US30 trade ideas

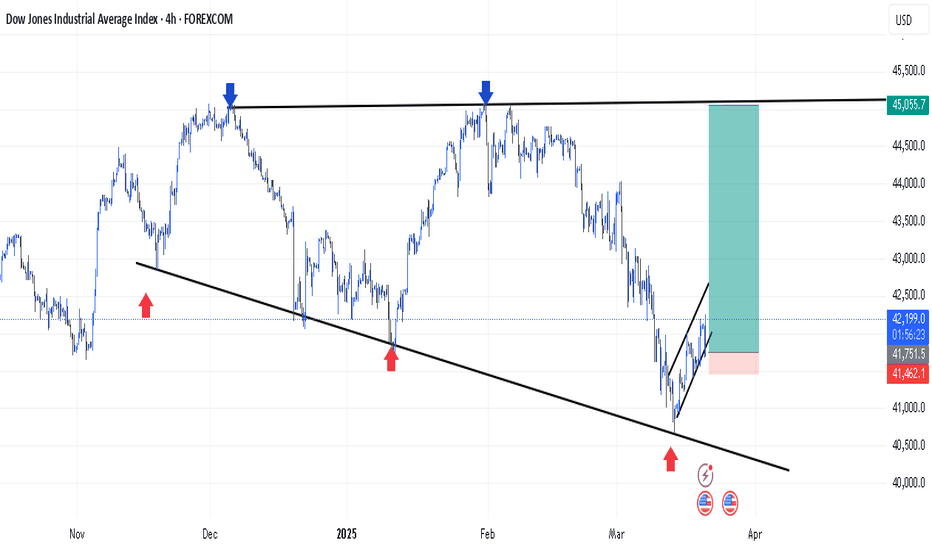

Dow Jones The Week Ahead 24th March '25 Dow Jones bearish & oversold, the key trading level is at 42488

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

US30BUY Opportunity

- Base channel on Daily time frame retested indicating end of Wave 4.

- Buy opportunity towards wave 5, potentially at price - 47 838.64

Buy Confirmation

- On 2 Hour timeframe, Bos and with a leading diagonal.

- We then place a buy limit at 41 087.27 as the demand zone

This is not investment advise. Enter at your own risk.

DOW JONES targeting 50000 on this final Bull yearDow Jones / US30 posted the first green weekly candle after hitting last week the 1week MA50.

This is obviously a critical support level as it has been holding since the October 30th 2023 rebound.

As this chart shows, Dow has been repeating the same patterns, Cycle after Cycle.

Right now it has entered the Final Year of Bull, which is the part where it rises aggressively to form the Top before the new Bear begins in the form of a Megaphone pattern.

The previous Bull peaked on the 2.382 Fibonacci extension of the Megaphone.

This means that a 50000 Target for Dow is perfectly plausible by the end of 2025.

Follow us, like the idea and leave a comment below!!

