XAUUSD – New Week Technical Bias (Market Open)

Bias Overview:

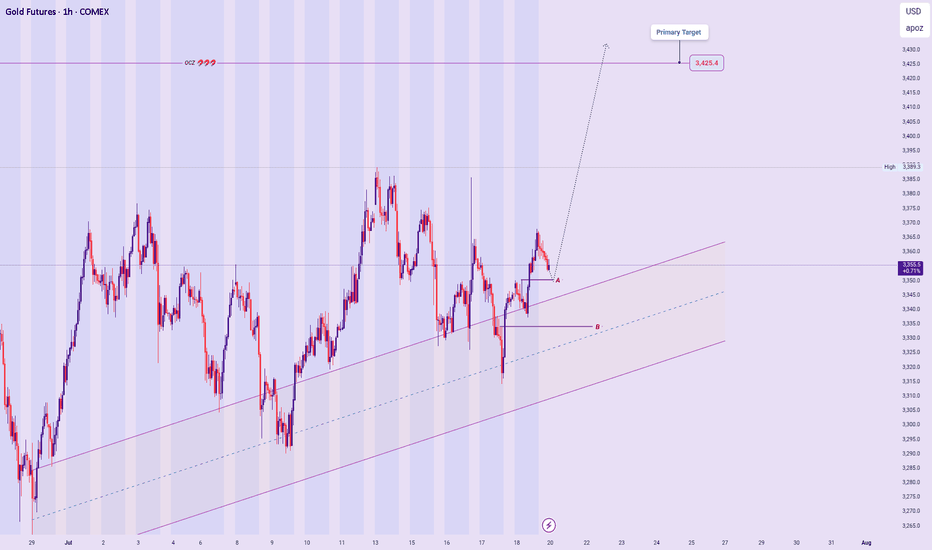

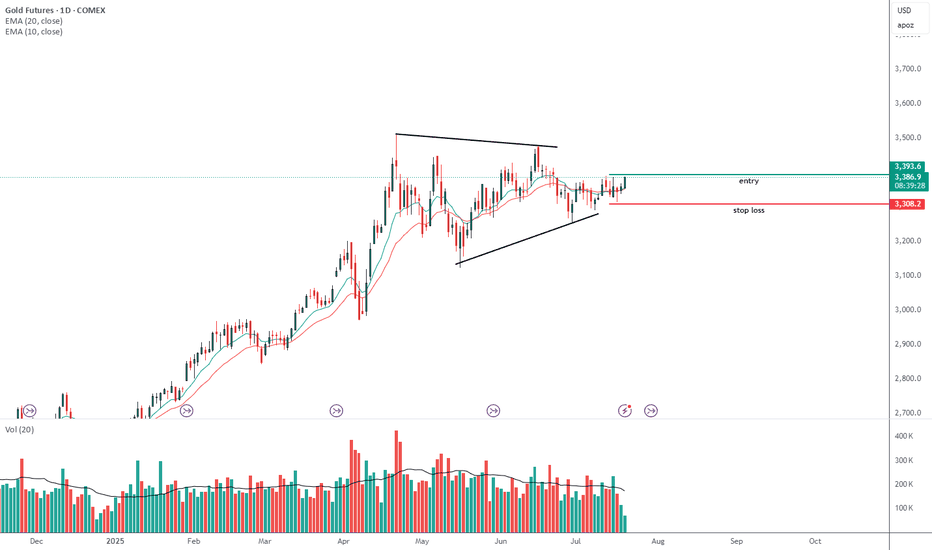

Current outlook remains aligned with previous bullish analysis, supported by the broader Ascend Sequence on higher timeframes.

Price Expectations:

Anticipating a micro decline toward Price Zone A as a potential springboard for a bullish continuation.

