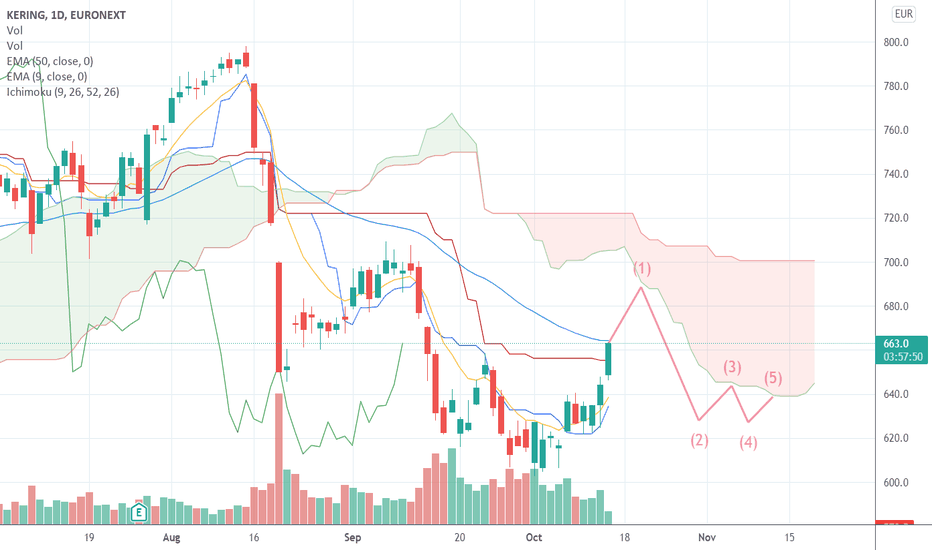

Bottom Fishing = Gucci and YSL saleTechnical Analysis:

Inverse head and shoulders sent this luxury brand conglomerate to the post Covid bull market highs. But we are in the midst of a rapid decline, with over a 70% drop in stock value. I expect us to start finding support at the key horizontal levels as Kering aims to implement cost cutting measures to slow the sinking ship. This should bring better value to stock holders who believe in the long term sustainability of this French luxury giant.

Fundamental Analysis:

**Bull Thesis on Kering (KER)**

Kering, a major player in the luxury goods sector, owns high-end brands such as Gucci, Saint Laurent, Bottega Veneta, Balenciaga, and Alexander McQueen. Despite the prestige of these brands, Kering’s stock has experienced a steep decline of over 70% from its peak, leading to its current valuation as a potentially undervalued opportunity in the luxury market.

1. Chinese Consumer Demand Already Priced In: Concerns about reduced demand from Chinese consumers due to economic slowdowns have contributed to Kering’s significant stock drop. However, these risks appear largely priced in, as the market has already discounted the stock heavily, reflecting worst-case scenarios. Luxury demand in China, while affected by economic uncertainty, remains a key part of Chinese culture, and with the start of new stimulus from the Chinese government, spending in the luxury sector could rebound.

2. Moat and Brand Power: Kering’s portfolio includes some of the world’s most iconic luxury brands. Gucci, in particular, is known for its enduring appeal, while brands like Saint Laurent and Bottega Veneta appeal to high-net-worth consumers globally. This brand recognition forms a durable moat, giving Kering pricing power and customer loyalty in the luxury space, even as spending patterns fluctuate.

3. Global Liquidity Cycle Upside: Central banks, particularly in the U.S. and China, have shown a willingness to intervene through stimulus measures during economic slowdowns. Should we see another global liquidity injection or stimulus cycle, Kering’s luxury products could benefit as high-net-worth individuals increase discretionary spending. Luxury stocks tend to outperform during these cycles as increased liquidity fuels consumer confidence and spending power.

4. Cost-Cutting Initiatives: Kering has also taken proactive steps to streamline operations and cut costs, which could stabilize margins even if revenue remains under pressure. These measures could position Kering to see greater profitability when demand eventually recovers, leveraging both improved efficiency and brand strength.

With high-end brands, a recognized moat in luxury, and operational improvements underway, Kering offers an appealing opportunity as it trades at a discount to its historical value. The luxury sector's resilience, combined with central bank actions and Kering’s cost-saving strategies, may set the stage for a compelling rebound in the stock price.

I will be looking to add as price finds a base and at the first sign of a reversal in a strong downtrend.

Not financial advice

PPRUF trade ideas

Bottom Fishing - Gucci, YSL on saleTechnical Analysis:

Inverse head and shoulders sent this luxury brand conglomerate to the post Covid bull market highs. But we are in the midst of a rapid decline, with over a 70% drop in stock value. I expect us to start finding support at the key horizontal levels as Kering aims to implement cost cutting measures to slow the sinking ship. This should bring better value to stock holders who believe in the long term sustainability of this French luxury giant.