Dow Jones INTRADAY Bearish oversold bounce backKey Support and Resistance Levels

Resistance Level 1: 42488

Resistance Level 2: 43067

Resistance Level 3: 43575

Support Level 1: 40657

Support Level 2: 40109

Support Level 3: 39584

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

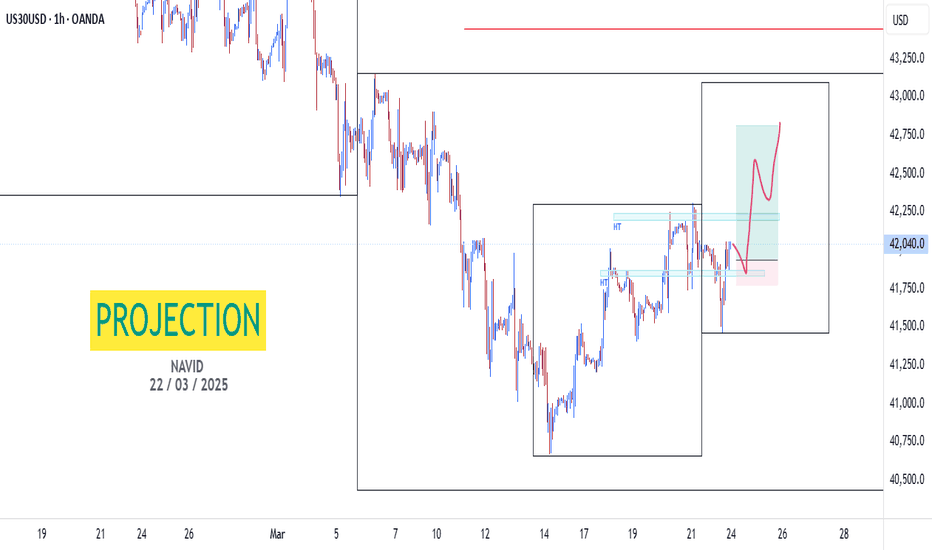

Dow Going Down Dow already reached the end of Resistance Zone now we going down.

I strongly believe we have two scenarios:

Scenario number One: re-test support Zone 1h (1 hour) and bounce higher.

Scenario number two: we going to POI (Point Of Interest or what called Institutional Candle) and bounce higher.

Note: these bounces doesn't mean down trend is finished but means that we will gain decent profits for couple of session since we don't have confirmation of finishing this down going move

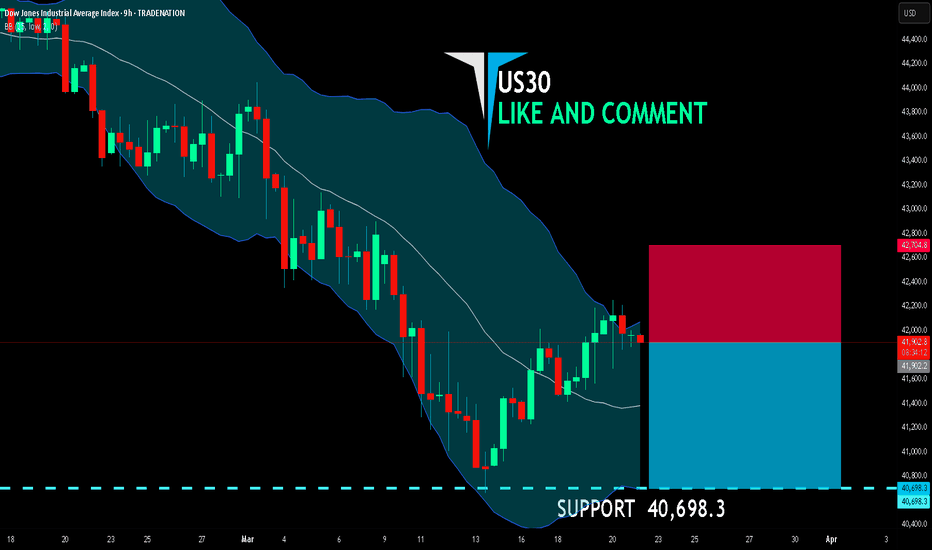

US30 BEARISH BIAS RIGHT NOW| SHORT

US30 SIGNAL

Trade Direction: short

Entry Level: 41,902.2

Target Level: 40,698.3

Stop Loss: 42,704.8

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Potential bearish drop?Dow Jones (US30) has rejected off the pivot and could drop to the 50% Fibonacci support.

Pivot: 42,208.96

1st Support: 41,442.18

1st Resistance: 42,990.92

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

"US30 at a Crossroads: Inflation, Fed Policy, and Market Swings The US30, also known as the Dow Jones Industrial Average (DJIA), is currently experiencing heightened volatility as investors grapple with mixed economic signals from the U.S. economy. On one hand, strong corporate earnings and resilient consumer spending have provided support, while on the other, concerns over persistent inflation, rising interest rates, and geopolitical tensions have weighed on sentiment. This reflects the broader state of the U.S. economy, which is navigating a delicate balance between slowing growth and inflationary pressures.

