Breadbasket Basics: Trading Wheat Futures🟡 1. Introduction

Wheat may be a breakfast-table staple, but for traders, it’s a globally sensitive asset — a commodity that reacts to geopolitics, climate patterns, and shifting demand from dozens of countries.

Despite its critical role in food security and its status as one of the most traded a

Wheat Futures

521'6USX / BUAD

−7'4−1.42%

At close at May 9, 18:19 GMT

USX / BUA

No trades

No news here

Looks like there's nothing to report right now

Wheat Trade ideaWheat has been in a downtrend for the past two years, but right now it’s sitting in a strong demand zone on the weekly chart for the year. Both the technicals and fundamentals are starting to look bullish, so this could be a solid setup for a long trade even if the overall trend is still down.

On T

CLong

Wheat / ZWN2025 / ZW1! - Price action at weekly supportWheat futures have had an interesting short-term price action character change, with a Higher-High printing on the H1. The price action is happening on a weekly level that has formed over the last year. Seasonality also favours wheat higher in the short term, although that is not the basis of this t

CLong

Wheat Poised for a Seasonal Breakout – Key TechnicalsWheat Futures Update –

Focus: Spring Setup + Multi-Timeframe Convergence

📈 RSI

RSI on both 1H and 4H charts bounced from oversold in March and continues to rise. This shows improving momentum with no signs of overbought stress yet. Bullish divergence at the lows confirms the current rebound.

⚡

CLong

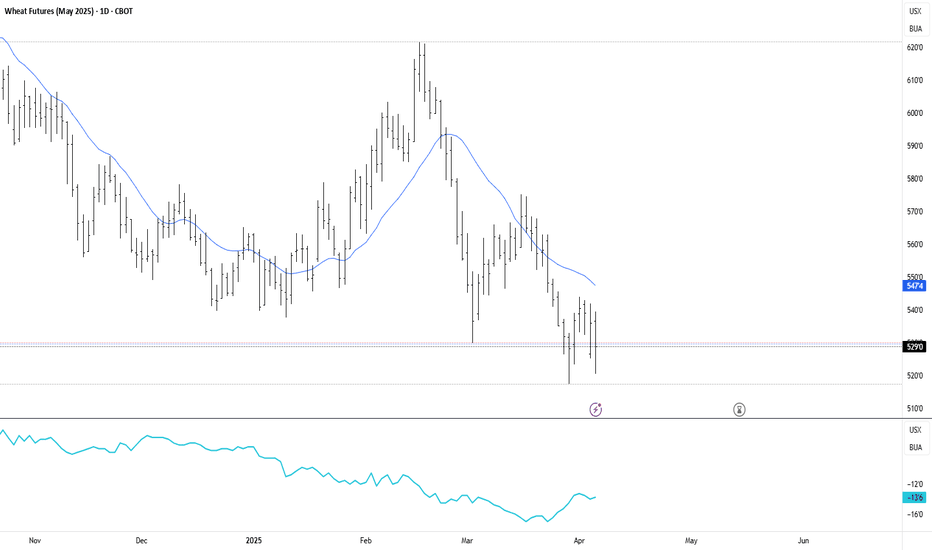

Wheat Futures Under Pressure: Breakdown Near Key Support

Short-term trend: Bearish. Price is consistently making lower highs and lower lows since late February.

Medium-term trend: Also bearish, as confirmed by price staying below the midline of the Bollinger Bands.

Price is near the lower Bollinger Band, suggesting it is oversold in the short term. Ho

CShort

Wheat ShortZW1! futures is now net short on the regression break.

The roll on this (+2.6%) in the short direction

CShort

Will Dry Soil Lift Wheat's Price?Global wheat markets are currently experiencing significant attention as traders and analysts weigh various factors influencing their future price trajectory. Recent activity, particularly in key futures markets, suggests a growing consensus towards potential upward price movements. While numerous e

CLong

Start of the bullish multi year cycle Maybe witnessing the start of a multi year bullish cycle. Not only prior highs seem a great return, but the possibility of a giant cup and handle pattern up to the 200% extension seems a great in terms of risk vs reward

CLong

Wheat LongWheat ZW1! Futures are now net long.

The roll is negative (-2.5%) long. I am not taking this trade.

CLong

I've Cracked the Bullish Code in Chicago Wheat Using COTZW (Chicago Wheat) is setup for longs based on COT positioning and other fundamental indicators.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

ZWK2025

May 2025DMarket closed

505'4USX / BUA−1.46%

ZWN2025

Jul 2025DMarket closed

521'6USX / BUA−1.42%

ZWU2025

Sep 2025DMarket closed

536'4USX / BUA−1.38%

ZWZ2025

Dec 2025DMarket closed

558'2USX / BUA−1.37%

ZWH2026

Mar 2026DMarket closed

577'0USX / BUA−1.33%

ZWK2026

May 2026DMarket closed

587'6USX / BUA−1.30%

ZWN2026

Jul 2026DMarket closed

594'4USX / BUA−1.20%

ZWU2026

Sep 2026DMarket closed

607'2USX / BUA−1.10%

ZWZ2026

Dec 2026DMarket closed

624'0USX / BUA−0.99%

ZWH2027

Mar 2027DMarket closed

637'2USX / BUA−0.86%

ZWK2027

May 2027DMarket closed

641'6USX / BUA−0.81%

See all ZW1! contracts

Frequently Asked Questions

The current price of Wheat Futures is 521'6 USX / BUA — it has fallen −1.42% in the past 24 hours. Watch Wheat Futures price in more detail on the chart.

The volume of Wheat Futures is 54.21 K. Track more important stats on the Wheat Futures chart.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Wheat Futures this number is 266.85 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Wheat Futures shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Wheat Futures. Today its technical rating is strong sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Wheat Futures technicals for a more comprehensive analysis.