Haze EMA SignalStrategy Logic:

Buy Entry 🟢

→ When the 11 EMA crosses above the 50 EMA,

→ And Stochastic RSI shows bullish momentum (%K > %D).

Sell / Exit 🔴

→ When the 11 EMA crosses below the 50 EMA,

→ And Stochastic RSI shows bearish momentum (%K < %D).

This dual-confirmation method helps reduce false signals by combining trend-following and momentum-based entries and exits.

SHORT TERM TRADE SIGNAL

EMA= 11/50

K/D/L=15/7/10

Forecasting

SKYFOR Chandelier StrategyHello everyone)) Its me SKYFOR)) Trading on VOOI))) If you like my indicator I will be happy if you can follow me on twitter too

Global M2 Money+ Supply Input Lead (USD)Global M2 Money Supply + INR+CAD Input Lead (USD)

This indicator calculates the global M2 money supply in USD by aggregating M2 data from multiple economies, converted to USD using their respective exchange rates. It overlays the scaled M2 data on the chart with a user-defined time shift to analyze potential correlations with asset prices, such as Bitcoin. The indicator is designed to help traders assess global liquidity trends with a customizable lead or lag.

Countries Included:

Eurozone (EUM2)

North America: United States (USM2), Canada (CAM2)

Non-EU Europe: Switzerland (CHM2), United Kingdom (GBM2), Finland (FIM2), Russia (RUM2)

Pacific: New Zealand (NZM2)

Asia: China (CNM2), Taiwan (TWM2), Hong Kong (HKM2), India (INM2), Japan (JPM2), Philippines (PHM2), Singapore (SGM2)

Latin America: Brazil (BRM2), Colombia (COM2), Mexico (MXM2)

Middle East: United Arab Emirates (AEM2), Turkey (TRM2)

Africa: South Africa (ZAM2)

Input for Lead/Lag:

Time Shift (days): Adjust this input to shift the M2 data forward (positive values) or backward (negative values) on the chart. For example, setting a lead of 85 days shifts the M2 data 85 days into the future, helping traders analyze potential leading indicators for price movements.

H4 Cross + LTF Candle Alignment (Short Lines)H4 Cross + LTF Candle Alignment (Short Lines)

This indicator identifies potential trade opportunities by combining two key conditions:

The current H4 candle crosses above or below the previous H4 candle's high or low.

On a lower timeframe (like 5 minutes), the price shows two consecutive candles moving in the same direction (bullish for long, bearish for short).

Once these conditions align, a short entry line is drawn on the chart and an alert is triggered, providing an early signal for potential price movements. Perfect for traders looking to capture trend continuation with a clear visual marker and timely alerts.

Quarters Theory Levels (Yotov Style)John Alex Sagwe's Quarters Theory Levels Script

This Pine Script, developed by John Alex Sagwe, is based on the concept of the "Quarters Theory" popularized by Illan Yotov. It aims to help traders identify key levels in the market using whole, half, and quarter-level calculations. The script plots major whole levels, half levels, and quarter levels above and below the current price, allowing traders to visualize potential price points where significant market action might occur.

The customizable parameters allow you to:

Set the base level and step size (for quarter levels),

Adjust the number of levels above and below the current price to be displayed,

Toggle between showing whole, half, or quarter levels,

Use price alerts when the market price nears these levels.

Whether you’re a novice or an experienced trader, this script can help you integrate the Quarters Theory into your trading strategy. It’s designed to be flexible and user-friendly, helping you visualize key market levels with ease.

Developed by: John Alex Sagwe, an avid trader and Pine Script enthusiast.

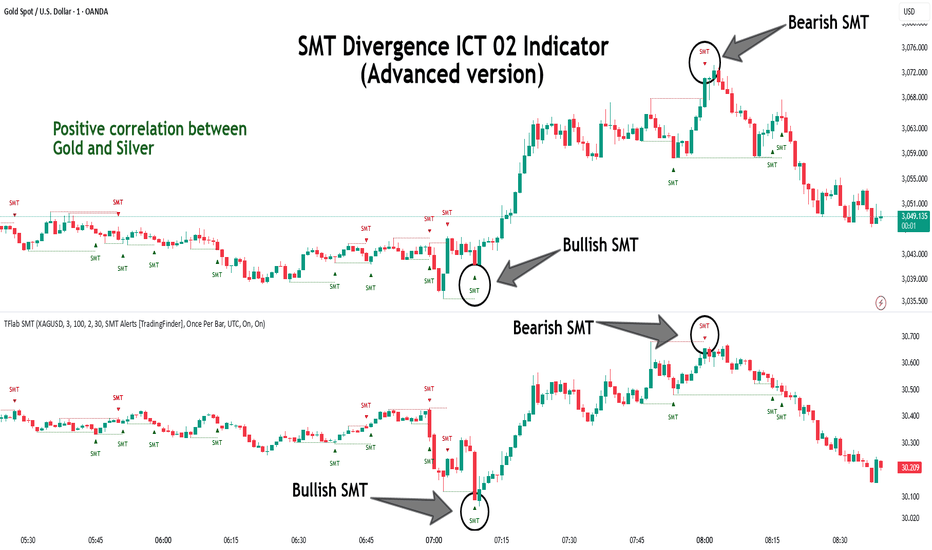

SMT Divergence ICT 02 [TradingFinder] Smart Money Technique SMC🔵 Introduction

SMT Divergence (Smart Money Technique Divergence) is a price action-based trading concept that detects discrepancies in market behavior between two assets that are generally expected to move in the same direction. Rooted in ICT (Inner Circle Trader) methodology, this approach helps traders recognize subtle signs of market manipulation or imbalance, often ahead of traditional indicators.

The core idea behind SMT divergence is simple: when two correlated instruments—such as currency pairs, indices, or assets from the same sector—start forming different swing points (highs or lows), this can reveal a lack of confirmation in the trend. Such divergence is often a precursor to a price reversal or pause in momentum.

