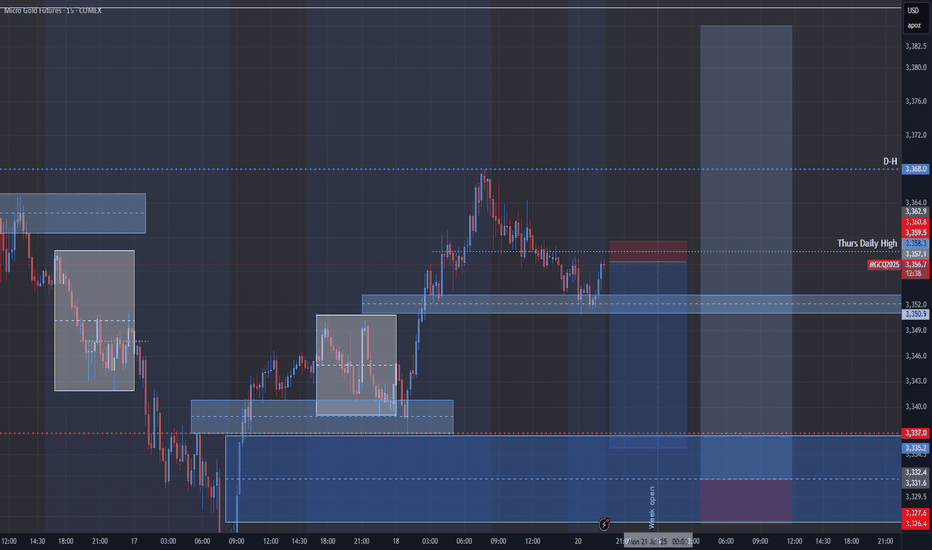

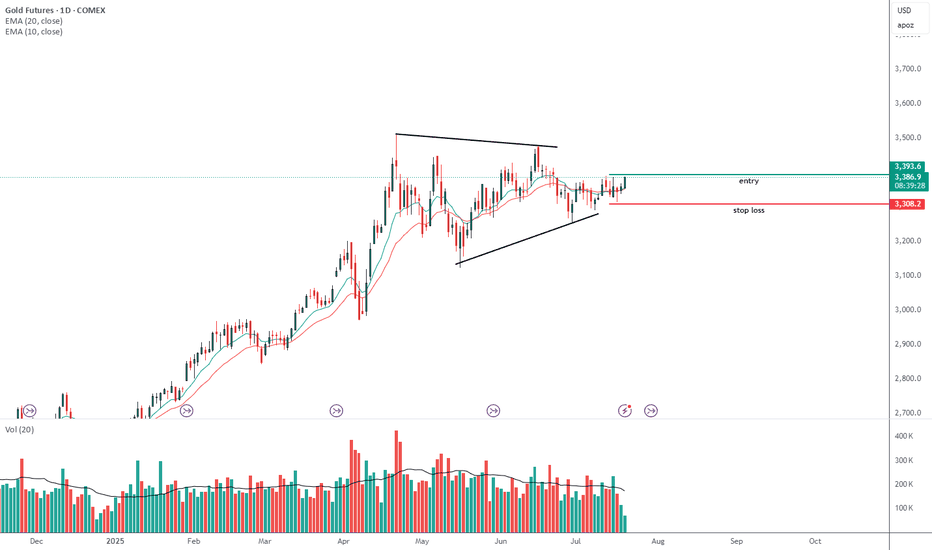

Gold will make a Low for the Week before Pushing BullishOn my previous Update I mention that we should have support off this H4 Gap. My problem with it s it immediately reacted to it when the market opened back up. well before the killzone. So I feel like this is a fake out to go short for now. they will make a low for the week then we will see it set up

Gold Futures (Nov 2025)

