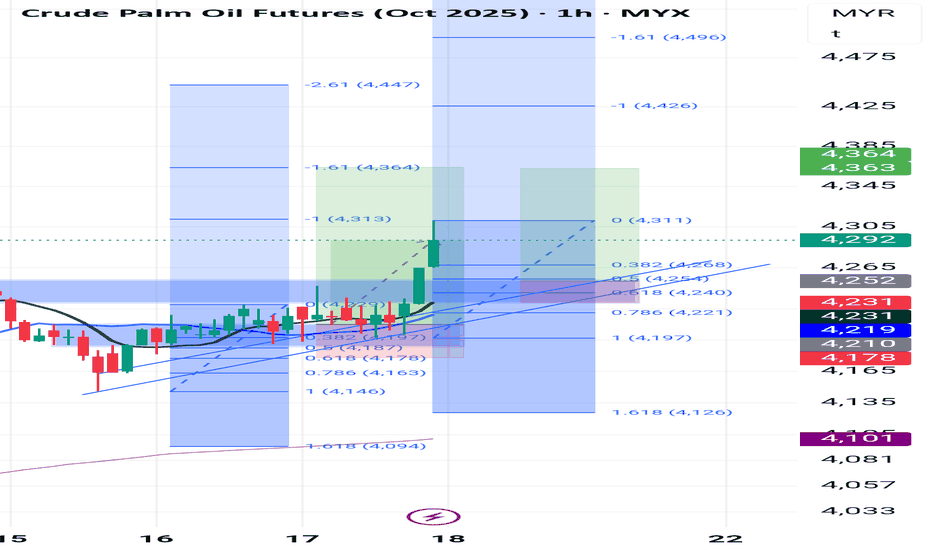

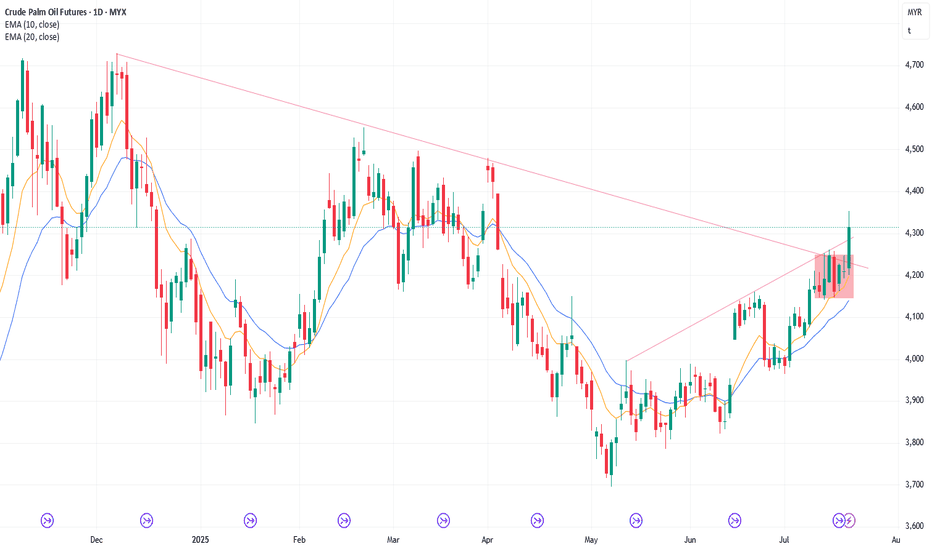

continuation bullish modeBased on the chart tf 1h, looks still strong to bullish mode. retracement area maybe between 4254 to 4230 which is area hh before (major market structure and Fibonacci retracement 0.5 to 0.618. and theres also strong support trendline in that area. however, will see how much the gap this morning .18

