LE1! trade ideas

View on Live Cattle (26/11)Likely to see price drop in this and next week

Looking for potential buying set up at the start of 2nd week of december.

remain bullish bias unless price breaks below 102.5

Disclaimer:

The information contained in this presentation is solely for educational purposes and does not constitute investment advice. We may or We may not take the trade.

The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable to your own financial situation.

I am not responsible for any liabilities arising from the result of your market involvement or individual trade activity

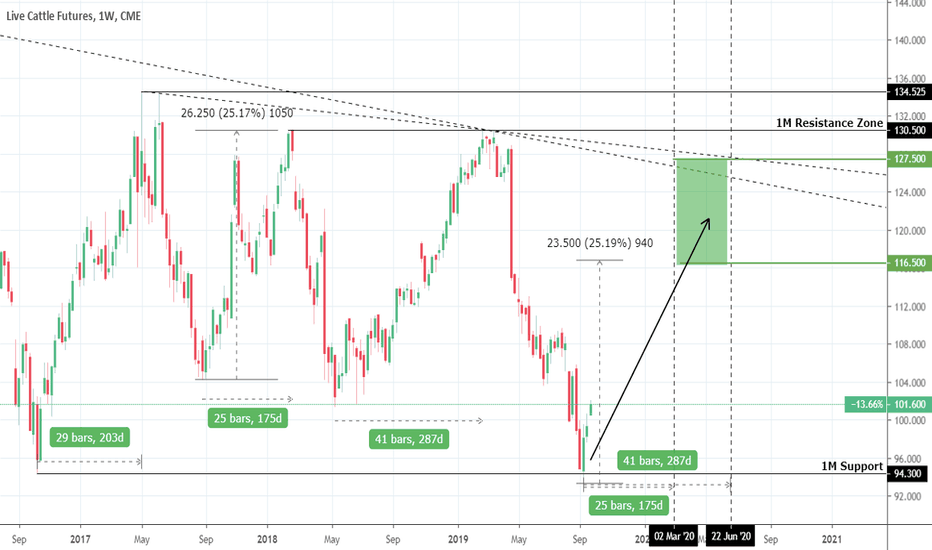

Live Cattle: Strong long term Buy Opportunity.Live Cattle has hit this month the 94.300 1M Support, with the last time we saw these levels being in October 2016. The price appears to be trading within a long term Rectangle within 94.300 and the 130.500 - 134.525 Resistance Zone. The current 3 week rebound on the 1M Support makes LE an automatic long term buy opportunity. We are therefore long at the moment and having calculated all possible scenarios within this Rectangle, we concluded that profit should be taken within 116.500 - 127.500. Take advantage of this opportunity based on your won risk tolerance levels.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

live cattle futures daily analysisHi friends

the daily chart of this market shows that it will experience a downtrend in the next few days with a very high probability at the same time it is better to be vigilant of the change of direction towards the opposite

please subscribe to receive more analysis

USMEF anticipates strong rebound for beefJune beef exports were on par with the May lows, down 33% from a year ago. Exports were lower than the previous year to most markets except for Canada, China and South Africa where official figures showed an increase. Exports accounted for 9.7% of beef production in June, down from 15.4% a year ago, the lowest in 10 years.

Historic Seasonality data shows August returns an average of 0.071%, September 0.428%, October 1.387%, November 0.925% and December 0.623%. Multi-year Inside trendline support (A) (now resistance) junctions with 50% fib level (1), taken from the January highs of this year and the April lows. Watch for increased buying pressure above this resistance zone, with a first weekly target of 114s. Weakness around these current levels will most likely result in revisiting first significant support at 100.475.

Live Cattle LongLive Cattle has seen prices at a high of 127-130 over the last 3 years. Price has bottomed at the end of April 2020 and since been on the rise.

Looking for price to retrace back towards the prior swing high.

1. Enter - on next candle

2. Stop - around 98.35 ( 3 atr )

3. Target - around 115.50 ( .618 extension )

4. Risk Reward = 2.8

Cattle prices in Brazil. Time for a REVERSAL!!!!With the high demand from China and some plants closing down due to COVID, the cattle prices in Brazil have just gone up since April. Today was the first real candle but it stopped at he 21 exp mov average.

The country has started to reopen the plants, COVId infection likely reached its plateau and we can expect the imbalance of demand supply to go to normality.

It is totally achievable to see prices of 210 or 200 very soon. Cattle prices in the US will bbe highly dependable of USDBRL correlation.

Live Cattle is bullLive cattle is bull.

Early May it jumped from 87 to 94, and next day hitting 98.

This breakout caused in the days to follow some oscillating within the 92-100 band, forming a clear up channel.

Market hit 100 yesterday, found support on the mid channel level and closed just below 100. I’m pretty sure we will test it again today.

My believe is this breakout, plus the upward channel, will result in new local high’s.

We have clearly broken out of the downward trend of the last months.

Once we break the 100 level, others will step in and this could lead to a decent bull trend.

LE1 Live Cattle Futures TradeEnd of 3 drive pattern at a double bottom of 2010 and 1.618 Fib of last move.

Risk with falling knife but enter with STOP of about $400.

Best if you watch this area on a smaller timeframe chart like 2-4 min and watch

for a break out candle heading above the 20 day MA or buy on the retest of the

.382 Fib from the low. Could consider "COW" as livestock etf as well. Cattle & Hogs

trade similar. I only trade these a couple times a year so don't risk the farm on my view!

Blessing

Live Cattle (LE1) ShortSo, my last analysis on live cattle was April 28th 2019 where i talked about the possibility of live cattle breaking support and going further down and it went much further than i thought. In my opinion, with the increasing "news" of coronavirus, I believe live cattle will continue on its trend downwards and will find support at the next support level/s identified on the chart. Enter and exit at your own risk.

DISCLAIMER

Please note that this chart is an opinion based chart only. Please trade at your own risk

LEV2020-LEZ2020: Spread on Live CattleLEV2020-LEZ2020

Commodity Spread Trading is an advanced way to profit statistically from the differences that occur in the commodity futures market based on Contango or Backwardation situations.

These statistics are offered by online software and allow for amazing performance.

So far we have achieved the highest gains in relation to drawdowns with this way of trading,

Here we enter Short on the Live Cattle Spread buying the October Futures and selling the December Futures.

Happy Trading to All!

LEZ2020-LEQ2020 - Spread on Live CattleLEZ2020-LEQ2020

Breakout of the resistance level on this inversion pattern in the Spread between the two futures contracts on Live Cattle.

The parameters respect our strategy and we are approaching the seasonal window that statistically ends on January 29th with 93% of chances to get profit from it.

Cattle to close gap?!The break of the tenkan on the Daily shows we have lost the positive momentum we had generated at the end of October. In fact the momentum was so high at that period that we created a big gap, the close of which is the basis of our trade.Price just couldn't go past the SSA on both the weekly and the monthly creating this slowdown in momentum we intend to capitalise on .We take some off the table around the daily kijun area and the rest on completion of the gap close. The lagging is in check and has no obstacles beneath it.

Entry: 2 small position at 118.100

SL: 120.800 ( safely above the highs)

TP1: 114.650 (daily kijun area)

TP2: 112.925 (completion of gap close)

NB: The whole point of trading is to make a modest return risking as little as possible. Risk management is key!