BEKASI FAJAR INDUSTRIAL ESTATE TBK

85IDRD

+1+1.19%

At close at Mar 21, 09:54 GMT

IDR

No trades

−3 IDR

39.53 B IDR

544.31 B IDR

3.54 B

About BEKASI FAJAR INDUSTRIAL ESTATE TBK

Sector

Industry

CEO

Yoshihiro Kobi

Website

Headquarters

Bekasi

Founded

1989

ISIN

ID1000122609

FIGI

BBG002QQ63Q8

PT Bekasi Fajar Industrial Estate Tbk engages in the development and management of industrial towns, including facilities and supporting infrastructure. It operates through the Industrial Estate, Leasing of Production Facilities, Commercial Industrial Estate, and Management of Industrial Estate segments. The company was founded on August 24, 1989 and is headquartered in Bekasi, Indonesia.

−60%

−40%

−20%

0%

20%

Q3 '23

Q4 '23

Q1 '24

Q2 '24

Q3 '24

−70.00 B

0.00

70.00 B

140.00 B

210.00 B

Revenue

Net income

Net margin %

Revenue

COGS

Gross profit

Op expenses

Op income

Non-Op income/ expenses

Taxes & Other

Net income

0.00

35.00 B

70.00 B

105.00 B

140.00 B

Revenue

COGS

Gross profit

Expenses & adjustments

Net income

0.00

35.00 B

70.00 B

105.00 B

140.00 B

Q3 '23

Q4 '23

Q1 '24

Q2 '24

Q3 '24

−500.00 B

0.00

500.00 B

1.00 T

1.50 T

Debt

Free cash flow

Cash & equivalents

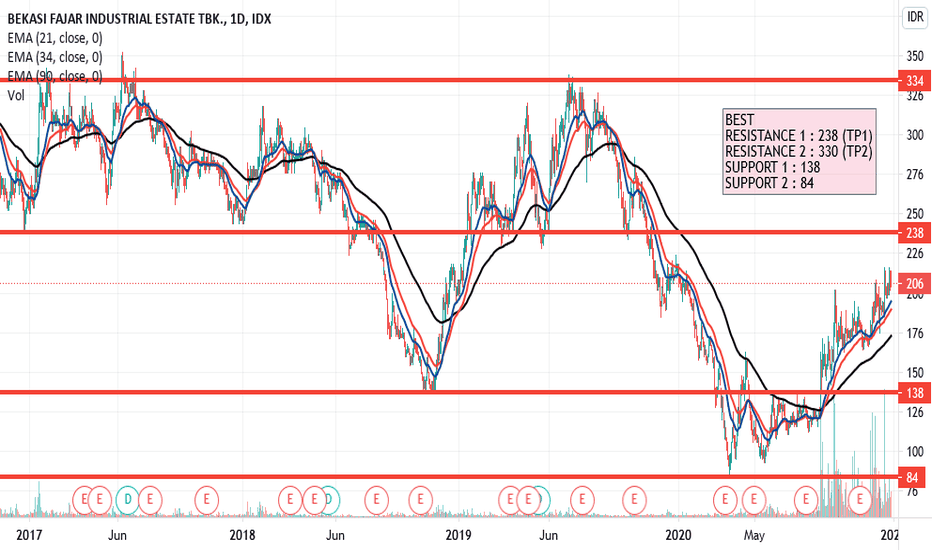

BEST My Bullish ViewBEST My Bullish View. Harmonic Pattern Anti Cypher and Butterfly. VCP. Cup and Handle.

ILong

ILong

BEST IS A Beautifuly Momenti look BEST potential break near resistance , i think BEST good for buy on weeknes & neutral trend.

if break reisitrance , BEST can up resistance 1 : 168 , maybe after until resistance 1 BEST will correction for weekly , and next resistance BEST will up to 210.

disclaimer On

Potential CnH PatternBEST has potential to form Cup and Handle pattern

Buy if price breaks 169

SL: 160

Target: 196

ILong

THE BEST IN ITS SECTOR, AND IT IS "BEST"Supporing Data:

- Midterm, the structure is still uptrend identified by price still making Higher Low

- 3 Days TF, SR flip has been highlighted in the greenbox

- Several Bull Engulf if zoom in in the daily timeframe (in the zoom between 138-140) concurrent with a setup of retracement

The level of

ILong

Potential Area to BuyShort Term Trading

Consider to BUY if price > 169

Target1: 195

Target2: 210

Domestic : Foreign Composition = 50:50

LONG TERM

PBV BEST is still under its 5 yrs average (0.64), current = 0.36

ILong

BEST buy on breakoutUptrend (Full Green)

Consolidation after Volume breakout with good candlestick

-> Buy on breakout

ILong

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of BEST is 85 IDR — it has increased by 1.19% in the past 24 hours. Watch BEKASI FAJAR INDUSTRIAL ESTATE TBK stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on IDX exchange BEKASI FAJAR INDUSTRIAL ESTATE TBK stocks are traded under the ticker BEST.

BEST stock has fallen by −4.49% compared to the previous week, the month change is a −10.53% fall, over the last year BEKASI FAJAR INDUSTRIAL ESTATE TBK has showed a −37.04% decrease.

BEST reached its all-time high on May 1, 2013 with the price of 1,050 IDR, and its all-time low was 80 IDR and was reached on Feb 28, 2025. View more price dynamics on BEST chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

BEST stock is 4.76% volatile and has beta coefficient of 1.22. Track BEKASI FAJAR INDUSTRIAL ESTATE TBK stock price on the chart and check out the list of the most volatile stocks — is BEKASI FAJAR INDUSTRIAL ESTATE TBK there?

Today BEKASI FAJAR INDUSTRIAL ESTATE TBK has the market capitalization of 820.02 B, it has decreased by −2.27% over the last week.

Yes, you can track BEKASI FAJAR INDUSTRIAL ESTATE TBK financials in yearly and quarterly reports right on TradingView.

BEST net income for the last quarter is 20.71 B IDR, while the quarter before that showed 19.82 B IDR of net income which accounts for 4.53% change. Track more BEKASI FAJAR INDUSTRIAL ESTATE TBK financial stats to get the full picture.

BEKASI FAJAR INDUSTRIAL ESTATE TBK dividend yield was 0.00% in 2023, and payout ratio reached 0.00%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Mar 23, 2025, the company has 217.00 employees. See our rating of the largest employees — is BEKASI FAJAR INDUSTRIAL ESTATE TBK on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. BEKASI FAJAR INDUSTRIAL ESTATE TBK EBITDA is 180.12 B IDR, and current EBITDA margin is 44.08%. See more stats in BEKASI FAJAR INDUSTRIAL ESTATE TBK financial statements.

Like other stocks, BEST shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BEKASI FAJAR INDUSTRIAL ESTATE TBK stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So BEKASI FAJAR INDUSTRIAL ESTATE TBK technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating BEKASI FAJAR INDUSTRIAL ESTATE TBK stock shows the sell signal. See more of BEKASI FAJAR INDUSTRIAL ESTATE TBK technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.