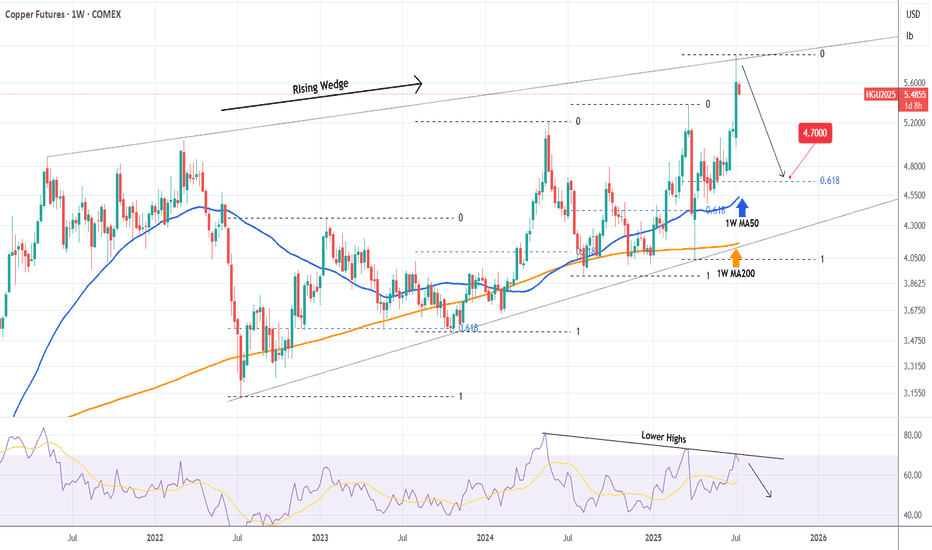

COPPER Top of 4-year Rising Wedge. Sell.Copper (HG1!) eventually followed the bearish break-out signal we gave on our last analysis (April 03, see chart below) and within 2 days it hit our 4.1250 Target:

Right now the price sits at the top of the 4-year Rising Wedge pattern and on the 1W time-frame it is a textbook technical sell sig

Copper Financial Futures (Jul 2025)

5.5135USDD

+0.0313+0.57%

Last update at Jul 15, 2021, 17:02 GMT

USD

No trades

Contract highlights

No news here

Looks like there's nothing to report right now

Tariffs Ignite a Copper FrenzyCOMEX copper has surged to a record premium over London Metal Exchange (LME) copper over the past few weeks, reflecting a lucrative arbitrage as traders rush metal into the U.S. ahead of looming import tariffs.

President Donald Trump’s announcement of a 50% tariff on U.S. copper imports (effective

CLong

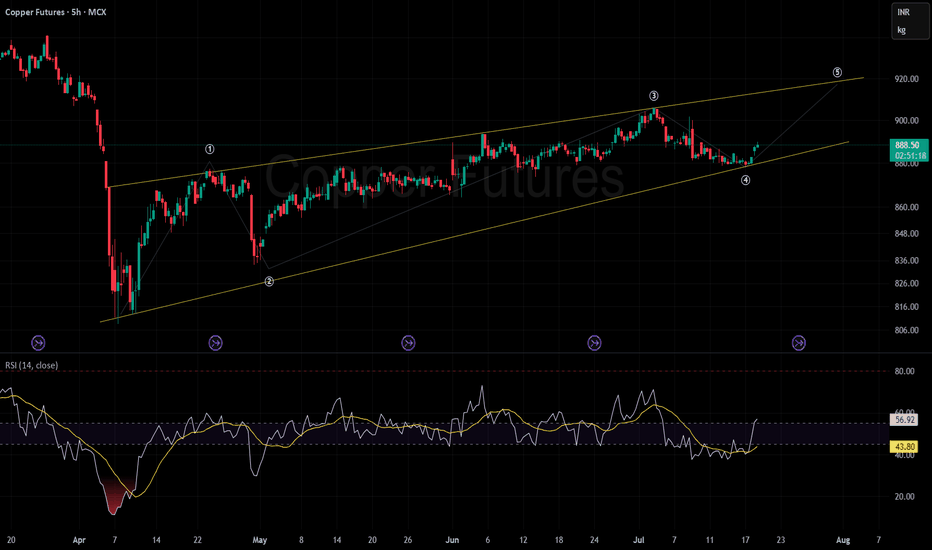

Copper looking good an upmoveKey Observations

Channel Pattern & Elliott Wave Count:

Price action is moving within a well-defined upward-sloping channel (yellow lines).

An Elliott Wave structure is marked (① to ⑤). The price just completed wave ④, suggesting the next move may attempt to form wave ⑤ towards the upper channel b

MLong

Copper: Event-driven Trade Idea on Recent TariffsCOMEX: Micro Copper Futures ( COMEX_MINI:MHG1! ), #microfutures

The Event

On July 9th, President Trump announced that he would impose a 50% tariff on imports of copper, effective August 1st.