Crude Palm Oil Futures

2,115MYR / TNED

+34+1.63%

At close at May 15, 2020, 03:55 GMT

MYR / TNE

No trades

Contract highlights

No news here

Looks like there's nothing to report right now

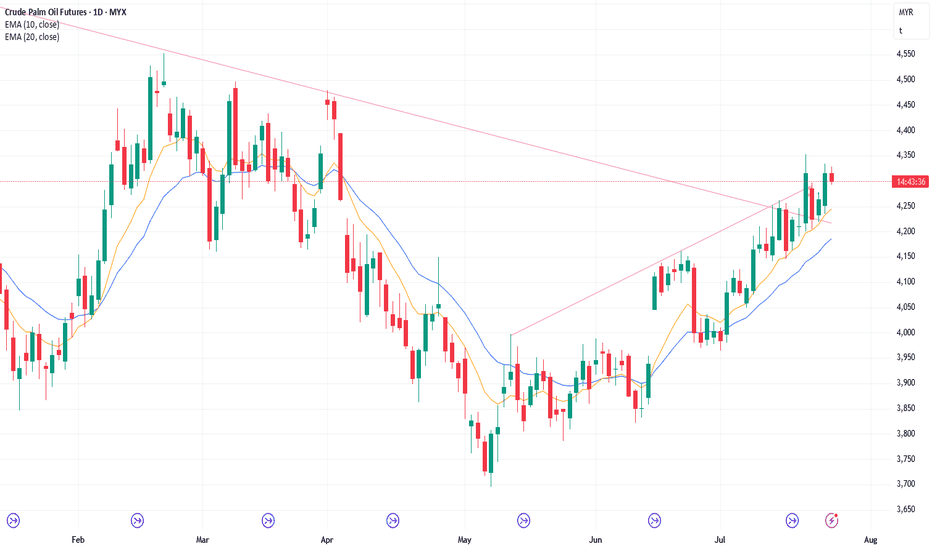

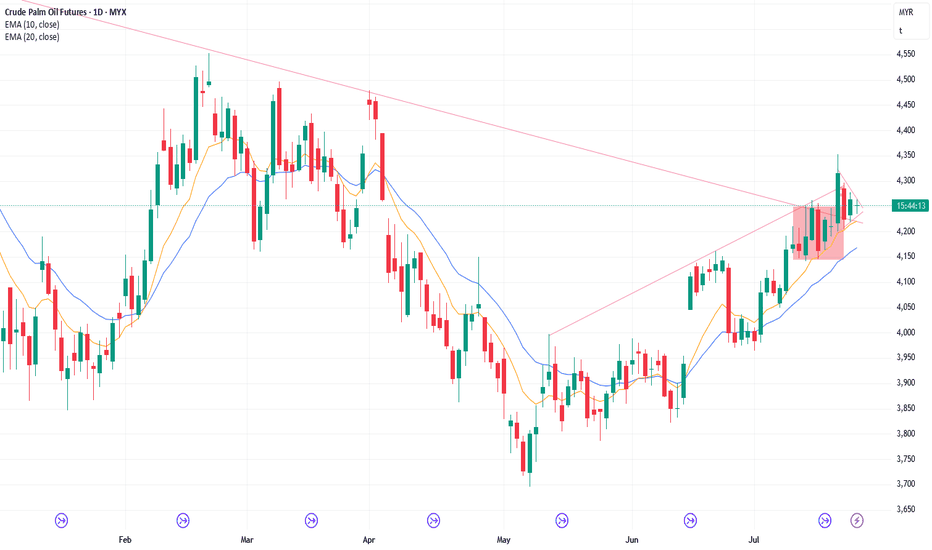

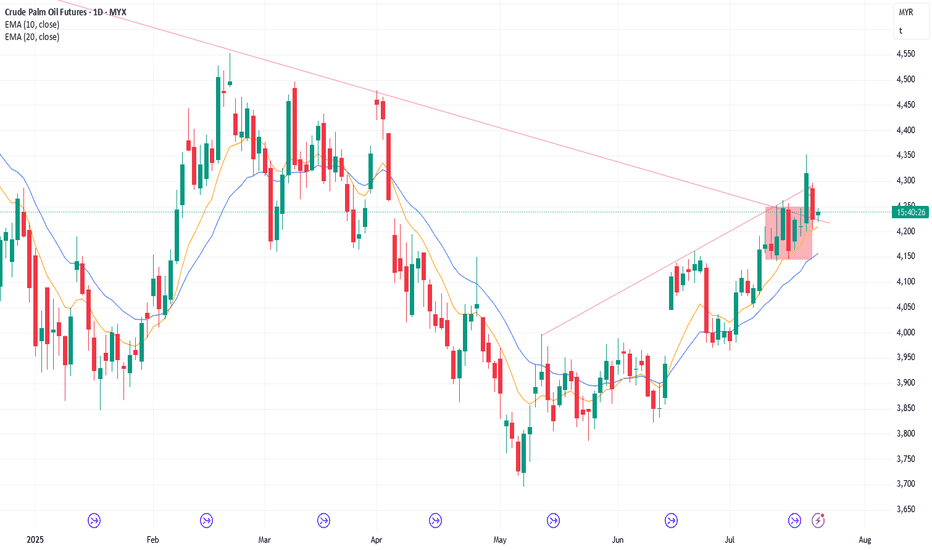

