Buy CBA at 160BA is approaching a long-term horizontal support level at $160, which has acted as a strong floor multiple times in the past.

Technical View:

Support Zone: $160–$161 (historical demand zone since mid-2023).

Trend Context: Price has been in a sideways range between $160 and $175, consolidating aft

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.98 USD

6.65 B USD

45.94 B USD

1.67 B

About COMMONWEALTH BANK OF AUSTRALIA

Sector

Industry

CEO

Matthew Comyn

Website

Headquarters

Sydney

Founded

1991

ISIN

AU000000CBA7

FIGI

BBG000BXG9G0

Commonwealth Bank of Australia engages in the provision of banking and financial services. It operates through the following segments: Retail Banking Services, Business Banking, Institutional Banking and Markets, New Zealand, Corporate Centre and Other, and Wealth Management. The Retail Banking Services segment provides home loan, consumer finance, and retail deposit products and servicing to all retail bank customers and non-relationship managed small business customers. The Business Banking segment offers specialized banking services to relationship managed business and Agribusiness customers, private banking to high-net-worth individuals, and margin lending and trading through CommSec. The Institutional Banking and Markets segment serves the firm's major corporate, institutional, and government clients using a relationship management model based on industry expertise and insights. The New Zealand segment comprises of banking, funds management, and insurance businesses operating in New Zealand. The Corporate Centre and Other segments include support functions such as investor relations, group marketing and strategy, group governance, and group treasury. The Wealth Management segment includes the global asset management, platform administration, and financial advice and life and general insurance businesses of the Australian operations. The company was founded in 1911 and is headquartered in Sydney, Australia.

$CBA in a Strong Uptrend: Long at $162!Commonwealth Bank of Australia ( ASX:CBA ) is showing a “Strong Uptrend” on a 1-week chart. 📈 We bought at $126.49 and sold at $159.24 previously. Now at $162.98, we’re in a long position at $162. With a Trend Score of 8/8 and 100% signal alignment, the projected price is $166.2 ( +1.1% ), suppor

ALong

CBAPossible Short‐Term Pullback:

If the correction continues, the 1.618 extension (around ~125–126) is a natural technical area to watch for potential support

**NOT financial advice. Always combine technicals with broader market conditions, fundamentals, and your own strategy.)

AShort

Shor CBA at 144. Target 130 . Stop 147. CBA has already qualified for putting in a double top with a divergent RSI on the daily.

I would like to short here at $144 with a target of $130 and a stop of $147.

(Risk reward is about 4.5 to 1)

Thanks

Kavi

AShort

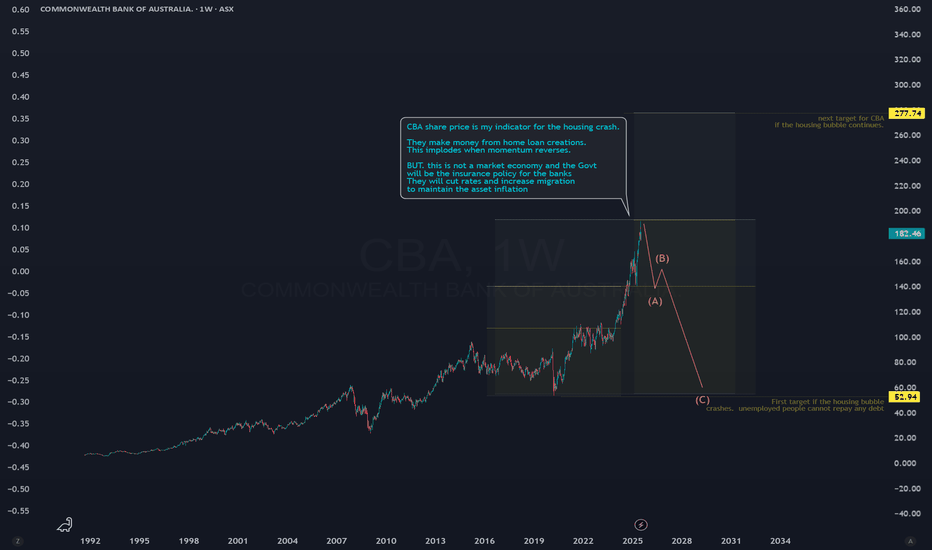

Short Commonwealth Bank of Australia at 156.25 Target 132Hello Followers

Id like to take another shot at shorting CBA here due to the interesting risk reward setup.

I had failed trying to short this once in the 130's and have been patient waiting for another setup.

Fundamental Reasons:

-Potential rolling over of the Australian housing market.

-Extr

AShort

Buying idea CBACBA just like the WBC bouncing back from 50 day moving avg. market sentiment positive and these two shares should see taking off again to highs we show few weeks a go. stop at 132.