This technique works effectively across various markets including Forex, stocks, and cryptocurrencies. It’s particularly valuable when used alongside concepts like liquidity sweeps, market structure breaks (MSBs), or order block identification.

In advanced use cases, Sequential SMT helps uncover patterns of alternating divergences across sessions, often signaling engineered liquidity traps before price reacts.

When combined with the Quarterly Theory—which segments market behavior into Accumulation, Manipulation, Distribution, and Continuation/Reversal phases—traders gain insight not only into where divergence happens, but when it's most likely to be significant within the market cycle.

Bullish SMT :

Bullish SMT Divergence occurs when one asset prints a higher low while the correlated asset forms a lower low. This asymmetry often suggests that the downside move is losing strength, hinting at a potential bullish shift.

Bearish SMT :

Bearish SMT Divergence is formed when one asset creates a higher high, while the second asset fails to confirm by printing a lower high. This typically signals weakening bullish pressure and the possibility of a reversal to the downside.

🔵 How to Use

The SMT Divergence indicator is designed to detect imbalances between two positively correlated assets—such as major currency pairs, indices, or commodities. These divergences often indicate early signs of market inefficiency or smart money manipulation and can help traders anticipate trend shifts with higher precision.

Unlike traditional divergence indicators or earlier versions of this script, this upgraded version does not rely solely on consecutive pivot comparisons. Instead, it dynamically scans all available pivots within the chart to identify divergences at any structural level—major or minor—across the price action. This broader detection method increases the reliability and frequency of meaningful SMT signals.

Moreover, when integrated with Sequential SMT logic, the indicator is capable of identifying multiple divergence sequences across sessions. These sequences often signal engineered liquidity traps and can be mapped within the Quarterly Theory framework, allowing traders to pinpoint not just the presence of divergence but also the phase of the market cycle it appears in (Accumulation, Manipulation, Distribution, or Continuation).

🟣 Bullish SMT Divergence

This signal occurs when the primary asset forms a higher low, while the correlated asset forms a lower low. This pattern implies weakening bearish momentum and a potential shift to the upside.

If the correlated asset breaks its previous low but the primary asset does not, this divergence suggests absorption of selling pressure and possible accumulation by smart money—making it a strong bullish signal, especially when aligned with a favorable market phase (e.g., the end of a manipulation phase in Q2).

🟣 Bearish SMT Divergence

This signal occurs when the primary asset creates a higher high, while the correlated asset forms a lower high. This mismatch indicates fading bullish momentum and a potential reversal to the downside.

If the correlated asset fails to confirm a breakout made by the main asset, the divergence may point to distribution or exhaustion. When seen within Q3 or Q4 phases of the Quarterly Theory, this pattern often precedes sharp declines or fake-outs engineered by smart money

🔵 Settings

⚙️ Logical Settings

Symbol : Choose the secondary asset to compare with the main chart asset (e.g., XAUUSD, US100, GBPUSD).

Pivot Period : Sets the sensitivity of the pivot detection algorithm. A smaller value increases responsiveness to price swings.

Activate Max Pivot Back : When enabled, limits the maximum number of past pivots to be considered for divergence detection.

Max Pivot Back Length : Defines how many past pivots can be used (if the above toggle is active).

Pivot Sync Threshold : The maximum allowed difference (in bars) between pivots of the two assets for them to be compared.

Validity Pivot Length : Defines the time window (in bars) during which a divergence remains valid before it's considered outdated.

🎨 Display Settings

Show Bullish SMT Line : Draws a line connecting the bullish divergence points.

Show Bullish SMT Label : Displays a label on the chart when a bullish divergence is detected.

Bullish Color : Sets the color for bullish SMT markers (label, shape, and line).

Show Bearish SMT Line : Draws a line for bearish divergence.

Show Bearish SMT Label : Displays a label when a bearish SMT divergence is found.

Bearish Color : Sets the color for bearish SMT visual elements.

🔔 Alert Settings

Alert Name : Custom name for the alert messages (used in TradingView’s alert system).

Message Frequency :

All : Every signal triggers an alert.

Once Per Bar : Alerts once per bar regardless of how many signals occur.

Per Bar Close : Only triggers when the bar closes and the signal still exists.

Time Zone Display : Choose the time zone in which alert timestamps are displayed (e.g., UTC).

Bullish SMT Divergence Alert : Enable/disable alerts specifically for bullish signals.

Bearish SMT Divergence Alert : Enable/disable alerts specifically for bearish signals

🔵Conclusion

The SMT Plus indicator offers a refined and powerful approach to detecting smart money behavior through divergence analysis between correlated assets. By removing the limitations of consecutive pivot comparisons and allowing for broader structural detection, it captures more accurate and timely signals that often precede major market moves.

When paired with frameworks like Sequential SMT and the Quarterly Theory, the indicator not only highlights where divergence occurs, but also when in the market cycle it's most likely to matter. Its flexible settings, customizable visuals, and integrated alert system make it suitable for intraday scalpers, swing traders, and even long-term macro analysts.

Whether you're using it as a standalone decision-making tool or combining it with other ICT concepts, SMT Plus gives you an edge in recognizing manipulation, timing reversals, and staying in sync with the real market narrative—not just the chart.

Mark Days with >4% Gain (vs. Previous Close)Shows days when the overall market increased by more than 4%

PBOC Balance Sheet (Approx USD Trillions)This indicator displays the People's Bank of China (PBOC) Balance Sheet in approximate USD trillions, converted from CNY data (ECONOMICS:CNCBBS) using a fixed exchange rate of 1 USD ≈ 7 CNY. The data is smoothed with a 3-month SMA and plotted as a black line in a separate pane, with a reference line at 6.0 USD trillions. Ideal for analyzing long-term macroeconomic trends and correlations with other financial metrics like bond yields or asset prices, it includes error handling for missing data to ensure reliable visualization.

