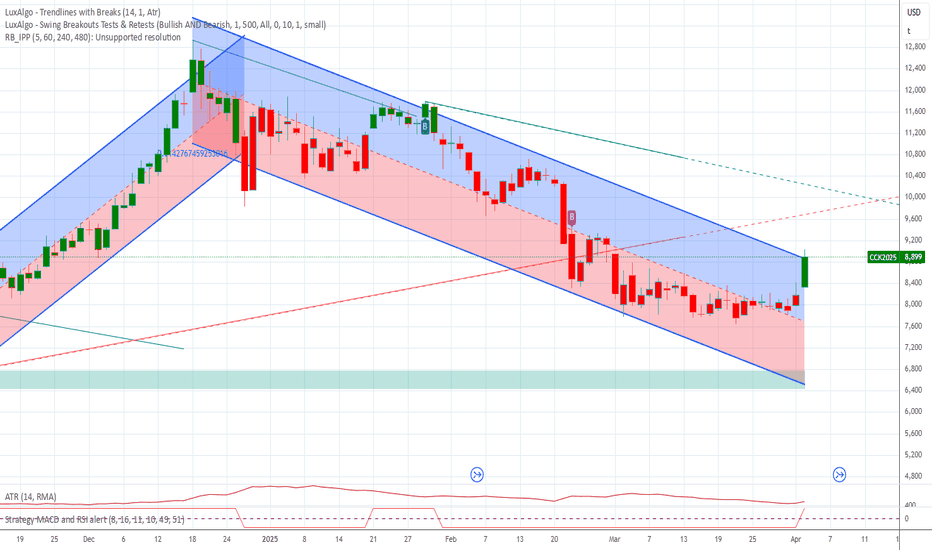

Cocoa Bounce From Demand – Can This Lead to a New 2025 High?On June 11th, price reacted sharply to a key demand block around the 8,880–9,000 zone, which aligns with:

Golden Pocket Fib (0.705–0.78) between 8,420 and 9,006

The midpoint of a previous consolidation range

A liquidity sweep followed by a strong bullish rejection

The RSI is showing a bullish di

Cocoa Futures

8,764USD / TNED

−374−4.09%

As of today at 17:18 GMT

USD / TNE

No trades

No news here

Looks like there's nothing to report right now

Cocoa $CC Evidence leans toward a bearish scenario due to the breakout below 9,200 and seasonal weakness in summer months. However, traders should remain open to bullish reversals, especially if institutional buying continues, and consider range-bound strategies if volatility stabilizes. Monitoring fundamenta

BULLISH CACOA Bullish on Cacoa with target at $13000. we may break this higher resistance with the durrent supply sortage on the market.

ILong

Cocoa Explosion Loading? Specs & Hedgers Agree🔍 Fundamental Analysis – Commitment of Traders (COT)

The latest COT report, dated May 13, 2025, reveals a strong bullish accumulation signal, with a significant increase in long positions across all major trader categories.

Specifically, Non-Commercials (speculative traders such as hedge funds and

IShort

Cocoa's Future: Sweet Commodity or Bitter Harvest?The global cocoa market faces significant turbulence, driven by a complex interplay of environmental, political, and economic factors threatening price stability and future supply. Climate change presents a major challenge, with unpredictable weather patterns in West Africa increasing disease risk a

ILong

Cocoa futures swing idea There is some room for price to advance to 9.500 area for a nice swing. We'll see.

ILong

LONG FUTURE CACAO Hello everyone, today I’m sharing my analysis on cocoa futures, as I see an interesting opportunity for an upward move. Below, I’ll break down the reasons behind my bullish bias and my entry strategy. Let’s get into the details!

Why I’m Bullish on Cocoa Futures

Institutional and Retail Activity

My

ILong

Cocoa Short: Completed wave 2 (or B) rallyI've previously publish an idea for Cocoa long because of ending diagonal. But it should be clear to an EWer that the down move was a 5-wave structure and thus the long idea was a wave 2 or B idea. Now that we have completed 3-waves up for Cocoa, I think it's time that Cocoa resumes it's down move a

IShort

Cocao Futures LongCC1! is not net long on the regression break.

The roll long on this commodity is (-1.4%) per a month.

I am entering a EA for this pair with limited risk and controlled entry.

ILong

Cocoa Swing LongTrade idea based on supply and demand, intermarket analysis, COT positioning and cross market valuation. Following a structured approach with clear entry, risk management, and confluence factors.

ILong

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

CCN2025

Jul 2025DMarket open

9,636USD / TNE−3.09%

CCU2025

Sep 2025DMarket open

8,764USD / TNE−4.09%

CCZ2025

Dec 2025DMarket open

8,081USD / TNE−4.22%

CCH2026

Mar 2026DMarket open

7,592USD / TNE−3.48%

CCK2026

May 2026DMarket open

7,440USD / TNE−3.10%

CCN2026

Jul 2026DMarket open

7,353USD / TNE−2.91%

CCU2026

Sep 2026DMarket open

7,238USD / TNE−3.14%

CCZ2026

Dec 2026DMarket open

7,080USD / TNE−3.12%

CCH2027

Mar 2027DMarket open

6,964USD / TNE−2.78%

CCK2027

May 2027DMarket open

7,040USD / TNE−0.91%

See all CC1! contracts

Frequently Asked Questions

The current price of Cocoa Futures is 8,764 USD / TNE — it has fallen −4.09% in the past 24 hours. Watch Cocoa Futures price in more detail on the chart.

The volume of Cocoa Futures is 9.77 K. Track more important stats on the Cocoa Futures chart.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Cocoa Futures this number is 41.20 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Cocoa Futures shows that traders are closing their positions, which means a weakening trend.