend-following ones) when the indicator shows a consistent pattern of low red columns, suggesting high market indecision.

Settings:

Color Threshold %: Allows you to set the percentage level above which columns turn green (default is 50%).

Smoothing MA Length: Adjusts the lookback period for the Simple Moving Average.

Disclaimer:

This indicator is a tool for technical analysis and should be used in conjunction with other methods (like price action, volume analysis, other indicators) and robust risk management. It does not provide direct buy/sell signals and past performance is not indicative of future results.

Today's Daily LevelsTrack daily price action like a pro with instant visibility of key levels, percentages, and P&L values - all in one clean view.

• Shows Daily Open, High, Low & Median levels

• Dynamic color-coding: green above open, red below

• Real-time price labels with:

Exact price levels

% distance between levels

Point values

Dollar values per contract

• Auto-repaints on timeframe changes

• 30min alerts for median crosses

EMA Shakeout DetectorEMA Shakeout & Reclaim Zones

Description:

This Pine Script helps traders quickly identify potential shakeout entries based on price action and volume dynamics. Shakeouts often signal strong accumulation, where institutions drive the stock below a key moving average before reclaiming it, creating an opportunity for traders to enter at favorable prices.

How It Works:

1. Volume Surge Filtering:

a. Computes the 51-day Simple Moving Average (SMA) of volume.

b. Identifies days where volume surged 2x above the 51-day average.

c. Filters stocks that had at least two such high-volume days in the last 21 trading days (configurable).

2. Stock Selection Criteria:

a. The stock must be within 25% of its 52-week high.

b. It should have rallied at least 30% from its 52-week low.

Shakeout Conditions:

1. The stock must be trading above the 51-day EMA before the shakeout.

2. A sudden price drop of more than 10% occurs, pushing the stock below the 51-day EMA.

3. A key index (e.g., Nifty 50, S&P 500) must be trading above its 10-day EMA, ensuring overall market strength.

Visualization:

Shakeout zones are highlighted in blue, making it easier to spot potential accumulation areas and study price & volume action in more detail.

This script is ideal for traders looking to identify institutional shakeouts and gain an edge by recognizing high-probability reversal setups.

Segnali C/V (Ibrido LinReg + ATR)“Discover the new LinReg + ATR Hybrid Bot: your compass in the markets!

Forget old static strategies: our system integrates the power of Linear Regression with the ATR indicator, detecting buying and selling opportunities in real time based on volatility and trends. Simple to use, quick to make decisions and designed to follow the market with intelligent trailing stops, the Hybrid Bot helps you maximize your entries and protect your profits. Try it now and take your trading to the next level!”

Multi-timeframe Trend & Momentum DashboardMulti-Timeframe Trend & Momentum Dashboard

This indicator is a comprehensive multi-timeframe analysis tool designed for traders who want to quickly assess market trends and momentum across several timeframes. It combines trend detection with duration tracking and displays key information in an easy-to-read on-chart table. Key features include:

Multi-Timeframe Analysis:

Analyzes nine different timeframes (from 1-minute up to 1-week) simultaneously, helping you gauge the overall market trend at a glance.

Trend Detection & Duration:

Uses a combination of a short-term EMA and a long-term SMA to determine whether the market is bullish, bearish, or neutral. It also tracks how long the current trend has persisted in terms of consecutive bars and displays this duration next to each timeframe.

RSI Display & Visual Alerts:

Calculates the RSI for each timeframe. RSI values are color-coded—green when above 50 (indicating bullish momentum) and red when below 50 (indicating bearish conditions). Additionally, if the market is bearish on a particular timeframe while the RSI is above 50, the RSI cell flashes yellow to alert you of a potential trend reversal or divergence.

On-Chart Trend Start Markers:

When a new trend is detected on your current chart’s timeframe, the indicator automatically marks the bar with a label showing the new trend direction, providing a clear visual cue for trend changes.

This powerful tool is perfect for traders looking to combine multi-timeframe trend analysis with momentum indicators, enabling a more informed and dynamic trading strategy. Whether you’re a day trader or swing trader, the Multi-Timeframe Trend & Momentum Dashboard brings clarity to market conditions across multiple time horizons.

EMA & RSI & MACD & Stochastic sec TTD

---

## **EMA & RSI & MACD – Trend Dashboard by Timeframe**

This script is a **multi-timeframe trend dashboard** that combines several popular technical indicators across key timeframes to give traders a **quick snapshot of trend direction**.

---

### 🔍 **What This Indicator Does**

This indicator visually displays the **trend bias** from five key indicators:

- **EMA 50/200**: Long-term trend (classic golden/death cross logic)

- **EMA 5/7/9**: Short-term trend

- **RSI (14)**: Momentum trend using RSI vs its own 14-SMA

- **MACD**: MACD line vs Signal line

- **EMA 5 vs SMA 14**: A unique short-to-mid-term trend perspective

Each trend is represented by an emoji symbol:

- 🟢 **Uptrend**

- 🔴 **Downtrend**

- ⚫️ **Neutral**

---

### 🕒 **Covered Timeframes**

You can toggle on/off each timeframe as needed:

- 2H

- 3H

- 4H

- 8H

- 12H

- 1D

These are displayed vertically, with trend indicators across columns, so you can spot multi-timeframe confluence easily.

