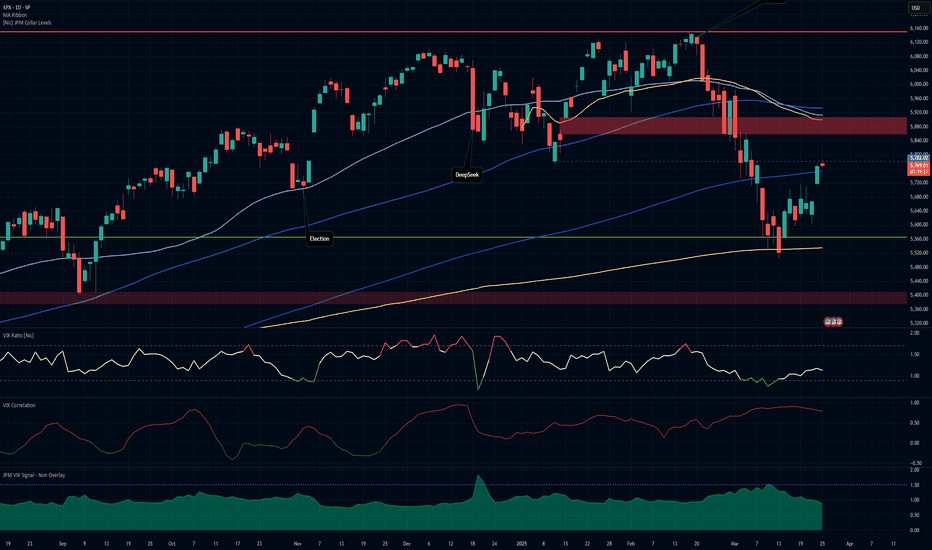

Take ProfitsIf you took the trade, good job.

We are at the 200 SMA, and this is a natural location to take profits.

Expecting some additional chop, the market never moves in a straight line... but the worst of it is over. If we retest the lows, I will buy again. If we retest the highs... or take too long... I will monitor for a new short.

SPX trade ideas

potential next target of 8000 for SPXAnalysis of the Chart:

Bull Run Identified:

Two bullish trends are highlighted after 10% corrections.

After each pullback of ~10%, the market resumed its upward trajectory.

Correction Zones:

First correction (~10.29%) occurred in mid-2023.

Second correction (~10.27%) happened recently in early 2025.

These corrections are typical in bull markets, indicating healthy price consolidations before further upside.

Next Target:

The chart suggests a potential next target of 8000 for SPX.

This implies a continued bullish trend and significant upside.

Conclusion:

The S&P 500 has experienced multiple bull runs after 10% corrections, indicating a strong uptrend.

If historical patterns repeat, the market could move towards 8000, provided macroeconomic conditions remain supportive.

US500 - Are Bulls Setting Up for a Bullish Push?Overview of Market Structure

The US500 has been trading in a well-defined bearish channel for an extended period, continuously making lower highs and lower lows. This downtrend was respected until recently, when the price broke out of its bearish structure, signaling a potential shift in market sentiment.

Following the breakout, price also breached a key resistance level (marked in red), which had previously acted as a significant supply zone. Now that this resistance has been broken, it may flip into a support level, offering a high-probability area for a bullish continuation.

I expect price to retest this newly-formed support zone before continuing its move upward, targeting the unfilled imbalance zone above (highlighted in green).

Breakout of the Bearish Structure

One of the most important aspects of this setup is the confirmed breakout of the bearish structure. The market was respecting a descending channel, creating lower highs and lower lows. However, with this breakout, price is no longer following the previous downtrend pattern.

A breakout like this often leads to a shift in market direction, meaning buyers are now in control, and the next likely move is bullish continuation.

Resistance Break & Potential Support Retest

The red zone represents a major resistance level that has now been broken. This area had previously rejected price multiple times, showing that sellers were strongly defending it.

Now that price has successfully closed above this level, we can anticipate a retest of this area as new support before price resumes its move higher. This is a classic example of a resistance-turned-support flip, a key concept in technical analysis.