While less likely, a deep

Gold Futures (Jul 2025)

3,433.6USD / APZD

−5.6−0.16%

As of today at 02:54 GMT

USD / APZ

No trades

Contract highlights

No news here

Looks like there's nothing to report right now

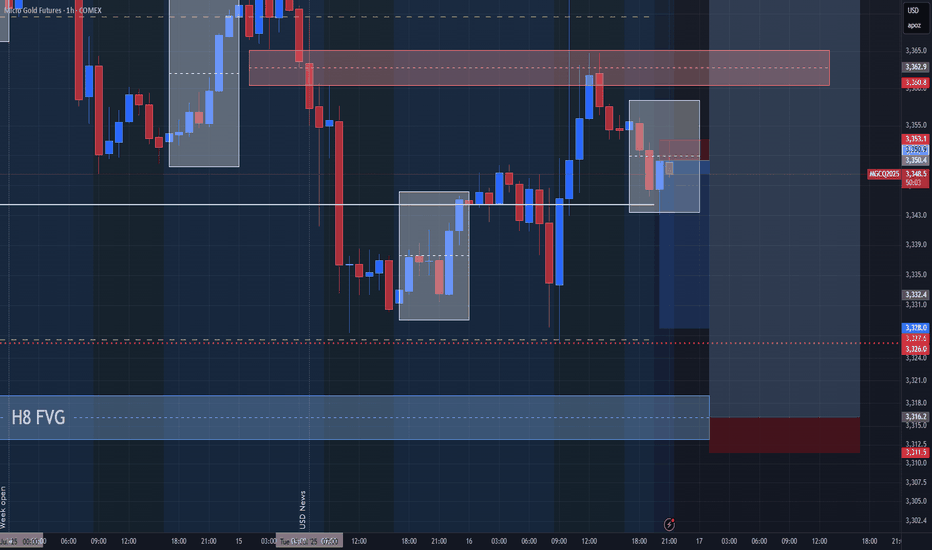

Twitter Speculation sent Gold FLIP Floppin!So yesterday there was a few Tweets that caused chaos in the market. Fed Rumors about Powell getting fired. Im still looking for my long. Waiting for a sweep on levels before getting active.

