NGM2025 trade ideas

Nat Gas Weekly: Groundhog Day/Week Update. 2/2/25

The groundhog saw his shadow, and it is money in the bank for NG!!!!! HA!!!

This week’s video will discuss the verification of the warm up last week and next week in the US. How another Elongated Polar Vortex (EPV), the ninth of the season looks to finally break the stratospheres back with a Sudden Stratospheric Warming (SSW) event. Although not so sure why something that has been seen for the last three weeks is called sudden! How that is going to influence the next 3-8 weeks, and the verification form past events. Remember that the models have a hard time with the interaction of different forcing inputs. They can see the warm moist Pacific air, they can see the cold dense air in the Artic, but they have a difficult time having the two inter act. Throw in there an extreme Polar event 80 miles up in the atmosphere and they are down right horrible. But luckily, we have the past to help us see what these conditions have done and are likely to do again.

We are so concerned about the weather due to it being close to ½ of the demand for NG usage. So if price discovery is dictated by the supply/demand balance and the weather influences one half of the demand, then we better understand what the weather will bring. Storage is dropping in Europe, putting a big demand for worldwide LNG. Tenders earmarked for Asia a being sold on the spot market and redirected to Europe. It looks that Europe is going to cool down again along with North America. I will post another time on the interaction between western European and North American weather patterns. But know that what happens in the US is telegraphed 7-10 days in Western Europe. This is why TTF has rallied this past week. They are looking at the same forcing patterns we are looking at. They get cold then the US get cold. They warm up the US warms up. Great tool to use in the summer also.

This coming cold is going to eat away into the US NG storage. Two weeks ago, it was predicted that storage was going to end up somewhere around 1.7 TCF at the end of the withdrawal season. But the market only looking at the model’s, screaming winter is over, winter is over!!!! Had industry readjusting the storage numbers back up closer to 2.0 TCF. Which would put the season end 250BCF above the 5-year average. This cold will eat into storage, LNG facilities will continue to come on-line and producers will continue to show proper supply management. Listen to the Company conference calls from the big E&Ps, Pipeline provider, and oil/gas field providers. They are all in agreement that last year’s pricing killed their bottom line and discipline is the word of the day.

I expect the models to continue to print colder as they take into count the MJO, major teleconnections, and the PV. The estimates for storage will begin to drop and the price to increase. There is much talk about Tariffs and the Chinese DeepSeek AI model going to influence the supply/demand balance. But these just become good excuses to sell rallies and pump price drops. The current COT report shows longs at their highest ratio to shorts since last May’s price rally. So be very careful of Long Squeezes. Just like a short squeeze, the future positions are highly leveraged and rapid and volatile price drops are more the rule than the exception. So, make sure you are watching the models during the 03:00-05:00 GMT and 17:00-19:00 GMT. I believe that the general trend is to be up until mid-March and will be investing and trading accordingly. These is not advice, but just what I am looking at for the basis of my own personal trading. I will post later in the week dedicated to only supply/demand/storage after the early week estimates get revised higher from the colder model prints and the overall general industry discussing the colder weather coming. Remember the institutional boys only want to discuss in the open what they have already bet on so the retail and smaller investor provide them with healthy exit points.

Keep it Burning!

NATGAS Massive Long! BUY!

My dear friends,

My technical analysis for NATGAS is below:

The market is trading on 3.072 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 3.428