Imbalance Zones & Price Efficiency

An important part of this trade setup is the unfilled imbalance zone above. When price moves too quickly in one direction, it often creates gaps or inefficiencies in the market, which tend to get revisited later.

The unfilled imbalance zone above (highlighted in green) is a key target for this bullish move.

Price is likely to fill this inefficiency after confirming support at the previous resistance level.

Since price action tends to seek out liquidity and inefficiencies, this gives us a clear roadmap for the next likely movement in the market.

Why This Trade Has High Probability

Breakout of Bearish Structure – This suggests a potential shift from a downtrend to an uptrend.

Resistance Turned Support – A classic market structure retest that provides strong confluence for a bullish move.

Imbalance Fill – The market tends to fill inefficiencies left in impulsive moves, making the imbalance zone above a logical target.

Liquidity Grab Potential – Retesting the broken resistance could serve as a liquidity grab before price moves higher.

Conclusion

This setup provides a high-probability long opportunity based on a bearish structure breakout, resistance-turned-support retest, and imbalance fill target. If price follows the expected path, we should see a retest of the red zone before a bullish continuation into the imbalance zone above.

By patiently waiting for price confirmation at key levels, this trade offers a strong risk-to-reward ratio while aligning with smart money concepts and price efficiency principles.

__________________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

S&P500 This is the buy opportunity of the year for a 7000 TargetThe S&P500 index (SPX) is in the process of posting its 2nd straight green 1W candle, following a streak of 4 red weeks since the February 17 peak. That streaκ was technically the Bearish Leg of the 1.5-year Channel Up and as you can see, it made a direct contact with its bottom (Higher Lows trend-line).

As the same time, the 1W RSI almost touched the 40.00 Support that priced the October 23 2023 Low, which was the previous Higher Low of the Channel Up. The similarities don't stop there as both Bearish Legs had approximately a -10.97% decline, the strongest within that time-frame.

The Bullish Leg that followed that bottom initially peaked on a +28.85% rise, almost touching the 2.236 Fibonacci extension. Assuming the symmetry holds between the Bullish Legs as well, we can be expecting the index to start the new Bullish Leg now and target 7000 by the end of the year, which is marginally below both the 2.236 Fib ext and a potential +28.85% rise.

This may indeed be the best buy opportunity for 2025.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

[W] SP500 - 24.3.2025This has been an unusually disturbing prediction that I have ever made, and yet so long expected. It's also probably for the first time, I do it on a weekly chart! The huge question mark here, is how FED will react to stagflation turning into a recession, and to recession with a looming threat to progress further. At some point, they might be tempted to act with low rate and EQ, which will further increase already high Gini index and might eventually cause defaults on loans and mortages. Thus, causing a crisis not seen since 2008. The current president Donald Trump might want to distract from the increasingly worsening domestic situation by seeking and external (and internal) enemy, further strengthening his grip on power. While the entire situation might provide a temporary boost to the defense sector alongside with utilities, foreign capital and trade will likely diminish. Unlike the 2008 crisis that was caused predominantly by internal factors, this case might be marked by geopolitical isolation which threatens to leave a much deeper scar.

Mastering Market Movements: Understanding Impulses and CorrectioHello,

Navigating the stock market successfully isn’t just about luck—it requires a keen understanding of market trends and the ability to spot price patterns. One of the most useful concepts traders rely on is the interplay between impulses and corrections. Recognizing these alternating phases can provide valuable insights into potential price movements, allowing you to make more confident and informed trading decisions.

In this article, we’ll break down what impulses and corrections are, how to identify them, and how you can use them to improve your trading strategy.

Understanding Impulses and Corrections

Stock prices move in cycles, alternating between strong trends (impulses) and temporary retracements (corrections). These movements are driven by market psychology, where shifts in supply and demand dictate price action.

Impulses: The Driving Force of Trends

Impulses are powerful, directional moves in the market that reflect strong momentum. These often occur when sentiment aligns with fundamental catalysts, such as positive news, strong earnings reports, or broader market trends. Impulses are the backbone of trends and can provide great opportunities for traders who know how to recognize them.

To spot impulses, look for:

Strong Price Movement: Impulses are characterized by significant and sustained price shifts, indicating a surge in buying or selling pressure. This is as shown in the

Volume Expansion: When an impulse occurs, trading volume typically increases, confirming that more market participants are involved and supporting the price movement.

Break of Key Resistance or Support Levels: Impulses often push through important technical levels, signaling strength and the continuation of a trend.

Corrections: The Market Taking a Breather

Corrections, also called retracements or pullbacks, are temporary price reversals within an ongoing trend. They provide opportunities for the market to pause before resuming its dominant direction.

To identify corrections, watch for:

Counter-Trend Price Movement: Corrections move against the main trend but usually retrace only a portion (25% to 50%) of the previous impulse.

Lower Volume: Unlike impulses, corrections occur on decreased trading volume, suggesting a temporary decline in market participation.

Support and Resistance Levels: Corrections often find support or resistance at previously established price levels, which can serve as potential reversal zones.

Applying Impulses and Corrections in Trading

Understanding these market phases can significantly improve your trading approach. Here’s how:

Identifying Trends: By observing a sequence of impulses and corrections, you can determine the overall market direction and align your trades accordingly.

Finding Entry and Exit Points: Impulses signal strong trends, while corrections present opportunities to enter trades at better prices before the next move higher or lower.

Managing Risk: Setting stop-loss levels strategically—such as below key support levels during corrections—can help minimize losses while allowing room for potential gains.

Final Thoughts

Recognizing and utilizing impulses and corrections can make a huge difference in your trading success. By learning to identify these patterns, you’ll gain deeper insights into market behavior, improve your timing, and enhance your ability to make smart, strategic moves.

Take a look at the US500FU chart—it clearly illustrates impulses and corrections in action.

Good luck, and happy trading!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SPX Targets 5400 - 5150 - 4750Hi Traders,

We so far we are following the pattern of 2022... If so we should be beginning the next down leg and looks like with Trump announcing auto Tarrifs today I expect it begins now instead of waiting till April 2, Liberation day, as Trump calls it. He is the default EW indicator which appears to capture the levels I was looking at using other TA. This won't be a sudden drop but I expect some if not all these levels to be hit once all is said and done. The market needs to become a lot cheaper for people to want to invest into a Tariff type environment. I wouldn't be surprised if he comes out with strong Tariffs on April 2 that we end up going into a recession by summer. The only way to get lower rates like trump wants is to tank the market which I think he is ok with to do. Lets see how this plays out.

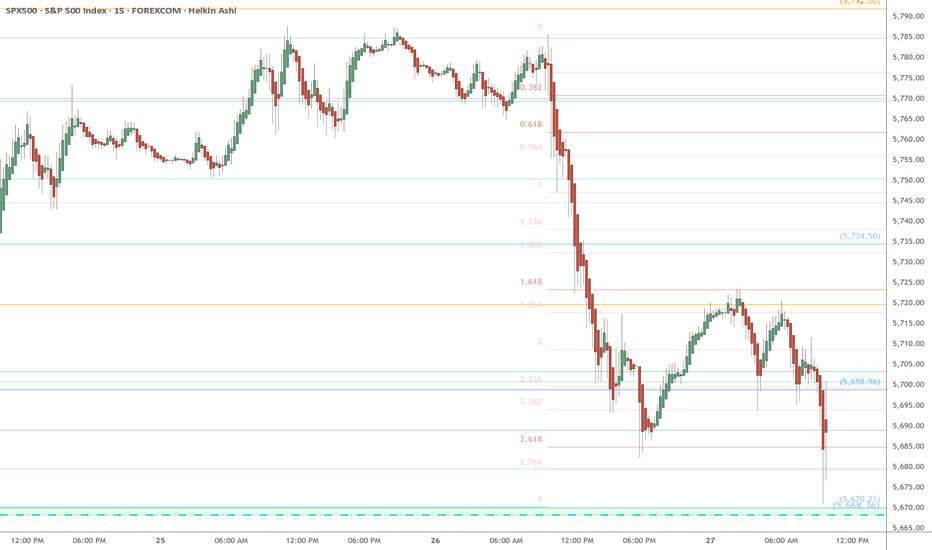

S&P 500 Struggling Ahead of Key Economic ReportsThe S&P 500 is showing signs of weakness as it approaches a critical juncture ahead of tomorrow’s economic reports. After a sharp V-shaped recovery, the index is now facing resistance and struggling to maintain upward momentum. If key support levels fail to hold, we could see further downside in the coming sessions.