China 10-Year Yield Inverted with Time Lead (Months)The "China 10-Year Yield Inverted with Time Lead (Months)" indicator is a Pine Script tool for TradingView that displays the inverted China 10-Year Government Bond Yield (sourced from TVC:CN10Y) with a user-defined time lead or lag in months. The yield is inverted by multiplying it by -1, making a rising yield appear as a downward movement and vice versa, which helps visualize inverse correlations with other assets. Users can input the number of months to shift the yield forward (lead) or backward (lag), with the shift calculated based on the chart’s timeframe (e.g., 20 bars per month on daily charts). The indicator plots the shifted, inverted yield as a blue line in a separate pane, with a zero line for reference, enabling traders to analyze leading or lagging relationships with other financial data, such as the PBOC Balance Sheet or Bitcoin price.

Mongoose Yield Spread Dashboard v5 – Labeled, Alerted, ReadableCurveGuard: Mongoose Edition

Track the macro tide before it turns.

This tool visualizes the three most-watched U.S. Treasury yield curve spreads:

2s10s (10Y - 2Y)

5s30s (30Y - 5Y)

3M10Y (10Y - 3M)

Each spread is plotted with dynamic color logic, inversion alerts, and floating labels. Background shading highlights historical inversion zones to help spot macro regime shifts in real time.

✅ Alert-ready

✅ Dark mode optimized

✅ Floating labels

✅ Clean layout for fast macro insight

📌 For educational and informational purposes only.

This script does not provide financial advice or trade recommendations.

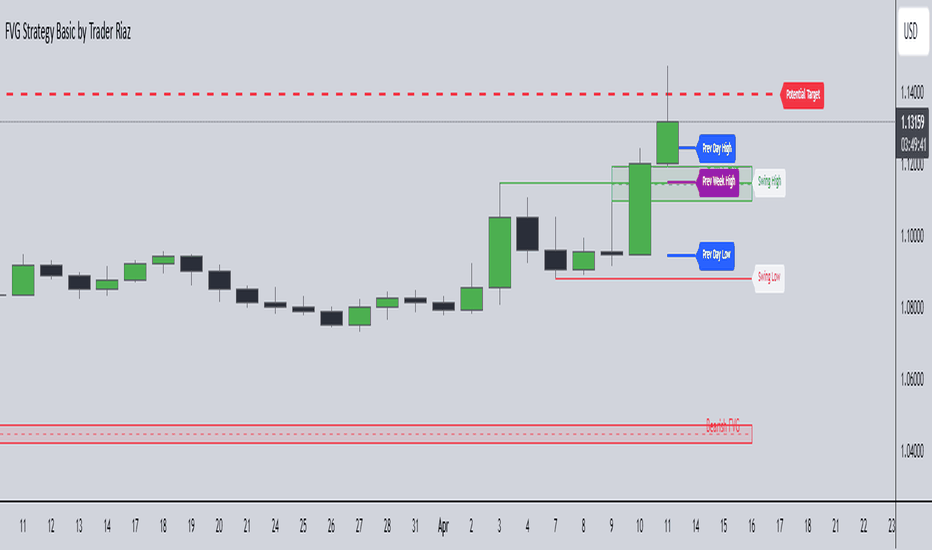

FVG, Swing, Target, D/W/M High Low Detector Basic by Trader Riaz"FVG, Swing, Target, D/W/M High Low Detector Basic by Trader Riaz " is a powerful TradingView indicator designed to enhance your trading strategy by identifying key market structures and levels. This all-in-one tool detects Fair Value Gaps (FVGs), Swing Highs/Lows, and previous Day, Previous Week, and Previous Month Highs/Lows, helping traders make informed decisions with ease.

Key Features:

Bullish & Bearish FVG Detection: Highlights Fair Value Gaps with customizable colors, labels, and extension options.

Swing Highs & Lows: Automatically detects and marks Swing Highs and Lows with adjustable display settings and extensions.

Next Target Levels: Identifies potential price targets based on market direction (rising or falling).

Daily, Weekly, and Monthly High/Low Levels: Displays previous day, week, and month highs/lows with customizable colors.

Customizable Settings: Fully adjustable inputs for colors, number of levels to display, and extension periods.

Clean Visuals: Intuitive and non-intrusive design with dashed lines, labels, and tooltips for better chart readability.

This indicator is ideal for traders looking to identify key price levels, improve market structure analysis, and enhance their trading strategies.

Happy Trading,

Trader Riaz

🌌 Astro Energy IndicatorAstro energy indicator to help you see how the astro energy is effecting the market and the price.

Global M2 10-Week Lead (for bitcoin)This script displays a combined view of the Global M2 Money Supply, converted to USD and adjusted with a configurable forward lead (default 10 weeks). It is designed to help visualize macro liquidity trends and anticipate potential impacts on Bitcoin price movements across any timeframe.

🔹 Main Features:

- Aggregates M2 data from 18 countries and regions including the USA, Eurozone, China, Japan, and more.

- All M2 values are converted to USD using respective exchange rates.

- Customizable “Slide Weeks Forward” setting lets you project global liquidity data into the future.

- Works on all timeframes by adjusting the projection logic dynamically.

- Toggle each country’s data on or off to customize the liquidity model.

💡 Use Case:

Global liquidity is often a leading indicator for major asset classes. This tool helps traders and analysts assess macro-level trends and their potential influence on Bitcoin by looking at changes in M2 money supply worldwide.

💡 Inspired By:

This tool mimics the Global M2 10-Week Lead liquidity indicator often referenced by Raoul Pal of Real Vision and Global Macro Investor, used for macro analysis and Bitcoin movement prediction.

📊 Note:

All economic and FX data is sourced from TradingView’s built-in datasets (ECONOMICS and FX_IDC). Data availability may vary depending on your plan.

M2 Global Liquidity AdjustedM2 Global Adjusted by @ivanpratx is a custom indicator designed to track aggregated global liquidity using M2 money supply data from the world's major economies. It visualizes both the current state of global liquidity and a forward-shifted version (3 months ahead) to help anticipate market movements.

