Philip Morris International Inc.

142.92EURD

−0.18−0.13%

At close at Sep 3, 20:54 GMT

EUR

No trades

Next report date

October 21

Report period

Q3 2025

EPS estimate

1.80 EUR

Revenue estimate

9.16 B EUR

4.48 EUR

6.79 B EUR

36.41 B EUR

1.55 B

About Philip Morris International Inc

Sector

Industry

CEO

Jacek Olczak

Website

Headquarters

Stamford

Founded

1847

ISIN

US7181721090

FIGI

BBG000HPKV04

Philip Morris International, Inc. is a holding company, which engages in the business of delivering a smoke-free future and evolving a portfolio for the long term to include products outside of the tobacco and nicotine sector. It operates through the following geographical segments: Europe Region (Europe), South and Southeast Asia, Commonwealth of Independent States, Middle East, and Africa Region (SSEA, CIS, and MEA), East Asia, Australia, and PMI Duty Free Region (EA, AU, and PMI DF), and Americas Region (Americas). The Europe segment includes all the European Union countries, Switzerland, the United Kingdom, Ukraine, Moldova, and Southeast Europe. The SSEA, CIS, and MEA segment focuses on South and Southeast Asia, the African continent, the Middle East, Turkey, Israel, Central Asia, Caucasus, and Russia. The EA, AU, and PMI DF segment is involved in the consolidation of international duty-free business with East Asia and Australia. The Americas segment is comprised of the United States, Canada, and Latin America. The company was founded by Philip Morris in 1847 and is headquartered in Stamford, CT.

−11%

0%

11%

22%

33%

Q2 '24

Q3 '24

Q4 '24

Q1 '25

Q2 '25

−3.50 B

0.00

3.50 B

7.00 B

10.50 B

Revenue

Net income

Net margin %

Revenue

COGS

Gross profit

Op expenses

Op income

Non-Op income/ expenses

Taxes & Other

Net income

0.00

2.50 B

5.00 B

7.50 B

10.00 B

Revenue

COGS

Gross profit

Expenses & adjustments

Net income

0.00

2.50 B

5.00 B

7.50 B

10.00 B

Q2 '24

Q3 '24

Q4 '24

Q1 '25

Q2 '25

−16.00 B

0.00

16.00 B

32.00 B

48.00 B

Debt

Free cash flow

Cash & equivalents

No news here

Looks like there's nothing to report right now

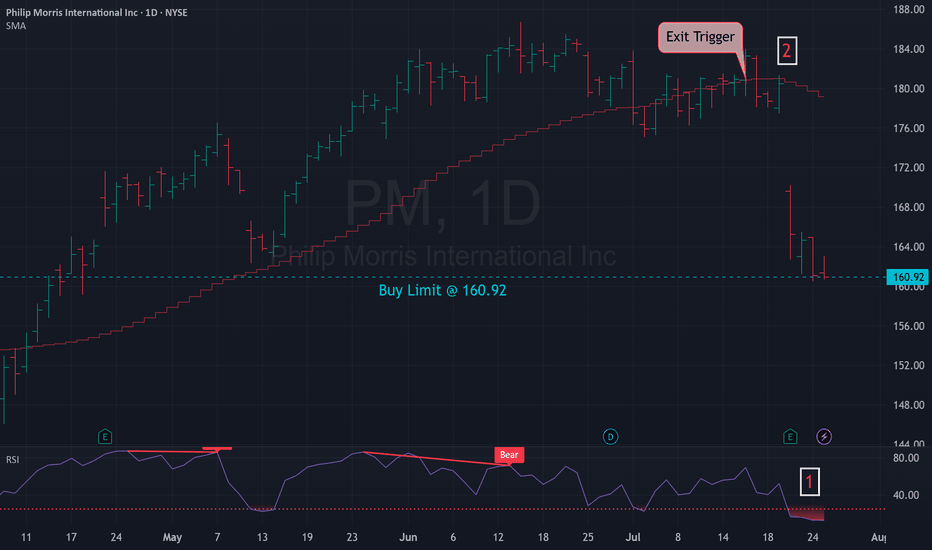

$PM Maintains a Strong Uptrend: Long at $147.17!Philip Morris International Inc. ( NYSE:PM ) is showing a “Strong Uptrend” on a 1-week chart. 📈 We bought at $109.86 and sold at $142.88 previously. Now at $169.17, we’re in a long position at $147.17. With a Trend Score of 8/8 and 100% signal alignment, the short-term projected price is $196.2 (

NLong

130 isn't a decider, it's a finder based in all on significanceWith the right angle poised to coincide with oscillators and indicators pointed in the direction of stabilizing at some point, it could be messy and start an entirely new direction in the public's sentiment. However, it could extend further to newer levels when things are in the cool-down phase.

NShort

PM- Looks ready for a pull back?PM has had a good run but currently running hot at around 80 RSI. Let's see if it can hit my targets. Or do you think it's going to make new highs? GL

NShort

Philip Morris Hit The Ceiling. PMOur last game take on PM centering on a bullish butterfly gave us profits on that very healthy looking impulse up. Now, it is time to come back to reality for this stock. RSX wise - out of OBOS territory, while crossing the MIDAS line. vWAP/US show gradient of trend and are resistant and in alignmen

NShort

PM - LONG - "Abysmal courage buy " Abysmal Courage Strategy - Having the courage to buy a winning stock showing strength on a day when market overall seems abysmal or extremely bleak the pundits are cautious the feeling is dire .

