Bitcoin's Safe-Haven Ascent: Could BTC Join Gold As the US dollar teeters on long-term support, yields flash warnings, and USD/JPY unravels, Bitcoin's structure points to a reversal—and a potential role alongside gold as a global safe-haven asset.

Bitcoin and Gold: The New Twin Pillars of Safety?

A profound shift may be underway in how investors, institutions, and even governments perceive Bitcoin. Traditionally viewed as a high-beta, speculative asset, Bitcoin now displays characteristics of a safe-haven, particularly as macroeconomic cracks widen across currencies and sovereign bonds. The timing of this shift aligns with a historic divergence in key legacy instruments—including the USD/JPY, US Dollar Index (DXY), and the 10-Year Treasury Yield.

Most notably, Bitcoin's price structure has begun to mimic the strategic behaviour of gold—establishing support in times of uncertainty and attracting institutional flows amid fiscal and monetary instability. This raises a crucial question: Is Bitcoin on the verge of joining gold as a global safe-haven asset?

Bitcoin Futures Technical Outlook: Falling Wedge with Macro Fuel

Bitcoin Futures have retraced sharply from the January 2025 high of $110,150, establishing a double-bottom support zone at $75,255. This level has been tested twice, forming the base of a falling wedge pattern—a historically bullish formation that often leads to explosive trend reversals.

At the time of writing, BTC trades at $85,725, just below the critical resistance of $86,210. A confirmed breakout above this level could trigger a reversal to the upside, with targets at $94,580 and $102,950 and eventually a retest of the yearly high.

This technical setup is not occurring in isolation—it coincides with widespread fragility in the fiat financial system, prompting institutional investors to reconsider their allocation frameworks.

Institutional Rotation: The Rise of Bitcoin ETFs and Safe-Haven Utility

Several recent developments support the view that Bitcoin is evolving into a macro hedge:

BlackRock, Fidelity, Franklin Templeton, and others have launched US-regulated Bitcoin spot ETFs, marking a major milestone in institutional validation.

MicroStrategy added 6,911 BTC to its balance sheet in March 2025, increasing total holdings to over 214,000 BTC—an institutional vote of confidence.

Global de-dollarization trends are accelerating. Central banks are accumulating gold, while sovereign wealth funds and hedge funds are experimenting with BTC allocations as fiat uncertainty grows.

There is a noticeable behavioural shift in how public and private entities are positioning around Bitcoin—as a hedge, a reserve diversification play, and a long-term insurance policy against fiat failure.

Conclusion: Bitcoin and Gold—Digital and Physical Reserves in a Changing World

Gold and Bitcoin are increasingly being viewed not as competitors but as complementary tools in future portfolio construction.

As legacy systems show signs of strain:

-USD/JPY is breaking long-term support

-DXY is teetering at cycle lows

-10YR yields are rolling over structurally

Bitcoin is diverging upward, carving a path that suggests more than just a short-term trade. The price structure, macro alignment, and institutional behaviour are signalling a fundamental transformation.

In the next five years, we may not just see Bitcoin as a digital asset—but as a strategic safe-haven asset class alongside gold—a modern counterpart to the oldest reserve in history.

BMC1! trade ideas

$BTC LONG BTCCRYPTOCAP:BTC

Position update on the current market structure.

The block was tested from above, but there was no full-fledged move in - a sign of limited pressure from the seller so far. That said, there remains the possibility of liquidity taking hold in the $82,000-$83,000 range. The key condition is the realization of the scenario within the next week, maximum - before the month's close.

May, in the absence of extraordinary events from the political agenda (primarily the US and Trump), should work out in positive dynamics.

If the market ignores the designated range and forms a break above $90,000 before the end of April - the scenario with a re-entry under $80,000 becomes extremely unlikely.

Simply put, the current volatility and fluctuations are just localized structural distortions within the dominant bullish medium-term trend. Going above $90,000 in this configuration becomes the base scenario, the only question is the nature of short-term price transformation.