---

### 📊 **Dashboard Features**

- Positioned **on chart** at customizable screen locations (e.g., Middle Right, Bottom Left, etc.)

- **Table color, text size, and emojis** can all be customized in the settings

- **Live updating table** (last bar only) to reduce lag and clutter

---

### 📈 **Calculation Logic**

Each trend indicator is derived as follows:

#### ✅ **EMA 5/7/9 Trend**

- 🟢 if 5 > 7 > 9 (short-term bullish)

- 🔴 if 5 < 7 < 9 (short-term bearish)

- ⚫️ otherwise (neutral)

#### ✅ **EMA 50/200 Trend**

- 🟢 if price > EMA50 > EMA200 (classic bullish)

- 🔴 if price < EMA50 < EMA200 (classic bearish)

- ⚫️ otherwise

#### ✅ **RSI Trend**

- 🟢 if RSI > SMA(RSI)

- 🔴 if RSI < SMA(RSI)

- ⚫️ otherwise

#### ✅ **MACD Trend**

- 🟢 if MACD Line > Signal Line

- 🔴 if MACD Line < Signal Line

- ⚫️ otherwise

#### ✅ **EMA 5 vs SMA 14 Trend**

- 🟢 if EMA5 > SMA14

- 🔴 if EMA5 < SMA14

- ⚫️ otherwise

---

### 🛠️ **Customization**

In the settings panel, users can:

- Show/hide each timeframe

- Change the table's position

- Adjust text size and color

- Customize emoji symbols used for trends

---

### 📌 Use Case

This dashboard is ideal for:

- **Swing traders** and **intraday traders** monitoring multiple timeframes

- Identifying **trend confluence zones** across indicators

- Making quick, high-confidence trading decisions

---

Options Trading Strategy with AlertsTitle: Options Trading Strategy with Buy/Sell Alerts

Description:

This script is designed for day traders and short-term options traders who focus on directional and trend-based trades. It integrates key indicators to identify high-probability entry and exit points for call and put options.

Features & Strategy Logic:

✅ Moving Averages (9 EMA, 21 EMA, 200 EMA) → Identifies short-term and long-term trends.

✅ VWAP (Volume Weighted Average Price) → Tracks institutional buying/selling pressure.

✅ RSI (Relative Strength Index, 14) → Confirms momentum and trend strength.

✅ MACD (12, 26, 9) → Detects shifts in momentum for trend continuation or reversals.

✅ Buy & Sell Alerts → Automatically notifies traders when optimal conditions are met.

How It Works:

• BUY (Call Signal):

• 9 EMA crosses above 21 EMA (bullish momentum).

• Price is above VWAP (institutional buying pressure).

• RSI is above 50 (bullish confirmation).

• MACD is trending upward.

• Trigger: Green “BUY” label appears below the candle.

• SELL (Put Signal):

• 9 EMA crosses below 21 EMA (bearish momentum).

• Price is below VWAP (institutional selling pressure).

• RSI is below 50 (bearish confirmation).

• MACD is trending downward.

• Trigger: Red “SELL” label appears above the candle.

How to Use:

1. Apply the script to 5-minute or 15-minute charts for best results.

2. Look for buy/sell labels and confirm with market context before entering trades.

3. Set alerts to receive real-time notifications when conditions align.

Ideal For:

✔️ Day traders looking for quick, high-probability trades.

✔️ Options traders focusing on directional movement.

✔️ Scalpers and momentum traders who rely on trend confirmation.

🔔 Set up alerts for automated trade notifications and never miss a setup!

2:45 AM Candle High/Low Crossing Bars2:45 AM Candle High/Low Crossing Bars is an indicator that focuses on the trading view 2:45am NY TIME high and low indicating green for buy and red bars for sell, with the 2:45am new york time highlight/ If the next candle sweeps the low we buy while if it sweeps the high we sell, all time zoon must be the new York UTC time.

Kase Permission StochasticOverview

The Kase Permission Stochastic indicator is an advanced momentum oscillator developed from Kase's trading methodology. It offers enhanced signal smoothing and filtering compared to traditional stochastic oscillators, providing clearer entry and exit signals with fewer false triggers.