Stock Chosen - PM

This is not a model stock but I bought it more so to be courageous on a red day , I

NLong

Confirmed BottomWe have reached the bottom of September and October again now. It had been broken at the end of September but was fulminantly confirmed wid a long spike and a window afterwards.

ThusI expect it to hold now again.

NLong

Philip Morris is Going to SMOKE Earnings on Feb. 6th ($140+)NYSE:PM - ZYN is clearly going nowhere but up, and that's the evil beauty of nicotine/ addiction. Once ya start, ya don't (typically) stop. Philip Morris announces earnings on February 6th, and I think they BLOW analyst expectations out of the water. 😮💨💸🏆

Technically, NYSE:PM is on the verge of

NLong

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

PM5503240

Philip Morris International Inc. 5.75% 17-NOV-2032Yield to maturity

—

Maturity date

Nov 17, 2032

PM5072872

Philip Morris International Inc. 0.875% 01-MAY-2026Yield to maturity

—

Maturity date

May 1, 2026

PM5752073

Philip Morris International Inc. 4.875% 13-FEB-2029Yield to maturity

—

Maturity date

Feb 13, 2029

PM5751894

Philip Morris International Inc. 5.125% 13-FEB-2031Yield to maturity

—

Maturity date

Feb 13, 2031

PM4982965

Philip Morris International Inc. 2.1% 01-MAY-2030Yield to maturity

—

Maturity date

May 1, 2030

PM5929960

Philip Morris International Inc. 4.9% 01-NOV-2034Yield to maturity

—

Maturity date

Nov 1, 2034

PM5541197

Philip Morris International Inc. 5.125% 15-FEB-2030Yield to maturity

—

Maturity date

Feb 15, 2030

PM5503327

Philip Morris International Inc. 5.625% 17-NOV-2029Yield to maturity

—

Maturity date

Nov 17, 2029

PM5647210

Philip Morris International Inc. 5.625% 07-SEP-2033Yield to maturity

—

Maturity date

Sep 7, 2033

PM6065565

Philip Morris International Inc. 4.375% 30-APR-2030Yield to maturity

—

Maturity date

Apr 30, 2030

PM4828101

Philip Morris International Inc. 3.375% 15-AUG-2029Yield to maturity

—

Maturity date

Aug 15, 2029

See all 4I1 bonds

Curated watchlists where 4I1 is featured.

Frequently Asked Questions

The current price of 4I1 is 142.92 EUR — it has decreased by −0.13% in the past 24 hours. Watch Philip Morris International Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange Philip Morris International Inc. stocks are traded under the ticker 4I1.

4I1 stock has fallen by −0.06% compared to the previous week, the month change is a 1.56% rise, over the last year Philip Morris International Inc. has showed a 28.76% increase.

We've gathered analysts' opinions on Philip Morris International Inc. future price: according to them, 4I1 price has a max estimate of 189.56 EUR and a min estimate of 150.79 EUR. Watch 4I1 chart and read a more detailed Philip Morris International Inc. stock forecast: see what analysts think of Philip Morris International Inc. and suggest that you do with its stocks.

4I1 stock is 0.36% volatile and has beta coefficient of 0.03. Track Philip Morris International Inc. stock price on the chart and check out the list of the most volatile stocks — is Philip Morris International Inc. there?

Today Philip Morris International Inc. has the market capitalization of 223.90 B, it has decreased by −0.69% over the last week.

Yes, you can track Philip Morris International Inc. financials in yearly and quarterly reports right on TradingView.

Philip Morris International Inc. is going to release the next earnings report on Oct 21, 2025. Keep track of upcoming events with our Earnings Calendar.

4I1 earnings for the last quarter are 1.62 EUR per share, whereas the estimation was 1.58 EUR resulting in a 2.83% surprise. The estimated earnings for the next quarter are 1.80 EUR per share. See more details about Philip Morris International Inc. earnings.

Philip Morris International Inc. revenue for the last quarter amounts to 8.61 B EUR, despite the estimated figure of 8.76 B EUR. In the next quarter, revenue is expected to reach 9.16 B EUR.

4I1 net income for the last quarter is 2.57 B EUR, while the quarter before that showed 2.48 B EUR of net income which accounts for 3.79% change. Track more Philip Morris International Inc. financial stats to get the full picture.

Yes, 4I1 dividends are paid quarterly. The last dividend per share was 1.15 EUR. As of today, Dividend Yield (TTM)% is 3.23%. Tracking Philip Morris International Inc. dividends might help you take more informed decisions.

Philip Morris International Inc. dividend yield was 4.40% in 2024, and payout ratio reached 117.24%. The year before the numbers were 5.46% and 102.46% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Sep 4, 2025, the company has 83.1 K employees. See our rating of the largest employees — is Philip Morris International Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Philip Morris International Inc. EBITDA is 13.06 B EUR, and current EBITDA margin is 39.85%. See more stats in Philip Morris International Inc. financial statements.

Like other stocks, 4I1 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Philip Morris International Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Philip Morris International Inc. technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Philip Morris International Inc. stock shows the buy signal. See more of Philip Morris International Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.