Light Crude Oil Futures

61.10USD / BLLD

−0.23−0.38%

As of today at 03:26 GMT

USD / BLL

No trades

About Light Crude Oil Futures

Crude Oil is a naturally occurring liquid fossil fuel resulting from plants and animals buried underground and exposed to extreme heat and pressure. Crude oil is one of the most demanded commodities and prices have significantly increased in recent times. Two major benchmarks for pricing crude oil are the United States' WTI (West Texas Intermediate) and United Kingdom's Brent. The differences between WTI and Brent include not only price but oil type as well, with WTI producing crude oil with a different density and sulfur content. The demand for crude oil is dependent on global economic conditions as well as market speculation. Crude oil prices are commonly measured in USD. Although there have been discussions of replacing the USD with another trade currency for crude oil, no definitive actions have been taken.

No news here

Looks like there's nothing to report right now

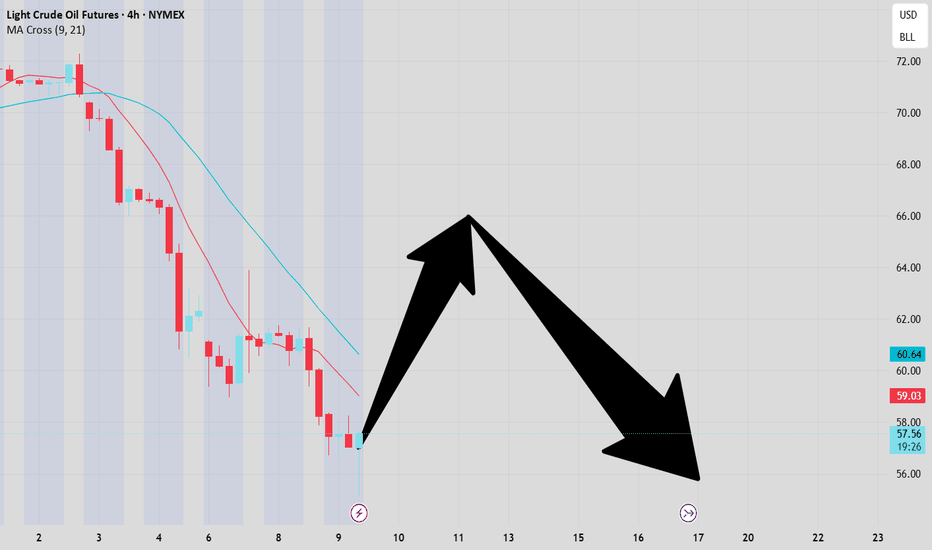

CL Swing Long Trade idea based on supply and demand, intermarket analysis and cross market valuation. Following a structured approach with clear entry, risk management, and confluence factors.

NLong

Crude oil-----Buy near 65.00, target 62.30-60.00Crude oil market analysis:

Recently, crude oil has also fluctuated greatly due to the influence of fundamentals. It started to rise rapidly yesterday, and the daily line closed with a standard big hammer candle pattern. Today, we rely on the 65.20 position to buy. We can also consider buying when it

NLong

I've Cracked the BULLISH Code in Crude Oil Using COTCrude oil is setup for longs based on fundamental conditions underlying the market place.

The quinquennial Bear Trap: Oil’s Next Leg DownIn this video I cover the potential for oil to trade down into the 55 $ range and what confluences we have at this price region .

Please support with a boost and I welcome any questions

CL ready for new move upBased on time fib and Feigenbaum constants, CL is closing in on the bottom for this swing, expected within marked timezone. The swing highs/lows follows the Feigenbaum projections for the last few swings. I expect a dip below $57 before a new run higher, at least to $72-73.

NLong

Buy idea on Crude Oil (CL1!)Based on :

- US10Y Leading long spike

- Commercials and Non Commercials at Extremes

- Open Interest at Extremes

- Cycles and quantitative data

- Undervalued conditions

-Demand zone

NLong

Crude oil------sell near 63.00, target 60.00-57.00Crude oil market analysis:

The recent daily crude oil line is still not very strong. There was a rebound, but it was just a rebound. Gold rose strongly, but crude oil did not rise strongly. Yesterday's crude oil also ran down slightly. Today's crude oil is still around 63.00 and 65.00, which are opp

NShort

Light Crude Oil (CL) is Targeting Further Declines in the Near TLight Crude Oil (CL) has exhibited a downward trajectory since reaching its high on January 16, 2025, with indications suggesting further declines ahead. The descent follows an incomplete bearish pattern, structured as a double three Elliott Wave formation. The initial decline, termed wave W, conclu

Crude oil-----sell near 61.00, target 69.00-67.00Crude oil market analysis:

Tariffs have been increased again, and crude oil continues to fall sharply. It is difficult to change the short-term selling of crude oil. In addition, data and fundamentals all suppress it. Today's crude oil can continue to find selling opportunities. The crude oil patte

NShort

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

CLK2025

Apr 2025DMarket open

61.10USD / BLL−0.38%

CLM2025

May 2025DMarket open

60.53USD / BLL−0.36%

CLN2025

Jun 2025DMarket open

60.03USD / BLL−0.32%

CLQ2025

Jul 2025DMarket open

59.55USD / BLL−0.32%

CLU2025

Aug 2025DMarket open

59.15USD / BLL−0.32%

CLV2025

Sep 2025DMarket open

58.86USD / BLL−0.34%

CLX2025

Oct 2025DMarket open

58.76USD / BLL−0.24%

CLZ2025

Nov 2025DMarket open

58.58USD / BLL−0.37%

CLF2026

Dec 2025DMarket open

58.65USD / BLL−0.15%

CLG2026

Jan 2026DMarket open

58.73USD / BLL−0.83%

CLH2026

Feb 2026DMarket open

58.71USD / BLL−0.05%

See all CL1! contracts

Frequently Asked Questions

The current price of Light Crude Oil Futures is 61.11 USD / BLL — it has fallen −0.36% in the past 24 hours. Watch Light Crude Oil Futures price in more detail on the chart.

The volume of Light Crude Oil Futures is 5.62 K. Track more important stats on the Light Crude Oil Futures chart.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Light Crude Oil Futures this number is 145.11 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Light Crude Oil Futures shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Light Crude Oil Futures. Today its technical rating is strong sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Light Crude Oil Futures technicals for a more comprehensive analysis.