3,395.0USD / APZD

−22.9−0.67%

As of today at 08:28 GMT

USD / APZ

No trades

Contract highlights

No news here

Looks like there's nothing to report right now

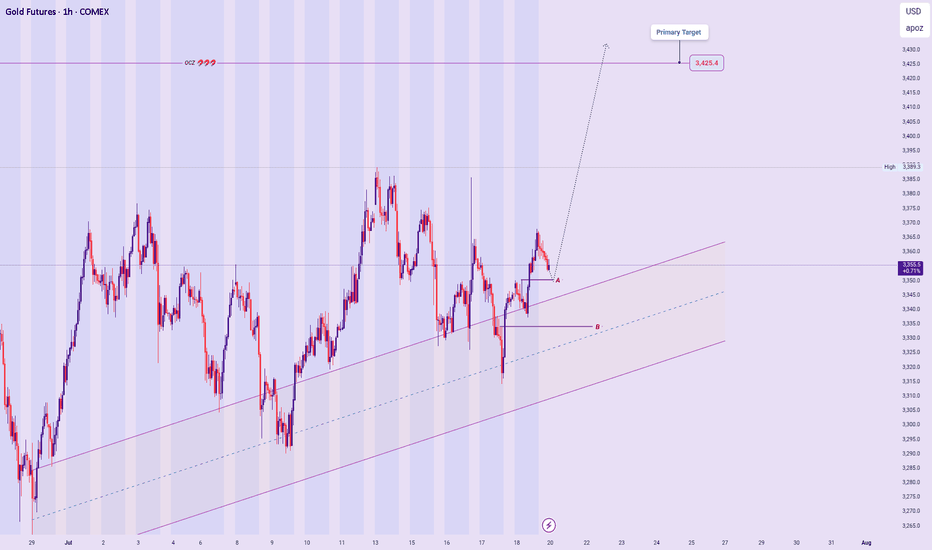

XAUUSD – New Week Technical Bias (Market Open)

Bias Overview:

Current outlook remains aligned with previous bullish analysis, supported by the broader Ascend Sequence on higher timeframes.

Price Expectations:

Anticipating a micro decline toward Price Zone A as a potential springboard for a bullish continuation.

While less likely, a deep

CLong

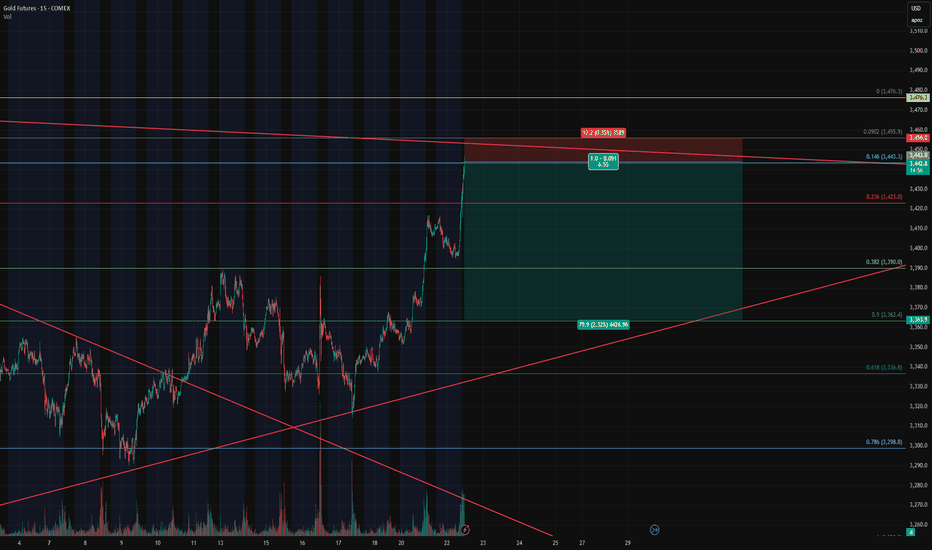

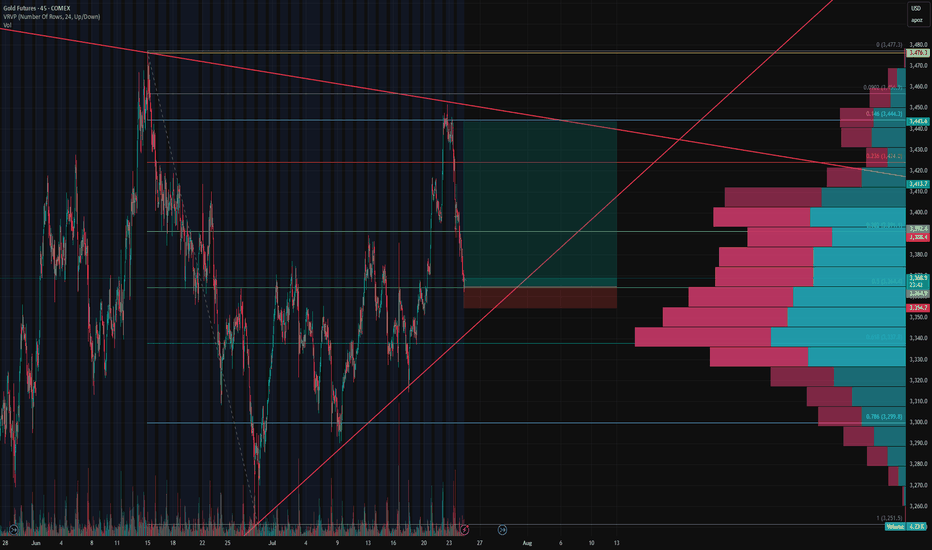

Gold Futures – Closing Longs and Flipping Short at Key Fib🔴 Gold Futures – Closing Longs and Flipping Short at Key Fib Confluence