Recommended Stop Loss - 2.914

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

———————————

WISH YOU ALL LUCK

NATGAS GAP CLOSURE|LONG|

✅NATGAS gapped down massively

And the price has almost reached

The strong horizontal support

At the round level of 3.00$

And as Gas is objectively oversold

We are already seeing some

Gap closure moves and we

Will be expecting a further

Move up until the gap is

Closed completely

LONG🚀

✅Like and subscribe to never miss a new idea!✅

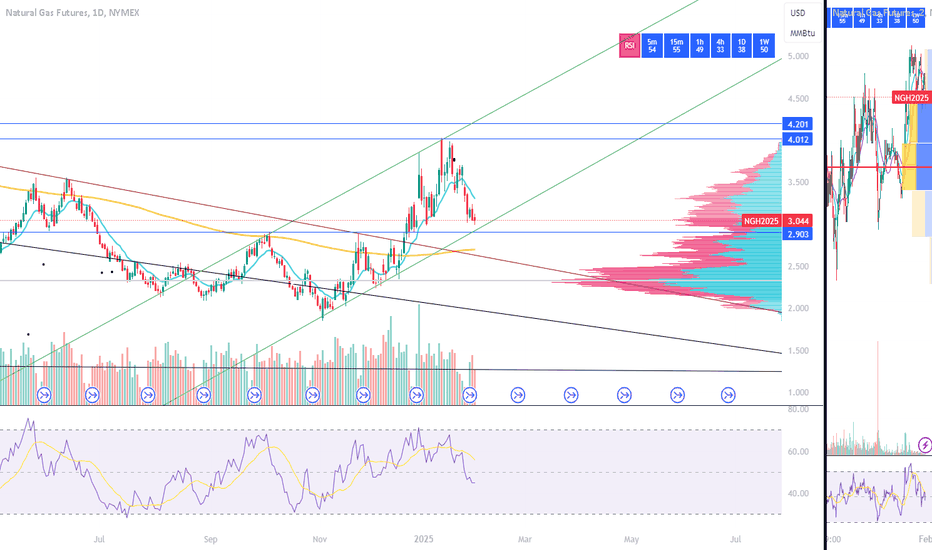

NATURAL GAS: Channel Down bottomed and is rebounding to 4.800Natural Gas is neutral on its 1D technical outlook (RSI = 47.119, MACD = -0.072, ADX = 39.523) as the bearish wave of the long term Channel Up found support on its bottom and the 1D MA100 and is rebounding. It hasn't yet crossed over the 1D MA50 but when it does the bullish signal will be validated. On any occassion, last time the 1D RSI rebounded near this level, it was on the October 18th and August 27th 2024 lows. Both later rebounded by at least +60.48%. We aim for a similar target (TP = 4.800).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

NATGAS: Trading Signal From Our Team

NATGAS

- Classic bullish setup

- Our team expects bullish continuation

SUGGESTED TRADE:

Swing Trade

Long NATGAS

Entry Point - 3.072

Stop Loss - 2.846

Take Profit - 3.554

Our Risk - 1%

Start protection of your profits from lower levels

❤️ Please, support our work with like & comment! ❤️

The ES January 27th I told one of my students that I would do a video when we were talking Friday night. she was long because she was Trading the move higher on the S&P. so she took a drawdown on her long position because it traded lower from the high on Friday. I made the mistake Italian her that the market was most likely going to go higher because of a two-bar reversal that would indicate the market might retest the high... and that if she were still long she'd be able to get out at a better price. this ended up being very bad advice because the market gaped on the open on Sunday. but this kind of volatility if you don't get stuck on the wrong side of the market gives enormous reward for buyers and sellers if you look for a reversal patterns that favor buyers and sellers if you know how to determine where the buyers and sellers are. my guess is since I don't know everybody.... is that most Traders will not short any Market no matter what. the one thing that I didn't say and I want to say here.... if you're only a one-sided Trader..... you will only take long positions.... you're bias will likely not help you look for a reversals in the market that go higher because your brain is only looking for buyers and your strategy will be that you want to be long and you never want to be short and that kind of strategy can filter out any real thought about what a good trade looks like and you're just not going to do it anyway. even if you don't think like a one-sided Trader even though you only go long I believe your bias is still detrimental to your ability to look for the two major things that create havoc in your Trading... not knowing where the buyers are and where the sellers are even if you don't short. it just for the records it it's much easier to take short trades in the Futures Market than it is to take short trades in the equities Market.

NATGAS Swing Long! Buy!

Hello,Traders!

NATGAS has lost almost

30% from the local highs

In no time so It is oversold

And as the Gas is about to

Retest the horizontal support

Of 2.948$ we will be expecting

A local bullish rebound

And a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Natural Gas Based on historical price patterns and seasonal demand cycles for natural gas, the **best months to buy natural gas stocks** (or ETFs tied to natural gas) have historically been **April–June** and **September–October**, when prices often hit seasonal lows. Here’s a breakdown of why these periods stand out:

---

### **1. April–June: Post-Winter Low**

- **Historical Trend**: Natural gas prices typically decline in spring due to reduced heating demand after winter. Storage inventories are often rebuilt during this period, leading to oversupply and lower prices.