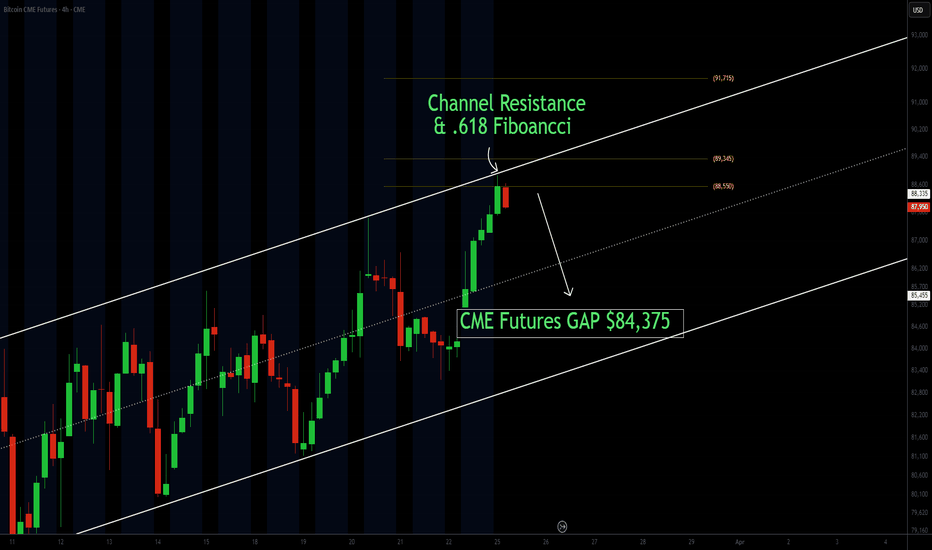

CME Futures Gap at $84,375 – Will Bitcoin Fill It Before Moving In today’s analysis, we are focusing on the CME futures chart, which has been open for trading over the past 24 hours. A key observation is the gap at $84,375, which remains unfilled despite Bitcoin’s bullish expansion on Monday. Historically, CME gaps have a high probability of being backfilled, making this an important technical level to watch.

Currently, Bitcoin is facing rejection at the range high of its trading channel, which aligns with channel resistance and the 0.618 Fibonacci retracement. If this rejection is confirmed, it increases the probability of price action rotating back toward the channel low support, which would fill the $84,375 gap before any move higher.

Key Takeaways:

• CME futures gap at $84,375 remains unfilled, which historically increases the likelihood of a pullback.

• Bitcoin is facing resistance at the channel high, in confluence with the 0.618 Fibonacci retracement.

• A confirmed rejection at resistance could lead to a move back down to fill the gap before resuming bullish momentum.

At this moment, more price action is needed to confirm whether this reversal will take place. However, traders should keep in mind that as long as the gap remains open, the probability of a move down remains high. The channel structure is key—if Bitcoin breaks down from this channel, it could signal further downside before any bullish continuation.

Patience is required as this setup develops. Keep an eye on how price interacts with key resistance and support levels before making any trading decisions.

Bitcoin Update: Testing the Waters in a DowntrendBitcoin Shows Resilience Amid Market Weakness

Bitcoin remains in a downtrend but has demonstrated notable strength during the recent market sell-off. Last week, we initiated a small position at $78K as a "probe" to test the waters. While this position remains active, Bitcoin needs to break through the current downtrend structure to confirm strength.

What's particularly interesting is how Bitcoin has performed significantly stronger than the S&P 500 during this period. The price action reveals telling signs about potential future movement.

Volume Analysis Points to Potential Reversal

Examining the trading volume at current price levels shows considerable effort to push prices downward. Despite this high selling volume, the results have been relatively poor for sellers. We've observed a small spring pattern forming, with price now challenging the resistance of the established channel.

This combination - high downward effort with limited results, occurring against a backdrop of significant weakness in the traditional stock market - creates a compelling short-term opportunity.

Our Trading Approach: Cautious Positioning

We're strategically approaching this spring setup, looking for a potential rally that could break through the current resistance level. However, it's important to note that spring patterns in a downtrend typically represent lower-probability trading scenarios.

For this reason, our current capital allocation remains conservative. We've implemented a measured approach:

Starting with small position sizing

Preparing to add to our position as confirmation develops

Setting a stop loss slightly above the recent low

Risk Management Remains Essential

This cautious positioning acknowledges the current market reality - while we see promising signs, the overall trend remains downward until proven otherwise. By starting with limited exposure, we maintain flexibility to either exit with minimal damage if the setup fails or increase our position if the market confirms our analysis.

The spring pattern we've identified suggests potential upward movement, but requires confirmation through a break of the downtrend structure before committing additional capital.

Looking Forward

The current Bitcoin price action represents an interesting juncture. The resilience shown against broader market weakness provides a foundation for potential bullish development, but prudent risk management remains essential in this environment.

We'll continue monitoring volume patterns, price action relative to the established channel, and Bitcoin's performance compared to traditional equity markets for further confirmation signals.

