TAIWAN SEMICONDUCTOR MANUFACTURING CEDEAR EACH 9 REP 1 ADS

26.95USDD

−0.20−0.74%

At close at Aug 13, 19:13 GMT

USD

No trades

0.15 USD

32.45 B USD

80.04 B USD

About TAIWAN SEMICONDUCTOR MANUFACTURING

Sector

Industry

CEO

Che Chia Wei

Website

Headquarters

Hsinchu

Founded

1987

ISIN

ARDEUT113016

FIGI

BBG000PXD6R2

Taiwan Semiconductor Manufacturing Co., Ltd. engages in the manufacture and sale of integrated circuits and wafer semiconductor devices. Its chips are used in personal computers and peripheral products, information applications, wired and wireless communications systems products, and automotive and industrial equipment including consumer electronics such as digital video compact disc player, digital television, game consoles, and digital cameras. The company was founded by Chung Mou Chang on February 21, 1987 and is headquartered in Hsinchu, Taiwan.

35.0%

37.1%

39.2%

41.3%

43.4%

Q2 '24

Q3 '24

Q4 '24

Q1 '25

Q2 '25

0.00

8.00 B

16.00 B

24.00 B

32.00 B

Revenue

Net income

Net margin %

Revenue

COGS

Gross profit

Op expenses

Op income

Non-Op income/ expenses

Taxes & Other

Net income

0.00

8.00 B

16.00 B

24.00 B

32.00 B

Revenue

COGS

Gross profit

Expenses & adjustments

Net income

0.00

8.00 B

16.00 B

24.00 B

32.00 B

No news here

Looks like there's nothing to report right now

TSM - LONG Swing Entry PlanNYSE:TSM - LONG Swing Entry Plan

E1: $231.00 – $229.00

→ Open initial position targeting +8% from entry level.

E2: $221.00 – $218.00

→ If price dips further, average down with a second equal-sized entry.

→ New target becomes +8% from the average of Entry 1 and Entry 2.

AD: $212.00 – $207.

NLong

8/5/25 - $tsm - Good to be back8/5/25 :: VROCKSTAR :: NYSE:TSM

Good to be back

- you all know i stick to the winners so it's always been $TSM/ NASDAQ:NVDA and then everyone else (go read the posts if inclined w/ more thoughts on either)

- NYSE:TSM is a key infrastructure layer for the next 5-10 yr of hyper-AI growth and not

NLong

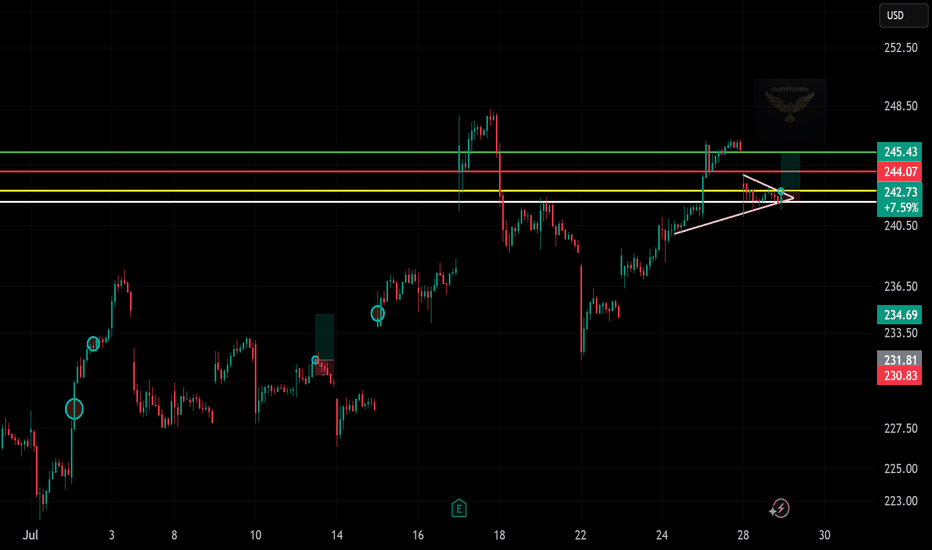

TSMBullish Case: A breakout above 246–248 could signal upward momentum.