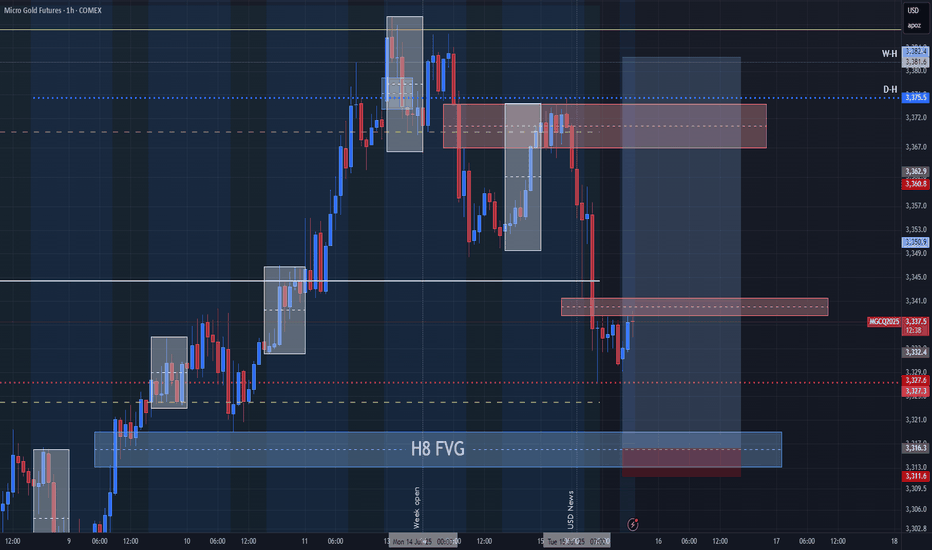

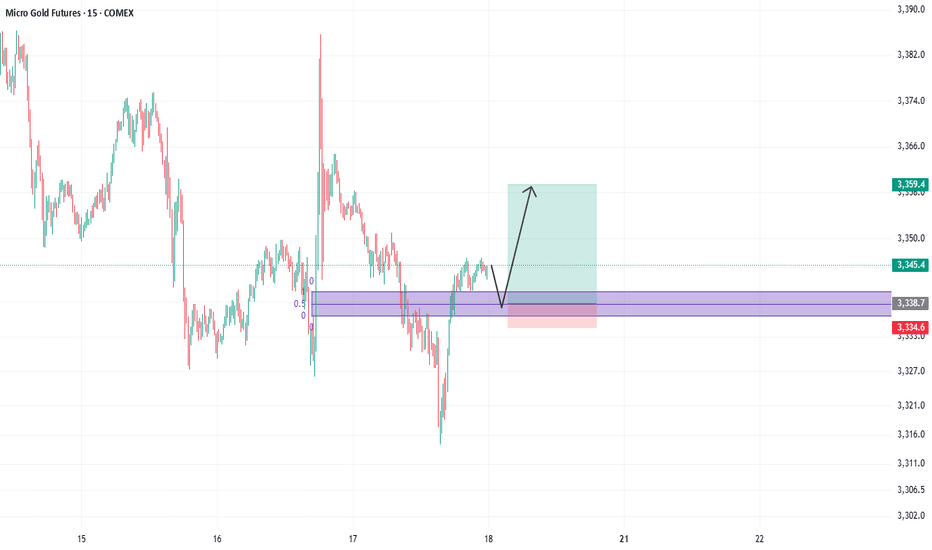

Longing GoldWell, it does look like a good long trade in here.

My confidence is moderate in this trade.

I would say 4 out of 10, this could hit. personally iam going to take this trade but will be more cautious with the amount of contracts that i will be putting on the line.

CLong

CLong

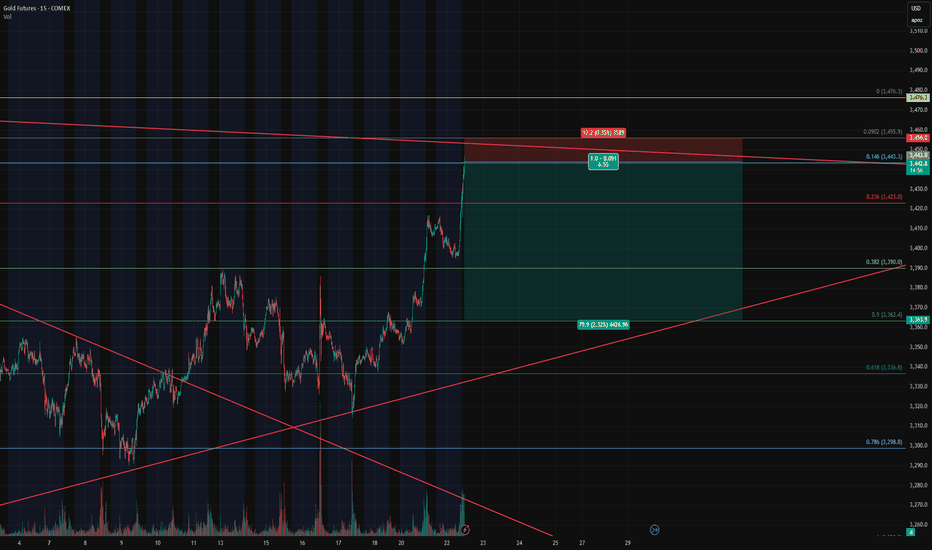

Gold Futures – Closing Longs and Flipping Short at Key Fib🔴 Gold Futures – Closing Longs and Flipping Short at Key Fib Confluence

Instrument : Gold Futures – COMEX ( COMEX:GC1! )

