TSLACL trade ideas

TSLA watch $253.47 (again) Golden Genesis fib to determine trendTSLA back to the Golden Genesis fib that we keep harping about.

This is a BIG deal, as the most important level of this epoc for it.

Many PINGs (exact hits) have made all traders keenly aware of it.

What happens here will say a LOT to a LOT of traders and algos.

=========================================================

Full view of the "Genesis Sequence"

=========================================================

TSLA: Low Is In , Rally IncomingTSLA is showing signs of strong accumulation, with buyers consistently stepping in and volume expanding on up-moves. Price structure is improving, breakouts further confirm strength, increasing the likelihood that bears have been left behind. Based on the price action and volume alone, TSLA looks ready for a potential sustained move higher.

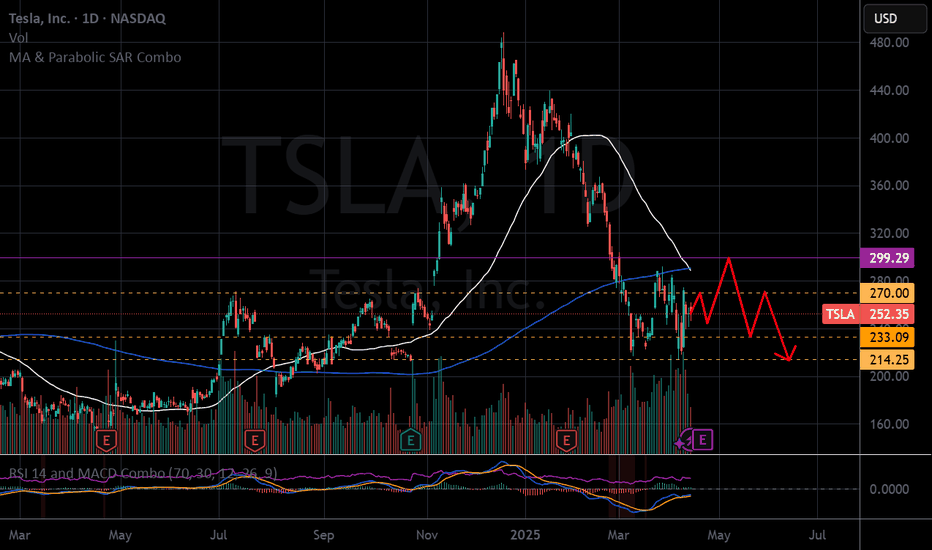

TeslaI hope y'all had the opportunity to buy into Tesla last week. As for me, I bought in @ $237 and sold @ 284.20. I only had 25 shares but made a nice 20% profit in about one week. It's trades like these that build your account and create wealth in the very long-term. Yes, I sold before we made it into the target box, but you have to remember, this is a larger (B) wave we're currently in. They can be very complex and unpredictable at times. Price is right in the area of the 0.382, it hit the smaller red 1.0, and has made a new high above the a wave made on 09 April. I would like to see it breach the (a) wave high of 25 March, but that isn't required. This means it has all the pre-requisites of completion. Will it hit the target box for another high? I think so, but I'm not greedy or try to top tick. 20% profit is good enough for me. The last thing I want to happen is the volatility of Tesla kick in and lose all the profits I just made. Don't be so scared of missing POTENTIAL profits that is causes you to lose the ones you ALREADY earned.

All that being said, I find it likely that we make another high into the target box due to the structure. It looks like it needs one more slight high. The red box is the "sweet" spot, but price can top at any moment. Also, if you look at MACD, it is coming into the trend line and thus is running into resistance. This should make you think a local top is near if not already struck. Let me know if y'all have any questions.

P.S: Don't ask me if you should sell. I already stated I sold my shares and cannot give you financial advice. Trade according to your own portfolio / risk tolerance.

TSLA technically turntUP... so the stock pops on a sob story. there will be action. pullback possible, but doesn't have to. 2-3 week rallies expected while the getting is good.

*weekly bullish close (engulfing)

*pullbacks should not be lower than prev week high (270 good)

*it's big tech earnings, so running during other strong tech success while down is a TSLA thing

tootles

TSLA Long-term Key LevelsIdentified Long-term Key Levels for TSLA

Disclaimer:

The information provided on this TradingView account is for educational and informational purposes only and should not be construed as financial advice. The content shared here reflects personal opinions and is not a recommendation to buy, sell, or hold any financial instrument. Trading and investing involve substantial risk and are not suitable for every investor. You should carefully consider your financial situation and consult with a financial advisor before making any investment decisions. Past performance is not indicative of future results. We do not guarantee the accuracy, completeness, or timeliness of the information provided. Use the information at your own risk.