Instrument : Gold Futures – COMEX ( COMEX:GC1! )

Timeframe : 15-Minute

New Position : Short

Entry Zone : ~3442

Target : ~3362

Stop Loss : ~3458

Risk/Reward : Approx. 6.5+

Setup Type : Reversal from Overextension / Fi

CShort

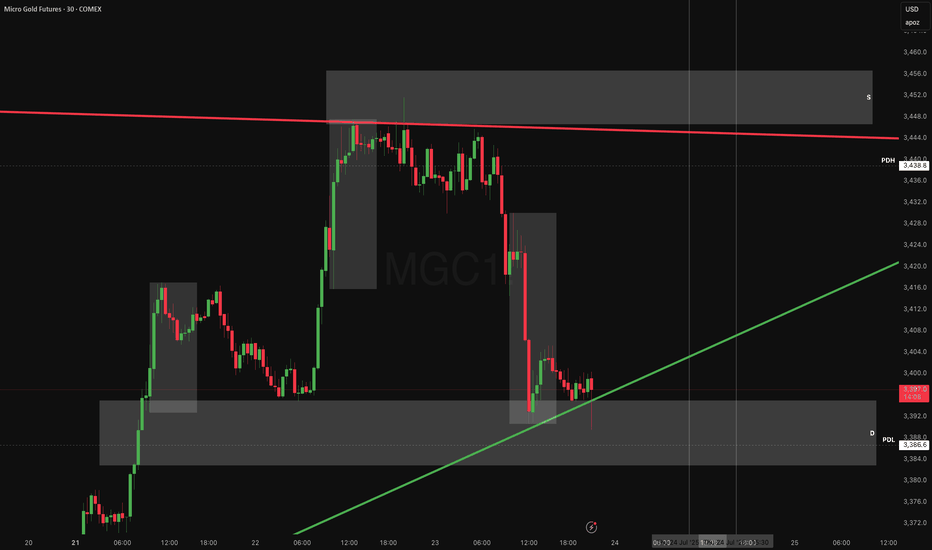

Gold Buyers Barely Holding. Sellers Licking Their Lips.The move on gold over the last two sessions has been clean, aggressive, and very telling. Price rallied hard into a well-defined supply zone between 3452 and 3460, which has acted as a sell-side magnet for the past three rotations.

We got five separate stabs into that zone, all failing to close wi

CLong

Longing GoldWell, it does look like a good long trade in here.

My confidence is moderate in this trade.

I would say 4 out of 10, this could hit. personally iam going to take this trade but will be more cautious with the amount of contracts that i will be putting on the line.

CLong

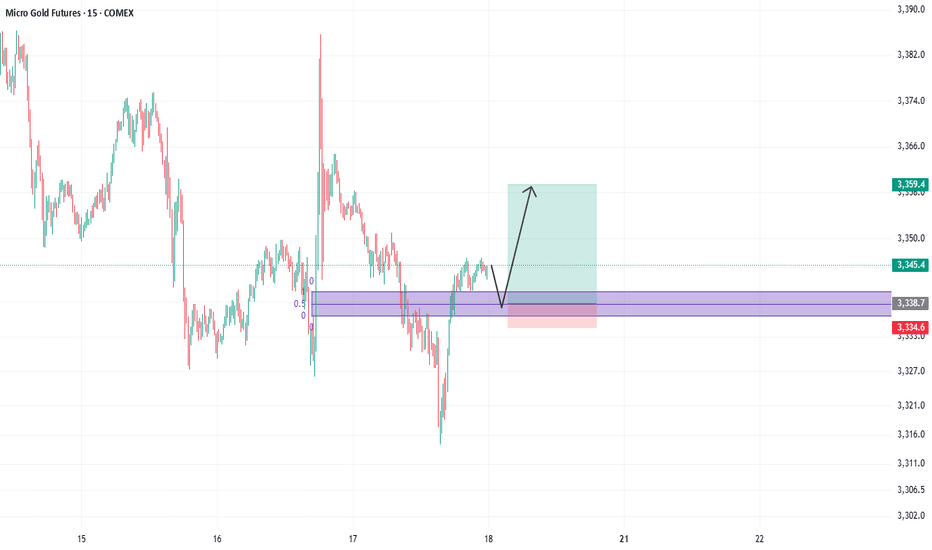

Gold Futures (GC1!) Long Setup – 0.5 Fib Bounce🟡 Gold Futures (GC1!) Long Setup – 0.5 Fib Bounce

After nailing the long from the bottom and perfectly shorting the top, we’re stepping back in for another calculated move.