DISCLAIMER : The content and materials featured are for your information and education only and are not attended to

ALong

CBA extreme downside risk2024 dividend per share annual, $4.65. Current share price $159.03 If you are an investor you are paying 34.2 times the div return with substanstial risk. Should you choose to put the $159.03 into a 5% term deposit with zero risk your return will be $7.95 being nearly double the return with zero ris

AShort

CBA Monthly hammerThis should be a warning to anyone considering buying CBA in the medium term

I'm not going to act on this but would be considering hunting for confirmed short opportunities as R:R would be high and quick..

AShort

ELLIOTT WAVE: CBA.ASX - 08 NOV, 2024 - BULLISHAUSTRALIAN STOCK: CBA.ASX - 08 NOV, 2024 - 1D CHART

©Master of Elliott Wave: Hua (Shane) Cuong, CEWA-M.

Wave ((iii))-navy of wave 5-grey continues to push higher, targeting a high around 162.19. While price must remain above 140.40 to maintain this view.

ALong

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

XS180718354

COMMONW.BK AUSTR. 18/28Yield to maturity

8.54%

Maturity date

Apr 18, 2028

USQ2704MAF5

COM.BK AUST. 21/41 REGSYield to maturity

6.61%

Maturity date

Mar 11, 2041

CBAU4583829

Commonwealth Bank of Australia 4.316% 10-JAN-2048Yield to maturity

6.34%

Maturity date

Jan 10, 2048

CBAAU4881224

Commonwealth Bank of Australia 3.743% 12-SEP-2039Yield to maturity

6.08%

Maturity date

Sep 12, 2039

US2027A1JN8

COMMONW.BK AUSTR.17/47MTNYield to maturity

6.02%

Maturity date

Jul 12, 2047

CBAU5766460

Commonwealth Bank of Australia 5.837% 13-MAR-2034Yield to maturity

5.90%

Maturity date

Mar 13, 2034

CBAAU6023903

Commonwealth Bank of Australia 5.929% 14-MAR-2046Yield to maturity

5.75%

Maturity date

Mar 14, 2046

AU3FN005599

COM.BK AUST. 20/30 FLRYield to maturity

5.52%

Maturity date

Sep 10, 2030

CBAAU5766461

Commonwealth Bank of Australia 5.837% 13-MAR-2034Yield to maturity

5.18%

Maturity date

Mar 13, 2034

CBAU6023901

Commonwealth Bank of Australia FRN 14-MAR-2030Yield to maturity

5.11%

Maturity date

Mar 14, 2030

See all CBAUF bonds

Frequently Asked Questions

The current price of CBAUF is 110.24 USD — it has decreased by −4.14% in the past 24 hours. Watch Commonwealth Bank of Australia stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on OTC exchange Commonwealth Bank of Australia stocks are traded under the ticker CBAUF.

CBAUF stock has fallen by −2.68% compared to the previous week, the month change is a −2.22% fall, over the last year Commonwealth Bank of Australia has showed a 25.73% increase.

We've gathered analysts' opinions on Commonwealth Bank of Australia future price: according to them, CBAUF price has a max estimate of 95.49 USD and a min estimate of 65.40 USD. Watch CBAUF chart and read a more detailed Commonwealth Bank of Australia stock forecast: see what analysts think of Commonwealth Bank of Australia and suggest that you do with its stocks.

CBAUF reached its all-time high on Jun 25, 2025 with the price of 121.80 USD, and its all-time low was 15.00 USD and was reached on Jan 26, 2009. View more price dynamics on CBAUF chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

CBAUF stock is 4.32% volatile and has beta coefficient of 1.01. Track Commonwealth Bank of Australia stock price on the chart and check out the list of the most volatile stocks — is Commonwealth Bank of Australia there?

Today Commonwealth Bank of Australia has the market capitalization of 181.64 B, it has increased by 0.71% over the last week.

Yes, you can track Commonwealth Bank of Australia financials in yearly and quarterly reports right on TradingView.

Commonwealth Bank of Australia is going to release the next earnings report on Feb 11, 2026. Keep track of upcoming events with our Earnings Calendar.

CBAUF earnings for the last half-year are 1.96 USD per share, whereas the estimation was 2.01 USD, resulting in a −2.44% surprise. The estimated earnings for the next half-year are 2.03 USD per share. See more details about Commonwealth Bank of Australia earnings.

Commonwealth Bank of Australia revenue for the last half-year amounts to 9.45 B USD, despite the estimated figure of 9.39 B USD. In the next half-year revenue is expected to reach 9.59 B USD.

CBAUF net income for the last half-year is 3.28 B USD, while the previous report showed 3.18 B USD of net income which accounts for 3.14% change. Track more Commonwealth Bank of Australia financial stats to get the full picture.

Commonwealth Bank of Australia dividend yield was 2.63% in 2025, and payout ratio reached 80.16%. The year before the numbers were 3.65% and 81.96% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 15, 2025, the company has 51.35 K employees. See our rating of the largest employees — is Commonwealth Bank of Australia on this list?

Like other stocks, CBAUF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Commonwealth Bank of Australia stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Commonwealth Bank of Australia technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Commonwealth Bank of Australia stock shows the buy signal. See more of Commonwealth Bank of Australia technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.