- **Example**: From 2000–2023, natural gas futures averaged **~15% lower prices in April–June** compared to winter peaks.

- **Why Buy Here**: Stocks may be undervalued as markets price in weaker short-term demand. This period offers a potential entry point before summer cooling demand (air conditioning) or hurricane-related supply risks emerge.

---

### **2. September–October: Pre-Winter Dip**

- **Historical Trend**: Prices often dip in early fall ("shoulder season") before winter demand kicks in. Traders anticipate storage levels (which peak in November) and may sell ahead of uncertainty.

- **Example**: In 13 of the past 20 years, natural gas hit a seasonal low in September or October.

- **Why Buy Here**: Investors can position for the winter rally (Nov–Feb), when heating demand spikes and prices historically rise. Stocks may rally in anticipation.

---

### **3. December–February: Use Caution**

- **Risk**: While winter sees price spikes due to cold weather, stocks may already reflect these gains by late fall. Buying during winter carries risk of a post-peak correction (e.g., mild winters in 2015–2016 caused prices to crash 40%).

---

### **Key Historical Exceptions**

- **Weather Shocks**: Extreme cold (e.g., 2014 Polar Vortex) or hurricanes (e.g., Katrina in 2005) can disrupt seasonal patterns.

- **Storage Gluts**: In years with record-high storage (e.g., 2020), prices may stay depressed even in winter.

- **Macro Shifts**: The U.S. shale boom (post-2008) and LNG exports (post-2016) have altered traditional seasonality.

---

### **Strategic Takeaways**

- **Buy Low, Sell High**: Focus on **April–June** and **September–October** for accumulation.

- **Avoid Chasing Winter Rallies**: By December, prices and stock valuations may already reflect winter premiums.

- **Pair with Data**: Monitor the EIA’s weekly storage reports (released Thursdays) and weather forecasts.

---

### **Long-Term Considerations**

- **Energy Transition Risks**: Renewables and decarbonization policies could suppress long-term demand for natural gas.

- **Geopolitics**: Global LNG demand (e.g., Europe replacing Russian gas) may create new volatility.

---

### **Bottom Line**

Historically, **April–June and September–October** have been the most favorable months to buy natural gas stocks. However, always validate with current storage data, weather outlooks, and macroeconomic trends. Natural gas is inherently volatile—**diversify** and avoid overexposure to this cyclical sector.

NATGAS Buyers In Panic! SELL!

My dear friends,

Please, find my technical outlook for NATGAS below:

The price is coiling around a solid key level - 4.010

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 3.872

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

———————————

WISH YOU ALL LUCK

Video: Beating the models with MeteorologyIt's a bit long, but my first video. I am explaining the upcoming February pattern. How and what to look for in the winter with long range synoptic weather models. I am expecting the upcoming week to be warmer than normal, but do believe that cold returns for an overall colder February. This is going to be influencing storage coming out of the demand season. This I believe will keep NG above the $3 mark until we see what happens with production after the winter draw down and LNG terminals bringing new trains on. More LNG coming online is iffy at best, due to the constant delays in completion. But hopefully with the new Trump administration there will not be any hold up on the FERC permits being issued. The delays are just good old fashion construction delays.

I expect a lower open and a drop before the contract rolls over Tuesday. Currently there is a wide margin between the Feb and March contract price that needs to be closed. The Feb contract dropping is one half of the equation, the other is the March contract gaining. So, I am looking to short the Feb contract until it rolls over and enter the lower March to the end of the month. Good old fashion, buy low sell high. This is not investing advice, just what my personal plan is. I continue to expect large 20-30 cent daily moves. So use your charting skills to set you resistance/support zones. I will continue to use the 20D SMA as resistance. It has stayed true for two full contracts. Until I see different in the long range weather, I expect the price to stay above this level. Although, there will be some readjustment after the contract rolls over with a lower drop and a gap down. Good luck!

Keep it Burning!!!

NATGAS A Fall Expected! SELL!

