Apparatchik Trump Says 'No.. More Pain' Ahead of Amazon EarningsPresident Trump's new tariffs have had a significant negative impact on Amazon's stock performance, revenue, and earnings, primarily due to increased costs and supply chain disruptions.

Here below is a detailed analysis of these effects.

Impact on Amazon's Stock Performance

Amazon's stock has seen substantial declines following the announcement of Trump's tariff plan. The company's shares dropped nearly 7% within two days of the announcement and are down nearly 21% year-to-date. These tariffs have exacerbated existing challenges for Amazon, which was already struggling in early 2025 with a 13% decline in stock value during the first quarter. The broader market also suffered, with technology stocks experiencing sharp declines as investors reacted to fears of higher costs and inflation.

Revenue Challenges

Amazon's reliance on Chinese suppliers for merchandise has made it particularly vulnerable to the newly imposed tariffs. Over 50% of Amazon's top third-party sellers are based in China, and many of their products are subject to hefty import taxes, including a 34% tariff on Chinese goods. These tariffs increase landed costs for a significant portion of Amazon's inventory, forcing sellers to either absorb the additional expenses or pass them on to consumers through higher prices. This could lead to reduced consumer demand, as higher prices may deter shoppers from purchasing goods on Amazon's platform.

Additionally, the elimination of duty exemptions on minor imports—previously advantageous for discount platforms such as Temu and Shein—has disrupted Amazon's competitive pricing strategy. While this change may level the playing field among e-commerce platforms, it also raises operational costs for Amazon's marketplace vendors who had relied on these exemptions.

Earnings Pressure

The tariffs are projected to slash Amazon's annual operating profits by $5 billion to $10 billion due to increased merchandise costs. Goldman Sachs estimates that these costs could rise by 15% to 20%, further straining profitability. While Amazon has historically maintained lower prices compared to competitors, absorbing these increased expenses without raising prices significantly may be unsustainable in the long term.

Moreover, fears of inflation resurgence due to Trump's trade policies could further dampen consumer purchasing power. This would likely lead to lower sales volumes and additional pressure on profit margins across Amazon's retail operations.

Potential Mitigation Strategies

To counteract these challenges, Amazon may implement several measures:

Vendor Negotiations. The company could negotiate with suppliers to share the burden of increased input costs rather than bearing them entirely.

Price Adjustments. Selective price increases on certain products may help offset rising costs without alienating customers entirely.

Supply Chain Diversification. Shifting sourcing away from heavily tariffed regions like China or focusing more on domestic suppliers could reduce exposure to trade disruptions.

Focus on Services. Amazon’s cloud division, AWS, contributes significantly to its operating income (58% in Q4 2024) and remains largely unaffected by tariffs. Increased emphasis on AWS could help mitigate losses from retail operations.

Technical challenge

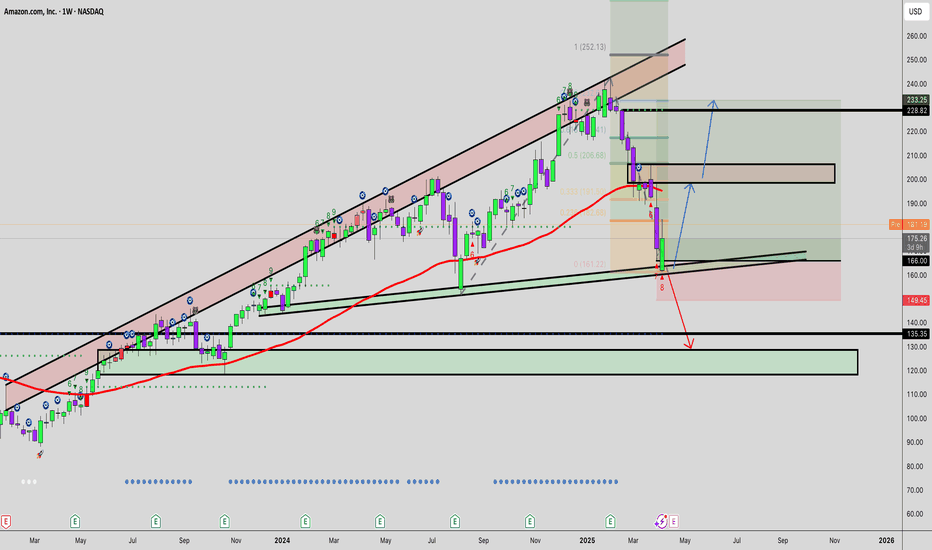

The main technical graph indicates on Bearish market in development, with nearly 30% potential to further decline, down to major 10-year average support.

