Atlas Copco AB

16.36USDD

−0.33−1.96%

Last update at 18:55 GMT

USD

No tradesPost-market

Next report date

July 18

Report period

Q2 2025

EPS estimate

0.14 USD

Revenue estimate

4.36 B USD

0.59 USD

2.68 B USD

15.91 B USD

2.49 B

About ATLAS COPCO AB SER. A

Sector

Industry

CEO

Vagner Rego

Website

Headquarters

Stockholm

Founded

1917

ISIN

SE0017486889

FIGI

BBG018KB6YY6

Atlas Copco AB engages in the provision of sustainable productivity solutions. The firm offers compressors, vacuum solutions, generators, power tools, and assembly systems. It operates through the following segments: Compressor Technique, Vacuum Technique, Industrial Technique, and Power Technique. The Compressor Technique segment provides compressed air solutions, industrial compressors, gas and process compressors and expanders, air and gas treatment equipment, and air management systems. The Vacuum Technique segment deals with vacuum products, exhaust management systems, valves, and related equipment. The Industrial Technique segment offers industrial power tools and systems, assembly solutions, quality assurance products, and software and services. The Power Technique segment supplies air, power, and flow solutions through products such as mobile compressors, pumps, light towers, and generators along with a number of complementary products. The company was founded by Eduard Fränckel on February 21, 1873 and is headquartered in Stockholm, Sweden.

15.0%

15.6%

16.2%

16.8%

17.4%

Q1 '24

Q2 '24

Q3 '24

Q4 '24

Q1 '25

0.00

1.10 B

2.20 B

3.30 B

4.40 B

Revenue

Net income

Net margin %

Revenue

COGS

Gross profit

Op expenses

Op income

Non-Op income/ expenses

Taxes & Other

Net income

0.00

1.10 B

2.20 B

3.30 B

4.40 B

Revenue

COGS

Gross profit

Expenses & adjustments

Net income

0.00

1.10 B

2.20 B

3.30 B

4.40 B

Q1 '24

Q2 '24

Q3 '24

Q4 '24

Q1 '25

0.00

900.00 M

1.80 B

2.70 B

3.60 B

Debt

Free cash flow

Cash & equivalents

No news here

Looks like there's nothing to report right now

BUY ATCO_AOn ATCO_A, you can see that it started going higher and higher, again after the brake it did after swipping the liquidity at 170.65, to give us a confirmation of the bullish movement.

Now for those who bought, you can watch how the price reacts in every levels in between the 1st and the 3rd target

OLong

OLong

Atlas Copco AB: Potential Entry Points in a Long-term UptrendOMXSTO:ATCO_A has demonstrated a long-term uptrend throughout its history, marked by two strong channels, with higher highs and higher lows.

Since the Ukraine-Russian market crash, OMXSTO:ATCO_A has experienced a 100% increase. Currently, the stock is at the resistance channel, which has r

Atlas Copco B UKSun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutua

Bullish Divergence - Easy MoneyThe chart is now showing some bullish divergence. Easy 7% gain on your investment.

OLong

Atlas Copco Bull projection .. ? MaybeToo early to say perhaps but keep an eye out for a cup and handle formation.

Bull season is approaching for sure but way too early to call it safe. In general, I see a high potential for a second correction on all stocks in the coming 2 weeks