Key Levels to Watch:

5,700 - 5,720: A significant resistance zone where recent rallies have stalled. A break above this level could signal renewed bullish momentum.

5,650 - 5,670: A minor support area that previously acted as a pivot. Losing this level could increase selling pressure.

5,520 - 5,504: A major support zone that must hold to prevent further downside. If broken, it could trigger a larger sell-off.

5,350 - 5,400: A potential next area of support if the index continues to slide. This level aligns with previous consolidation zones.

4,790 - 4,800: A worst-case scenario target if market sentiment deteriorates significantly.

Technical Breakdown:

The current price action suggests a potential reversal if support levels do not hold. The index has failed to reclaim key resistance and is now at risk of breaking down further. Volume has increased during recent selling, indicating stronger downside pressure.

The next move will likely be dictated by tomorrow’s reports. If economic data comes in weaker than expected, it could fuel concerns of a slowdown, leading to further selling. Conversely, stronger-than-expected data may provide temporary relief, but resistance levels still need to be reclaimed for the uptrend to resume.

Market Sentiment and Strategy:

A break below 5,504 could trigger a wave of selling, making downside targets more likely.

If support holds and we see a strong bounce, it could offer a short-term buying opportunity.

Given increased volatility, traders should be cautious and monitor key levels closely.

With economic data on the horizon, the S&P 500 is at a critical decision point. The next 24-48 hours will determine whether the recent recovery holds or if further downside is ahead.

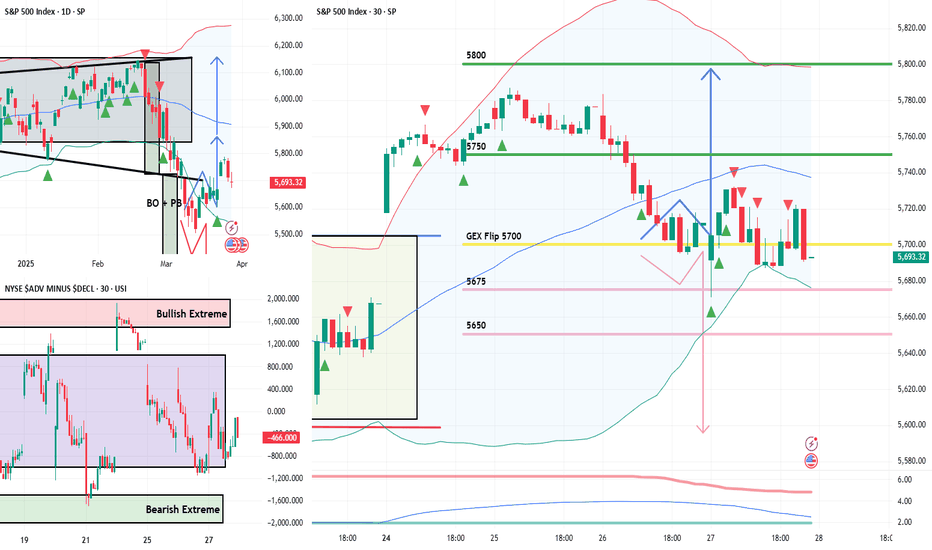

03/24 SPX Weekly GEX Outlook, Options FlowYou can see that every expiry has shifted into a stronger bullish stance heading into Friday, with GEX exposure moving upward across the board—though total net GEX is still in negative territory, while net DEX (delta exposure) is positive. This combination points toward a likely near-term rebound this week, which makes sense after testing the 5600 range last week….