Conclusion

Trump’s tariffs have created substantial headwinds for Amazon by driving up costs and disrupting its supply chain. These challenges have led to stock declines, reduced revenue potential, and significant earnings pressure. While Amazon is exploring mitigation strategies such as vendor negotiations and diversification, the long-term impact will depend on how effectively the company adapts its operations amidst ongoing trade tensions.

--

Best 'Apparatchik' wishes,

PandorraResearch Team 😎

AMZN trade ideas

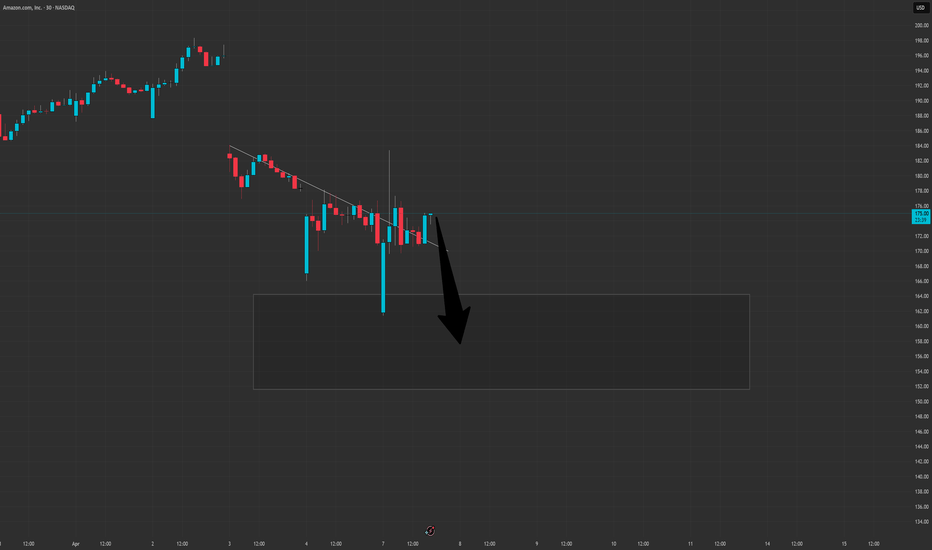

AMZN at a Decision Point! Bulls or Bears—Who Will Win This Week?Technical Analysis (TA) for AMZN – April 7, 2025

After last week's broad-market flush triggered by tariff headlines, AMZN now sits at a key support level near $170, showing signs of weakness but holding a structure that traders should monitor closely.

Market Structure & Price Action:

* Price remains within a descending channel, making consistent lower highs.

* The recent Break of Structure (BOS) confirms bearish control after failing to hold the demand zone near $175.

* Price has now formed a small consolidation box below the BOS, typically a sign of continuation if no bullish momentum appears.

* Support remains weak near $170; a breakdown here opens the door toward the next major level at $165 and potentially down to $160.

* Overhead resistance sits at $184.50, aligned with the upper trendline and a previous liquidity sweep.

Indicators:

* MACD is slowly curling up from deeply negative territory, but still lacks a clear bullish crossover.

* Stoch RSI is oversold but hasn’t crossed up yet, indicating buyers are not yet stepping in aggressively.

GEX and Options Sentiment Analysis (1H Timeframe):

* Put Support (NETGEX) is strongest at $170, exactly where price is sitting now, giving short-term protection to the downside.

* Beneath that, $165 and $160 show substantial GEX negatives, meaning if $170 breaks, downside acceleration is highly likely.

* Gamma Resistance and Call Wall are stacked between $190–$203, with $190 showing the highest positive NETGEX – making it a strong resistance cap.

* IVR 142 and IVx avg 83.4%: Elevated volatility indicates strong market uncertainty.

* PUTs: 16.4% dominance, with 3 red GEX dots = bearish pressure with low call support.

Trade Setups to Watch This Week:

Bearish Continuation Setup (If $170 breaks):

* Entry: Below $169.80

* Target 1: $165

* Target 2: $160

* Stop: Above $173.50

Bullish Reversal (Only if strong reclaim of BOS):

* Entry: Above $176.50

* Target 1: $182.50

* Target 2: $190

* Stop: Below $170

Summary & Suggestions:

* Short-term traders can look to play the breakdown below $170, but must react quickly and respect momentum.