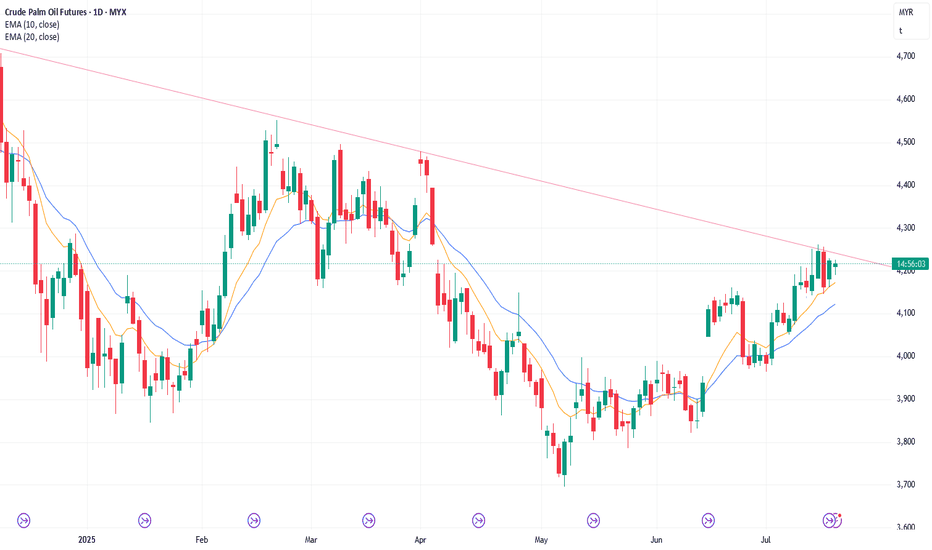

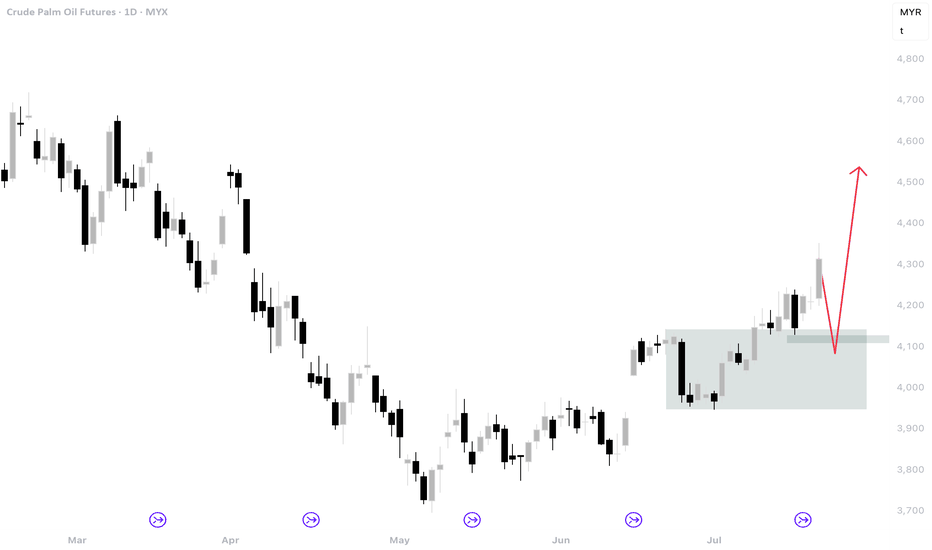

FCPO Week 30 2025: 4500?It took a very long time to reach 4300. The next target is 4500. However it won't be easy because there are a few resistance above 4300. Expecting that price might retrace a bit before continuing higher.