Fundamental Analysis:

**Bull Thesis on Kering (KER)**

Kering, a major player in the luxury goods sector, owns high-end brands such as Gucci, Saint Laurent, Bottega Veneta, Balenciaga, and Alexander McQueen. Despite the prestige of these brands, Kering’s stock has experienced a steep decline of over 70% from its peak, leading to its current valuation as a potentially undervalued opportunity in the luxury market.

1. Chinese Consumer Demand Already Priced In: Concerns about reduced demand from Chinese consumers due to economic slowdowns have contributed to Kering’s significant stock drop. However, these risks appear largely priced in, as the market has already discounted the stock heavily, reflecting worst-case scenarios. Luxury demand in China, while affected by economic uncertainty, remains a key part of Chinese culture, and with the start of new stimulus from the Chinese government, spending in the luxury sector could rebound.

2. Moat and Brand Power: Kering’s portfolio includes some of the world’s most iconic luxury brands. Gucci, in particular, is known for its enduring appeal, while brands like Saint Laurent and Bottega Veneta appeal to high-net-worth consumers globally. This brand recognition forms a durable moat, giving Kering pricing power and customer loyalty in the luxury space, even as spending patterns fluctuate.

3. Global Liquidity Cycle Upside: Central banks, particularly in the U.S. and China, have shown a willingness to intervene through stimulus measures during economic slowdowns. Should we see another global liquidity injection or stimulus cycle, Kering’s luxury products could benefit as high-net-worth individuals increase discretionary spending. Luxury stocks tend to outperform during these cycles as increased liquidity fuels consumer confidence and spending power.

4. Cost-Cutting Initiatives: Kering has also taken proactive steps to streamline operations and cut costs, which could stabilize margins even if revenue remains under pressure. These measures could position Kering to see greater profitability when demand eventually recovers, leveraging both improved efficiency and brand strength.

With high-end brands, a recognized moat in luxury, and operational improvements underway, Kering offers an appealing opportunity as it trades at a discount to its historical value. The luxury sector's resilience, combined with central bank actions and Kering’s cost-saving strategies, may set the stage for a compelling rebound in the stock price.

I will be looking to add as price finds a base and at the first sign of a reversal in a strong downtrend.

Not financial advice

Kering | Chart & Forecast SummaryKey Indicators on Trade Set Up in General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Active Sessions on Relevant Range & Elemented Probabilities;

* Asian(Ranging) - London(Upwards) - NYC(Downwards)

* Weekend Crypto Session

Trend | Time Frame Conductive | Weekly Time Frame

- General Trend

- Measurement on Session

* Support & Resistance

* Trade Area | Focus & Motion Ahead

# Position & Risk Reward | Daily Time Frame

- Measurement on Session

* Retracement | 0.5 & 0.618

* Extension | 0.88 & 1

Conclusion | Trade Plan Execution & Risk Management on Demand;

Overall Consensus | Sell

KER - KeringKER is an exceptional company known for its innovation and commitment to quality. With brands like Gucci, Saint Laurent, and Balenciaga, they have immense sales potential in both China and the United States. Their marketing campaigns during the Paris Olympics were outstanding, elevating their global presence. Bravo KER!

Profit Margin at 11%.

Trading at 52% below estimate of its fair value

Earnings are forecast to grow 12% per year

Trading at good value compared to peers and industry

[KER] Kerling French Luxe Monster StockHere is a potential big stock for the next years to hold on the portfolio.

Regarding today's French political status, it can be the perfect opportunity to buy some luxury stocks like Kerling with big drawdown.

I am looking to sell after 1000€ breakout.

Great Trade !

KERING: Bullish-BUTTERFLY detected and Ichimoku:Rebound possibleKERING: Bullish-BUTTERFLY detected and Ichimoku: Rebound possible?!

concerning kering a Butterfly was detected by the wolf of Zurich

+Divergence ROC (Rate Of Change)

the share price can rise to 452 then 507 according to Ichimoku

the price could reach 461 "daily" then 515

and finally the €613 “in Weekly”

"Monthly" the share price could rise around 542 and 573 then 614 stay cautious

Kering SA - H&S Pattern looking for deeper correctionOn the monthly chart, Kering's outlook isn't looking great at all. Trading below ichimoku cloud and RSI below 50. There is a major bearish divergence spotted on RSI that isn't improving the outlook. Once EUR 400 - EUR 380 support is lost, expect some heavy selling towards EUR 240 - EUR 230 area. Could take weeks/months to unfold. This goes well with my fundamental view for the stock. Not FA.

KERING Monthly chart outlook negative forming massive H&SOn the monthly chart, Kering's outlook isn't looking great at all. Trading below ichimoku cloud and RSI below 50. There is a major bearish divergence spotted on RSI that isn't improving the outlook. Once EUR 400 - EUR 380 support is lost, expect some heavy selling towards EUR 240 - EUR 230 area. Could take weeks/months to unfold. This goes well with my fundamental view for the stock. Not FA.

Kering France SSI Live Trading Series

Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

Kering France Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

Kering Europe Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions