Contract highlights

No news here

Looks like there's nothing to report right now

SILVER – Breakout Attempt Underway SILVER | 1H TIMEFRAME

Price is breaking out of the falling wedge + forming a cup-type rounded bottom from support.

📊 Technical Overview:

• Cup formation breakout spotted ✅

• Price attempting to sustain above falling wedge resistance

• 55 EMA & 25 EMA crossed bullish

• Volume buildup visible

•

#SILVER #XAGUSD Silver at crucial deciding pointCAPITALCOM:SILVER ICMARKETS:XAGUSD Silver at a crucial junction, with multiple possibility. However we believe to a 1% little higher possibility than the odd that the july31st low should stay intact at least for one more push higher. Trade small.

Speculative Silver target USD42 by November 2025Hello,

Its always a bit risky choosing a price target AND a timeframe, but here is mine, lets see how it unfolds.

Silver is looking like it is going to do a "short, sharp" correction, as the wave two correction (April to June 2025) was slow and complex. Then it will head for $42. The correction ma

CLong

Journey of silver buy at support sell at resistance There is Up trending channel, follow the channel and make money since silver is long term bullish atleast.

Not mentioning the levels do the math follow the channel and find the support

MShort

#SILVER #MCX Short term buying oppturnuity#SILVER #MCX Short term buying oppturnuity seen. Condition for buying and levels to look for has been shared for reference.

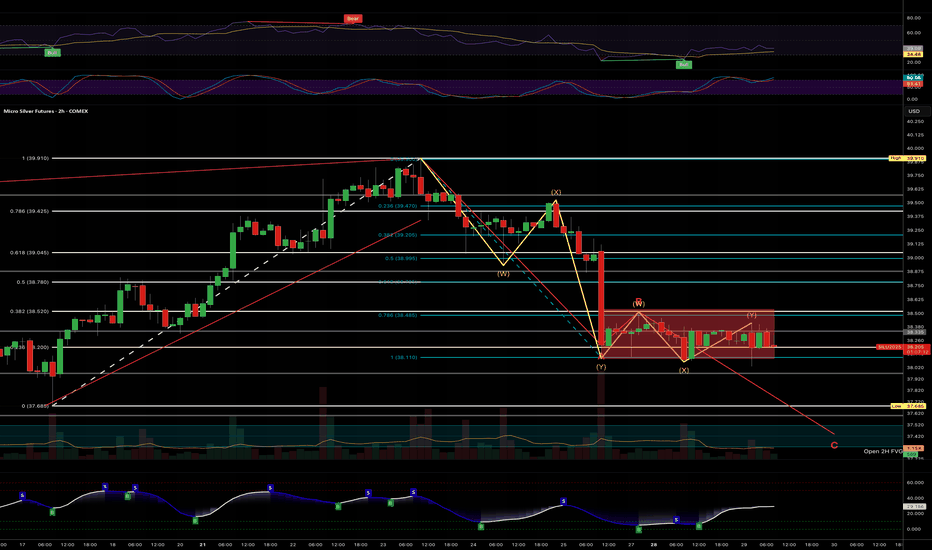

Silver - failure to break highs yesterday...This week is news packed... I was hoping to see Silver break above recently lower highs.

I am out of all positions - but I would not be surprised to see further breakdown in a second corrective leg, finding support at the FVG above next fib retracement.

Like I said, though, this week has alot of

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

SIQ2025

Aug 2025DMarket closed

37.895USD / APZ−0.23%

SIU2025

Sep 2025DMarket closed

37.975USD / APZ−0.25%

SIV2025

Oct 2025DMarket closed

38.135USD / APZ−0.25%

SIX2025

Nov 2025DMarket closed

38.310USD / APZ−0.24%

SIZ2025

Dec 2025DMarket closed

38.465USD / APZ−0.25%

SIF2026

Jan 2026DMarket closed

38.640USD / APZ−0.25%

SIG2026

Feb 2026DMarket closed

38.800USD / APZ−0.25%

SIH2026

Mar 2026DMarket closed

38.935USD / APZ−0.25%

SIJ2026

Apr 2026DMarket closed

39.080USD / APZ−0.26%

SIK2026

May 2026DMarket closed

39.230USD / APZ−0.26%

SIM2026

Jun 2026DMarket closed

39.400USD / APZ−0.26%

See all SIX2026 contracts

Frequently Asked Questions

The current price of Silver Futures (Nov 2026) is 40.100 USD / APZ — it has fallen −0.25% in the past 24 hours. Watch Silver Futures (Nov 2026) price in more detail on the chart.

Track more important stats on the Silver Futures (Nov 2026) chart.

The nearest expiration date for Silver Futures (Nov 2026) is Nov 25, 2026.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Silver Futures (Nov 2026) before Nov 25, 2026.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Silver Futures (Nov 2026) this number is 0.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Silver Futures (Nov 2026) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Silver Futures (Nov 2026). Today its technical rating is neutral, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Silver Futures (Nov 2026) technicals for a more comprehensive analysis.