This tool is particularly valuable for analyzing Bitcoin due to its strong correlation with global liquidity trends in recent years. By observing the forward-shifted M2 line, traders and analysts can identify potential macro-driven inflection points before they occur in price action, offering a leading perspective on market cycles.

The indicator combines M2 data from the US, China, Eurozone, Japan, and the UK—converted to a common base—to create a unified global liquidity view. It serves as a practical, high-level signal for assessing risk appetite, market expansion or contraction phases, and major turning points in crypto and broader asset classes.

Pre Open and Open Range BreakoutNew York ORB 15minutes ORB

pre-open 8am-815am ORB

open market 930 pm-945am ORB

base from zzzcrypto123 ORB

OverUnder Yield Spread🗺️ OverUnder is a structural regime visualizer , engineered to diagnose the shape, tone, and trajectory of the yield curve. Rather than signaling trades directly, it informs traders of the world they’re operating in. Yield curve steepening or flattening, normalizing or inverting — each regime reflects a macro pressure zone that impacts duration demand, liquidity conditions, and systemic risk appetite. OverUnder abstracts that complexity into a color-coded compression map, helping traders orient themselves before making risk decisions. Whether you’re in bonds, currencies, crypto, or equities, the regime matters — and OverUnder makes it visible.

🧠 Core Logic

Built to show the slope and intent of a selected rate pair, the OverUnder Yield Spread defaults to 🇺🇸US10Y-US2Y, but can just as easily compare global sovereign curves or even dislocated monetary systems. This value is continuously monitored and passed through a debounce filter to determine whether the curve is:

• Inverted, or

• Steepening

If the curve is flattening below zero: the world is bracing for contraction. Policy lags. Risk appetite deteriorates. Duration gets bid, but only as protection. Stocks and speculative assets suffer, regardless of positioning.

📍 Curve Regimes in Bull and Bear Contexts

• Flattening occurs when the short and long ends compress . In a bull regime, flattening may reflect long-end demand or fading growth expectations. In a bear regime, flattening often precedes or confirms central bank tightening.

• Steepening indicates expanding spread . In a bull context, this may signal healthy risk appetite or early expansion. In a bear or crisis context, it may reflect aggressive front-end cuts and dislocation between short- and long-term expectations.

• If the curve is steepening above zero: the world is rotating into early expansion. Risk assets behave constructively. Bond traders position for normalization. Equities and crypto begin trending higher on rising forward expectations.

🖐️ Dynamically Colored Spread Line Reflects 1 of 4 Regime States

• 🟢 Normal / Steepening — early expansion or reflation

• 🔵 Normal / Flattening — late-cycle or neutral slowdown

• 🟠 Inverted / Steepening — policy reversal or soft landing attempt

• 🔴 Inverted / Flattening — hard contraction, credit stress, policy lag

🍋 The Lemon Label

At every bar, an anchored label floats directly on the spread line. It displays the active regime (in plain English) and the precise spread in percent (or basis points, depending on resolution). Colored lemon yellow, neither green nor red, the label is always legible — a design choice to de-emphasize bias and center the data .

🎨 Fill Zones

These bands offer spatial, persistent views of macro compression or inversion depth.

• Blue fill appears above the zero line in normal (non-inverted) conditions

• Red fill appears below the zero line during inversion

🧪 Sample Reading: 1W chart of TLT

OverUnder reveals a multi-year arc of structural inversion and regime transition. From mid-2021 through late 2023, the spread remains decisively inverted, signaling persistent flattening and credit stress as bond prices trended sharply lower. This prolonged inversion aligns with a high-volatility phase in TLT, marked by lower highs and an accelerating downtrend, confirming policy lag and macro tightening conditions.

As of early 2025, the spread has crossed back above the zero baseline into a “Normal / Steepening” regime (annotated at +0.56%), suggesting a macro inflection point. Price action remains subdued, but the shift in yield structure may foreshadow a change in trend context — particularly if follow-through in steepening persists.

🎭 Different Traders Respond Differently:

• Bond traders monitor slope change to anticipate policy pivots or recession signals.

• Equity traders use regime shifts to time rotations, from growth into defense, or from contraction into reflation.

• Currency traders interpret curve steepening as yield compression or divergence depending on region.

• Crypto traders treat inversion as a liquidity vacuum — and steepening as an early-phase risk unlock.

🛡️ Can It Compare Different Bond Markets?

Yes — with caveats. The indicator can be used to compare distinct sovereign yield instruments, for example:

• 🇫🇷FR10Y vs 🇩🇪DE10Y - France vs Germany

• 🇯🇵JP10Y vs 🇺🇸US10Y - BoJ vs Fed policy curves

However:

🙈 This no longer visualizes the domestic yield curve, but rather the differential between rate expectations across regions

🙉 The interpretation of “inversion” changes — it reflects spread compression across nations , not within a domestic yield structure

🙊 Color regimes should then be viewed as relative rate positioning , not absolute curve health

🙋🏻 Example: OverUnder compares French vs German 10Y yields

1. 🇫🇷 Change the long-duration ticker to FR10Y

2. 🇩🇪 Set the short-duration ticker to DE10Y

3. 🤔 Interpret the result as: “How much higher is France’s long-term borrowing cost vs Germany’s?”

You’ll see steepening when the spread rises (France decoupling), flattening when the spread compresses (convergence), and inversions when Germany yields rise above France’s — historically rare and meaningful.

🧐 Suggested Use

OverUnder is not a signal engine — it’s a context map. Its value comes from situating any trade idea within the prevailing yield regime. Use it before entries, not after them.

• On the 1W timeframe, OverUnder excels as a macro overlay. Yield regime shifts unfold over quarters, not days. Weekly structure smooths out rate volatility and reveals the true curvature of policy response and liquidity pressure. Use this view to orient your portfolio, define directional bias, or confirm long-duration trend turns in assets like TLT, SPX, or BTC.

• On the 1D timeframe, the indicator becomes tactically useful — especially when aligning breakout setups or trend continuations with steepening or flattening transitions. Daily views can also identify early-stage regime cracks that may not yet be visible on the weekly.