How It Works

This indicator calculates a specialized stochastic using a multi-stage smoothing process:

Initial stochastic calculation based on high, low, and close prices

Application of weighted moving averages (WMA) for short-term smoothing

Progressive smoothing through differential factors

Final smoothing to reduce noise and highlight significant trend changes

The indicator oscillates between 0 and 100, with two main components:

Main Line (Green): The smoothed stochastic value

Signal Line (Yellow): A further smoothed version of the main line

Signal Generation

Trading signals are generated when the main line crosses the signal line:

Buy Signal (Green Triangle): When the main line crosses above the signal line

Sell Signal (Red Triangle): When the main line crosses below the signal line

Key Features

Multiple Smoothing Algorithms: Uses a combination of weighted and exponential moving averages for superior noise reduction

Clear Visualization: Color-coded lines and background filling

Reference Levels: Horizontal lines at 25, 50, and 75 for context

Customizable Colors: All visual elements can be color-customized

Customization Options

PST Length: Base period for the stochastic calculation (default: 9)

PST X: Multiplier for the lookback period (default: 5)

PST Smooth: Smoothing factor for progressive calculations (default: 3)

Smooth Period: Final smoothing period (default: 10)

Trading Applications

Trend Confirmation: Use crossovers to confirm entries in the direction of the prevailing trend

Reversal Detection: Identify potential market reversals when crossovers occur at extreme levels

Range-Bound Markets: Look for oscillations between overbought and oversold levels

Filter for Other Indicators: Use as a confirmation tool alongside other technical indicators

Best Practices

Most effective in trending markets or during well-defined ranges

Combine with price action analysis for better context

Consider the overall market environment before taking signals

Use longer settings for fewer but higher-quality signals

The Kase Permission Stochastic delivers a sophisticated approach to momentum analysis, offering a refined perspective on market conditions while filtering out much of the noise that affects standard oscillators.

Momentum Breakout OscillatorUses VIX volatility, MACD, RSI, SMA, VWAP to determine buy and sell. Checks volume, must be beyond a certain threshold (eg. 1.5x regular volume)

yatofxDescription: "Ramon Coto's 3 Session Bar Color" Indicator

This TradingView Pine Script indicator colors candlestick bars based on three custom trading sessions. It allows traders to visually distinguish different market timeframes on their charts.

Features:

Three configurable trading sessions with user-defined time ranges.

Customizable session colors:

Session A → Blue

Session B → Red

Session C → Lime

Enable/disable sessions independently using input toggles.

Automatic session detection: Bars are colored based on the active session.

Optimized for TradingView Mobile & Desktop with clear and efficient logic.

How It Works:

1. User Inputs: The script takes session time ranges and enables/disables each session.

2. Session Detection: The script checks whether the current time falls within any of the defined sessions.

3. Bar Coloring: If a session is active, the corresponding color is applied to the bars.

This indicator helps traders quickly recognize which market session they are in, improving decision-making for session-based strategies.

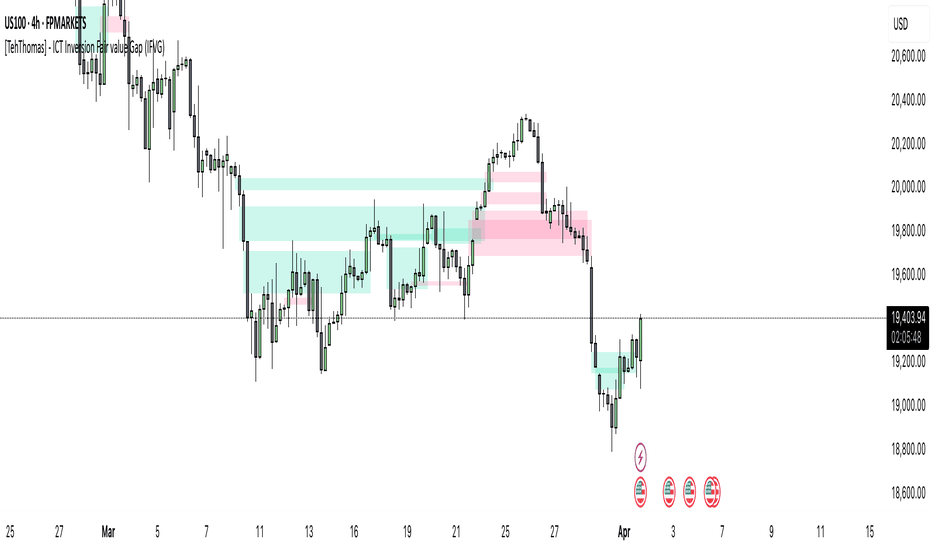

[TehThomas] - ICT Inversion Fair value Gap (IFVG) The Inversion Fair Value Gap (IFVG) indicator is a powerful tool designed for traders who utilize ICT (Inner Circle Trader) strategies. It focuses on identifying and displaying Inversion Fair Value Gaps, which are critical zones that emerge when traditional Fair Value Gaps (FVGs) are invalidated by price action. These gaps represent key areas where price often reacts, making them essential for identifying potential reversals, trend continuations, and liquidity zones.

What Are Inversion Fair Value Gaps?

Inversion Fair Value Gaps occur when price revisits a traditional FVG and breaks through it, effectively flipping its role in the market. For example:

A bullish FVG that is invalidated becomes a bearish zone, often acting as resistance.

A bearish FVG that is invalidated transforms into a bullish zone, serving as support.

These gaps are significant because they often align with institutional trading activity. They highlight areas where large orders have been executed or where liquidity has been targeted. Understanding these gaps provides traders with a deeper insight into market structure and helps them anticipate future price movements with greater accuracy.