Note: This analysis is based on market conditions at the time of writing and is for educational purposes only.

A lot of good reversals and lots of volatility which is good for April 10th we will be going into the 10th in about 15 minutes so we're looking at the market before the clock tells us that it's Thursday. there was tremendous volatility and great opportunities for trading as a buyer and a seller.... either one because high probability markets favor buyers as well as sellers. and since it's late at night you can take a look at some of these markets to see what you think there are at least 3 or 4 markets that are going to go higher in my opinion. some of them will make great range markets and if you have a good distance between where the buyers and sellers are and it's a range Market that too is a good opportunity for buyers and sellers,

Is Bitcoin holding up or sell-off coming soon?CME:BTC1!

Surprisingly, the price of bitcoin and bitcoin futures have held up well compared to stocks given that Bitcoin is a high risk, highly volatile crypto currency.

It is almost as if hedge funds, and other investors have not had to liquidate their BTC exposure due to margin calls.

Open Interest has been stable and average daily volume is holding up. This can be viewed by accessing the CME Bitcoin Open Interest and Volume .

What is next for Bitcoin futures?

As noted in our analysis, CME bitcoin futures are currently trading below the key level 2024 mid-range.

Key Levels:

2024 Mid-Range, Key LIS: 79655

2024 till YTD CVPOC: 71705

Support Zone: 63140 - 57275

2024 till YT CVAL: 57275

Scenario 1: Further Downside - technical breakdown

We expect further downside and move towards our support zone marked on the chart. Enter short on a pull back towards mid-range with stops above high of Apr 3rd, 2025.

Example Trade 1:

• Short Entry: 79000

• Stop: 85240

• Target: 60000

• Risk: 6240

• Reward: 22000

• Risk/Reward Ratio: ~ 3R

Scenario 2: Reclaim mid-range and consolidate

In this scenario, if the price gets back above 2024 mid-range and stays above, we expect the price to range between 90K to 80K.

Example Trade 2:

• Long Entry: 80000

• Stop: 74630

• Target: 89000

• Risk: 5370

• Reward: 9000

• Risk/Reward Ratio: ~ 1.68 R

Important Notes:

• These are example trade ideas not intended to be a recommendation to trade, and traders are encouraged to do their own analysis and preparation before entering any positions.

• Stop losses are not guaranteed to trigger at specified levels, and actual losses may exceed predetermined stop levels.

• NFA does not have regulatory oversight over spot cryptocurrencies or virtual currencies derivatives traded on unregulated/decentralized exchanges.

Glossary Index for all technical terms used:

YTD: Year to Date

LIS: Line in Sand

CVPOC: Composite Volume Point of Control

CVAL: Composite Value Area Low

Green Zones: Bull/ Buyers support zones

Bitcoin At $250,000 In 2025: Bull-Market Entry (Buy) Zone ActiveBitcoin's 2025 bull-market buy-zone is still active. Actually, Bitcoin is at a great price right now. We are aiming for a target of $250,000 for this cycle. We are looking at the bottom right now, literally. Any buy below $90,000 is extremely good and below $80,000 a dream come-true. This will be obvious in just a matter of weeks.

How are you feeling today?

I hope the start of the weekend is treating you good.

This is a friendly reminder, Bitcoin has been sideways for months. When Bitcoin drops, it drops but, currently, there are no new lows.

Bitcoin peaked in December 2024 and produced a double-top in January 2025. A small retrace and that's it; the accumulation phase is ongoing and the buy-zone active.

There are many signals that support a correction bottom being in. We looked at these already so you will have to trust me. Leverage is possible on this setup. Leverage for a long-term trade. This is the best possible scenario and the best type of trade.

No complexities. No calculators. No fees. No interest, just buy and hold.

Wait patiently... It will be a very strong rise and the Altcoins will grow even more than Bitcoin. The entire Cryptocurrency market will produce maximum growth.

This post is intended to alert of you a great entry-timing. Great prices as well but timing right now is great. We might have to wait a bit longer, it won't move right away, but with this price you can't go wrong.

I am wishing you tons of profits in 2025 and financial success.

Thank you for reading.

If you are new, feel free to follow.

Master Ananda for you (formerly Alan Santana).

Namaste.

Bitcoin Futures Gap in Focus: $79,610 – $83,925Hello traders,

In today’s analysis we’re focusing on the open CME futures gap left behind by Bitcoin between $79,610 and $83,925. Historically, these gaps have a strong tendency to be filled — not always immediately, but eventually. This gap now acts as a magnet for price and should be considered in any short- to mid-term trading strategy.