• Avoid sub-daily use unless you’re anchoring a thesis already built on higher timeframe structure. The yield curve is a macro construct — it doesn’t oscillate cleanly at intraday speeds. Shorter views may offer clarity during event-driven spikes (like FOMC reactions), but they do not replace weekly context.

Ultimately, OverUnder helps you decide: What kind of world am I trading in? Use it to confirm macro context, avoid fighting the curve, and lean into trades aligned with the broader pressure regime.

RSI + MA + Divergence + SnR + Price levelOverview

This indicator combines several technical analysis tools to give traders a comprehensive view based on the RSI indicator. Its main features include:

RSI & Moving Averages on RSI:

RSI: Calculates the RSI based on the closing price (or a user-selected source) with a configurable period (default is 14).

EMA and WMA: Computes and plots an Exponential Moving Average (EMA with a period of 9) and a Weighted Moving Average (WMA with a period of 45) on the RSI, helping to smooth out signals and better identify trends.

Price Ladder Based on RSI:

Draws horizontal lines at specified target RSI levels (from targetRSI1 to targetRSI7, default levels ranging from 20 to 80).

Calculates a target price based on the price change relative to the averaged gains and losses, providing an estimated price level when the RSI reaches those critical levels.

Divergence Detection:

Identifies divergence between price and RSI:

Bullish Divergence: Detected when the price forms a lower low but RSI fails to confirm with a corresponding lower low, with the RSI falling under a configurable threshold (d_below).

Bearish Divergence: Detected when the price forms a higher high while the RSI does not, with the RSI exceeding a configurable upper threshold (d_upper).

Optionally displays labels on the chart to alert the trader when divergence signals are detected.

Auto Support & Resistance on RSI:

Automatically calculates and plots support and resistance lines based on the RSI over different lookback periods (e.g., 34, 89, 200 bars).

Helps traders identify key RSI levels where price reversals or breakouts might occur.

Benefits for the Trader

This indicator is designed to assist traders in their decision-making process by integrating multiple technical analysis elements:

Identifying Market Trends:

By combining the RSI with its moving averages (EMA, WMA), traders can better assess market trends and the strength of these trends, thereby improving trade entry accuracy.

Early Reversal Signals via Divergence:

Divergence signals (both bullish and bearish) can help forecast potential reversals in the market, allowing traders to adjust their strategies timely.

Determining RSI-Based Support/Resistance Levels:

Automatic identification of support and resistance levels on the RSI provides key areas where a price reversal or breakout may occur, assisting traders in setting stop-loss and take-profit levels strategically.

Price Target Forecasting with the Price Ladder:

The target price labels calculated at important RSI levels provide insights into potential price objectives, aiding in risk management and profit planning.

Flexible Configuration:

Traders can customize key parameters such as the RSI period, lengths for EMA and WMA, target RSI levels, divergence conditions, and support/resistance settings. This flexibility allows the indicator to adapt to different trading styles and strategies.

How to read data

Some use-cases

Used to estimate price according to the RSI level.

When you trade using RSI, you want to set your stop-loss or take-profit levels based on RSI. By looking at the price ladder, you know the corresponding price level to enter a trade.

Used to determine the entry zone.

RSI often reacts to its own previously established support/resistance levels. Use the Auto SnR feature to identify those zones.

Used to determine the trend.

RSI and its moving averages help identify the price trend:

Uptrend: 3 lines separate and point upward.

Downtrend: 3 lines separate and point downward.

Use WMA45 to determine the trend:

Uptrend: WMA45 is moving upward or trading above the 50 level.

Downtrend: WMA45 is moving downward or trading below the 50 level.

Sideways: WMA45 is trading around the 50 level.

Use EMA9 to confirm the trend: A crossover of EMA9 through WMA45 confirms the formation of a new trend.

Configuration

The script allows users to configure a number of important parameters to suit their analytical preferences:

RSI Settings:

RSI Length (rsiLengthInput): The number of periods used to compute the RSI (default is 14, adjustable as needed).

RSI Source (rsiSourceInput): Select the price source (default is the closing price).

RSI Color (rsiClr): The color used to display the RSI line.

Moving Averages on RSI:

EMA Length (emaLength): The period for calculating the EMA on RSI (default is 9).

WMA Length (wmaLength): The period for calculating the WMA on RSI (default is 45).

EMA Color (emaClr) and WMA Color (wmaClr): Customize the colors of the EMA and WMA lines.

Price Ladder Settings:

Toggle Price Ladder (showPrice): Enable or disable the display of the price ladder.

Target RSI Levels: targetRSI1 through targetRSI7: RSI values at which target prices are calculated (default values range from 20, 30, 40, 50, 60, 70 to 80).

Price Label Color (priceColor): The text color for displaying the target price labels.

Divergence Settings:

Divergence Toggle (calculateDivergence): Option to enable or disable divergence calculation and display.

Divergence Conditions:

d_below: RSI level below which bullish divergence is considered.

d_upper: RSI level above which bearish divergence is considered.

Display Divergence Labels (showDivergenceLabel): Option to display labels on the chart when divergence is detected.

Auto Support & Resistance on RSI:

Toggle Auto S&R (enableAutoSnR): Enable or disable automatic plotting of support and resistance levels.

Lookback Periods for Support/Resistance:

L1_lookback: Lookback period for level 1 (e.g., 34 bars).

L2_lookback: Lookback period for level 2 (e.g., 89 bars).

L3_lookback: Lookback period for level 3 (e.g., 200 bars).

Support and Resistance Colors:

rsiSupportClr: Color for the support line.

rsiResistanceClr: Color for the resistance line.

Alerts:

Divergence Alerts: Alert conditions are set up to notify the trader when bullish or bearish divergence is detected, aiding in timely decision-making.

Dkoderweb repainting issue fix strategyHarmonic Pattern Recognition Trading Strategy

This TradingView strategy called "Dkoderweb repainting issue fix strategy" is designed to identify and trade harmonic price patterns with optimized entry and exit points using Fibonacci levels. The strategy implements various popular harmonic patterns including Bat, Butterfly, Gartley, Crab, Shark, ABCD, and their anti-patterns.