Why This Strategy Works

The IFVG concept is rooted in ICT principles, which emphasize liquidity dynamics, market inefficiencies, and institutional order flow. Traditional FVGs represent imbalances in price action caused by gaps between candles. When these gaps are invalidated, they become inversion zones that can act as magnets for price. These zones frequently serve as high-probability areas for price reversals or trend continuations.

This strategy works because it aligns with how institutional traders operate. Inversion gaps often mark areas of interest for "smart money," making them reliable indicators of potential market turning points. By focusing on these zones, traders can align their strategies with institutional behavior and improve their overall trading edge.

How the Indicator Works

This indicator simplifies the process of identifying and tracking IFVGs by automating their detection and visualization on the chart. It scans the chart in real-time to identify bullish and bearish FVGs that meet user-defined thresholds for inversion. Once identified, these gaps are dynamically displayed on the chart with distinct colors for bullish and bearish zones.

The indicator also tracks whether these gaps are mitigated or broken by price action. When an IFVG is broken, it extends the zone for a user-defined number of bars to visualize its potential role as a new support or resistance level. Additionally, alerts can be enabled to notify traders when new IFVGs form or when existing ones are broken, ensuring timely decision-making in fast-moving markets.

Key Features

Automatic Detection: The indicator automatically identifies bullish and bearish IFVGs based on user-defined thresholds.

Dynamic Visualization: It displays IFVGs directly on the chart with customizable colors for easy differentiation.

Real-Time Updates: The status of each IFVG is updated dynamically based on price action.

Zone Extensions: Broken IFVGs are extended to visualize their potential as support or resistance levels.

Alerts: Notifications can be set up to alert traders when key events occur, such as the formation or breaking of an IFVG.

These features make the tool highly efficient and reduce the need for manual analysis, allowing traders to focus on execution rather than tedious chart work.

Benefits of Using This Indicator

The IFVG indicator offers several advantages that make it an indispensable tool for ICT traders. By automating the detection of inversion gaps, it saves time and reduces errors in analysis. The clearly defined zones improve risk management by providing precise entry points, stop-loss levels, and profit targets based on market structure.

This tool is also highly versatile and adapts seamlessly across different timeframes. Whether you’re scalping lower timeframes or swing trading higher ones, it provides actionable insights tailored to your trading style. Furthermore, by aligning your strategy with institutional logic, you gain a significant edge in anticipating market movements.

Practical Applications

This indicator can be used across various trading styles:

Scalping: Identify quick reversal points on lower timeframes using real-time alerts.

Day Trading: Use inversion gaps as key levels for intraday support/resistance or trend continuation setups.

Swing Trading: Analyse higher timeframes to identify major inversion zones that could act as critical turning points in larger trends.

By integrating this tool into your trading routine, you can streamline your analysis process and focus on executing high-probability setups.

Conclusion

The Inversion Fair Value Gap (IFVG) indicator is more than just a technical analysis tool—it’s a strategic ally for traders looking to refine their edge in the markets. By automating the detection and tracking of inversion gaps based on ICT principles, it simplifies complex market analysis while maintaining accuracy and depth. Whether you’re new to ICT strategies or an experienced trader seeking greater precision, this indicator will elevate your trading game by aligning your approach with institutional behavior.

If you’re serious about improving your trading results while saving time and effort, this tool is an essential addition to your toolkit. It provides clarity in chaotic markets, enhances precision in trade execution, and ensures you never miss critical opportunities in your trading journey.

__________________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

Médias Móveis Personalizadas por TipoContains 9, 20, 50, and 200 moving averages and a VWAP, allowing selection between simple and exponential with different colors and more!

Contem medias de 9 20 50 e 200 e uma vwap podendo escolher entre simples e exponencial com diferentes cores e etc!

Fibonacci Circle Zones🟩 The Fibonacci Circle Zones indicator is a technical visualization tool, building upon the concept of traditional Fibonacci circles. It provides configurable options for analyzing geometric relationships between price and time, used to identify potential support and resistance zones derived from circle-based projections. The indicator constructs these Fibonacci circles based on two user-selected anchor points (Point A and Point B), which define the foundational price range and time duration for the geometric analysis.

Key features include multiple mathematical Circle Formulas for radius scaling and several options for defining the circle's center point, enabling exploration of complex, non-linear geometric relationships between price and time distinct from traditional linear Fibonacci analysis. Available formulas incorporate various mathematical constants (π, e, φ variants, Silver Ratio) alongside traditional Fibonacci ratios, facilitating investigation into different scaling hypotheses. Furthermore, selecting the Center point relative to the A-B anchors allows these circular time-price patterns to be constructed and analyzed from different geometric perspectives. Analysis can be further tailored through detailed customization of up to 12 Fibonacci levels, including their mathematical values, colors, and visibility..

📚 THEORY and CONCEPT 📚

Fibonacci circles represent an application of Fibonacci principles within technical analysis, extending beyond typical horizontal price levels by incorporating the dimension of time. These geometric constructions traditionally use numerical proportions, often derived from the Fibonacci sequence, to project potential zones of price-time interaction, such as support or resistance. A theoretical understanding of such geometric tools involves considering several core components: the significance of the chosen geometric origin or center point , the mathematical principles governing the proportional scaling of successive radii, and the fundamental calculation considerations (like chart scale adjustments and base radius definitions) that influence the resulting geometry and ensure its accurate representation.

