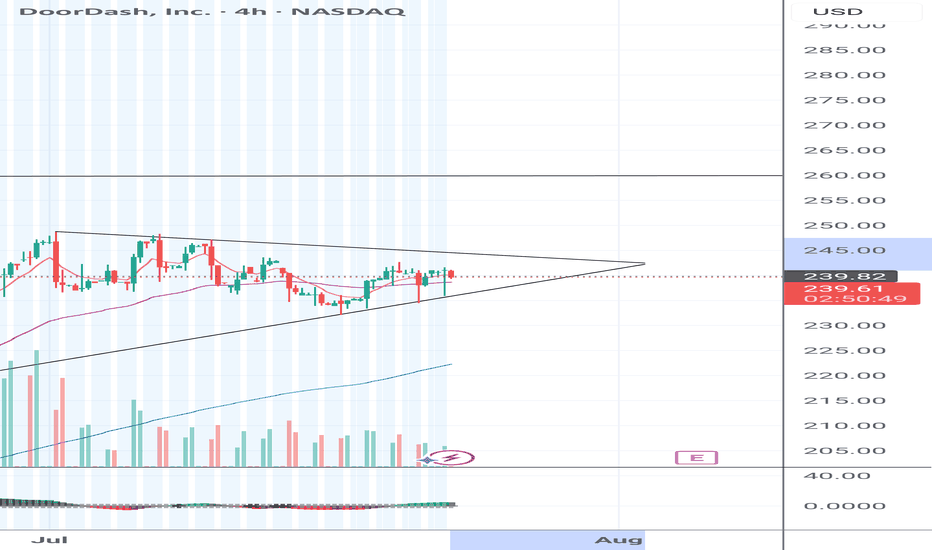

DASH | Bearish Head & Shoulders Breakdown in Play📉 DASH | Bearish Head & Shoulders Breakdown in Play

DoorDash ( NASDAQ:DASH ) just confirmed a Head & Shoulders pattern on the daily chart after an extended impulsive rally. The structure suggests a corrective wave targeting deeper levels.

🔎 Key Observations:

Clear 5-wave impulse up completed, top

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.60 EUR

118.82 M EUR

10.36 B EUR

344.89 M

About DoorDash, Inc.

Sector

Industry

CEO

Tony Xu

Website

Headquarters

San Francisco

Founded

2013

ISIN

US25809K1051

FIGI

BBG01HQ1YBN3

DoorDash, Inc. engages in the design, development, and operation of a food delivery and logistics platform. It serves consumers in the United States, Canada, and Australia. The company was founded by Andy Fang, Tony Xu, Stanley Tang, and Evan Moore on January 12, 2013 and is headquartered in San Francisco, CA.

Related stocks

DASH: Correction Ahead📉 DASH: Correction Ahead

After a strong rebound, DASH is showing overextended momentum.

RSI → leaning into overbought territory.

Volume → tapering off despite higher prints.

Resistance → testing a key supply zone; sellers likely to defend.

Macro flow → broader altcoin sector showing fatigue as

DOORDASH ($DASH) – FROM FOOD DELIVERY TO GLOBAL POWERHOUSEDOORDASH ( NASDAQ:DASH ) – FROM FOOD DELIVERY TO GLOBAL POWERHOUSE

(1/7)

DoorDash just reported 25% YoY revenue growth to $2.9B! That’s a hearty slice of the delivery pie. 🚀🍕 Let’s dig into the numbers, risks, and what might lie ahead for $DASH.

(2/7) – EARNINGS SPOTLIGHT

• GAAP net income: $0.33

DASH Earnings Print Incoming ## 🚨 DASH Earnings Play (Aug 6) – Bullish Call Setup 🚨

**DoorDash (DASH) Gearing Up for a Big Move Post-Earnings?**

### 🧠 Key Thesis:

Analysts are turning **bullish** ahead of earnings, and the **options market is lighting up with call activity**—particularly at the **\$275–\$280 strikes**. With

$DASH NASDAQ:DASH buyers look hesitant to buy right now after the weak job report and the Fed signaling no rate cuts anytime soon. This adds pressure on consumer pockets, limiting discretionary spending. If this trend continues, we might see DoorDash consumers slow down their activity, which could impact

Super Performance CandidateNASDAQ:DASH , market leadership commanding 60% of U.S food delivery market, outpacing competitors, consistent revenue growth, strong financials positions this equity to gain market share with our upcoming roaring market.

At a RS Rating of 95,

I have reasons to believe this equity value could incre

DASH Weekly Options Trade — June 15, 2025📈 DASH Weekly Options Trade — June 15, 2025

💡 Ticker: DASH

🎯 Strategy: Bullish Swing — Call Option

📅 Expiry: June 20, 2025

⏱ Entry Timing: Market Open (only if breakout confirmed)

📈 Confidence: 70%

🔍 Analysis Summary

All four models (Grok, Llama, Gemini, DeepSeek) point to short-term bullish moment

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of 4DASH is 209.15 EUR — it has decreased by −1.90% in the past 24 hours. Watch DoorDash, Inc. Class A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on EUROTLX exchange DoorDash, Inc. Class A stocks are traded under the ticker 4DASH.

4DASH stock has risen by 0.10% compared to the previous week, the month change is a −4.82% fall, over the last year DoorDash, Inc. Class A has showed a 83.14% increase.

We've gathered analysts' opinions on DoorDash, Inc. Class A future price: according to them, 4DASH price has a max estimate of 309.07 EUR and a min estimate of 205.19 EUR. Watch 4DASH chart and read a more detailed DoorDash, Inc. Class A stock forecast: see what analysts think of DoorDash, Inc. Class A and suggest that you do with its stocks.

4DASH reached its all-time high on Aug 7, 2025 with the price of 233.55 EUR, and its all-time low was 43.35 EUR and was reached on Jan 10, 2023. View more price dynamics on 4DASH chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

4DASH stock is 1.94% volatile and has beta coefficient of 1.45. Track DoorDash, Inc. Class A stock price on the chart and check out the list of the most volatile stocks — is DoorDash, Inc. Class A there?

Today DoorDash, Inc. Class A has the market capitalization of 90.53 B, it has decreased by −0.56% over the last week.

Yes, you can track DoorDash, Inc. Class A financials in yearly and quarterly reports right on TradingView.

DoorDash, Inc. Class A is going to release the next earnings report on Oct 29, 2025. Keep track of upcoming events with our Earnings Calendar.

4DASH earnings for the last quarter are 0.55 EUR per share, whereas the estimation was 0.37 EUR resulting in a 48.28% surprise. The estimated earnings for the next quarter are 0.59 EUR per share. See more details about DoorDash, Inc. Class A earnings.

DoorDash, Inc. Class A revenue for the last quarter amounts to 2.79 B EUR, despite the estimated figure of 2.68 B EUR. In the next quarter, revenue is expected to reach 2.88 B EUR.

4DASH net income for the last quarter is 241.94 M EUR, while the quarter before that showed 178.40 M EUR of net income which accounts for 35.62% change. Track more DoorDash, Inc. Class A financial stats to get the full picture.

No, 4DASH doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Sep 7, 2025, the company has 23.7 K employees. See our rating of the largest employees — is DoorDash, Inc. Class A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. DoorDash, Inc. Class A EBITDA is 998.31 M EUR, and current EBITDA margin is 5.72%. See more stats in DoorDash, Inc. Class A financial statements.

Like other stocks, 4DASH shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade DoorDash, Inc. Class A stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So DoorDash, Inc. Class A technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating DoorDash, Inc. Class A stock shows the buy signal. See more of DoorDash, Inc. Class A technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.