NVDA trade ideas

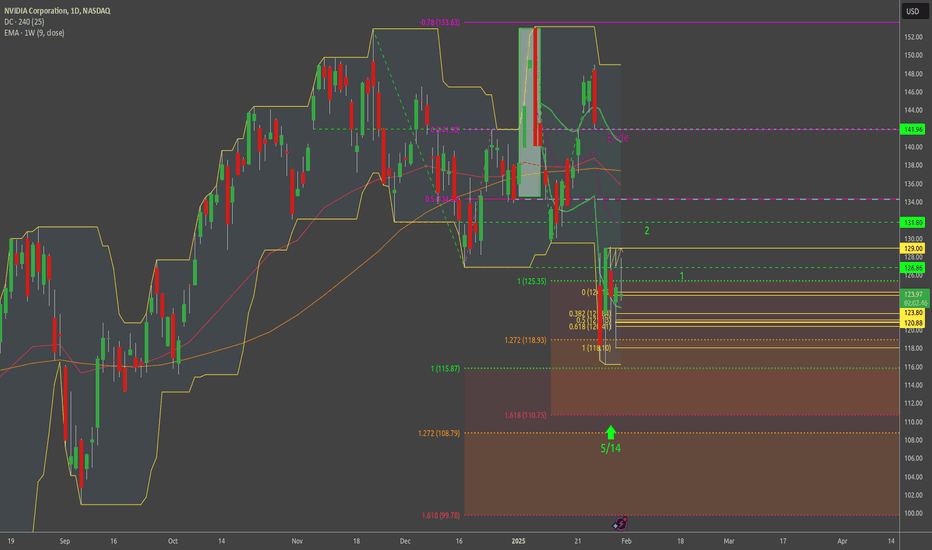

NVDA | Pivot Points | $100Price action still pulling back around $127 - $120 for a continued sell-off towards $100

I'm using pivot points to help read the direction of trend and then measuring the waves in sellers to get an idea of how well momentum is doing which can also be used to generate targets like shown on chart

Entering at current price would make a 1:1 trade vs looking for a higher entry @ ~126 would allow for less risk.

NVDA Potential Long Term Investment NVIDIA stands out as a promising investment because of its dominant position in several fast-growing technology sectors. Its leadership in graphics processing units (GPUs) fuels advancements in gaming, high-performance computing, and artificial intelligence (AI), making it a cornerstone in the digital revolution. As industries worldwide increasingly rely on AI and machine learning, NVIDIA’s innovative solutions offer unmatched performance that powers everything from immersive gaming experiences to complex data analytics in data centers.

The company’s aggressive research and development investments have continually driven product innovation, ensuring that it remains at the forefront of emerging trends like autonomous vehicles and edge computing. In addition to its technological prowess, NVIDIA boasts strong financial metrics, including robust revenue growth, profitability, and a solid balance sheet that supports further expansion. Strategic partnerships and a global market presence reinforce its competitive edge and long-term prospects.

Although risks and market volatility persist in the technology sector, NVIDIA’s commitment to innovation and its scalable business model provide compelling reasons for investors to consider it. Despite receiving the short end of the stick for several months as price consolidates within a wide value range, the stock has recently experienced the largest single day decline in Nvidia's history. Although some may panic and question the true intrinsic value for this company, it should be clear that Nvidia is a leader in the technology space. Overall, the company’s unique blend of cutting-edge technology, strategic vision, and sound financial health positions it as an attractive choice for those seeking long-term investment opportunities in a transformative industry.

Technically speaking, we have an Anchored VWAP taken from the start of the rally from $50 in confluence with a previous low liquidity zone around $100.

I will be watching this zone for a long term investment opportunity.

NVDA I am thinking this scenario over the next few months, I am thinking of DCA'ing into some long term shares. some NVDL 2X leveraged for Swing trades, and some LEAP options.

I personally am not fond of short term options on this name. IV is often high and the moves are large.

I would likely take less risk with spreads or sell premium.

I'm not a professional, just like to participate and this is accountability for me...

NVDA Update: Potential Trend ReversalFor NVDA holders; NVDA has been in a strong downtrend, forming a series of lower highs and lower lows.

The price recently tested a key demand zone (114.49 - 117.07), showing signs of a possible reversal.