⨀ Circle Center ⨀

The traditional construction methodology for Fibonacci circles begins with the selection of two significant anchor points on the chart, usually representing a key price swing, such as a swing low (Point A) and a subsequent swing high (Point B), or vice versa. This defined segment establishes the primary vector—representing both the price range and the time duration of that specific market move. From these two points, a base distance or radius is derived (this calculation can vary, sometimes using the vertical price distance, the time duration, or the diagonal distance). A center point for the circles is then typically established, often at the midpoint (time and price) between points A and B, or sometimes anchored directly at point B.

Concentric circles are then projected outwards from this center point. The radii of these successive circles are calculated by multiplying the base distance by key Fibonacci ratios and other standard proportions. The underlying concept posits that markets may exhibit harmonic relationships or cyclical behavior that adheres to these proportions, suggesting these expanding geometric zones could highlight areas where future price movements might decelerate, reverse, or find equilibrium, reflecting a potential proportional resonance with the initial defining swing in both price and time.

The Fibonacci Circle Zones indicator enhances traditional Fibonacci circle construction by offering greater analytical depth and flexibility: it addresses the origin point of the circles: instead of being limited to common definitions like the midpoint or endpoint B, this indicator provides a selection of distinct center point calculations relative to the initial A-B swing. The underlying idea is that the geometric source from which harmonic projections emanate might vary depending on the market structure being analyzed. This flexibility allows for experimentation with different center points (derived algorithmically from the A, B, and midpoint coordinates), facilitating exploration of how price interacts with circular zones anchored from various perspectives within the defining swing.

Potential Center Points Setup : This view shows the anchor points A and B , defined by the user, which form the basis of the calculations. The indicator dynamically calculates various potential Center points ( C through N , and X ) based on the A-B structure, representing different geometric origins available for selection in the settings.

Point X holds particular significance as it represents the calculated midpoint (in both time and price) between A and B. This 'X' point corresponds to the default 'Auto' center setting upon initial application of the indicator and aligns with the centering logic used in TradingView's standard Fibonacci Circle tool, offering a familiar starting point.

The other potential center points allow for exploring circles originating from different geometric anchors relative to the A-B structure. While detailing the precise calculation for each is beyond the scope of this overview, they can be broadly categorized: points C through H are derived from relationships primarily within the A-B time/price range, whereas points I through N represent centers projected beyond point B, extrapolating the A-B geometry. Point J, for example, is calculated as a reflection of the A-X midpoint projected beyond B. This variety provides a rich set of options for analyzing circle patterns originating from historical, midpoint, and extrapolated future anchor perspectives.

Default Settings (Center X, FibCircle) : Using the default Center X (calculated midpoint) with the default FibCircle . Although circles begin plotting only after Point B is established, their curvature shows they are geometrically centered on X. This configuration matches the standard TradingView Fib Circle tool, providing a baseline.

Centering on Endpoint B : Using Point B, the user-defined end of the swing, as the Center . This anchors the circular projections directly to the swing's termination point. Unlike centering on the midpoint (X) or start point (A), this focuses the analysis on geometric expansion originating precisely from the conclusion of the measured A-B move.

Projected Center J : Using the projected Point J as the Center . Its position is calculated based on the A-B swing (conceptually, it represents a forward projection related to the A-X midpoint relationship) and is located chronologically beyond Point B. This type of forward projection often allows complete circles to be visualized as price develops into the corresponding time zone.

Time Symmetry Projection (Center L) : Uses the projected Point L as the Center . It is located at the price level of the start point (A), projected forward in time from B by the full duration of the A-B swing . This perspective focuses analysis on temporal symmetry , exploring geometric expansions from a point representing a full time cycle completion anchored back at the swing's origin price level.

⭕ Circle Formula

Beyond the center point , the expansion of the projected circles is determined by the selected Circle Formula . This setting provides different mathematical methods, or scaling options , for scaling the circle radii. Each option applies a distinct mathematical constant or relationship to the base radius derived from the A-B swing, allowing for exploration of various geometric proportions.

eScaled

Mathematical Basis: Scales the radius by Euler's number ( e ≈ 2.718), the base of natural logarithms. This constant appears frequently in processes involving continuous growth or decay.

Enables investigation of market geometry scaled by e , exploring relationships potentially based on natural exponential growth applied to time-price circles, potentially relevant for analyzing phases of accelerating momentum or volatility expansion.

FibCircle

Mathematical Basis: Scales the radius to align with TradingView’s built-in Fibonacci Circle Tool.

Provides a baseline circle size, potentially emulating scaling used in standard drawing tools, serving as a reference point for comparison with other options.

GoldenFib

Mathematical Basis: Scales the radius by the Golden Ratio (φ ≈ 1.618).

Explores the fundamental Golden Ratio proportion, central to Fibonacci analysis, applied directly to circular time-price geometry, potentially highlighting zones reflecting harmonic expansion or retracement patterns often associated with φ.