Key Features

Pattern Recognition: Identifies 17+ harmonic price patterns including standard and anti-patterns

Fibonacci-Based Entries and Exits: Uses customizable Fibonacci levels for precision entries, take profits, and stop losses

Alternative Timeframe Analysis: Option to use higher timeframes for pattern identification

Heiken Ashi Support: Optional use of Heiken Ashi candles instead of regular candlesticks

Visual Indicators:

Pattern visualization with ZigZag indicator

Buy/sell signal markers

Color-coded background to highlight active trade zones

Customizable Fibonacci level display

How It Works

The strategy uses a ZigZag-based pattern identification system to detect pivot points

When a valid harmonic pattern forms, the strategy calculates the optimal entry window using the specified Fibonacci level (default 0.382)

Entries trigger when price returns to the entry window after pattern completion

Take profit and stop loss levels are automatically set based on customizable Fibonacci ratios

Visual alerts notify you of entries and exits

The strategy tracks active trades and displays them with background color highlights

Customizable Settings

Trade size

Entry window Fibonacci level (default 0.382)

Take profit Fibonacci level (default 0.618)

Stop loss Fibonacci level (default -0.618)

Alert messages for entries and exits

Display options for specific Fibonacci levels

Alternative timeframe selection

This strategy is designed to fix repainting issues that are common in harmonic pattern strategies, ensuring more reliable signals and backtesting results.

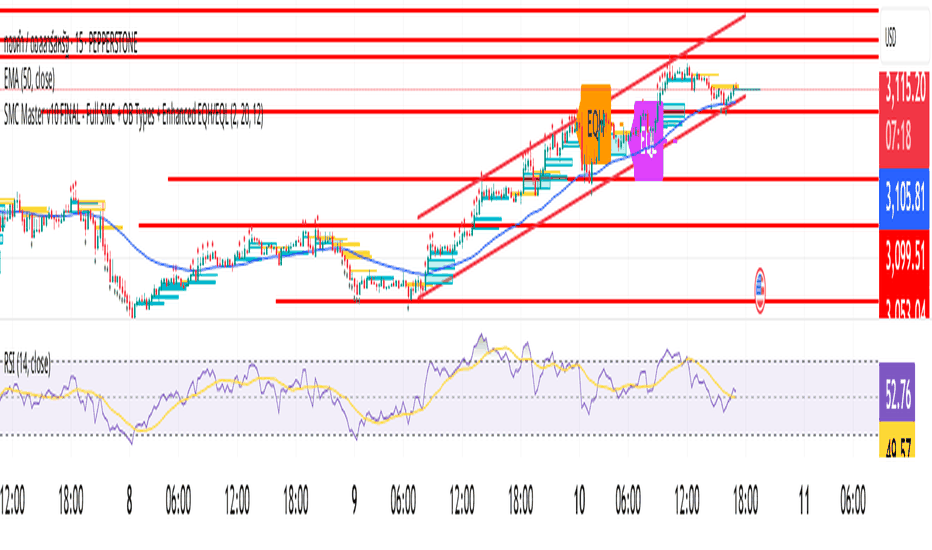

SMC Master v10 FINAL - Full SMC + OB Types + Enhanced EQH/EQL🇹🇭 ภาษาไทย: คำอธิบายอินดิเคเตอร์

🔰 อินดิเคเตอร์ SMC Master for MT4 คืออะไร?

SMC Master คืออินดิเคเตอร์ที่ออกแบบมาเพื่อนักเทรดที่ใช้แนวคิด Smart Money Concepts (SMC) อย่างจริงจัง

ช่วยให้คุณมองเห็นจุดเข้าเทรดที่แม่นยำ โดยไม่ต้องตีกราฟเองทุกครั้ง

✅ ฟีเจอร์หลัก:

🔹 วาด Order Block (OB) ทั้งฝั่งซื้อ-ขาย พร้อมบอกประเภท (RBD, DBR, DBD, RBR)

🔹 สร้างสัญญาณ Buy/Sell เฉพาะ OB ปัจจุบันเท่านั้น

🔹 วาด SL / TP อัตโนมัติ และลบเมื่อโดน

🔹 ตรวจจับ BOS / CHoCH พร้อมลูกศรแสดงทิศทาง

🔹 วาด Fair Value Gap (FVG)

🔹 แสดง EQH / EQL พร้อมเส้นแนวนอนแนวรับ-แนวต้าน

🔔 มีระบบแจ้งเตือน: Popup + Push Notification (ไม่มีเสียง)

🧠 เหมาะสำหรับใคร?

เทรดเดอร์ที่ใช้ SMC

คนที่ต้องการอินดิเคเตอร์ช่วยดู OB, SL/TP, และโครงสร้างตลาด

เหมาะกับทุก Timeframe และคู่เงิน

📌 ข้อแนะนำ:

ใช้ร่วมกับเทคนิคบริหารความเสี่ยงของคุณเสมอ

อินดิเคเตอร์นี้ไม่ repaint และทำงานกับแท่งปัจจุบันเท่านั้น

🇺🇸 English: Indicator Description

🔰 What is “SMC Master for MT4”?

SMC Master is a powerful indicator designed for traders who follow Smart Money Concepts (SMC).

It automatically identifies key market structures, entry zones, and trade signals — so you don’t have to draw everything manually.

✅ Key Features:

🔹 Detects Bullish/Bearish Order Blocks and labels them (RBD, DBR, RBR, DBD)

🔹 Generates Buy/Sell signals only for the latest valid OB

🔹 Auto-calculates SL / TP and removes them once hit

🔹 Detects BOS / CHoCH with directional arrows

🔹 Displays Fair Value Gaps (FVG)

🔹 Marks EQH / EQL with horizontal lines

🔔 Alerts: Popup + Push Notification (no sound)

🧠 Who is this for?