OLong

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

44QY

ATLAS COPCO AB 0.625% SNR EMTN 30/08/2026Yield to maturity

2.45%

Maturity date

Aug 30, 2026

See all ATLPF bonds

Frequently Asked Questions

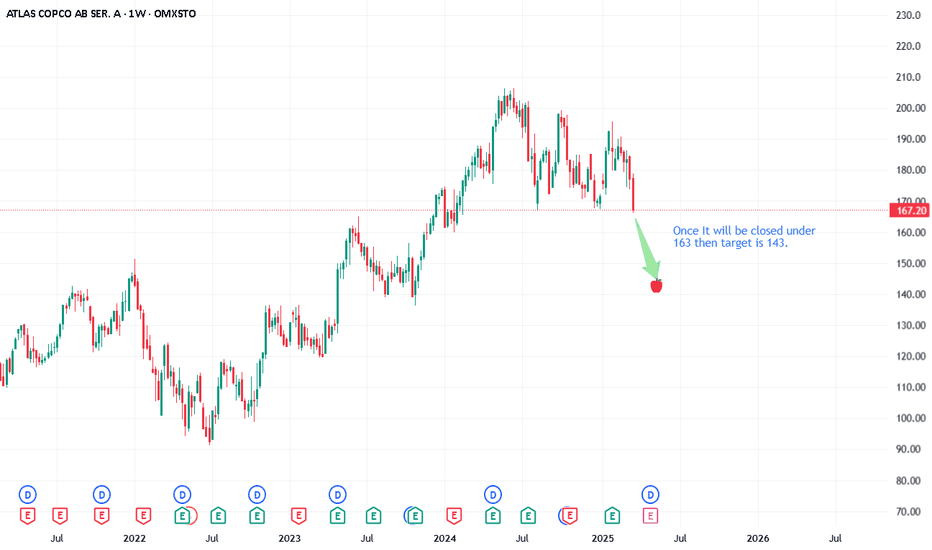

The current price of ATLPF is 16.36 USD — it has decreased by −1.96% in the past 24 hours. Watch Atlas Copco AB stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on OTC exchange Atlas Copco AB stocks are traded under the ticker ATLPF.

ATLPF stock has fallen by −0.89% compared to the previous week, the month change is a 9.01% rise, over the last year Atlas Copco AB has showed a −18.79% decrease.

We've gathered analysts' opinions on Atlas Copco AB future price: according to them, ATLPF price has a max estimate of 19.67 USD and a min estimate of 13.46 USD. Watch ATLPF chart and read a more detailed Atlas Copco AB stock forecast: see what analysts think of Atlas Copco AB and suggest that you do with its stocks.

ATLPF reached its all-time high on Jun 6, 2024 with the price of 20.15 USD, and its all-time low was 8.96 USD and was reached on Jul 5, 2022. View more price dynamics on ATLPF chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ATLPF stock is 2.27% volatile and has beta coefficient of 1.33. Track Atlas Copco AB stock price on the chart and check out the list of the most volatile stocks — is Atlas Copco AB there?

Today Atlas Copco AB has the market capitalization of 79.35 B, it has decreased by −0.74% over the last week.

Yes, you can track Atlas Copco AB financials in yearly and quarterly reports right on TradingView.

Atlas Copco AB is going to release the next earnings report on Jul 18, 2025. Keep track of upcoming events with our Earnings Calendar.

ATLPF earnings for the last quarter are 0.13 USD per share, whereas the estimation was 0.15 USD resulting in a −8.75% surprise. The estimated earnings for the next quarter are 0.14 USD per share. See more details about Atlas Copco AB earnings.

Atlas Copco AB revenue for the last quarter amounts to 4.24 B USD, despite the estimated figure of 4.32 B USD. In the next quarter, revenue is expected to reach 4.36 B USD.

ATLPF net income for the last quarter is 654.42 M USD, while the quarter before that showed 701.82 M USD of net income which accounts for −6.75% change. Track more Atlas Copco AB financial stats to get the full picture.

Atlas Copco AB dividend yield was 1.78% in 2024, and payout ratio reached 49.09%. The year before the numbers were 1.61% and 48.64% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jun 9, 2025, the company has 55.15 K employees. See our rating of the largest employees — is Atlas Copco AB on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Atlas Copco AB EBITDA is 4.59 B USD, and current EBITDA margin is 25.86%. See more stats in Atlas Copco AB financial statements.

Like other stocks, ATLPF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Atlas Copco AB stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Atlas Copco AB technincal analysis shows the neutral today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Atlas Copco AB stock shows the sell signal. See more of Atlas Copco AB technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.