The decision was based on national security assessment. Copper is the second most used material by the U

CShort

Bullish Reversal Builds in Copper: Eyes on $5.20 Resistance

The current price has closed above the Bollinger Band middle line (20-day SMA), indicating short-term upward momentum.

A sustained close above 4.90–4.95 could open the way to challenge the psychological level of 5.00 and possibly 5.20.

Immediate resistance: 4.95 → 5.00 → 5.20

Support zones: 4.7

CLong

$COPPER triangle trade?CAPITALCOM:COPPER triangle has potentially printed and a triangle is an Elliot wave pattern that results in a terminal thrust up to complete a motif wave.

That would trap bulls as price terminates with a poke above the all time high keeping them believing they can capture the same gains already g

CLong

Copper - the hot topic this weekUS is planning to implement tariffs on copper imports at a scale of 50%. It's an interesting move, which might not make much sense. Let's dig in.

MARKETSCOM:COPPER

COMEX:HG1!

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when tra

RameThe break of all-time highs triggered an acceleration of the bullish movement.

The movement could continue if the orbital resistance at 5.895 is broken, with a target of 6.82 to be achieved by August 26, 2025.

The bullish scenario would be negated if the support at 5.25 is broken.

CLong

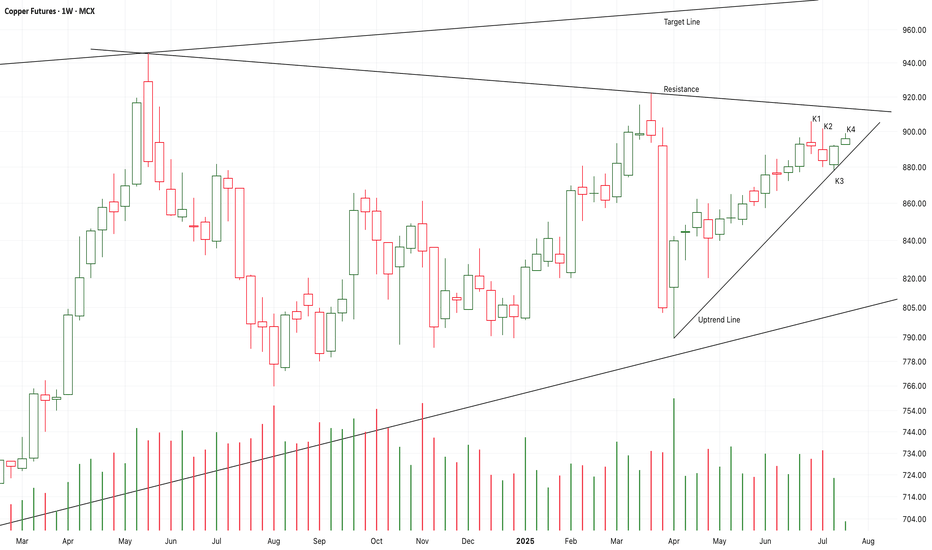

Chart Pattern Analysis Of Copper

K2 and K3 is a strong bullish up engulfing pattent.

K4 started with a bull gap to verify it.

It seems that K5 or K6 will break up the resistance to test the target line in the near future.

If I didn’t buy it earlier,I will try to buy it here.

I still hold the idea that the expensive metals such a

MLong

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

HGSN2025

Jul 2025DMarket open

5.5135USD+0.57%

HGSQ2025

Aug 2025DMarket open

5.7052USD+1.52%

HGSU2025

Sep 2025DMarket open

5.7235USD+1.49%

HGSV2025

Oct 2025DMarket open

5.7441USD+1.47%

HGSX2025

Nov 2025DMarket open

5.7689USD+1.47%

HGSZ2025

Dec 2025DMarket open

5.7908USD+1.47%

HGSF2026

Jan 2026DMarket open

5.8057USD+1.47%

HGSG2026

Feb 2026DMarket open

5.8218USD+1.47%

HGSH2026

Mar 2026DMarket open

5.8295USD+1.46%

HGSJ2026

Apr 2026DMarket open

5.8393USD+1.47%

HGSK2026

May 2026DMarket open

5.8429USD+1.47%

See all HGSN2025 contracts

Frequently Asked Questions

The current price of Copper Financial Futures (Jul 2025) is 5.5135 USD — it has risen 0.57% in the past 24 hours. Watch Copper Financial Futures (Jul 2025) price in more detail on the chart.

Track more important stats on the Copper Financial Futures (Jul 2025) chart.

The nearest expiration date for Copper Financial Futures (Jul 2025) is Jul 31, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Copper Financial Futures (Jul 2025) before Jul 31, 2025.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Copper Financial Futures (Jul 2025) this number is 581.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Copper Financial Futures (Jul 2025) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Copper Financial Futures (Jul 2025). Today its technical rating is strong buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Copper Financial Futures (Jul 2025) technicals for a more comprehensive analysis.