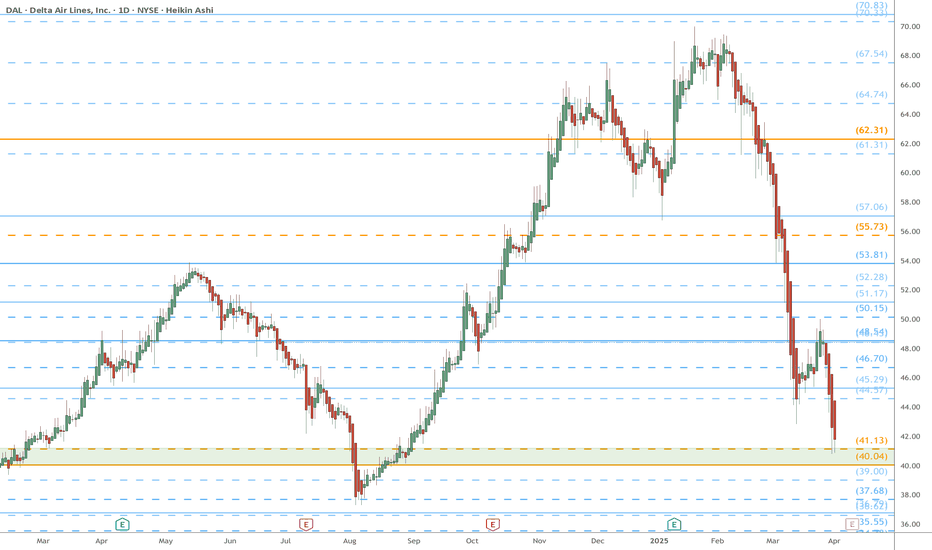

DAL WILL PAY US!!!Watching DAL for potential continuation to the downside. Price is still holding under key resistance and failing to reclaim structure. If we see a retracement toward the $40.30–$40.80 zone, I’ll be looking for rejection and confirmation to enter short.

Day trading targets are $39.10, $38.60, and $3

DELTA AIR LINES INC CEDEAR EACH 8 REP 1 ORD

6,960ARSD

+770+12.44%

At close at May 5, 22:13 GMT

ARS

No trades

Key facts today

Delta Air Lines shares rose about 3.4% after Seaport Global Securities increased its price target from $50 to $65, making it a top gainer on the S&P 500.

Delta Air Lines has cut capacity due to declining demand, aligning with Alaska, Frontier, Spirit, and JetBlue to manage operations during the busy summer season.

670 ARS

3.17 T ARS

56.44 T ARS

About Delta Air Lines, Inc.

Sector

Industry

CEO

Edward Herman Bastian

Website

Headquarters

Atlanta

Founded

1985

ISIN

AR0051689021

FIGI

BBG01MDJCZP6

Delta Air Lines, Inc. engages in the provision of scheduled air transportation for passengers and cargo. It operates through the Airline and Refinery segments. The Airline segment provides scheduled air transportation for passengers and cargo. The Refinery segment provides jet fuel to the airline segment. The company was founded by Collett Everman Woolman in 1928 and is headquartered in Atlanta, GA.

0.25%

2.25%

4.25%

6.25%

8.25%

Q1 '24

Q2 '24

Q3 '24

Q4 '24

Q1 '25

0.00

4.00 T

8.00 T

12.00 T

16.00 T

Revenue

Net income

Net margin %

Revenue

COGS

Gross profit

Op expenses

Op income

Non-Op income/ expenses

Taxes & Other

Net income

0.00

4.00 T

8.00 T

12.00 T

16.00 T

Revenue

COGS

Gross profit

Expenses & adjustments

Net income

0.00

4.00 T

8.00 T

12.00 T

16.00 T

No news here

Looks like there's nothing to report right now

Breaking: Delta Air Lines, Inc. (NYSE: $DAL) Surged 8% TodayShares of Delta Airlines, Inc (NYSE: NYSE:DAL ) surges 8% today after the company reported adjusted earnings per share (EPS) of $0.46 on operating revenue of $14.04 billion. Analysts polled by Visible Alpha had forecast $0.39 and $13.89 billion, respectively.