* Investors should stay cautious here. Only consider adding if AMZN reclaims the BOS zone and the market stabilizes.

* With tariff-related volatility still in the headlines, trade with reduced size and tighter stops.

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk before trading.

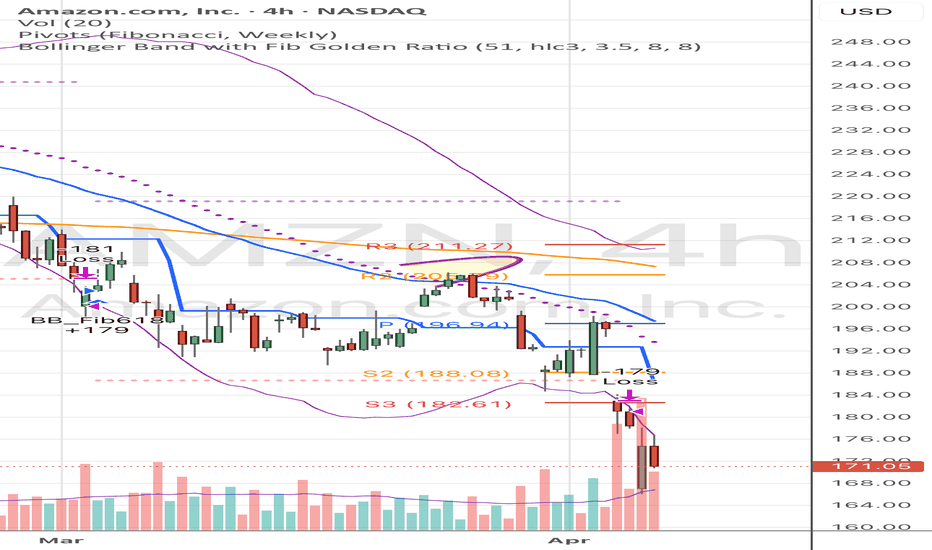

A falling knife - don’t catch it

Analysis on 4H Chart (April 2025)

Amazon (AMZN) experienced a sharp sell-off, currently trading at $171.05, down -7.41% on the session. This 4H chart shows a significant bearish movement, and there are clear signs of trend continuation if key support zones don’t hold.

• Current Price: $171.05

• Weekly Pivot S3: $182.61 (Broken convincingly)

• Next Major Support: Psychological level around $165, and volume profile shows thinning in that region — potential for rapid drop if $170 fails.

• Resistance Levels:

• R1: $196.94 (Pivot)

• R2: $205.79

• R3: $211.27 (Aligns with previous highs)

Volume Profile:

• Sharp increase in bearish volume on the breakdown – confirms strong selling pressure.

• Price has breached the lower Bollinger Band decisively — could mean oversold in the short term.

Trade Ideas

Short-Term Bearish Continuation

• Entry: Below $170 on a retest and rejection.

• Target: $165 (1st target), $160 (2nd target).

• Stop: Above $175

Happy trading

More Downside For AMZN Before CrossroadsMy overall thesis is we are in the very early stages of a multi-year decline ultimately with the S&P 500 below 3500. I am estimating this symbol to be in wave position SuperCycle 2, Cycle A, Primary 1, Intermediate 3 (pink), Minor 3 (yellow), Minute 5(green). I originally had this symbol nearly complete with Primary wave 1, but the continued declines received significant wave 3 of 3 of 3 signals (pink lines in bottom chart band). It is still unclear if we are in my theoretical larger decline or if we are in a simple corrective wave. It will take at least another two months to likely achieve the answer.

Theory 1 is my hypothesis where we are about to finish Minor wave 3 in Intermediate wave 3 in Primary wave 1 in a multi-year market correction. This would see AMZN bottom around 148-156 within two weeks and briefly head up toward 180 before continuing significant downward movement. Currently Intermediate wave 1 lasted 201 trading hours. Based on the breakneck pace of Intermediate wave 3, it may finish well before the 201st hour on 5 May. Extensions based on Minor wave 1's movement could put Minor wave 3's bottom around 162.59.

Theory 2 is that Intermediate waves 1, 2 and 3 (pink) are actually waves A, B, and C (white) in a short-term corrective wave. This would mean this symbol returns to all-time highs around the fall of 2025.

Theory 3 places the stock in the third wave about to finish a wave A down. Wave B up would last a few months before wave C takes the market to a bottom sometime around the end of 2025.