Bearish Risk: Failure to hold 239–240 may lead to a test of lower support (~225).

NLong

TSM Breakdown — Short Trade in Motion!“”

🎯 Setup:

→ Entry: ~$241.74

→ SL: ~$243.00

→ Target: $239.81

📌 Bearish rejection + trendline break = short opportunity.

NShort

Trade Setup: LONG on TSM !📈 (Taiwan Semiconductor)

🕰️ Timeframe: 30-minute chart

🔍 Pattern: Ascending triangle breakout

📉 Previous Trend: Recovery after drop

🔁 Setup: Bullish continuation with breakout confirmation

🧩 Technical Breakdown:

Support Zone:

~$242.50 (yellow horizontal support)

Uptrend line holding as dynamic su

NLong

TSM eyes on $194: Major Resistance to Break-n-Run or Dip-to-Buy TSM has been recovering with the chip sector.

Currently testing a Major Resistance zone.

Look for a Dip-to-Buy or Break-n-Retest entry.

$193.92-195.18 is the exact zone of concern.

$177.83-178.31 is the first major support.

$203.68-204.56 is the first resistance above.

============================

TSMCThe Taiwan Semiconductor Manufacturing Company Limited (TSMC) is the world’s largest and most advanced semiconductor foundry, headquartered in Hsinchu Science Park, Taiwan. Founded in 1987 by Morris Chang, TSMC pioneered the pure-play foundry model, focusing exclusively on manufacturing chips design

BLong

TsmEdged up to the top of resistance here.

Expecting a correction back to 176-185 area here

1hour chart

Here's the uptrend since april..

The support would now be around 227.

I expect a pullback to that area this week and if support holds price could bounce back and tag weekly resistance arou

NShort

Higher Prices Inbound!NYSE:TSM , market dominance, serving clients such as NASDAQ:AAPL , NASDAQ:NVDA and NASDAQ:AMD . AI demand surging, strong financials with optimistic revenue outlook.

At a RS Rating of 90

I have reasons to believe this equity price could increase

NLong

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

TSM5285159

TSMC Arizona Corp. 3.25% 25-OCT-2051Yield to maturity

5.81%

Maturity date

Oct 25, 2051

TSM5285158

TSMC Arizona Corp. 3.125% 25-OCT-2041Yield to maturity

5.55%

Maturity date

Oct 25, 2041

TSM5399900

TSMC Arizona Corp. 4.5% 22-APR-2052Yield to maturity

5.14%

Maturity date

Apr 22, 2052

TSM5170546

TSMC Global Ltd. 2.25% 23-APR-2031Yield to maturity

4.62%

Maturity date

Apr 23, 2031

TSM5050794

TSMC Global Ltd. 1.375% 28-SEP-2030Yield to maturity

4.56%

Maturity date

Sep 28, 2030

TSM5285157

TSMC Arizona Corp. 2.5% 25-OCT-2031Yield to maturity

4.51%

Maturity date

Oct 25, 2031

TSM5448853

TSMC Global Ltd. 4.625% 22-JUL-2032Yield to maturity

4.41%

Maturity date

Jul 22, 2032

TSM5050792

TSMC Global Ltd. 1.0% 28-SEP-2027Yield to maturity

4.34%

Maturity date

Sep 28, 2027

TSM5050790

TSMC Global Ltd. 0.75% 28-SEP-2025Yield to maturity

4.33%

Maturity date

Sep 28, 2025

TSM5170542

TSMC Global Ltd. 1.25% 23-APR-2026Yield to maturity

4.31%

Maturity date

Apr 23, 2026

TSM5448852

TSMC Global Ltd. 4.375% 22-JUL-2027Yield to maturity

4.29%

Maturity date

Jul 22, 2027

See all TSMC bonds