Breaking the supply zone (120.02 - 124.79) would be a bullish confirmation.

A breakout above 127.87 ( last swing High) would further confirm that the downtrend is over and a new impulsive move is beginning.

The price is challenging the downtrend line at the moment, and a strong breakout could trigger a strong rally.

✅ Bullish Signs to watch:

Break above 120 = Confirmation of strength

Break above 124.79 = Bullish breakout

Break above 127.87 = Strong confirmation for trend reversal

🚨 Bearish Signs:

Rejection at 120 or 124.79 could lead to further downside.

A drop below 114 would invalidate the bullish thesis.

"Amateurs focus on how much money they can make. Professionals focus on how much they can lose." – Jack Schwager

🚨 Disclaimer: This is not financial advice. Always do your own research and manage risk accordingly. 🚨

$NVDA: Broadening Formation & Earnings Play – $180 Calls for MayHey what's up everyone. Here's an analysis on NASDAQ:NVDA 👇🏽

💹 Trade Analysis & Setup

NVIDIA ( NASDAQ:NVDA ) is currently trading at $116.66, showing high volatility inside a Broadening Formation (BF) on both the daily and monthly timeframes.

This setup is a textbook liquidity expansion pattern, where price is making higher highs and lower lows within a widening megaphone structure.

The key catalyst in play is NVDA earnings on Feb 21, 2025, which could drive significant price action and IV expansion.

🔼 Bullish Case (Targets: $129 - $141.88 - $150+)

Earnings Catalyst (Feb 21): AI demand remains strong, with NVDA leading the semiconductor market.

Breakout Zone at $123-$125: NVDA must reclaim this zone to shift into an uptrend.

$129 (Prior Weekly High): A breakout here could bring momentum buyers & institutions into play.

Gap Fill to $141.88: Major upside potential exists if NVDA can sustain bullish momentum post-earnings.

🔻 Bearish Risks (Key Support & Breakdown Levels)

Daily Lower BF Break (~$113-$115): If this level fails, downside could accelerate toward $110-$105.

Monthly Broadening Formation Lower Level (~$100-$95): Extreme downside risk in the worst-case scenario.

Earnings Disappointment: If NVDA’s report fails to meet expectations, a strong move down is possible.

Theta Decay Impact: My contract loses value daily (~$3.53 per day), so a slow move up is not favorable.

IV Crush Post-Earnings: If NVDA doesn’t move much after earnings, option value could rapidly drop.

🚀 My Trade Plan

Bullish Breakout Plan: Hold if NVDA reclaims $123-$129, targeting $141-$150+ before March-April.

Earnings Play Strategy: Hold through earnings ONLY IF NVDA builds strength into Feb 21.

Exit if $113 breaks below with strong volume to prevent further downside losses.

NVDA’s Daily & Monthly Broadening Formations confirm high volatility & liquidity expansion. The next major move is likely earnings-driven.

If NVDA clears $129, I will hold my calls. If support at $113 fails, I may exit early.

💡 Trade Details:

Position: NVDA $180c 16 MAY 25

Entry Price: $2.60

Current Price: $1.72

P/L Open: (-$85.66) / (-33.8%)

Delta: 11.36 (~0.11)

Theta: (-3.53)

Key Catalyst: Earnings on Feb 21, 2025

NVDA GEX Analysis and Option Trading SuggestionsKey Observations

1. Put Support:

* A significant put support level is observed at $115, with a high negative gamma exposure of -73.82%. This level is likely to act as strong support due to market makers hedging their positions.

2. Call Resistance:

* Call walls are visible at $125 and $140, with the second call wall at $140 being the strongest resistance due to the higher gamma concentration (65.46%). These levels may serve as barriers for upward movement.

3. Gamma Flip Zone:

* The $120 level appears to be a key pivot point, where the gamma transitions from negative to positive. If NVDA can hold above $120, it may gain momentum toward $125.

4. IVR (Implied Volatility Rank):

* IVR at 69.2 indicates relatively high implied volatility compared to historical levels, suggesting elevated options premiums.

* This high IVR can be leveraged for credit strategies.

5. Implied Volatility (IVx):

* IVx at 73.6 indicates substantial movement expectations in the near term.