📉 Price pulled back to the 0.5 Fibonacci retracement, aligning perfectly with the upward trendline support and a key HVN on t

CLong

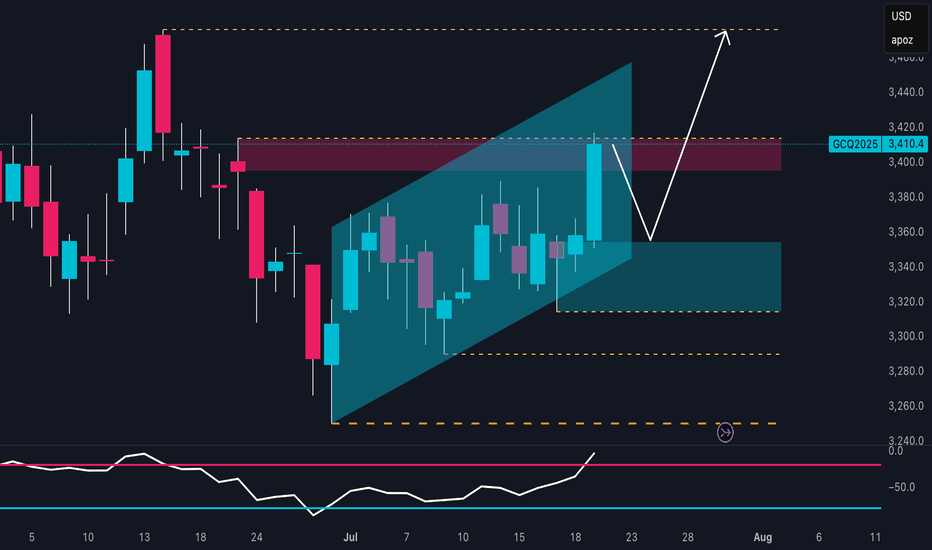

Gold Bulls Reloading? Smart Money Buys!The technical outlook on XAU/USD shows a well-defined bullish trend, developing within an ascending channel that started in late June. Price recently pushed toward the upper boundary of this channel, reaching a key resistance zone between 3,410 and 3,420 USD, which aligns with a previous supply area

CLong

Gold. 14.07.2025. The plan for the next few days.The nearest resistance zones are where it's interesting to look for sales. It's not certain that there will be a big reversal, but I think we'll see a correction. We're waiting for a reaction and looking for an entry point.

The post will be adjusted based on any changes.

Don't forget to click o

GC Ready to Bleed? This Setup Has Teeth.As we head into the new trading week, GC presents a clean, disciplined short setup developing right below Friday’s key high. Price tapped the Previous Day High ($3,368) and supply zone before rejecting, failing to hold bullish momentum into the weekend close.

The market structure is currently defin

CShort

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

GCN2025

Jul 2025DMarket open

3,371.0USD / APZ−0.68%

GCQ2025

Aug 2025DMarket open

3,347.5USD / APZ−0.77%

GCU2025

Sep 2025DMarket open

3,363.0USD / APZ−0.76%

GCV2025

Oct 2025DMarket open

3,376.5USD / APZ−0.76%

GCX2025

Nov 2025DMarket open

3,395.0USD / APZ−0.67%

GCZ2025

Dec 2025DMarket open

3,405.1USD / APZ−0.76%

GCF2026

Jan 2026DMarket open

3,445.9USD / APZ−0.69%

GCG2026

Feb 2026DMarket open

3,433.3USD / APZ−0.75%

GCH2026

Mar 2026DMarket open

3,471.6USD / APZ−0.67%

GCJ2026

Apr 2026DMarket open

3,458.2USD / APZ−0.74%

GCK2026

May 2026DMarket open

3,495.8USD / APZ−0.66%

See all GCX2025 contracts

Frequently Asked Questions

The current price of Gold Futures (Nov 2025) is 3,395.0 USD / APZ — it has fallen −0.67% in the past 24 hours. Watch Gold Futures (Nov 2025) price in more detail on the chart.

The volume of Gold Futures (Nov 2025) is 22.00. Track more important stats on the Gold Futures (Nov 2025) chart.

The nearest expiration date for Gold Futures (Nov 2025) is Nov 25, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Gold Futures (Nov 2025) before Nov 25, 2025.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Gold Futures (Nov 2025) this number is 427.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Gold Futures (Nov 2025) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Gold Futures (Nov 2025). Today its technical rating is sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Gold Futures (Nov 2025) technicals for a more comprehensive analysis.