MLong

11/7/25 FT Selling or, Sideways and Another Leg Up?

Thursday’s candlestick (Jul 10) was a bear doji closing slightly below the middle of its range.

In our last report, we said traders would see if the bears could create a strong bear bar closing near its low, or if the market would trade lower, but close with a long tail below or above the middl

24/7/25 Buying Pressure Is Slightly Stronger

Wednesday’s candlestick (Jul 22) was a bull bar closing near its high.

In our last report, we said traders would see if the bulls could create follow-through buying and test near the July 18 high, or if the market would form a breakout below the triangle and ii (inside-inside) pattern instead.

23//7/25 No FT Selling Again. Market in Breakout Mode

Tuesday’s candlestick (Jul 22) was an inside bull bar closing near its high.

In our last report, we said traders would see if the bears could create follow-through selling, or if the market would trade higher and retest the July 18 high instead.

The market traded higher for the day, and the be

22/7/25 Can Bears Finally Create Follow-through Selling?

Monday’s candlestick (Jul 21) was a big inside bear bar closing in its lower half with a prominent tail below.

In our last report, we said traders would see if the bulls could create follow-through buying, or if the follow-through buying over the next 1-2 days would be limited. If this is the c

21/7/25 Can Bulls Create FT Buying Over Next Few Days?

Friday’s candlestick (Jul 18) was a big bull bar closing in its upper half with a prominent tail above.

In our last report, we said traders would see if the bulls could close the day's candlestick near its high, or if the daily candlestick would close with a long tail above or below the middle

18/7/25 Weekly Candlestick To Close Near Its High or Tail Above?

Thursday’s candlestick (Jul 17) was a doji bar with a long tail above.

In our last report, we said traders would see if the bulls could create a follow-through bull bar testing the July 14 high, or if the market would form a lower high (versus July 14) and be followed by some selling pressure i

17/7/25 Retest Jul 14 High or Weak Follow-through Buying?

Wednesday’s candlestick (Jul 16) was an inside bull bar closing near its high.

In our last report, we stated that traders would observe whether the bears could create a follow-through bear bar, even if it were just a bear doji, or if the market would trade higher to retest the July 14 high. If

16/7/25 Can Bears Create A Follow-through Bear Bar?

Tuesday’s candlestick (Jul 15) was a big bear bar closing in its lower half with a prominent tail below.

In our last report, we said traders would see if the bulls could create a strong breakout above the bear trend line, or if the market would trade sideways and stall around the bear trend lin

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

FCPOQ2025

Aug 2025DMarket open

4,267MYR / TNE+0.54%

FCPOU2025

Sep 2025DMarket open

4,317MYR / TNE+0.44%

FCPOV2025

Oct 2025DMarket open

4,338MYR / TNE+0.53%

FCPOX2025

Nov 2025DMarket open

4,341MYR / TNE+0.49%

FCPOZ2025

Dec 2025DMarket open

4,339MYR / TNE+0.51%

FCPOF2026

Jan 2026DMarket open

4,335MYR / TNE+0.51%

FCPOG2026

Feb 2026DMarket open

4,327MYR / TNE+0.67%

FCPOH2026

Mar 2026DMarket open

4,306MYR / TNE+0.70%

FCPOJ2026

Apr 2026DMarket open

4,270MYR / TNE+0.66%

FCPOK2026

May 2026DMarket open

4,236MYR / TNE+0.69%

FCPOM2026

Jun 2026DMarket open

4,212MYR / TNE+0.72%

See all FCPOK2020 contracts

Frequently Asked Questions

The nearest expiration date for Crude Palm Oil Futures is May 15, 2020.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Crude Palm Oil Futures before May 15, 2020.