Here’s a more detailed breakdown of the key zones and likely moves this week:

Bullish Target:

The current uptrend could reach 5750 on its first attempt (already reached in Monday, thx bullsh :) ). If a positive gamma squeeze emerges at that level, we might see an extension to 5800 or even 5850 as a final profit-taking zone for bulls this week.

HVL (Gamma Slip Zone):

Placed at 5680, this threshold currently supports a low-volatility environment. A drop below 5680, however, could reignite fear and fuel bearish momentum.

Put Floors & Net OI:

The largest net negative open interest (OI) cluster is at 5650, with the next key level near 5600. At 5600, net DEX reads fully positive, suggesting strong buying support if the market tests that lower boundary.

3-MONTH THE SQUID GAME II 'JUBILEE'. WHAT IS NOW & WHAT IS NEXTIt's gone three months or so... (Duh..? WTF.. 3 months, really? 😸😸😸) since "The Squid Game" Season II has been released on December 26, 2024.

Nearly month later comrade Trump entered The White House (again).

Still, everyone was on a rush, chatting endless "Blah-Blah-Blah", "I-crypto-czar", "crypto-capital-of-the-world", "we-robot", "mambo-jumbo", "super-duper", AI, VR and so on hyped bullsh#t.

Here's a short educational breakdown, what we think about all of that, at our beloved @PandorraResearch Team.

Trading can easily resemble gambling when approached without discipline, strategy, or proper risk management. Here are key reasons to avoid gambling-like trading behaviors, supported by real-world examples:

1. Lack of Strategy and Emotional Decision-Making

Trading becomes gambling when decisions are based on emotions, intuition, or market hype rather than thorough analysis. For instance, Geraldine lost £15,000 on a spread-betting platform after attending a workshop that taught ineffective strategies. She believed the platform profited from her losses, highlighting how impulsive, uneducated decisions can lead to significant financial harm. Similarly, traders who overtrade or ignore risk management often experience devastating losses, as they rely on luck rather than a structured plan.

2. Overleveraging and One-Sided Bets

Overleveraging—opening excessively large positions—is a common gambling behavior in trading. This approach increases stress and the likelihood of substantial losses. A trader who lost $400,000 on a single Robinhood bet exemplifies this. He overinvested in a call option, hoping for a quick profit, but the trade turned against him, wiping out nearly all his capital. Opening one-sided bets or adding to losing positions further compounds risks, as traders attempt to recover losses through increasingly risky moves.

3. Ignoring Stop Losses and Risk Management

Failing to set stop losses or refusing to exit losing trades is another form of gambling. Traders who cling to their biases and avoid cutting losses often face irreversible damage to their portfolios. For example, many traders refuse to take stop losses, leading to catastrophic losses that erode their confidence and capital. This behavior mirrors the destructive cycle of gambling addiction, where individuals chase losses in hopes of a turnaround.

4. Psychological and Financial Consequences

Gambling-like trading can lead to severe psychological and financial consequences. Harry, a trader with a gambling addiction, repeatedly lost money despite asking his trading platform to restrict his account. His inability to control his trading behavior highlights the addictive nature of high-risk trading and its potential to ruin lives. Similarly, excessive gambling has been linked to increased debt, bankruptcy, and mental health issues, such as anxiety and depression.

5. Long-Term Sustainability

Smart trading focuses on steady gains and minimal losses, whereas gambling relies on luck and high-risk bets. Traders who chase big wins often lose their profits in subsequent trades, perpetuating a cycle of losses. Studies show that frequent trading, driven by overconfidence or problem gambling, reduces investment returns and increases financial instability.

In conclusion, avoiding gambling-like trading requires discipline, education, and a well-defined strategy. Real-world examples demonstrate the dangers of emotional decision-making, overleveraging, and ignoring risk management. By adopting a structured approach and prioritizing long-term sustainability, traders can mitigate risks and avoid the pitfalls of gambling.

--

Best 'squid' wishes,

@PandorraResearch Team

A short on S&P at 5770S&P has been moving up quick strongly over the past few days. It has reached a level that is a strong resistance and we will show this pair today.

1) There is deep crab pattern

2) H1 is overbought

3) There is RSI divergence on M15, M30 and H1

We will take profit when RSI is oversold.