Option Trading Suggestions

1. Bullish Scenario:

* If NVDA breaks and holds above $120:

* Trade Idea: Buy a Call Debit Spread.

* Strike 1: $120 (Buy Call)

* Strike 2: $125 (Sell Call)

* Expiry: 1-2 weeks out.

* Reasoning: The goal is to target the next resistance level at $125 while mitigating high IV costs.

2. Bearish Scenario:

* If NVDA fails to hold $115:

* Trade Idea: Buy a Put Debit Spread.

* Strike 1: $115 (Buy Put)

* Strike 2: $110 (Sell Put)

* Expiry: 1-2 weeks out.

* Reasoning: Targets the next support at $110, aligning with put gamma walls.

3. Neutral Strategy:

* For range-bound movement between $115 and $125:

* Trade Idea: Sell an Iron Condor.

* Sell Put: $115

* Buy Put: $110

* Sell Call: $125

* Buy Call: $130

* Reasoning: Capitalizes on elevated IV while limiting risk.

Thoughts and Insights

* Momentum Assessment: NVDA's ability to hold $120 is critical for a bullish continuation. If it fails, the focus shifts to $115 as the next support.

* Volatility Expectation: Elevated IV suggests potential for sharp moves; however, premium collection strategies can be lucrative.

* Key Levels to Monitor:

* Support: $115, $110

* Resistance: $120, $125, $140

Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always perform your own due diligence and risk management before trading.

NVIDA Looking Ahead

Through the previous week, we have seen increased volatility within the market with many eyes looking at NASDAQ:NVDA historic loss. Many question as to whether or not DeepSeek brought the end of NVDA's market dominance or if it will continue its bull run. Looking ahead to figure out which scenario will play out, for NVDA to continue its bull-run I'd like to see them break past that previous lower high at $130.29, eventually to hopefully reclaim some of the gap left in the DeepSeek wake. If it fails to reclaim that lower high and push down to a lower low, I would then be watching the lower key levels at $100.95 and $90.69 as a resistance level.

Nvidia's Price Approaches the $110 MarkThe stock has dropped more than 11% over the past five trading sessions due to newly imposed tariffs on Taiwanese semiconductors (which could increase Nvidia's costs) and growing concerns over DeepSeek's advanced AI model, which has intensified competition in the sector. Additionally, rising global trade tensions have led investors to lose confidence in Nvidia's future market outlook. As one of the most influential technology companies worldwide, a potential slowdown in global economic growth could negatively impact Nvidia's sales and revenue projections.

Accelerated Downtrend

Nvidia has already undergone a significant decline from the $150 price zone and is now approaching the key support level at $114 per share. So far, the sharp bearish moves have largely been accompanied by price gaps, and no clear trend-defining structure has emerged to establish a decisive bearish bias. This suggests that, in the long run, investors should watch for potential bullish corrections, given the speed of the recent sell-off.

RSI Indicator

The RSI line has consistently declined and is now approaching the oversold zone near the 30 level. This signals a strong imbalance between buying and selling pressure, which could increase the likelihood of short-term upward corrections in the stock price.

Key Levels

$130: The most significant resistance level, representing a neutral price zone over the past few months. A return to this level could reinforce a sideways market outlook in the coming weeks.

$114: A critical support level, aligning with the 61.8% Fibonacci retracement barrier. Sustained movements below this level could reinforce the bearish perspective and trigger a more extended selling wave.

By Julian Pineda, CFA - Market Analyst

NVIDIA has reached the first targetNASDAQ:NVDA created a perfect double top pattern, breaking the baseline forcefully and offering up to two perfect pullbacks that only confirmed that the $127.7 level had ceased to be support and had become a critical resistance .

A few weeks ago, we already warned that considering shorts on NVDA was feasible due to the breakdown of a previous pattern (see previous ideas). Now that the double top has broken down, the most common target would be to see prices around the $103 area , which, given NVDA's strong fundamentals and monopoly in AI, seems unlikely.

But with Trump, you never know! If market uncertainty persists, the most extreme level would be around the $90 area, where a significant amount of money should appear to buy NVDA at a substantial discount.

Spike Not Yet DigestedIt looks that we are building a bottom after the broad spike 2-3 days ago.