GoldenContour

Mathematical Basis: Scales the radius by a factor derived from Golden Ratio geometry (√(1 + φ²) / 2 ≈ 0.951). It represents a specific geometric relationship derived from φ.

Allows analysis using proportions linked to the geometry of the Golden Rectangle, scaled to produce circles very close to the initial base radius. This explores structural relationships often associated with natural balance or proportionality observed in Golden Ratio constructions.

SilverRatio

Mathematical Basis: Scales the radius by the Silver Ratio (1 + √2 ≈ 2.414). The Silver Ratio governs relationships in specific regular polygons and recursive sequences.

Allows exploration using the proportions of the Silver Ratio, offering a significant expansion factor based on another fundamental metallic mean for comparison with φ-based methods.

PhiDecay

Mathematical Basis: Scales the radius by φ raised to the power of -φ (φ⁻ᵠ ≈ 0.53). This unique exponentiation explores a less common, non-linear transformation involving φ.

Explores market geometry scaled by this specific phi-derived factor which is significantly less than 1.0, offering a distinct contractile proportion for analysis, potentially relevant for identifying zones related to consolidation phases or decaying momentum.

PhiSquared

Mathematical Basis: Scales the radius by φ squared, normalized by dividing by 3 (φ² / 3 ≈ 0.873).

Enables investigation of patterns related to the φ² relationship (a key Fibonacci extension concept), visualized at a scale just below 1.0 due to normalization. This scaling explores projections commonly associated with significant trend extension targets in linear Fibonacci analysis, adapted here for circular geometry.

PiScaled

Mathematical Basis: Scales the radius by Pi (π ≈ 3.141).

Explores direct scaling by the fundamental circle constant (π), investigating proportions inherent to circular geometry within the market's time-price structure, potentially highlighting areas related to natural market cycles, rotational symmetry, or full-cycle completions.

PlasticNumber

Mathematical Basis: Scales the radius by the Plastic Number (approx 1.3247), the third metallic mean. Like φ and the Silver Ratio, it is the solution to a specific cubic equation and relates to certain geometric forms.

Introduces another distinct fundamental mathematical constant for geometric exploration, comparing market proportions to those potentially governed by the Plastic Number.

SilverFib

Mathematical Basis: Scales the radius by the reciprocal Golden Ratio (1/φ ≈ 0.618).

Explores proportions directly related to the core 0.618 Fibonacci ratio, fundamental within Fibonacci-based geometric analysis, often significant for identifying primary retracement levels or corrective wave structures within a trend.

Unscaled

Mathematical Basis: No scaling applied.

Provides the base circle defined by points A/B and the Center setting without any additional mathematical scaling, serving as a pure geometric reference based on the A-B structure.

🧪 Advanced Calculation Settings

Two advanced settings allow further refinement of the circle calculations: matching the chart's scale and defining how the base radius is calculated from the A-B swing.

The Chart Scale setting ensures geometric accuracy by aligning circle calculations with the chart's vertical axis display. Price charts can use either a standard (linear) or logarithmic scale, where vertical distances represent price changes differently. The setting offers two options:

Standard : Select this option when the price chart's vertical axis is set to a standard linear scale.

Logarithmic : It is necessary to select this option if the price chart's vertical axis is set to a logarithmic scale. Doing so ensures the indicator adjusts its calculations to maintain correct geometric proportions relative to the visual price action on the log-scaled chart.

The Radius Calc setting determines how the fundamental base radius is derived from the A-B swing, offering two primary options:

Auto : This is the default setting and represents the traditional method for radius calculation. This method bases the radius calculation on the vertical price range of the A-B swing, focusing the geometry on the price amplitude.

Geometric : This setting provides an alternative calculation method, determining the base radius from the diagonal distance between Point A and Point B. It considers both the price change and the time duration relative to the chart's aspect ratio, defining the radius based on the overall magnitude of the A-B price-time vector.

This choice allows the resulting circle geometry to be based either purely on the swing's vertical price range ( Auto ) or on its combined price-time movement ( Geometric ).

🖼️ CHART EXAMPLES 🖼️

Default Behavior (X Center, FibCircle Formula) : This configuration uses the midpoint ( Center X) and the FibCircle scaling Formula , representing the indicator's effective default setup when 'Auto' is selected for both options initially. This is designed to match the output of the standard TradingView Fibonacci Circle drawing tool.

Center B with Unscaled Formula : This example shows the indicator applied to an uptrend with the Center set to Point B and the Circle Formula set to Unscaled . This configuration projects the defined levels (0.236, 0.382, etc.) as arcs originating directly from the swing's termination point (B) without applying any additional mathematical scaling from the formulas.

Visualization with Projected Center J : Here, circles are centered on the projected point J, calculated from the A-B structure but located forward in time from point B. Notice how using this forward-projected origin allows complete inner circles to be drawn once price action develops into that zone, providing a distinct visual representation of the expanding geometric field compared to using earlier anchor points. ( Unscaled formula used in this example).