S&P 500 Correction Channel Keeps Bulls in Control, for NowThe S&P 500 has formed an uptrend channel after breaking out of the "tariff panic" downtrend, which had dragged the index down more than 10%. But is this new short-term uptrend merely a correction, or has the real direction changed? That’s the key question, one that will likely be answered in early April when the new tariffs take effect.

February consumer confidence data didn’t look promising, but much of the negativity had already been priced in during the earlier 10% sell-off. However, this week’s PCE report, combined with next week’s tariffs and jobs report, could become a catalyst for determining the short- to medium-term direction.

The 200-hour SMA has now reached the upper line of the trend channel. Together, they may create a strong resistance level. To the downside, 5700 is a key horizontal support level. By the end of this week, it will converge with the lower boundary of the channel, right as both the GDP and PCE data are released. Including the time factor, this confluence could mark the main short-term support.

As long as the trend channel holds, bulls remain in control.

Bullish Entry Spotted – Now We Wait...Bullish Entry Spotted – Now We Wait... | SPX Analysis 28 Mar 2025

Imagine the market dressed like Jack Nicholson in One Flew Over the Cuckoo’s Nest—slack-jawed, glassy-eyed, and strapped into a straightjacket made of indecision. That’s been the vibe all week. SPX continues to shuffle back and forth around 5700 like it's lost its meds and forgot where it was going. But if you’ve been following the plan, none of this should be surprising.

We mapped it out on Monday, discussed it live in our Fast Forward mentorship call, and here we are watching it all play out with popcorn in hand. Today’s action may seem like “not much ado about anything,” but if you know what to look for… there’s gold in this grind.

---

The end of March has the feel of a market that’s had one too many – not enough to fall over, but just enough to slur its way through price action.

All week we’ve been dancing around the 5700 level – and for good reason. It’s acting as a triple threat:

The GEX Flip Point

The prior range high

And now, the Bollinger Bands have closed in to confirm this as a possible launch (or rejection) zone.

Add in the emergence of a pinch point, and what we’ve got is a market that’s coiling like a spring… but refusing to actually bounce.

📈 Bullish Swing Activated:

During Monday’s Fast Forward group session, we mapped out a key level to watch for pulse bars. Lo and behold, the market obliged. I entered a bullish swing trade after seeing those bars fire right at the expected spot. No surprises, no panic – just execution.

🐻 Bear Swing Trigger Set:

If the market does decide to do a dramatic nosedive, I’ve marked 5675 as my bear/hedge trigger – just under Thursday’s lows. Until then, it’s a game of “wait, watch, and get ready to stack the next trade.”

💤 Nothing Much? Still Profitable:

Look, I get it – this week’s been slower than a BBC period drama. But just because things move at glacial speed doesn’t mean there’s nothing to do. As always, it’s about planning the trade, then trading the plan – not reacting to every twitch like a caffeinated squirrel.

And if you’re wondering how the market feels…

Let’s just say the “moves” this week have been scratchier than usual, so I’ll be looking for a special cream over the weekend.

---

The first “stock ticker” was powered by telegraph wires and clock springs. It was invented in 1867 by Edward Calahan… who was just 22 years old at the time.

Before computers, before real-time data feeds, and way before Robinhood traders turned market moves into meme fodder – we had the ticker tape. Edward Calahan, a young telegraph operator, created the first stock ticker machine using the same tech that powered telegrams. It printed stock prices on a long ribbon of paper, allowing traders to see “live” quotes for the first time.

This primitive marvel revolutionised Wall Street – traders no longer had to wait hours (or days) for price updates. And now here we are, trading from our phones while sipping lattes and watching pulse bars ping in real-time. Technology, eh?

--

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. Ready to stop scratching your head and start stacking profits?

If you want to trade with clarity – not confusion – then it’s time to get serious about structure.

🔥 Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1's

📺 Or watch the free training to see the SPX Income System in action.

No fluff. Just profits, pulse bars, and patterns that actually work.