Tesla Suspends Guidance: Why Its Forecasts Were Often WrongTesla Pulls the Plug on Guidance: Why Its Forecasts Weren't Worth Much Anyway

Tesla, the electric vehicle behemoth that has captivated and often confounded investors for over a decade, has made another move guaranteed to stir debate: it's suspending its forward-looking guidance. For many companies, withdrawing financial forecasts signals significant uncertainty or a major strategic shift, often sending shares tumbling. While Tesla's stock undoubtedly reacts to such news, a deeper look reveals a compelling argument: Tesla's official guidance, particularly in recent years, had become such a moving target, so frequently untethered from eventual reality, that its predictive value was already deeply questionable. Suspending it might simply be acknowledging the obvious.

For years, Tesla's earnings calls and investor communications were punctuated by ambitious, often audacious, targets set by CEO Elon Musk and the company. These weren't just vague aspirations; they were often specific numbers for vehicle deliveries, production ramps, timelines for new technologies like Full Self-Driving (FSD), and launch dates for anticipated models like the Cybertruck or the Semi. The market, enthralled by Tesla's disruptive potential and Musk's charismatic pronouncements, frequently hung on these words, baking them into valuation models and trading strategies.

However, the history of Tesla meeting these self-imposed targets is, charitably speaking, inconsistent. The guidance often veered into the quixotic, reflecting a potent blend of extreme optimism, engineering ambition, and perhaps a dash of Musk's famed "reality distortion field."

Consider the infamous "production hell" of the Model 3 ramp-up. Initial targets were wildly optimistic, projecting volumes that the company struggled immensely to achieve, facing bottlenecks in battery production and assembly line automation. While Tesla eventually overcame these hurdles, the timeline and cost deviated significantly from early guidance. Similarly, the promise of Full Self-Driving has been a perennial "next year" phenomenon. While the capabilities of Tesla's Autopilot and FSD Beta have advanced significantly, the arrival of true Level 4 or 5 autonomy, capable of operating without driver supervision under virtually all conditions – as often implied by the timelines suggested in guidance – remains elusive, years behind schedules hinted at in past forecasts.

The Cybertruck provides another stark example. Unveiled in 2019 with a projected start date that came and went multiple times, its eventual, limited launch in late 2023 was years behind schedule, and scaling its unique manufacturing process remains a challenge. Guidance around its ramp-up has been adjusted repeatedly.

This pattern isn't necessarily born from deliberate deception, but rather from a confluence of factors inherent to Tesla's DNA and the volatile industries it operates in:

1. Aggressive Goal Setting: Musk is known for setting incredibly ambitious "stretch goals" intended to motivate teams to achieve breakthroughs. While effective internally, translating these aspirational targets directly into public financial guidance is fraught with risk.

2. Underestimation of Complexity: Bringing revolutionary products to mass market – whether it's a new vehicle platform, a complex software suite like FSD, or novel battery technology – involves navigating unforeseen engineering, manufacturing, supply chain, and regulatory hurdles. Initial guidance often seemed to underestimate these complexities.

3. Market Volatility: The EV market itself is dynamic. Consumer demand shifts, government incentives change, raw material costs fluctuate, and competition intensifies – all factors that can derail even well-laid plans and render guidance obsolete.

4. The "Musk Factor": Elon Musk's public statements, sometimes made spontaneously on social media or during earnings calls, often became de facto guidance, even if not formally enshrined. His optimism could inflate expectations beyond what the operational side of the business could reliably deliver on a set schedule.

Given this history, why did the market continue to pay such close attention? Part of it was the sheer scale of Tesla's ambition and its undeniable success in revolutionizing the automotive industry. Investors betting on disruption were often willing to overlook missed targets, focusing instead on the long-term vision. Past stock performance also created a feedback loop; as the stock soared despite missed guidance, it reinforced the idea that the specific numbers mattered less than the overall trajectory and narrative. Guidance served as a signal of intent and ambition, even if the execution timeline slipped.

However, the context has shifted dramatically. Tesla is no longer the lone wolf in a nascent EV market. Competition is fierce, particularly from Chinese automakers like BYD, but also from legacy manufacturers finally hitting their stride with compelling EV offerings. Global EV demand growth, while still present, has slowed from its previously exponential pace. Tesla itself has engaged in significant price cuts globally to maintain volume, putting pressure on its once-stellar automotive margins.