All three theories will observe the same movement over the next few weeks with a low soon and then a bounce up. Theory 2 becomes the likely winner if AMZN breaks above 206.21 within the next 2 months. Theories 1 and 3 will trade the same for quite some time.

I will reevaluate this stock once Minor wave 3 finishes. It should aid in providing a better bottom for Intermediate wave 3 in the next week or two.

Amazon (NASDAQ: $AMZN) Drops 8% as Trump Tariffs Shake Markets. Amazon (NASDAQ: NASDAQ:AMZN ) is facing huge downward pressure following President Donald Trump's announcement of sweeping tariffs. The stock dropped 9.26% in early trading, reaching $176.92 as of 11:01 AM EDT.

These tariffs impact over 100 countries, including China, a key supplier for third-party merchants on Amazon’s platform. Rising import costs could push prices higher, affecting consumer spending and Amazon’s profit margins.

Looking at the broader market, it is also struggling from the tariffs. The Magnificent Seven stocks, including Apple, Nvidia, Meta, Tesla, Alphabet, Microsoft, and Amazon, have all seen huge drops.

Amazon’s 8% drop is among the largest, further highlighting its vulnerability to trade disruptions. If these tariffs persist, they could reignite inflation, weigh on economic growth and further impact stock prices. Amazon has faced major market shifts in the past. In 2022, its stock lost over 50% of its value within a few quarters.

The question now is, can the current decline lead to similar losses?

With Amazon trading at $242 in February, some fear it could drop below $120 if the economic outlook worsens.

Adding to concerns, geopolitical risks remain high. The ongoing war in Ukraine, coupled with uncertainty over future U.S policies, creates a volatile environment for stocks. Amazon’s reliance on global supply chains and consumer spending makes it highly sensitive to market shocks.

Technical Analysis

Looking at Amazon technically, there has been a downtrend since early February when it reached an all-time high and a 52-week high of $242. This peak came shortly after the presidential inauguration, but since then, the market conditions have not been favorable. The introduction of new tariffs has fueled bearish momentum, pushing Amazon lower toward key support levels.

Currently, the stock is testing a double support level, an ascending trendline and a horizontal support around $180. If buyers step in at this level, a rebound could occur, targeting the previous $252 all-time high. However, given the economic uncertainty, there is a strong chance the stock may break below this current support.

If the weekly candle closes strongly below the $180 level, the next critical point where the stock might find support is around $144. This area has historically provided strong buying interest and it may serve as a potential bottom if the decline continues.

Looking at momentum indicators, the weekly RSI currently sits at 33, indicating strong bearish momentum. Despite the reading approaching the oversold reading, macroeconomic data shows the downtrend remains dominant and further losses could be ahead.

What's the Outlook? Can Amazon Recover Soon?

The coming weeks will be crucial for Amazon’s stock. With earnings expected between April 28th and May 2nd, market sentiment may shift based on revenue growth and profit margins. However, ongoing trade uncertainties and rising costs remain key risks.

For now, monitor price action around the current market price of $180. A strong bullish move could confirm a short-term recovery. On the other side, a break below this double support level may signal a further drop towards $144 support level.

Amazon UpdatePrice made yet another new low since my last post. However, we have some nice pos div at this time and MACD appears to be bouncing off of the trend line. Either way, I do believe that minor A wave will be complete soon and minor B will kick off. Minor B should ideally take us back up to the $220 area. Remember, bottoming is an event while topping is a process.

Congrats on AMZN shorts - posted before it happenedThis trade idea was posted couple days ago and now the target has been met. I believe there might be some more room down but might get some retracement tomorrow before expanding more on Friday, let's see. But if you followed this you're getting bangers tomorrow.

AMZN Swing Trade IdeaWith bearish trend and how price is now taking out buystops and coming into equilibrium/discount, there's opportunity to sell at a premium. This trade idea is based on daily and H4 levels, and considering the fact that Nasdaq (QQQ) becomes bearish rest of the week. With High Impact news remainder of the wick, there might be manipulation to take out more buystops before selling down. We'll see.

AMZN LongBought AMZN Calls due to retracement I called out in January of this year. Bought

250C LEAPS with min 15 months expiration.

1. Key weekly S/R level reached {$190}

2. Weekly uptrend established in 2022

3. Golden ratio Fib level

4. 5m time frame illustrating inverted head and shoulders candle pattern.

5. 5m time frame entry based on local down trendline break.

