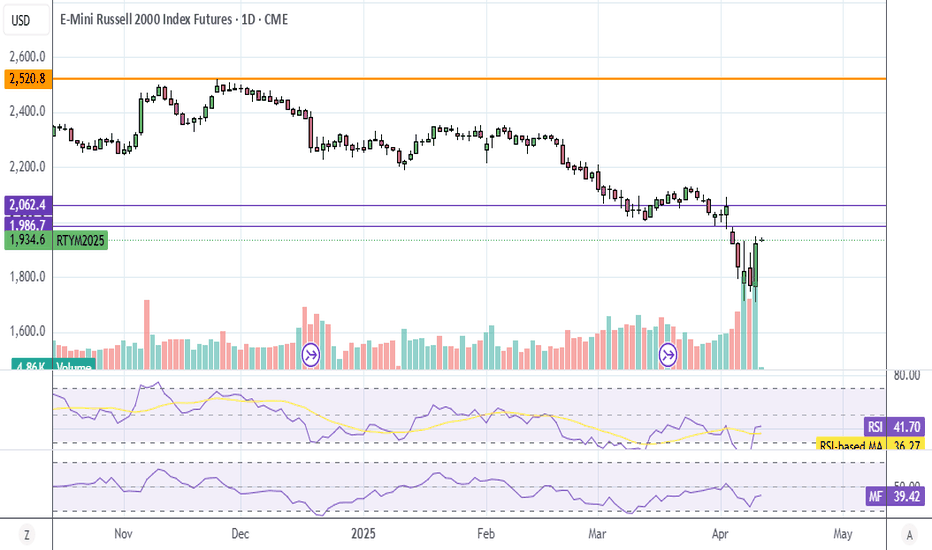

Russell 2000: Signs of Topping as Macro Risks LoomRussell 2000 futures look sluggish heading into a week laden with macro risk events. Given the cyclical characteristics of the underlying index, any hint of weakness may amplify U.S. recession fears, increasing the risk of renewed downside for stocks.

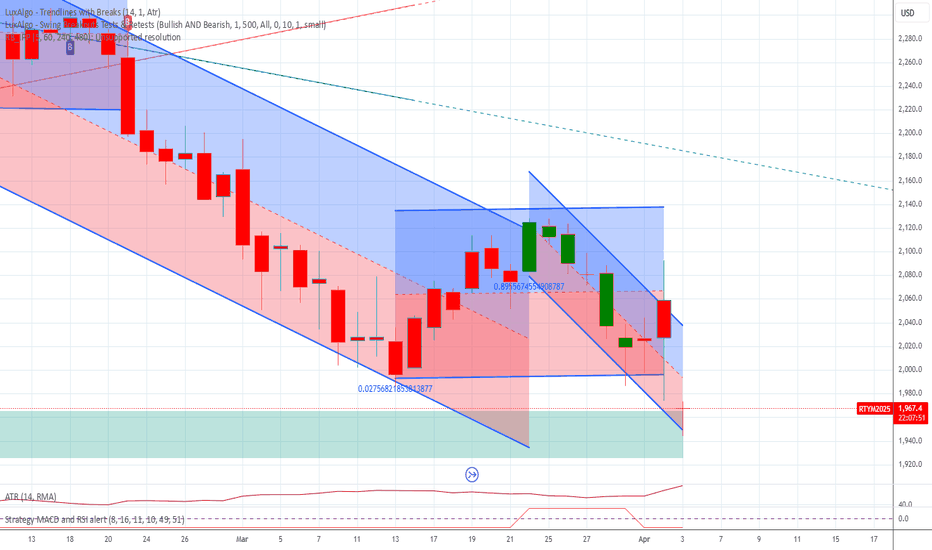

Sitting within what resembles a rising wedge an

E-Mini Russell 2000 Index Futures

2,026.8USDD

+44.8+2.26%

At close at May 2, 20:59 GMT

USD

No trades

No news here

Looks like there's nothing to report right now

MAY 1ST - BULLISH IDEA - M2K- RUSELLThe market seems to fill the 4 hours gap, and took al liquidity acumulated, now it's has all the path free to visit the daily bearish order block.

CLong

RTY Daily UpdateSmall caps got hit hardest by the tariffs, fell the most, went up the least today, and has the furthest to go to fill the futures gap and also the all time high (ATH).