PhiSquared Scaling from Endpoint B : The PhiSquared scaling Formula applied from the user-defined swing endpoint (Point B). Radii expand based on a normalized relationship with φ² (the square of the Golden Ratio), creating a unique geometric structure and spacing between the circle levels compared to other formulas like Unscaled or GoldenFib .

Centering on Swing Origin (Point A) : Illustrates using Point A, the user-defined start of the swing, as the circle Center . Note the significantly larger scale and wider spacing of the resulting circles. This difference occurs because centering on the swing's origin (A) typically leads to a larger base radius calculation compared to using the midpoint (X) or endpoint (B). ( Unscaled formula used).

Center Point D : Point D, dynamically calculated from the A-B swing, is used as the origin ( Center =D). It is specifically located at the price level of the swing's start point (A) occurring precisely at the time coordinate of the swing's end point (B). This offers a unique perspective, anchoring the geometric expansion to the initial price level at the exact moment the defining swing concludes. ( Unscaled formula shown).

Center Point G : Point G, also dynamically calculated from the A-B swing, is used as the origin ( Center =G). It is located at the price level of the swing's endpoint (B) occurring at the time coordinate of the start point (A). This provides the complementary perspective to Point D, anchoring the geometric expansion to the final price level achieved but originating from the moment the swing began . As observed in the example, using Point G typically results in very wide circle projections due to its position relative to the core A-B action. ( Unscaled formula shown).

Center Point I: Half-Duration Projection : Using the dynamically calculated Point I as the Center . Located at Point B's price level but projected forward in time by half the A-B swing duration , Point I's calculated time coordinate often falls outside the initially visible chart area. As the chart progresses, this origin point will appear, revealing large, sweeping arcs representing geometric expansions based on a half-cycle temporal projection from the swing's endpoint price. ( Unscaled formula shown).

Center Point M : Point M, also dynamically calculated from the A-B swing, serves as the origin ( Center =M). It combines the midpoint price level (derived from X) with a time coordinate projected forward from Point B by the full duration of the A-B swing . This perspective anchors the geometric expansion to the swing's balance price level but originates from the completion point of a full temporal cycle relative to the A-B move. Like other projected centers, using M allows for complete circles to be visualized as price progresses into its time zone. ( SilverFib formula shown).

Geometric Validation & Functionality : Comparing the indicator (red lines), using its default settings ( Center X, FibCircle Formula ), against TradingView's standard Fib Circle tool (green lines/white background). The precise alignment, particularly visible at the 1.50 and 2.00 levels shown, validates the core geometry calculation.

🛠️ CONFIGURATION AND SETTINGS 🛠️

The Fibonacci Circle Zones indicator offers a range of configurable settings to tailor its functionality and visual representation. These options allow customization of the circle origin, scaling method, level visibility, visual appearance, and input points.

Center and Formula

Settings for selecting the circle origin and scaling method.

Center : Dropdown menu to select the origin point for the circles.

Auto : Automatically uses point X (the calculated midpoint between A and B).

Selectable points including start/end (A, B), midpoint (X), plus various points derived from or projected beyond the A-B swing (C-N).

Circle Formula : Dropdown menu to select the mathematical method for scaling circle radii.

Auto : Automatically selects a default formula ('FibCircle' if Center is 'X', 'Unscaled' otherwise).

Includes standard Fibonacci scaling ( FibCircle, GoldenFib ), other mathematical constants ( PiScaled, eScaled ), metallic means ( SilverRatio ), phi transformations ( PhiDecay, PhiSquared ), and others.

Fib Levels

Configuration options for the 12 individual Fibonacci levels.

Advanced Settings

Settings related to core calculation methods.

Radius Calc : Defines how the base radius is calculated (e.g., 'Auto' for vertical price range, 'Geometric' for diagonal price-time distance).

Chart Scale : Aligns circle calculations with the chart's vertical axis setting ('Standard' or 'Logarithmic') for accurate visual proportions.

Visual Settings

Settings controlling the visual display of the indicator elements.

Plots : Dropdown controlling which parts of the calculated circles are displayed ( Upper , All , or Lower ).

Labels : Dropdown controlling the display of the numerical level value labels ( All , Left , Right , or None ).

Setup : Dropdown controlling the visibility of the initial setup graphics ( Show or Hide ).

Info : Dropdown controlling the visibility of the small information table ( Show or Hide ).

Text Size : Adjusts the font size for all text elements displayed by the indicator (Value ranges from 0 to 36).

Line Width : Adjusts the width of the circle plots (1-10).

Time/Price

Inputs for the anchor points defining the base swing.

These settings define the start (Point A) and end (Point B) of the price swing used for all calculations.

Point A (Time, Price) : Input fields for the exact time coordinate and price level of the swing's starting point (A).

Point B (Time, Price) : Input fields for the exact time coordinate and price level of the swing's ending point (B).

Interactive Adjustment : Points A and B can typically be adjusted directly by clicking and dragging their markers on the chart (if 'Setup' is set to 'Show'). Changes update settings automatically.