Key Points:

• The gap fill zone is between $79.6K and $83.9K, and a move into this range could prompt a market-wide bounce.

• Despite the setup, confirmation is critical before entering — price may dip further before reclaiming the gap.

• Short-term trade opportunities may arise on correlated assets while BTC works to fill the gap.

It’s essential to factor in broader market volatility when planning trades. Bitcoin may move aggressively within this zone, and without confirmation, entries can be risky. High volatility often leads to fakeouts, so patience and discipline are key.

While the futures gap provides a technical target, it’s not a standalone reason to enter a trade. Use your trading system for entry signals, and don’t ignore macro conditions or sentiment. This gap is a useful reference point, not a trigger on its own.

Theme: Distribution Phase with Sentiment OverhangSetup Overview

Bitcoin is exhibiting classical post-euphoria distribution behavior. Following the ETF-driven rally, price has failed to follow through. Structure is weakening under persistent denial from retail participants. Crowd remains heavily long and emotionally invested in the prior bullish narrative, while the market structure continues to deteriorate.

COT & Sentiment Snapshot

Leveraged long interest remains high

Crowd anchored to ETF news cycle

Positioning shows no substantial unwind yet

Structural failure evident with compression under resistance

Market Structure & Technical Breakdown

Post-rally failure to continue trend

Distribution pattern forming with lower highs

Compression and weakening momentum under key supply

Lack of bullish response to positive news suggests exhaustion

Behavioral Finance Layer (Watts + Livermore)

“The crowd believes what it wants to believe, even when the structure says otherwise.”

Anchoring bias to bullish ETF narrative

Denial and overconfidence prevalent in sentiment

Herd behavior preventing repositioning

Emotional fragility building toward reflexive flush

Reflexivity Risk Model

Phase 1: Failed follow-through post-ETF optimism

Phase 2: Breakdown below structural demand

Phase 3: Crowding into late long entries

Phase 4: Emotional flush and positioning reset expected

Strategic Bias: Bearish (Short Bias)

The setup favors downside continuation until behavioral and structural washout occurs. Patience is key — the true opportunity lies in timing the emotional capitulation and reassessing risk post-reset.

BTC Futures : My first attempt with a target price of 0Hello friends; I think not believing in Bitcoin is as natural as believing in Bitcoin.

I can't express my opinion here with moving averages and/or RSI levels.

The Beyond Technical Analysis might make sense for this trade.

If we are wrong, what is important here is our position and risk management. We do not open a transaction to say "I told you so".

I cannot explain this with any technical analysis method, blockchain data, etc.

Technically; everything that will be built based on this is the same as building a sand castle.

I don't think Bitcoin has an equivalent.

If we consider serious inflation rates, it is obvious that people will have much bigger and more vital priorities than buying Bitcoin or other cryptocurrencies. I am not even talking about electricity costs.

I definitely don't think it can be in the same class as Gold.

This trade alone offers us a very good risk/reward ratio.

I chose the contract covering the next period ending on May 30th, not the continuous CME contract, in order to save time.

A good place for a first try.

I will definitely try something similar.

I don't think I will have any views other than the short side in the future.

For years I have been asked, "If you don't believe us, why don't you open a short position?" I will try to achieve this.

So there's also an experimental side to this.

HIGHLIGHTS

We are closing our position before the contract switch date of May 30, 2025, without looking at the price. If necessary, we will try again in the next contract.

The value of 113690 is our stop value. We end our trade at this value.

We choose the smallest value as the position size.

If you expect something to be 0,

you should choose trading instruments that evaluate your position in currencies rather than in BTC value.

I chose CME because it is suitable for this.

Contracts that are further away are definitely not liquid.

It may be difficult to find buyers even at high values.

Target : 0

Absolutely no margin addition.

Best regards.

Bitcoin CME Short AnalysisChart Description

The chart shows a recent strong move up in BTC CME Futures, highlighted by the green Fibonacci retracement levels measuring the prior swing low to swing high.

Two red boxes are drawn near the top, marking a potential resistance/supply zone where price previously stalled.

A white downward arrow indicates your expectation of a pullback from this resistance area.

At the bottom, an oscillator (in yellow) appears to form lower highs (a potential divergence), suggesting fading momentum as price tested the red boxes.