SMC-based traders

Traders who want auto-OB, clean market structure, and entry zone clarity

Works on all timeframes and symbols

📌 Tips for Use:

Always pair it with proper risk management

This indicator does not repaint and works with the current price action only

Dkoderweb repainting issue fix indicator# Harmonic Pattern Trading Indicator for TradingView

This indicator, called "Dkoderweb repainting issue fix indicator," is designed to identify and trade harmonic chart patterns in financial markets. It uses Fibonacci relationships between price points to detect various patterns like Bat, Butterfly, Gartley, Crab, Shark, and others.

## Key Features:

- **Pattern Recognition**: Automatically identifies over a dozen harmonic patterns including standard and anti-patterns

- **Customizable Settings**: Options to use Heikin Ashi candles and alternate timeframes

- **Fibonacci Levels**: Configurable display of key Fibonacci retracement levels

- **Entry and Exit Signals**: Clear buy/sell signals with visual triangles above/below bars

- **Trade Management**: Automatic take-profit and stop-loss levels based on Fibonacci relationships

- **Visual Aids**: Color-coded backgrounds to highlight active trade zones

- **Alert System**: Customizable alert messages for trade entries and exits

## How It Works:

The indicator uses a zigzag function to identify significant price pivots, then analyzes the relationships between these pivots to detect specific harmonic patterns. When a valid pattern forms and price reaches the entry zone (defined by a Fibonacci level), the indicator generates a trade signal.

Each pattern has specific Fibonacci ratio requirements between its points, and the indicator continuously scans for these relationships. Trade management is handled automatically with predefined take-profit and stop-loss levels.

This version specifically addresses repainting issues that are common in pattern-detection indicators, making it more reliable for both backtesting and live trading.

Mercury Venus Conjunction Sextiles 2019-2026How to Use It and What It Means Astrologically

How to Use the Script in TradingView

This Pine Script, called "Mercury Venus Aspects 2019–2026," is made to highlight the dates of Mercury-Venus conjunctions (0°) and sextiles (60°) from 2019 to 2026 on TradingView charts. Here's how to use it:

click “Add to Chart.” It will apply to any chart you have open—stocks, forex, crypto, etc.

Customize the Display

You can turn on/off the visibility of conjunctions and sextiles using checkboxes under "Inputs" in the settings.

You can also adjust the label size (small, normal, large, or huge) for better readability on your chart.

What You’ll See on the Chart

Conjunctions appear as blue shaded zones with labels like “C1,” “C2,” etc. These mark dates when Mercury and Venus are at the same degree.

Sextiles show up in orange with labels like “S1,” “S2,” marking when they’re about 60° apart.

Each event spans a 2-day window (one day before and after the exact aspect).

How to Use It Practically

You can overlay the script on market charts to look for any patterns between these planetary aspects and price movements.

You can also use it to plan personal or financial activities, since these aspects often affect communication, money, and relationships.

What to Keep in Mind

Dates are approximate and based on average planetary cycles (Mercury: ~88 days, Venus: ~225 days). For exact timing, use an ephemeris.

Only conjunctions and sextiles are shown. Oppositions, squares, and trines aren’t included because Mercury and Venus never get far enough apart (more than 75°).

This script is great for astrologers, traders, and enthusiasts who want to see Mercury-Venus aspects directly on their charts and explore their possible effects.

Astrological Meaning of Mercury-Venus Aspects

What Mercury and Venus Represent

Mercury rules communication, thinking, technology, travel, and trade. In global events (mundane astrology), it affects media, markets, and movement of information.

Venus is about love, beauty, money, and pleasure. It influences relationships, aesthetics, and finance. In the world stage, it’s linked to luxury, art, fashion, and economic balance.

When Mercury and Venus form aspects (like conjunctions or sextiles), their energies mix in helpful ways that can affect people and events.

Conjunction (0°) – Mercury and Venus Together

These two planets are in the same sign and degree, so their qualities merge.

For people:

Positive: Smooth communication, charm, creativity, and better relationships. Great for romance, art, and social interaction.

Negative: Too much focus on appearances, sweet talk, or pleasure can cloud judgment. Decisions may lack depth.

For the economy:

Positive: Boosts in media, entertainment, fashion, and tech. Good for trade, deals, and optimism in financial markets.

Negative: Risk of overspending or unrealistic expectations. May cause small market bubbles or misleading hype.

Sextile (60°) – Mercury and Venus in Harmony

These two planets are two signs apart, creating a smooth, supportive energy.

For people:

Positive: Easy conversations, creative teamwork, small financial wins, and pleasant social experiences.

Negative: Energy is mild, so opportunities might be missed if not acted on. People may avoid hard decisions.

For the economy:

Positive: Gradual improvements in areas like marketing, social media, hospitality, and design. Good for diplomacy.

Negative: Lack of strong initiative could limit bigger gains. Minor missteps are possible due to a laid-back attitude.

General Effects

These aspects are mostly beneficial. They support creativity, financial thinking, and social harmony.

Downsides: Conjunctions may lead to overindulgence or shallow choices, while sextiles may cause missed chances due to low energy.

These aspects rarely cause major economic shifts on their own but can amplify trends depending on other planetary influences (like Saturn or Uranus).

Zodiac Sign Influence

Fire signs (Aries, Leo, Sagittarius): Bold communication, energetic spending, gains in media or entertainment.

Earth signs (Taurus, Virgo, Capricorn): Practical results, stable finances, growth in real-world assets like property or food.

Air signs (Gemini, Libra, Aquarius): Intellectual growth, tech innovation, and social ideas flourish.

Water signs (Cancer, Scorpio, Pisces): Emotional depth in conversations, artistic growth, and financial sensitivity.

Mercury-Venus aspects are gentle but helpful. They combine logic (Mercury) with emotion and value (Venus). They’re good times for love, communication, and money—but their benefits depend on how we use the energy. This script lets you easily track these moments on a chart and explore how they might align with real-life trends or decisions.