S&P500 Short: Expecting Price to Fall back below trendlineFor this idea, there are 2 things to take note:

1. I believe the breakout to the upside to be a false breakout. Thus price should fall back into the channel.

2. The "C" wave is slightly shorter than "A" wave, but it shouldn't matter since corrective wave does not conform to the "3rd wave cannot be the shortest" rule.

If you are an active trader, you can choose to place your stop where I indicated. But if you are really more swing trader and can take wider swings, then I recommend putting stop above where the Fibonacci shows 1.

Good luck!

SPX a brear flag complete?SPX is going to finish a bear flag and could break down. The Vix is also showing slight upward strength but not much yet. Based on that I don't think we have much downside now in next 2/3 months. However the overall trend of VIX is trending upwards similar to 2022 making higher bottoms since Dec 24, So we could have a year with big swings like we did in 2022

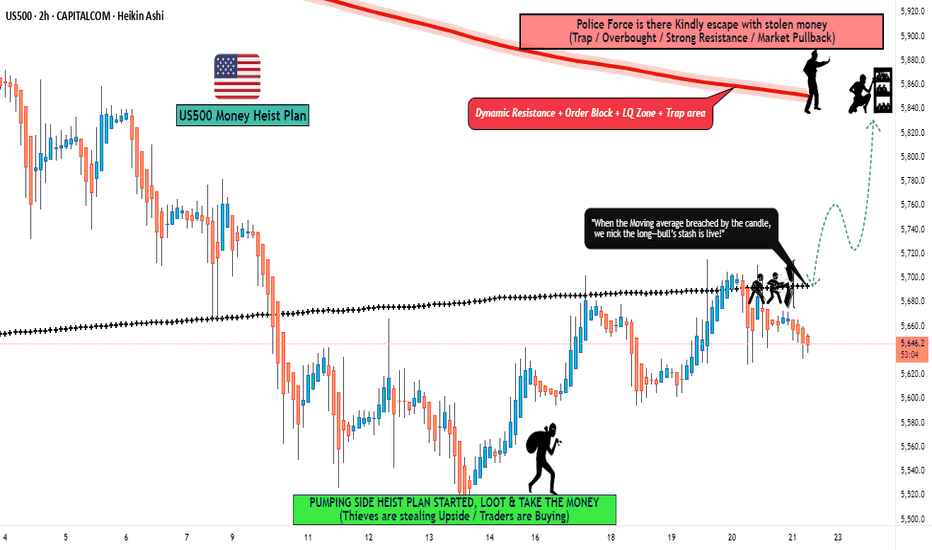

"US500 / SPX500" Index CFD Market Heist Plan (Day or Swing)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US500 / SPX500" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (5700) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 2H timeframe (5600) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 5850 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"US500 / SPX500" Index CFD Market Heist Plan (Swing/Day) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Market Neutral: Nasdaq, S&P500, Nikkei225, Hang SengThe equity indices has fallen to our target and we are seeing 5-wave completions. So I think it is a good time to reduce your shorts and move from a short to a more neutral stance. The current price is also a good support for the indices.

Remember that there is a weekend risk here also.

Good luck!

US500 Long Setup – 15M | NYC Reversal from Demand Bias: Bullish Trade Setup Overview:

After a deep selloff and subsequent accumulation pattern, US500 printed a clean bullish reaction from the lower demand zone during the NY session, signaling a potential continuation to the upside.

Key Confluences:

🔹 Accumulation + Manipulation Phase Complete

The chart shows classic Wyckoff accumulation followed by manipulation below short-term lows, leading into an aggressive NY open rally—suggesting institutional involvement.

🔹 Entry From Demand + FVG Reclaim

Price tagged the 5676.5 level, which aligns with the edge of a refined 15M FVG and an H1 demand zone. Strong rejection and follow-through confirms buyer strength.

🔹 Clean Break of Supply Structure

Price has pierced through a previous short-term supply zone, turning it into potential support. This is a signal that bulls are reclaiming control.

Bias: Bullish

Entry: 5676.5

Stop Loss: 5660.4

Take Profits:

TP1: 5693.6

TP2: 5720.0

TP3: 5781.6