*Not trade advice. Information is for entertainment only*

Consider a Long Position on AMZN Amid Market Volatility

-Key Insights: With the current market trend showing increased volatility

highlighted by broad index declines, investors should consider focusing on

Amazon's support levels for strategic entry points. Despite not having a

specific current market price available, the historic support levels at $190,

$180, $170, and $150 provide critical zones to watch. These levels suggest

possible stabilization points where buying interest might converge, potentially

offering compelling entry opportunities should the price approach within these

ranges.

-Price Targets: For the upcoming week, consider a long position with realistic

targets and stops:

- Target 1 (T1): $195

- Target 2 (T2): $205

- Stop Level 1 (S1): $175

- Stop Level 2 (S2): $165

-Recent Performance: In light of recent 2% drops across major indices and tech

sectors, including tech-heavy stocks like Tesla, Amazon is likely facing similar

pressures. This environment of heightened volatility has contributed

significantly to cautious investor sentiment around Amazon and its big tech

peers.

-Expert Analysis: Expert consensus advises a defensive approach, emphasizing

monitoring key support levels and considering historical trading patterns in

anticipation of market corrections or rebounds. This strategic perspective helps

position investors to take advantage of any downturns for potential longer-term

gains.

-News Impact: Though no specific current news events affecting Amazon were

identified, it is crucial for investors to stay informed about general market

conditions and the impact of broader tech performance. Understanding these

dynamics will assist investors in navigating through current uncertainty,

enabling a more informed trading strategy.

By aligning trading actions with these insights and ensuring a keen eye on both

broader market signals and Amazon's key support levels, investors can

effectively position themselves to potentially capitalize on AMZN's pricing

movements in the week ahead.

Amazon (AMZN) is Entering a High-Probability Reversal Zone!

1. Market Structure & Price Action (1H Chart)

* Trend: AMZN is currently in a short-term bearish trend after rejecting from the $207 supply zone.

* CHoCH (Change of Character): The recent CHoCH around ~$198 confirms bearish control.

* Price Range: Current price is consolidating in the $191–193 zone, a potential SMC Reversal Block.

* Support Zone: $189–190 (FVG + previous demand and lowest Bid/Ask zone).

* Resistance: $198.76 (prior CHoCH zone), then $202.5–207.5.

2. Indicators

* MACD: Histogram flipping bullish with MACD line above the signal line — signaling early momentum.

* Stoch RSI: Moving up from oversold, crossing bullish — momentum is building.

3. Smart Money Concepts (SMC) Highlights

* Reversal Zone (marked): Price has entered a key bullish mitigation zone where demand previously absorbed supply.

* Internal Trendline Break: If price breaks above $195, it could trigger a BOS (Break of Structure) and change direction.

* Liquidity Grab: Previous lows at ~$189 may have been swept to trap shorts.

4. Options Flow & GEX Insights

* GEX Levels:

* Highest Positive GEX/Call Resistance: $207.04

* Major GEX Walls: $202.5, $205

* Strong PUT Wall: $185 (Highest negative NETGEX / Support)

* IV & Positioning:

* IVR: 56.6

* IVx Avg: 46

* Put%: 2.1% — 🟢 Very low put hedging pressure, bullish

* GEX Color: 🔴🔴🔴 (Bearish zone but near bottom range)

5. Trade Scenarios

🟢 Bullish Setup

* Entry: $192.5–193 (retest of reversal zone)

* Target 1: $198.76 (gap fill + CHoCH)

* Target 2: $202.5–205 (mid gamma wall)

* Stop Loss: Below $189

🔴 Bearish Setup

* Entry: If rejection below $195 with weak volume

* Target 1: $189.3

* Target 2: $185 (GEX PUT support)

* Stop Loss: Close above $198.76

6. Sentiment & Bias

* Bias: Cautiously Bullish

* Price is near exhaustion zone with momentum starting to flip.

* Watch closely for confirmation above $195 for long setups.

* Failure to hold $189 may break structure downward.

Conclusion

AMZN is sitting in a key inflection zone where Smart Money may step in. Momentum and indicators are turning up, but macro resistance at $198–202 must be cleared. Use tight risk management and let confirmation guide your trade.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk accordingly.

Resistance or Rebound?

Amazon's chart is hanging around $192. Think of this zone as a tug-of-war between buyers and sellers. It's acted as support before, but can it hold again? If it fails, look out below! On the upside, cracking through the $216 resistance could signal a breakout. Will Amazon finally break free, or is it destined for more sideways action? What's your game plan? Are you accumulating near support or waiting for a clear breakout?