Disclaimer: This script and its interpretations are for informational and educational purposes only. They do not constitute financial, trading, or professional astrological advice. Always conduct your own research and consult qualified professionals before making any financial or personal decisions. Use at your own discretion.

Momentum Indicators Bias/*

Description:

This script, "Advanced Momentum Indicators Bias," displays a table summarizing the directional bias of various technical indicators on a TradingView chart. It allows users to toggle between simple "Up/Down" directions and advanced "Strong Up/Weak Up/Strong Down/Weak Down" classifications using the `use_advanced_counts` input.

How It Works:

1. **Inputs**: Users can enable/disable 25 indicators and customize table appearance (position, colors, visibility).

2. **Direction Calculation**: Each indicator has a `get_*_dir()` function that determines its direction:

- When `use_advanced_counts` is false, it returns "up" or "down" based on basic conditions (e.g., RSI > 50 = "up").

- When `use_advanced_counts` is true, it returns "strong_up," "weak_up," "strong_down," or "weak_down" by assessing trend strength.

3. **Strength Determination**:

- Advanced indicators (e.g., RSI, MACD) use momentum (e.g., value increasing vs. previous) to differentiate "strong" (rising) from "weak" (flat/declining).

- Simple indicators (e.g., ADX, Ichimoku) add a strength heuristic (e.g., price or indicator value change) when `use_advanced_counts` is true.

4. **Table Display**: The `get_display_text` function maps directions to text:

- Toggle off: "Up" or "Down."

- Toggle on: "Strong Up," "Weak Up," "Strong Down," or "Weak Down" only.

- Background colors reflect strength (solid for strong, faded for weak).

5. **Total Count**: Optionally shows a summary of up/down counts, with detailed strong/weak counts when advanced mode is enabled.

Indicators Used:

- Oscillators: RSI, MACD, Stochastic, MFI, Williams %R, CCI, ROC, Momentum, Trix, Schaff Trend Cycle, Chaikin Oscillator, Ultimate Oscillator.

- Trend/Other: ADX, Ichimoku, Parabolic SAR, Aroon, OBV, Bull Bear Power, Elder Ray, Gator Oscillator, Keltner Channels, Zig Zag, Donchian Channels, Envelopes, Fractals.

The script overlays the chart and updates on the last bar, providing a quick visual bias assessment across multiple indicators.

*/

Probability Grid [LuxAlgo]The Probability Grid tool allows traders to see the probability of where and when the next reversal would occur, it displays a 10x10 grid and/or dashboard with the probability of the next reversal occurring beyond each cell or within each cell.

🔶 USAGE

By default, the tool displays deciles (percentiles from 0 to 90), users can enable, disable and modify each percentile, but two of them must always be enabled or the tool will display an error message alerting of it.

The use of the tool is quite simple, as shown in the chart above, the further the price moves on the grid, the higher the probability of a reversal.

In this case, the reversal took place on the cell with a probability of 9%, which means that there is a probability of 91% within the square defined by the last reversal and this cell.

🔹 Grid vs Dashboard

The tool can display a grid starting from the last reversal and/or a dashboard at three predefined locations, as shown in the chart above.

🔶 DETAILS

🔹 Raw Data vs Normalized Data

By default the tool displays the normalized data, this means that instead of using the raw data (price delta between reversals) it uses the returns between each reversal, this is useful to make an apples to apples comparison of all the data in the dataset.

This can be seen in the left side of the chart above (BTCUSD Daily chart) where normalize data is disabled, the percentiles from 0 to 40 overlap and are indistinguishable from each other because the tool uses the raw price delta over the entire bitcoin history, with normalize data enabled as we can see in the right side of the chart we can have a fair comparison of the data over the entire history.

🔹 Probability Beyond or Within Each Cell

Two different probability modes are available, the default mode is Probability Beyond Each Cell, the number displayed in each cell is the probability of the next reversal to be located in the area beyond the cell, for example, if the cell displays 20%, it means that in the area formed by the square starting from the last reversal and ending at the cell, there is an 80% probability and outside that square there is a 20% probability for the location of the next reversal.

The second probability mode is the probability within each cell, this outlines the chance that the next reversal will be within the cell, as we can see on the right chart above, when using deciles as percentiles (default settings), each cell has the same 1% probability for the 10x10 grid.

🔶 SETTINGS

Swing Length: The maximum length in bars used to identify a swing

Maximum Reversals: Maximum number of reversals included in calculations

Normalize Data: Use returns between swings instead of raw price

Probability: Choose between two different probability modes: beyond and inside each cell

Percentiles: Enable/disable each of the ten percentiles and select the percentile number and line style

🔹 Dashboard

Show Dashboard: Enable or disable the dashboard

Position: Choose dashboard location

Size: Choose dashboard size

🔹 Style

Show Grid: Enable or disable the grid

Size: Choose grid text size

Colors: Choose grid background colors

Show Marks: Enable/disable reversal markers

Accumulation & Buy Zones [SmartFusion Spot]SmartFusion AI is an advanced version of an indicator for the TradingView platform, utilizing artificial intelligence methods to analyze and predict market movements. This indicator is perfect for traders who want to combine powerful multi-timeframe analysis with intelligent algorithms for decision-making.

Features:

Multi-Timeframe Analysis — The indicator considers data from multiple time intervals (from 15 minutes to 1 week), allowing you to see both short-term and long-term trends.

Profit/Loss Levels — Automatically calculates and displays take profit and stop loss levels based on current market conditions, minimizing risk.

Buy/Sell Signals — Generates precise entry and exit signals, confirmed by volume indicators and RSI.

Automatic Support and Resistance Levels — The indicator automatically identifies key levels where reversals or breakouts are likely to occur.

Scalper Mode — For those trading on smaller timeframes, the indicator offers a specialized scalping mode to capture quick market movements with minimal risk.

Benefits:

Increased trading accuracy with integrated AI algorithms.

User-friendly interface with detailed signals.

Easy to set up and customizable for different trading styles.

Reduced stress in decision-making thanks to automatic calculations and recommendations.