What I Think Is Next

Given the resistance in the red box area and the potential momentum divergence, you anticipate a short-term correction or pullback.

Possible downside targets could include the nearby Fibonacci retracement levels (e.g., 0.382 or 0.5), where BTC CME might find support and consolidate before the next move.

If price can’t hold those fib levels, a deeper correction toward lower support zones is possible. Conversely, a strong breakout above the red boxes and any key fib extensions could signal further upside continuation.

Chart Pattern Analysis Of Bitcoin

The demand from K1 to K3 is decreasing,

It verified the downtrend momentum here.

The demand at K3 slightly increased,

But it failed to close the bear gap at K0.

If the following candles is a weak rebound to test the upper limit of the channel,

It will be a good place to short it there.

Short-86518/Stop-87800/Target-75K

Bitcoin CME Futures Update: Gap Filled, But Weakness PersistsHello traders,

Today’s analysis focuses on the CME futures chart, providing an update on the latest price action. Since our last update, the gap has been filled, but notably, Bitcoin has failed to show any significant bounce that would indicate buyer strength. Instead, price has closed through the gap and is now trading below this level, signaling continued market weakness.

Key Technical Considerations

• $84,000 Reclaim is Critical: If Bitcoin fails to reclaim $84,000 in the coming days, the probability of a liquidation event increases. This could drive price toward the next key swing low around $67,735.

• Untapped Liquidity Zones: Multiple higher lows remain untouched, meaning there is still pristine liquidity that could act as a magnet for price.

• Swing Failure Pattern (SFP) Potential: A bounce at $67,735 could form an SFP, temporarily trapping shorts before rebounding. However, if price closes below this level on a high-time-frame basis, further downside toward much lower price levels is likely.

Conclusion: Caution is Advised

Bitcoin’s price action remains weak, and unless a decisive reclaim of $84,000 occurs, further downside remains the higher-probability scenario. The market structure still favors sellers, and traders should exercise caution, as a deeper correction could be in play if Bitcoin loses its next key support.

How Institutional Capital Is Reshaping the Bitcoin MarketThe Evolution of Bitcoin as an Institutional Asset

Bitcoin has undergone a fundamental shift. Once viewed as a speculative retail-driven asset, it has now become a key instrument for institutional capital. The introduction of CME Bitcoin futures marked the beginning of this transformation, providing hedge funds, asset managers, and corporates with a regulated vehicle for exposure.

Institutional participation has fundamentally altered Bitcoin’s market structure—bringing greater liquidity, deeper price discovery, and a more defined risk profile. However, it has also introduced a new layer of macro-driven volatility, as capital flows are increasingly dictated by monetary policy, risk sentiment, and global liquidity cycles.

COT Data: A Window into Institutional Strategy

One of the most effective tools for understanding institutional positioning in Bitcoin futures is the Commitment of Traders (COT) report, published weekly by the Commodity Futures Trading Commission (CFTC). This report categorizes market participants into three distinct groups:

🔹 Commercials (Institutions & Corporates)

🔹 Non-Commercials (Hedge Funds & Proprietary Traders)

🔹 Non-Reportables (Retail & Small Traders)

Key Market Dynamics

1. Institutional Hedging: Risk Management Over Speculation

Large financial institutions and corporate entities—categorized as commercial traders—consistently maintain net short positions in Bitcoin futures. This does not indicate bearish sentiment but rather reflects standard risk management strategies. Just as energy firms hedge oil exposure or multinational corporations hedge currency risk, institutions use Bitcoin derivatives to offset exposure to the spot market. (the commercials are largely buying "over-the-counter" while selling BTC at exchange signaling a bullish outlook).

As a result, institutional activity adds an element of market stability, reducing disorderly price swings driven by speculative retail flows. However, their presence also means that Bitcoin, like other financialized assets, is now subject to broader macroeconomic risk factors.

2. Hedge Funds as Volatility Drivers

Hedge funds and proprietary trading desks—classified as non-commercial traders—play a far more active role in price discovery. Their positioning behavior closely correlates with trend momentum, with leveraged funds aggressively increasing long exposure in bull markets and shifting to short positions during downturns.

The growing role of hedge funds has amplified Bitcoin’s volatility, as rapid position changes in futures markets create spillover effects in the spot market. As Bitcoin becomes increasingly integrated with traditional finance, these flows are now influenced by central bank policy, liquidity conditions, and cross-asset correlations.

