6/6/25 - $anf - Upgrading this to a buy ~$806/6/25 :: VROCKSTAR :: NYSE:ANF

Upgrading this to a buy ~$80

- low teens fcf yield

- single digit PE

- brand healthy and growing

- stock beat/ stock ripped

- company buying back shares

- when i compare to something like $lulu... i think... this name is already priced for recession and anything lo

ABERCROMBIE & FITCH CO

70.85EURR

−1.13−1.57%

At close at Jun 10, 19:13 GMT

EUR

No trades

Next report date

≈

August 21

Report period

Q2 2025

EPS estimate

1.98 EUR

Revenue estimate

1.03 B EUR

9.31 EUR

546.67 M EUR

4.78 B EUR

46.45 M

About Abercrombie & Fitch Company

Sector

Industry

CEO

Fran Horowitz-Bonadies

Website

Headquarters

New Albany

Founded

1892

FIGI

BBG000K8NHX0

Abercrombie & Fitch Co. engages in the retail of apparel, personal care products, and accessories. The firm operates through following geographical segments: Americas, EMEA and APAC. The Americas segment includes operations in North America and South America. The EMEA segment includes operations in Europe, the Middle East and Africa. The APAC segment includes operations in the Asia-Pacific region, including Asia and Oceania. The company was founded by David Abercrombie in 1892 and is headquartered in New Albany, OH.

7.0%

8.3%

9.6%

10.9%

12.2%

Q1 '24

Q2 '24

Q3 '24

Q4 '24

Q1 '25

0.00

400.00 M

800.00 M

1.20 B

1.60 B

Revenue

Net income

Net margin %

Revenue

COGS

Gross profit

Op expenses

Op income

Non-Op income/ expenses

Taxes & Other

Net income

0.00

250.00 M

500.00 M

750.00 M

1.00 B

Revenue

COGS

Gross profit

Expenses & adjustments

Net income

0.00

250.00 M

500.00 M

750.00 M

1.00 B

Q1 '24

Q2 '24

Q3 '24

Q4 '24

Q1 '25

−350.00 M

0.00

350.00 M

700.00 M

1.05 B

Debt

Free cash flow

Cash & equivalents

No news here

Looks like there's nothing to report right now

ANF Abercrombie & Fitch BELL CURVE SEEN.Abercrombie & Fitch looks to print a Bell Curve.

To date the Bell Curve Transform is not available without some manipulation of Sinusoids on the TV Platform that I can find.

While this is an early Study, time will tell that the theory should perform @ a 75% probability outcome.

Here the Risk to R

NLong

ANF | Long Setup | Strong Fundamentals | (May 2025)ANF | Long Setup | Strong Fundamentals + Earnings Momentum | (May 2025)

1️⃣ Short Insight Summary:

Abercrombie & Fitch (ANF) shows solid financial strength with consistent growth outlook. Current valuation is attractive with potential upside toward key resistance levels.

2️⃣ Trade Parameters:

Bias

NLong

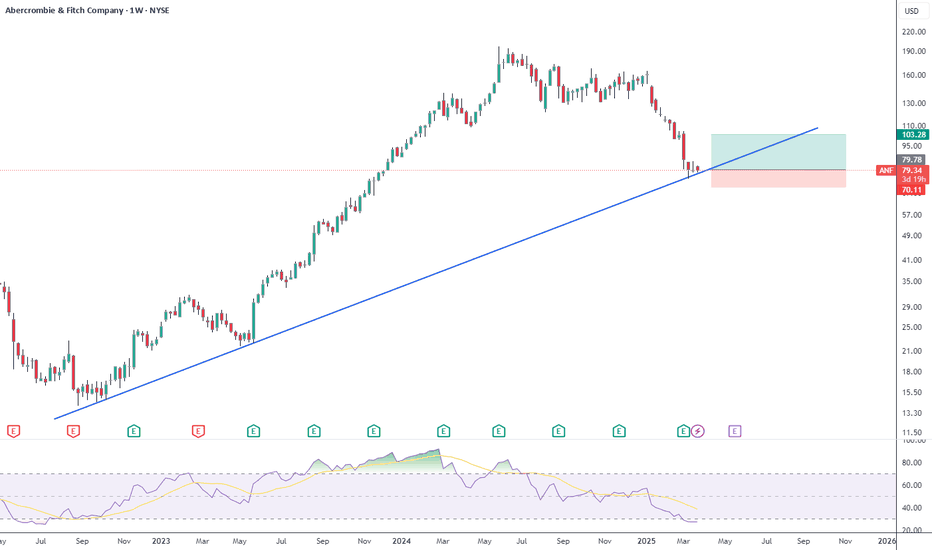

Sitting on a long term supportPrice is oversold in the weekly and daily timeframes. Also is consolidating on the monthly support trendline. I think is going to test the $105 resistance area that's a 30% upside. SL triggers if a weekly candle closes as shown.