There is big volatility as the market is not yet aware whether the fallis over already. The more it is option expiration day today.

Thus today is decisive whether we are able to close the spike which would be healthy.

I think that we we settle down today to open higher on Monday when the otions will have expired.

NVDA Trading Plan: Waiting for a Break Above SMA 150 at 130.84Currently, the price of NVDA is 117.81, which is below the 150 SMA (128.9). The suggested entry point is 130.84, which is safely above the SMA 150, indicating a confirmation of upward momentum.

Entry Strategy:

Wait for the price to break above 130.84.

Ensure the SMA 150 continues to trend upward for additional confirmation.

Stop Loss:

Set the stop loss was at 126.97, below the SMA 150, to minimize risk.

Target:

Monitor the price action for key resistance levels to determine potential profit targets.

Alerts:

Set an alert on TradingView at 130.84 to notify you when the price breaks the entry level. NASDAQ:NVDA

NVDA - Waiting for a pullback to add to my short exposureThe first NVDA analysis went pretty well.

Let's see what we can do from here.

Over the weekend the world was going crazy once more. This knocked the markets down and they opened in the red, and so does NVDA.

I would like to see a pullback to the 1/4 line. Because this would give me the chance to load the short even more.

Target is the Center-Line.

(Former analysis linked)

Incoming 50% correction for NVIDIA to $50Patiently we waited and finally it has happened.It was the month of January 2025 when this immense bubble would break support. 2 years after it first confirmed in September 2022.

A number of reasons now exist for a bearish outlook. Look left. On the above 5 week chart:

1) Price action and RSI support breakouts.

2) RSI support confirms resistance on past support.

3) Looking left previous corrections were at least 50% from the support exit, that’s $50 today should that repeat.

4) Looking left the chart suggests this correction is over after 210 days. In other words August 10th presents a unique long term investment opportunity.

Is it possible price action continues upward trend? Sure.

Is it probable? No.

Ww

NVIDIA at Crossroads: Will $116 Hold as the New Support? Jan. 3Technical Analysis:

* Trend Overview: NVDA has recently broken below the short-term support trendline, aligning with a bearish pattern. The stock is testing a critical support zone around $116, with declining momentum.

* Key Indicators:

* MACD: Bearish crossover with increasing negative divergence indicates selling pressure.

* Stoch RSI: Currently near oversold levels, showing possible consolidation or a short-term bounce.

* Volume: Rising sell volume signals strong bearish conviction as the price approaches key support.

Support and Resistance Levels:

* Immediate Support: $116 (critical level).

* Secondary Support: $110 (aligned with the next significant demand zone).

* Resistance Levels:

* Near-term resistance at $124.

* Further resistance at $128.95 and $149.10 (as noted by the CALL wall).

Options and GEX Analysis:

* Highest Positive GEX Level: $128.95, serving as the next potential gamma resistance.

* PUT Dominance: Significant PUT support around $116 aligns with technical support, offering a strong defensive zone.

* Volatility Metrics:

* IVR: 70.4% (indicating above-average implied volatility).

* Options Flow: 41.4% CALLs dominance suggests a lack of bullish sentiment, though potential for a rebound remains.

Scenarios:

1. Bullish:

* Entry: Above $124 on strong momentum.

* Target: $128.95 or higher if the gamma squeeze accelerates.

* Stop Loss: Below $120.

2. Bearish:

* Entry: On a breakdown below $116 with strong volume.

* Target: $110 or lower.

* Stop Loss: Above $118.

Conclusion:

NVDA is testing a critical support zone. A break below $116 could intensify the bearish momentum, while holding this level might attract short-term buyers aiming for $124+. Options data suggests bearish sentiment dominates, yet watch for unusual activity at support.

Range or Double top on Hourly?Range or Double top?

Is NVDA going to continue the short-term down trend or have a price reversal? Hypothetically if the price moves below 118.33, the chance increases for more bearish activity, if price closes above the high wave candle the 120-price range and price does not consolidate there is a possibility of price movement to 128.92. Please keep in mind the MACD (Chris Moody) indicator is very close to having a bearish cross over and the Stochastic RSI is bearish; and in addition, we had some very interesting news events this weekend that may sway the markets acting like invisible engulfing candles.