3. Retail Traders as Contrarian Indicators

Retail positioning—reflected in the non-reportables segment of the COT report—has historically served as a contrarian signal. Retail traders tend to buy late in rallies and panic sell in downturns, mirroring behavioral patterns observed in equity and commodity markets.

When retail long positioning reaches extremes, it has often coincided with local market tops. Conversely, sharp reductions in retail exposure have frequently preceded institutional accumulation phases. Understanding these positioning shifts offers insight into potential inflection points in Bitcoin’s price cycle.

Strategic Implications for Investors

📌 Bitcoin Is Now a Macro-Driven Asset

The growing institutionalization of Bitcoin means its price action is increasingly correlated with monetary policy cycles, risk sentiment, and cross-asset capital flows. Investors must now evaluate Bitcoin through the same macro lens as equities, commodities, and FX markets.

📌 Hedge Fund Flows Will Remain a Dominant Volatility Driver

While institutional adoption has increased market depth, speculative hedge fund activity ensures that Bitcoin’s volatility remains structurally high. Understanding hedge fund positioning in CME futures is now crucial for understanding short-term price swings.

📌 Retail Capitulation Often Marks Institutional Entry Points

Historically, retail traders have entered long positions at local highs and capitulated near market lows. Tracking non-reportable positions in COT data can provide contrarian signals, helping investors identify optimal entry and exit points.

Conclusion

Bitcoin’s transformation into an institutional-grade asset has introduced both stability and complexity to its market structure. CME Bitcoin futures positioning plus ETF inflows now serves as a key barometer for institutional sentiment, risk appetite, and capital flows.

As Bitcoin continues its integration into global financial markets, investors must move beyond traditional retail-driven narratives and adopt a more sophisticated approach to analyzing institutional flows, macroeconomic trends, and cross-market correlations.

BTC CME Gaps Filled – What’s Next?

The last pending gap on the BTC CME chart has now been completely filled, leaving no remaining inefficiencies. This marks a key technical milestone for BTC price action.

📊 Current Market Structure

🔹 BTC has now filled all CME gaps, eliminating past price inefficiencies.

🔹 Price may now move based purely on organic market dynamics.

With all CME gaps cleared, BTC traders should watch for fresh market-driven movements! 🚦

Bitcoin CME Gap Update

A new GAP form below the current price which ranging 85135 - 84280 panda fam, this means possible leg down incoming in short bearish bias but short term only 🐻

The recent GAP i updated here at Tier 2 Premium Fam was above price right ? That is the reason our price recently moves up and materialized to our bullish bias on BTC. 🚀

The key here panda fam on alts trade is ride with the trend and stay patience timing is the key as always 🍀

Bitcoin Price Rally: Market Insights and Potential Resistance Le(Taken from a clip from last week's Wyckoff Crypto Discussion)

Bitcoin Price Rally: Market Insights and Potential Resistance Levels

Explore the latest Bitcoin market analysis, including potential rally targets, supply and demand dynamics, and key resistance levels for short-term traders.

Current Market Outlook

The Bitcoin market is experiencing a notable short-term rally that has caught the attention of traders and analysts. Recent market observations suggest a nuanced approach to the current price movement, with several critical factors at play.

Rally Dynamics and Price Targets

Traders previously identified a potential long setup with an initial target around $88,000. The market is now approaching this crucial resistance level, with minimal supply pressure currently visible. This positioning presents an interesting scenario for cryptocurrency investors monitoring Bitcoin’s price action.

Supply and Demand Landscape

The current market condition is characterized by simultaneously diminished supply and demand. Experienced analysts note that such rallies typically conclude with a significant volume increase. While the upward movement has been somewhat measured, there remains potential for further price appreciation.

Key Resistance and Trading Strategy

The $88,000 level stands out as a primary resistance point of interest. Traders are closely watching for any significant activity at this price point. The current rally, while progressing, has been described as slightly underwhelming compared to typical market expectations.

Short-Term Positioning

Despite the measured progress, many traders maintain a short-term bullish position. The market continues to test support and resistance levels, creating a cautious but optimistic trading environment. Investors are looking for more decisive price action to confirm the rally’s strength.

Market Expectations

Traders typically anticipate a quick recovery and bounce following local price attempts. The current market is in a phase of continuous testing, with participants hoping to see more substantial efforts to push prices higher.

Conclusion

Bitcoin’s current market phase presents a complex trading landscape. While the rally shows promise, traders remain vigilant, watching for definitive price movements and volume changes that could signal the next significant market direction.

This analysis is for educational purposes only and should not be considered investment advice.