In the coming months, the US30 is likely to remain sensitive to Federal Reserve policy decisions, particularly regarding rate cuts or hikes, as well as developments in the labor market and global economic conditions. Investors should brace for continued fluctuations, with potential upside if inflation shows signs of easing and downside risks if economic data points to a sharper slowdown.

FUSIONMARKETS:US30

Recession searches spike on Google!!Good day traders and investors.,

The term recession has had a few spikes over the years since Google has been around, but what does it mean? These searches are typical made by the common folks.

Did the herd get it right this time?? Probably not, I have generally bet against them. The Google search trends has the data to back the information. Generally this means the bottom is either in or close. Also on two occasions there have been a couple of back to back spikes. Almost like one was a precursor.

You can see very clear in this naked chart of the DOW JONES, that only includes the GOOGLE TRENDS search of the term “RECESSION”. I have time aligned the GOOGLE TRENDS data to the DOW JONES it really shows a clear picture. The herd is always a day late and a dollar short. By the time they are searching it most of the pain is gone and the market is at or near a bottom. The only question that remains is, how long? If it lasts too long it could hurt any forward movement.

Let me know what you think

Kind regards,

WeAreSat0shi

TOP IS NOT IN YET (MORE UPSIDE AFTER THE MINOR CORRECTIONS)We discussed the 5-year bull cycle that starts off every 20-year cycle. We identified that the current 5-year bull cycle will be one of the wildest in the history of the DJIA market by virtue of the current energy level within the log expansion. We will start a new progressive series to discuss the current 20-year cycle in motion.

First we will look closely at these three different 20-year cycles

From the three cycles we can identify a peculiar recurring structure, that is, after the approximately 5th year top we have a wild decline that averagely bottoms below the starting price. We will not dwell much on this cycle as it's not the current cycle in progress. Between these cycles is an (Alternate Cycle) that also has a similar fractal construction.

The first two alternate cycles directly lie between the cycles identified earlier and have a similar fractal. The most striking identity of these alternate cycles is that the origin point is the lowest point within the 20 year trend. The correction from the 5th year top is not so steep and never goes below the origin

The 1942/1962 cycle lies between the 1921/1942 and 1962/1982 cycles

The 1982/2002 cycle lies between the 1962/1982 and 2002/2022 cycles

This means the next alternate 20-year cycle is the 2022/2042 cycle which will lie between 2002/2022 and 2042/2062 cycles. From the internal construction of this cycle we can dive deeper and model the structure forward in both price and time. Example, the vertical price axis for the 1942/1962 cycle was (+648.61 pts) and total horizontal time elapsed was (+1052 wks).

We have a (648.61 x 1052) structure showing a perfect golden ratio of price and time

(1052 / 648.61) = 1.6219

1982/2002 cycle had price axis = 1098.03 pts and time = 1052 wks

We have approximately a 1098.03 x 1052 square of price and time

By observing the cumulative growth pattern we can make projection of the current cycle in progress. We would go through the growth gradually and identify price and time resistances as price action progresses. Please check back as we build step by step the growth structure of the current cycle.