NLong

SHORT ANFLooking for a retest, before entering into a short position. The consumer is tried imo, and growth is stalled.

NShort

ANF 3d Q1 2025ANF printing one of my favorite patterns to follow. After a parabolic last few years, finally topping in a similar style to NASDAQ:SMCI and $ARKK. Not expecting this to go straight down, but short of a miracle, this is looking like a parabolic top and distribution.

For reference,

NShort

ANF Abercrombie Reversal begins 1990s are back This one is going to float higher as the upper middle class conservatives ramp up glamour spending under POTUS Trump

NLong

NShort

Watch out for this symmetrical triangle patternANF tried to break triangle with upward breakout, but rebounded. It's very close to the end of the triangle. So watch out for breakout in either direction.

Once breakout is confirmed, for upward breakout, immediate target will be $180+.

For downward breakout, around $110

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where AFT is featured.

Frequently Asked Questions

The current price of AFT is 70.85 EUR — it has decreased by −1.57% in the past 24 hours. Watch ABERCROMBIE & FITCH CO stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on GETTEX exchange ABERCROMBIE & FITCH CO stocks are traded under the ticker AFT.

AFT stock has risen by 4.36% compared to the previous week, the month change is a 7.84% rise, over the last year ABERCROMBIE & FITCH CO has showed a −56.54% decrease.

We've gathered analysts' opinions on ABERCROMBIE & FITCH CO future price: according to them, AFT price has a max estimate of 129.33 EUR and a min estimate of 72.14 EUR. Watch AFT chart and read a more detailed ABERCROMBIE & FITCH CO stock forecast: see what analysts think of ABERCROMBIE & FITCH CO and suggest that you do with its stocks.

AFT stock is 2.81% volatile and has beta coefficient of 1.18. Track ABERCROMBIE & FITCH CO stock price on the chart and check out the list of the most volatile stocks — is ABERCROMBIE & FITCH CO there?

Today ABERCROMBIE & FITCH CO has the market capitalization of 3.42 B, it has increased by 13.43% over the last week.

Yes, you can track ABERCROMBIE & FITCH CO financials in yearly and quarterly reports right on TradingView.

ABERCROMBIE & FITCH CO is going to release the next earnings report on Aug 21, 2025. Keep track of upcoming events with our Earnings Calendar.

AFT earnings for the last quarter are 1.40 EUR per share, whereas the estimation was 1.20 EUR resulting in a 16.96% surprise. The estimated earnings for the next quarter are 1.98 EUR per share. See more details about ABERCROMBIE & FITCH CO earnings.

ABERCROMBIE & FITCH CO revenue for the last quarter amounts to 968.92 M EUR, despite the estimated figure of 935.66 M EUR. In the next quarter, revenue is expected to reach 1.03 B EUR.

AFT net income for the last quarter is 71.00 M EUR, while the quarter before that showed 180.76 M EUR of net income which accounts for −60.72% change. Track more ABERCROMBIE & FITCH CO financial stats to get the full picture.

ABERCROMBIE & FITCH CO dividend yield was 0.00% in 2024, and payout ratio reached 0.00%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jun 11, 2025, the company has 39.2 K employees. See our rating of the largest employees — is ABERCROMBIE & FITCH CO on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ABERCROMBIE & FITCH CO EBITDA is 760.90 M EUR, and current EBITDA margin is 17.90%. See more stats in ABERCROMBIE & FITCH CO financial statements.

Like other stocks, AFT shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ABERCROMBIE & FITCH CO stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ABERCROMBIE & FITCH CO technincal analysis shows the neutral today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ABERCROMBIE & FITCH CO stock shows the neutral signal. See more of ABERCROMBIE & FITCH CO technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.