The company which provides scheduled

NLong

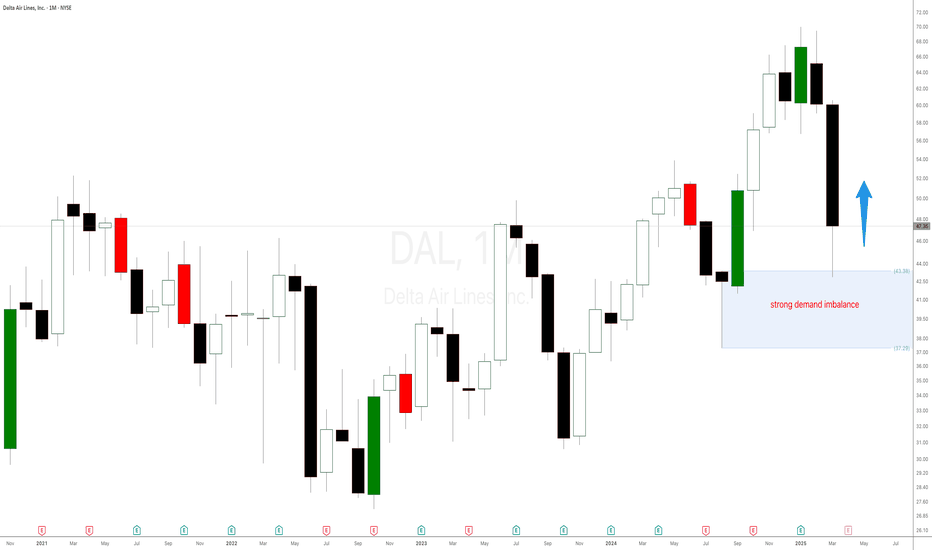

Delta Airlines - Long Term FlyerHey, all. Pretty intense idea here, but I am a buyer of NYSE:DAL at these levels. Obviously, the chart looks awful from a recent performance perspective. However, if you take a long term view, we could actually be rebalancing after an initial range expansion to the upside. Just like NASDAQ:RIVN ,

NLong

Watch This Before Trading Delta Airlines Stock in 2025!The Art of Trading: Price Action, Supply and Demand, and Patience in Delta Airlines. Trading in the stock market is a skill that requires a deep understanding of market dynamics, disciplined decision-making, and the ability to remain patient in the face of volatility. Among the most effective strate

NLong

DAL (Delta Air Lines) – 30-Min Short Trade Setup !📉🚀

🔹 Asset: Delta Air Lines (DAL)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bearish Breakdown Trade

📌 Trade Plan (Short Position)

✅ Entry Zone: Below $46.68 (Breakdown Confirmation)

✅ Stop-Loss (SL): Above $49.14 (Invalidation Level)

🎯 Take Profit Targets:

📌 TP1: $43.71 (First Support Level)

📌 TP2:

NShort

General Market Ramblings - $BTCUSD, $TSLA, $GDX, $DAL, $BBEUHi, all. Wanted to get something published for the first time in awhile. Unfortunately my mom passed away recently and that has been something I have been going through. It is therapeutic to record something and get it out to you all. I am approaching feature film length on this one, so kudos if you

DAL eyes on $57.06: Break and Retest to mark end of DownTrend? Airlines had a nice flight but are now coming in for a landing.

DAL trying to regain altitude but is held down by turbulence.

$ 56.69-57.06 is the exact zone of concern for bulls to break.

=====================================================

.

30 Day 'Jade Lizard' TradeNYSE:DAL

Jade Lizard Trade

Expiration (4/4) just prior to earnings (4/9)

BUY (+1) $66 Call 4/4

SELL (-1) $65 Call 4/4

SELL (-1) $51 Put 4/4

CREDIT = ~$150-$200 as of 3/4 market close

If assigned on short put, break-even on 100 shares will be around $49.25

If the price shoots UP to infinity t

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

DAL4900990

Delta Air Lines, Inc. 3.75% 28-OCT-2029Yield to maturity

5.73%

Maturity date

Oct 28, 2029

DAL4277694

Delta Air Lines, Inc. 3.625% 30-JUL-2027Yield to maturity

5.32%

Maturity date

Jul 30, 2027

DAL5000237

Delta Air Lines, Inc. 7.375% 15-JAN-2026Yield to maturity

5.31%

Maturity date

Jan 15, 2026

DAL4277695

Delta Air Lines, Inc. 3.875% 30-JUL-2027Yield to maturity

5.10%

Maturity date

Jul 30, 2027

DAL4622961

Delta Air Lines, Inc. 4.375% 19-APR-2028Yield to maturity

5.10%

Maturity date

Apr 19, 2028

DAL4962233

Delta Air Lines, Inc. 2.5% 10-JUN-2028Yield to maturity

4.69%

Maturity date

Jun 10, 2028

DAL4962232

Delta Air Lines, Inc. 2.0% 10-JUN-2028Yield to maturity

4.37%

Maturity date

Jun 10, 2028

See all DAL bonds

Curated watchlists where DAL is featured.