In this more challenging environment, the luxury of consistently missing ambitious targets wears thin. The decision to suspend guidance now can be interpreted in several ways:

• Pragmatic Realism: Management may genuinely lack visibility into near-term demand, production capabilities (especially with new models or processes), or the impact of macroeconomic factors. Suspending guidance is arguably more responsible than issuing forecasts they have low confidence in.

• Strategic Pivot: Tesla is increasingly emphasizing its future potential in AI, robotics (Optimus), and autonomous ride-sharing (Robotaxi). These ventures have even longer and more uncertain development timelines than vehicle production. Focusing investor attention away from quarterly delivery numbers might be part of a strategy to reframe the company's narrative around these future bets.

• Avoiding Accountability: A more cynical take is that suspending guidance removes a key benchmark against which management's performance can be judged, particularly during a period of slowing growth and heightened competition.

Regardless of the primary motivation, the practical implication for investors is clear: the already thin reed of Tesla's official guidance is now gone entirely. This forces a greater reliance on analyzing tangible results – actual deliveries, reported margins, cash flow generation, progress on FSD adoption rates, and demonstrable advancements in new ventures – rather than promises of future performance.

The suspension underscores that investing in Tesla requires a strong belief in its long-term vision and its ability to execute on extremely complex technological and manufacturing challenges, often without a clear, company-provided roadmap for the immediate future. The focus must shift from parsing guidance to meticulously evaluating performance, competitive positioning, and the plausibility of its next-generation bets.

In conclusion, Tesla's decision to stop issuing formal guidance is less of a shockwave and more of a formal acknowledgment of a long-standing reality. Its forecasts were often more aspirational than operational, reflecting a culture of ambitious goal-setting within a highly volatile industry. While the absence of guidance introduces a new layer of uncertainty, savvy investors likely already applied a significant discount factor to Tesla's projections. The company's future success now hinges more transparently than ever not on what it promises for tomorrow, but on what it demonstrably delivers today. The quixotic forecasts may be gone, but the fundamental challenge of execution remains.

TSLA Setting Up for the Next Big Move?🚘Tesla's been cooking up some serious price action — and now it’s getting interesting. After holding above key supports, bulls might be eyeing their next shot. Here’s the plan I’m watching:

📥 Entry zones:

• 240 (aggressive)

• 215 (ideal support zone)

• 195 (deep discount territory)

🎯 Profit targets:

• 265

• 290

• 355+ (if momentum takes off)

TSLA has been showing signs of accumulation — and if buyers step in near 215–195, we could be looking at the early stages of a powerful move. Of course, nothing is guaranteed. The EV space is competitive, and macro volatility can flip the script fast.

🔍 Keep an eye on volume, trend confirmations, and news that could push sentiment one way or the other.

⚠️ Disclaimer: This is not financial advice. Just sharing my personal analysis and trade idea. Always do your own research and manage risk according to your own strategy.

THE DEATH CROSSDeath Cross Triggered During Consolidation: What It Could Mean

The 50 SMA (blue) just crossed below the 200 SMA (red), signaling a Death Cross—a traditionally bearish indicator. But here’s the catch: this didn’t happen during a steep downtrend. It happened during consolidation.

That changes the narrative.

When a Death Cross forms during a period of sideways chop instead of a clear downtrend, it often reflects lagging momentum, not accelerating weakness. It can trap shorts expecting a breakdown, especially if price is coiling above strong support or forming a basing pattern.

💡 Key things I’m watching:

Does price respect the consolidation range low?

Are we forming a bullish divergence on RSI or MACD?

How does volume behave around the cross?

This may not be a "short and hold" moment—this might be a shakeout before trend resolution. Stay sharp. Don't trade the cross, trade the context.

Tesla Braces for Q1 Earnings: Will Q1 Results Trigger a sell-offMounting Delivery Pressure, Global Boycotts, and Revenue Misses Leave Tesla at a Critical Turning Point

Overview

Tesla shareholders are on edge ahead of the automaker's Q1 2025 earnings report, set to be released on Tuesday, April 22. The results will cover financial performance from January 2024 to March 2025, a period already clouded by deteriorating delivery volumes, narrowing margins, and rising geopolitical headwinds.