📝 NOTES 📝

Fibonacci circles begin plotting only once the time corresponding to Point B has passed and is confirmed on the chart. While potential center locations might be visible earlier (as shown in the setup graphic), the final circle calculations require the complete geometry of the A-B swing. This approach ensures that as new price bars form, the circles are accurately rendered based on the finalized A-B relationship and the chosen center and scaling.

The indicator's calculations are anchored to user-defined start (A) and end (B) points on the chart. When switching between charts with significantly different price scales (e.g., from an index at 5,000 to a crypto asset at $0.50), it is typically necessary to adjust these anchor points to ensure the circle elements are correctly positioned and scaled.

⚠️ DISCLAIMER ⚠️

The Fibonacci Circle Zones indicator is a visual analysis tool designed to illustrate Fibonacci relationships through geometric constructions incorporating curved lines, providing a structured framework for identifying potential areas of price interaction. Like all technical and visual indicators, these visual representations may visually align with key price zones in hindsight, reflecting observed price dynamics. It is not intended as a predictive or standalone trading signal indicator.

The indicator calculates levels and projections using user-defined anchor points and Fibonacci ratios. While it aims to align with TradingView’s standard Fibonacci circle tool by employing mathematical and geometric formulas, no guarantee is made that its calculations are identical to TradingView's proprietary methods.

🧠 BEYOND THE CODE 🧠

The Fibonacci Circle Zones indicator, like other xxattaxx indicators , is designed with education and community collaboration in mind. Its open-source nature encourages exploration, experimentation, and the development of new Fibonacci and grid calculation indicators and tools. We hope this indicator serves as a framework and a starting point for future Innovation and discussions.

Imbalance(FVG) DetectorImbalance (FVG) Detector

Overview

The Imbalance (FVG) Detector is a technical analysis tool designed to highlight price inefficiencies by identifying Fair Value Gaps (FVGs). These gaps occur when rapid price movement leaves an area with little to no traded volume, which may later act as a zone of interest. The indicator automatically detects and marks these imbalances on the chart, allowing users to observe historical price behavior more effectively.

Key Features

- Automatic Imbalance Detection: Identifies bullish and bearish imbalances based on a structured three-bar price action model.

- Customizable Sensitivity: Users can adjust the minimum imbalance percentage threshold to tailor detection settings to different assets and market conditions.

- Real-time Visualization: Marked imbalances are displayed as colored boxes directly on the chart.

- Dynamic Box Updates: Imbalance zones extend forward in time until price interacts with them.

- Alert System: Users can set alerts for when new imbalances appear or when price tests an existing imbalance.

How It Works

The indicator identifies market imbalances using a three-bar price structure:

- Bullish Imbalance: Occurs when the high of three bars ago is lower than the low of the previous bar, forming a price gap.

- Bearish Imbalance: Occurs when the low of three bars ago is higher than the high of the previous bar, creating a downward gap.

When an imbalance is detected:

- Green Boxes indicate bullish imbalances.

- Red Boxes indicate bearish imbalances.

- Once price interacts with an imbalance, the box fades to gray, marking it as tested.

! Designed for Crypto Markets

This indicator is particularly useful in crypto markets, where frequent volatility can create price inefficiencies. It provides a structured way to visualize gaps in price movement, helping users analyze historical liquidity areas.

Customization Options

- Min Imbalance Percentage Size: Adjusts the sensitivity of the imbalance detection.

- Alerts: Users can enable alerts to stay notified of new or tested imbalances.

Important Notes

- This indicator is a technical analysis tool and does not provide trading signals or financial advice.

- It does not predict future price movement but highlights historical price inefficiencies.

- Always use this tool alongside other market analysis methods and risk management strategies.

Morning & Evening Star Strategy (1% TP, 0.5% SL)Morning star and evening star indicator which allows you to identify the trader basis on this price action pattern. It is only for education purpose and nothing else

Omar TradingOmar Trading Indicator – Description

The Omar Trading Indicator is a custom-built trading tool designed to identify potential buy signals based on multiple technical analysis factors. This indicator combines several key elements to improve trade accuracy and reliability.

Key Features:

✅ Zero Reversal from the Bottom – Detects price reversals from recent lows.

✅ Liquidity Check – Uses volume analysis to confirm market strength.

✅ MACD Crossover – Identifies bullish momentum when the MACD line crosses above the signal line.

✅ Moving Average Crossover – Confirms trend direction when a fast-moving average crosses a slow-moving average.

✅ Fibonacci Levels – Displays key Fibonacci retracement levels to identify potential support and resistance zones.

How It Works:

• The indicator scans for a zero-level price reversal from recent lows.

• It checks if volume is above the average liquidity level to confirm trade strength.

• A bullish MACD crossover is required to ensure upward momentum.

• A moving average crossover provides additional confirmation.

• Fibonacci retracement levels help traders identify key price zones for entry or exit.

Alerts & Notifications:

• The indicator plots buy signals directly on the chart.

• TradingView alerts can be set up to notify traders when all conditions align.

• Telegram integration allows automatic notifications for trade opportunities.

This tool is ideal for traders looking for a systematic and multi-confirmation approach to identifying potential buy opportunities.