Trade safe

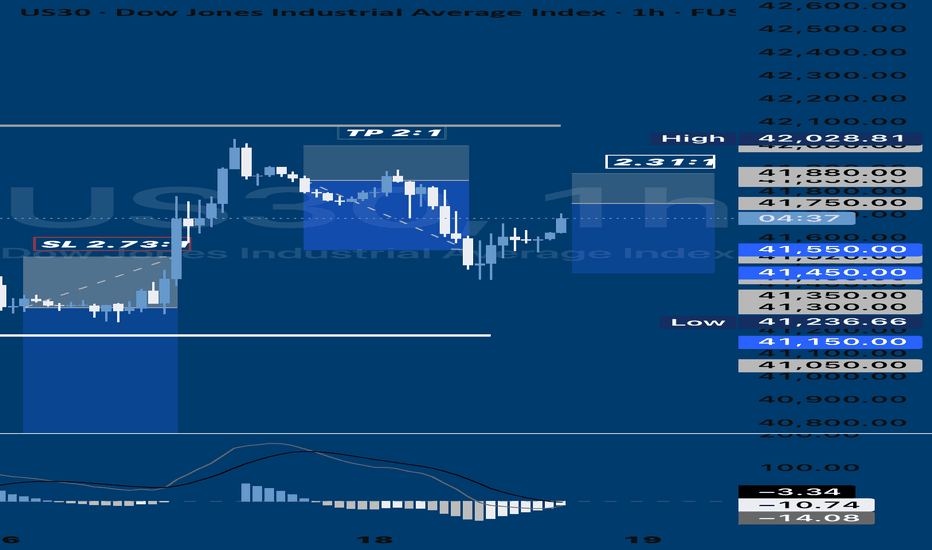

Trade idea: US30 short ( SELL LIMIT )Technical Analysis:

1. Daily Chart:

• Trend: Bearish correction after a strong uptrend.

• MACD: Negative, showing increasing bearish momentum.

• RSI: 38.25, indicating oversold conditions but with room for further downside.

• Price Action: The price has broken below the short-term moving average, signaling further weakness.

2. 15-Min Chart:

• Trend: Downtrend with lower highs and lower lows.

• MACD: Bearish crossover, confirming downward momentum.

• RSI: 62.60, indicating price has rebounded but is not yet overbought.

• Resistance: Around 41786, which aligns with prior price rejection.

3. 3-Min Chart:

• Trend: Recent short-term uptrend, but likely a retracement in the larger bearish structure.

• RSI: 77.65 (overbought), indicating a potential short opportunity.

• MACD: Bullish but losing momentum.

⸻

Fundamental Analysis:

• Recent Market Sentiment: High volatility suggests caution. A larger correction is possible.

• Interest Rate & Economic Data: If the Fed remains hawkish, equities could see further declines.

• Geopolitical & Economic Risks: Uncertainty in global markets could weigh on the Dow.

⸻

Trade Setup:

• Position: Short (Sell) US30

• Entry: 41750 (near resistance on the 15-min chart)

• Stop Loss (SL): 41880 (above previous highs, tight risk control)

• Take Profit (TP): 41450 (key support level)

• Risk-Reward Ratio (RRR): 2:1

FUSIONMARKETS:US30

Trade Idea : US30 Sell ( MARKET)1. Technical Analysis

Daily Chart

• Trend: The index is in a broader downtrend, with a recent pullback from highs around 42890 to 42060.

• MACD: Deep in negative territory, suggesting bearish momentum.

• RSI: 43.01 — indicating it’s closer to oversold but still has room to fall further before a reversal.

15-Minute Chart

• Trend: Short-term uptrend, showing a rally from a dip around 40900 to 42060, but nearing resistance near 42145.

• MACD: Positive, but momentum appears to slow down.

• RSI: 61.29 — heading toward overbought territory, indicating a potential pullback.

3-Minute Chart

• Trend: Micro uptrend, but showing signs of consolidation after the recent strong push.

• MACD: Positive but flattening, suggesting momentum is fading.

• RSI: 60.10 — also near overbought.

⸻

2. Fundamental Analysis

• Market Sentiment: Recent rallies seem more like a technical rebound rather than a fundamentally-driven bullish push.

• Geopolitical/Economic Factors: If the broader market sentiment remains uncertain (e.g., interest rate worries, inflation data), the US30 could face further downward pressure.

• Dollar Strength: A strong USD typically weighs on US equities, which aligns with the bearish technical outlook.

⸻

3. Trade Setup: Short Position (Sell)

• Entry: 42080 (near current price, just under resistance)

• Stop Loss (SL): 42150 (just above the last 15-min resistance level)

• Take Profit (TP): 41700 (previous support on the 15-min chart) FUSIONMARKETS:US30