Despite once being the undisputed leader of the EV revolution, Tesla's recent track record paints a troubling picture. The company has missed revenue expectations in five of the past six quarters, raising questions about its ability to maintain market dominance as competition intensifies and global sentiment turns increasingly hostile.

Tesla's Earnings History – The Pressure Is Mounting

Quarter Reported Revenue EstimateSurprise (%)

Sep 2023 $23.35B $24.19B –3.46%

Dec 2023 $25.17B $25.60B –1.67%

Mar 2024 $21.30B $22.22B –4.14%

Jun 2024 $25.50B $24.52B +3.99%

Sep 2024 $25.18B $25.47B –1.12%

Dec 2024 $25.71B $27.26B –5.69%

The $1.55 billion miss in Q4 2024 was the worst in over a year and may signal a more systemic weakness in demand. With every disappointing print, the pressure on Tesla's valuation grows—and investors know it.

Global Factors at Play: Boycotts and Geopolitical Fallout

Tesla's earnings concerns are not only internal. A growing global boycott, fueled by rising international tensions and political backlash against Elon Musk's affiliations with U.S. defence and surveillance initiatives, threatens to cut deeper into global sales—particularly in key markets like Europe and China.

China, once a growth engine for Tesla, is showing signs of resistance amid tightening regulatory pressure and rising national preference for domestic EV manufacturers like BYD and NIO. Similarly, European sentiment toward Tesla is deteriorating as the company becomes entangled in broader geopolitical narratives surrounding U.S. industrial policy.

Stock Price Structure: A Technical Breakdown

Technically, Tesla's stock has formed a disjointed channel since early April, a structure often interpreted as indecision or quiet accumulation/distribution by institutional players.

Key Resistance: $244 (22-month support-turned-resistance)

Immediate Support Levels: $213 → $194 → $182

Upside Targets if Reclaimed key resistance: $263 and $275

The price closed at $241 ahead of the Easter break, down more than 50% from the December 2024 peak, a staggering reversal for what was once Wall Street's darling.

What to Watch Ahead

Delivery Volumes: Investors will focus on whether Tesla can stabilize global deliveries amid mounting competition and boycotts.

Margin Compression: Rising costs and aggressive price cuts have weighed on gross margins for several quarters.

Outlook and Guidance: Any hint of softness in Q1 guidance could trigger further downside.

Institutional Positioning: Watch for post-earnings volume spikes to reveal if big money is unloading or accumulating.

Final Take

Tesla is teetering on the edge of a critical earnings report. If Tuesday's release disappoints, the stock could break down below $213, opening the door to levels not seen since mid-2024. While a bullish recovery isn't off the table, it hinges on a strong beat and improved forward guidance—neither of which is guaranteed.

TSLA bottom on Weekly chartI am calling a temporary bottom on TSLA stock due to Ichimoku cloud support on the Weekly chart. Ignore the bad news and all the other things going on. Price is everything. Stop losses should be placed below the cloud support. If It keeps going down and I end up being wrong SO BE IT. If it goes up from here then you can thank me later by buying me a coffee with your profits. But no Starbucks coffee please. I don't consider that coffee, more like road tar. Carry on recruits.

TESLA | Monthly Analysis After NASDAQ:TSLA hitting its ATH target, 87% - 90% retracement is next target

start of 2027 = will be a buying signal for tesla unless there's some issues involving with Elon Musk, then tesla could experience under performance

Long term investors - prepare for down side inside buying channel

We potentially about to see a HUGE move on TSLAWe broke a SUPER LONG-TERM BEARISH TRENDLINE (blue) on the weekly timeframe.

+

We have been RANGING for quite some time...

+

TSLA has a personality of explosive, crazy moves

+

TSLA builds HUMAN ROBOTS... (SUPER HIGH VALUE in my opinion, the potential for this is astronomical)

What do we actually need for this move to materialize?

We need the market in our favor.

Lets see if the market will push strongly up or bleed down.

Please also note that before explosive move previously that no one believed it would happen, the earnings reports of TSLA were RED the same as now.

ALWAYS MAKE SURE YOU MANAGE YOUR RISK.

TSLA Diamond Penet BreakoutThe "TSLA Diamond Penet Breakout" strategy suggests monitoring two critical levels: if Tesla's stock price breaks below the "red" level, it indicates a short position opportunity; conversely, breaking above the "green" level suggests taking a long position. This strategy also forecasts a potential 3% price movement following a breakout in either direction, emphasizing the importance of these defined thresholds for trading actions .