Timeframe : 15-Minute

New Position : Short

Entry Zone : ~3442

Target : ~3362

Stop Loss : ~3458

Risk/Reward : Approx. 6.5+

Setup Type : Reversal from Overextension / Fi

CShort

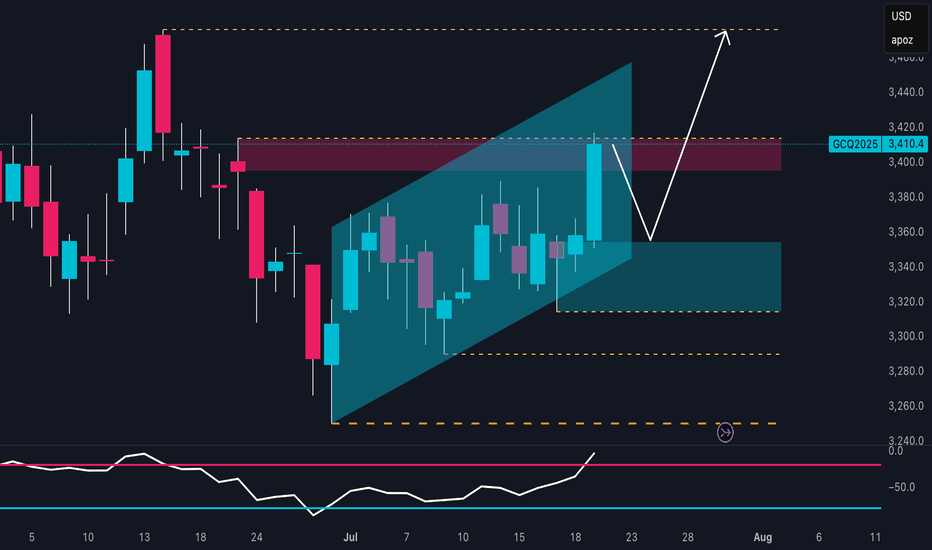

Gold. 14.07.2025. The plan for the next few days.The nearest resistance zones are where it's interesting to look for sales. It's not certain that there will be a big reversal, but I think we'll see a correction. We're waiting for a reaction and looking for an entry point.

The post will be adjusted based on any changes.

Don't forget to click o

Gold is Setting up for another moveLooking for price to make some impulsive moves before we get active. Looking like they are trying to establish a low for the week before they go full on bullish. waiting for them to find that bottom.

Gold Bulls Reloading? Smart Money Buys!The technical outlook on XAU/USD shows a well-defined bullish trend, developing within an ascending channel that started in late June. Price recently pushed toward the upper boundary of this channel, reaching a key resistance zone between 3,410 and 3,420 USD, which aligns with a previous supply area

CLong

This is a good video7.14 . 25 this is a great video because there are so many examples of patterns to look at and there weren't that many markets that I was following and about 3 or 4 of the markets actually had dramatic movement in the direction you would expect and this is an example of setting up your pattern and

GC Ready to Bleed? This Setup Has Teeth.As we head into the new trading week, GC presents a clean, disciplined short setup developing right below Friday’s key high. Price tapped the Previous Day High ($3,368) and supply zone before rejecting, failing to hold bullish momentum into the weekend close.

The market structure is currently defin

CShort

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

GCN2025

Jul 2025DMarket open

3,433.6USD / APZ−0.16%

GCQ2025

Aug 2025DMarket open

3,436.6USD / APZ−0.21%

GCU2025

Sep 2025DMarket open

3,451.1USD / APZ−0.22%

GCV2025

Oct 2025DMarket open

3,464.3USD / APZ−0.22%

GCX2025

Nov 2025DMarket open

3,488.1USD / APZ+1.12%

GCZ2025

Dec 2025DMarket open

3,494.6USD / APZ−0.21%

GCF2026

Jan 2026DMarket open

3,516.5USD / APZ+1.12%

GCG2026

Feb 2026DMarket open

3,526.5USD / APZ−0.10%

GCH2026

Mar 2026DMarket open

3,542.6USD / APZ+1.14%

GCJ2026

Apr 2026DMarket open

3,551.0USD / APZ−0.12%

GCK2026

May 2026DMarket open

3,567.5USD / APZ+1.13%

See all GCN2025 contracts

Frequently Asked Questions

The current price of Gold Futures (Jul 2025) is 3,433.6 USD / APZ — it has fallen −0.16% in the past 24 hours. Watch Gold Futures (Jul 2025) price in more detail on the chart.

The volume of Gold Futures (Jul 2025) is 3.00. Track more important stats on the Gold Futures (Jul 2025) chart.

The nearest expiration date for Gold Futures (Jul 2025) is Jul 29, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Gold Futures (Jul 2025) before Jul 29, 2025.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Gold Futures (Jul 2025) this number is 120.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Gold Futures (Jul 2025) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Gold Futures (Jul 2025). Today its technical rating is buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Gold Futures (Jul 2025) technicals for a more comprehensive analysis.