I think RTY (IWM ETF) will outperform ES/NQ (SPY/QQQ) the next 90 days as Trump unwinds all of the tariffs including the 10%. He'l

CShort

Russell2000 Futures ShortRTY1! Future is now net Short on the regression break.

I am not taking this trade.

CShort

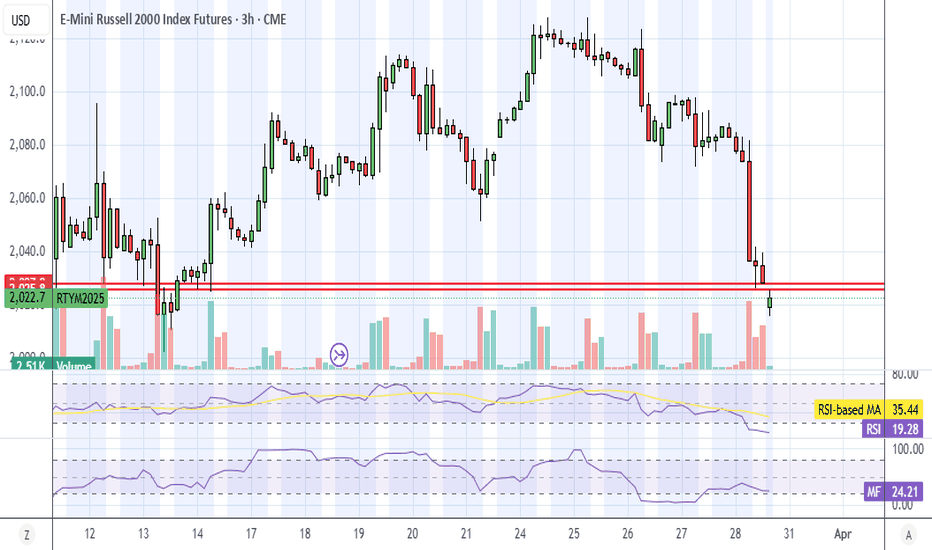

Russell 2000: Squeeze Potential BuildsWith uncertainty surrounding U.S. trade policy about to be resolved and price signals turning bullish, the ingredients for a squeeze in Russell 2000 futures are now in place.

Unlike other stock indices with far larger constituents, U.S. small caps have lagged this week’s rebound—potentially due to

CLong

RTY One hour time frame_LONG_+779 TicksThe RTY one hour time frame is in an up trend.

The market is making higher highs and higher

lows. The market has an up Fibonacci with an

extension price point 2170.1 about +779 ticks

above the market. As long as the market stays

above the up trend line. It will be a good idea

to look for long ideas

CLong

Russell 2000 Futures: Bearish Reversal in Play?Russell 2000 futures may resume the bearish trend established earlier this year, trading below wedge support following the completion of an evening star reversal pattern on Wednesday.

Shorts could be established on the break with a stop above the former uptrend for protection. Support may be encoun

CShort

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

RTYM2025

Jun 2025DMarket closed

2,026.8USD+2.26%

RTYU2025

Sep 2025DMarket closed

2,042.7USD+2.28%

RTYZ2025

Dec 2025DMarket closed

2,056.8USD+2.28%

RTYH2026

Mar 2026DMarket closed

2,070.9USD+2.28%

RTYM2026

Jun 2026DMarket closed

2,084.9USD+2.28%

RTYZ2026

Dec 2026DMarket closed

2,113.3USD+2.28%

RTYM2027

Jun 2027DMarket closed

2,141.3USD+2.27%

RTYZ2027

Dec 2027DMarket closed

2,169.7USD+2.28%

RTYM2028

Jun 2028DMarket closed

2,197.9USD+2.28%

RTYZ2028

Dec 2028DMarket closed

2,226.1USD+2.27%

RTYZ2029

Dec 2029DMarket closed

2,283.6USD+2.28%

See all RTY1! contracts

Frequently Asked Questions

The current price of E-Mini Russell 2000 Index Futures is 2,026.8 USD — it has risen 2.26% in the past 24 hours. Watch E-Mini Russell 2000 Index Futures price in more detail on the chart.

The volume of E-Mini Russell 2000 Index Futures is 180.07 K. Track more important stats on the E-Mini Russell 2000 Index Futures chart.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For E-Mini Russell 2000 Index Futures this number is 457.81 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for E-Mini Russell 2000 Index Futures shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for E-Mini Russell 2000 Index Futures. Today its technical rating is buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of E-Mini Russell 2000 Index Futures technicals for a more comprehensive analysis.