My dear followers,

I analysed this chart on NATGAS and concluded the following:

The market is trading on 3.981 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 3.750

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

———————————

WISH YOU ALL LUCK

SPX new all time high. GE ripping today. GOLD, OIL, NGSPX puts in new all time high yesterday tags 6100$!! GE beats earnings this morning. NFLX rips higher yesterday as earnings blowout. ORCL, MSFT, PLTR all move higher due to TRUMP Stargate program news. Will the markets continue higher or sell off this week??? GOLD, OIL, NATGAS all making moves.

1/23/25 Pre-report update1/23/29 Mid week update

Pattern forcing issues. Due to favorable wind patterns in the high latitudes, high pressure over Alaska, and the return of the seventh elongated Polar vortex, there is a better than average chance there will be a return to the cold and storminess after a relaxation in the bitter cold next week. The snow cover will aid the atmosphere in keeping any moderation in air masses cooler that the models have projected the past few days. This needs to be understood that the relaxation is at a time when the Northern Hemisphere is at its coldest. So, this is a relaxation to a generally normal(cold) period. Not a warm up to well above average. We are in the second week of the coldest part of the North American heating season and even with a relaxation form normal, this will continue to draw normal to above normal amounts of NG from storage. Since mid November, we have had generally 15 days of cold and stormy followed by 15 days of dry and normal to a bit warmer. We are now finishing our second cold and stormy pattern heading into another 15 days of normal to a bit above. The synoptic models are again showing another 15 days of cold returning sometime around the 5th of February to keep the NG burning straight through March. This is important because as opposed to last year, we are not going to see below average draws, with producers overproducing NG and below average LNG production for the next month.

Storage is going to be the big impact going into the shoulder season and we are more than likely going to flip to below the 5-year average for storage tomorrow. The current industry projections are now indicating that we will exit the draw season close to 150 BCF below the 5-year average and over 500 BCF below last year. It is estimated that storage will come in at 1700 BCF or the eight lightest storage in the last 30 years. I do believe that pricing does have another possible 15% to the upside, but this will probably be the terminus for the withdrawal season. With a steady adjustment of pricing into the injection season to the $3 range. But unlike last year, I do not see any reason for historic low pricing to return. Producers have done a fantastic job at being disciplined.

I am still currently long on the March contract and will probably readjust my position after the report today. I am not planning on holding any position over the weekend. I am going to need to see the models continue verifying a bit more. But I will continue to trade the big daily moves, which I believe we can continue to expect for some time.

Natural Gas at Critical Support - Breakout or Breakdown? Natural Gas Futures (4 HR Timeframe)

Analysis Overview:

Natural Gas is currently trading within a well-defined ascending channel, showing consistent higher highs and higher lows. However, the price is now testing the lower channel support around 323.8, which could determine the next directional move.

Ascending Channel:

The price has respected the channel boundaries, with the upper trendline acting as resistance and the lower trendline as support.

Currently, the price is hovering near the lower support zone, indicating a possible breakout or

A confirmed breakdown below 323 could lead to further downside momentum, targeting the 305 level, which aligns with a significant supply zone.

This would represent a potential 7.64% decline from current levels.

Supply Zone: Resistance expected around 330-335. Watch for rejection patterns in this zone.

Demand Zone: Support exists near 305-310, providing a potential buying opportunity if the price drops to this level.

Volume & Moving Average:

The price is below the 50-period moving average, indicating bearish momentum. Watch for price interaction with this dynamic resistance.

Key Levels:

Resistance: 330 (upper channel).

Support: 323 (channel support), 305 (key demand zone).

Trading Strategy:

Bearish Setup:

Entry: Below 323 after a confirmed breakdown.

Targets: 318 - 313 - 308

Stop Loss: Above 330

Conclusion:

Natural Gas is at a critical inflection point. Monitor price action closely for a breakout or breakdown. Use proper risk management and wait for confirmation before entering trades.

Let me know your thoughts in the comments! 🚀

#NaturalGas #TechnicalAnalysis #TradingView #MCX #PriceAction

NATGAS Rising Support Ahead! Buy!

Hello,Traders!

NATGAS is trading in a

Rising opening wedge pattern

And the price will soon

Retest the rising support

Below so we are bullish

Biased and we will be

Expecting a move up

From the support line

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!